Tax Rebate On Mortgage Loan Web 4 janv 2023 nbsp 0183 32 Mortgage interest is tax deductible on mortgages of up to 750 000 unless the mortgage was taken out before Dec 16 2017 then it s tax deductible on mortgages

Web 20 juil 2016 nbsp 0183 32 The reduction is the basic rate value currently 20 of the lower of finance costs costs not deducted from rental income in the tax year this will be a proportion of Web 5 janv 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can deduct

Tax Rebate On Mortgage Loan

Tax Rebate On Mortgage Loan

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

What Is Rebate On A Mortgage Loan

https://www.gcash.com/wp-content/uploads/2020/06/Loans-CIMB-Loans-Interest-Rebate_1200x628-1.jpg

What Does Rebate Lost Mean On Student Loans

https://studentloanhero.com/wp-content/uploads/f21d66bc-bb4b-4eb4-8ba2-066e3aa6040a_pasted20image200.png

Web 14 juin 2022 nbsp 0183 32 Definition A mortgage rebate is a type of cash back incentive home lenders may offer to entice potential homebuyers into using their lending services A mortgage Web How much is the tax refund on the mortgage interest deduction You will only receive a tax reduction if the deductible financing interest and fees exceed the amount added to your

Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on Web 19 janv 2023 nbsp 0183 32 The tax relief landlords get on a buy to let mortgage interest has now ended as of April 2020 Instead you ll receive a tax credit based on 20 of your mortgage interest payments We help you

Download Tax Rebate On Mortgage Loan

More picture related to Tax Rebate On Mortgage Loan

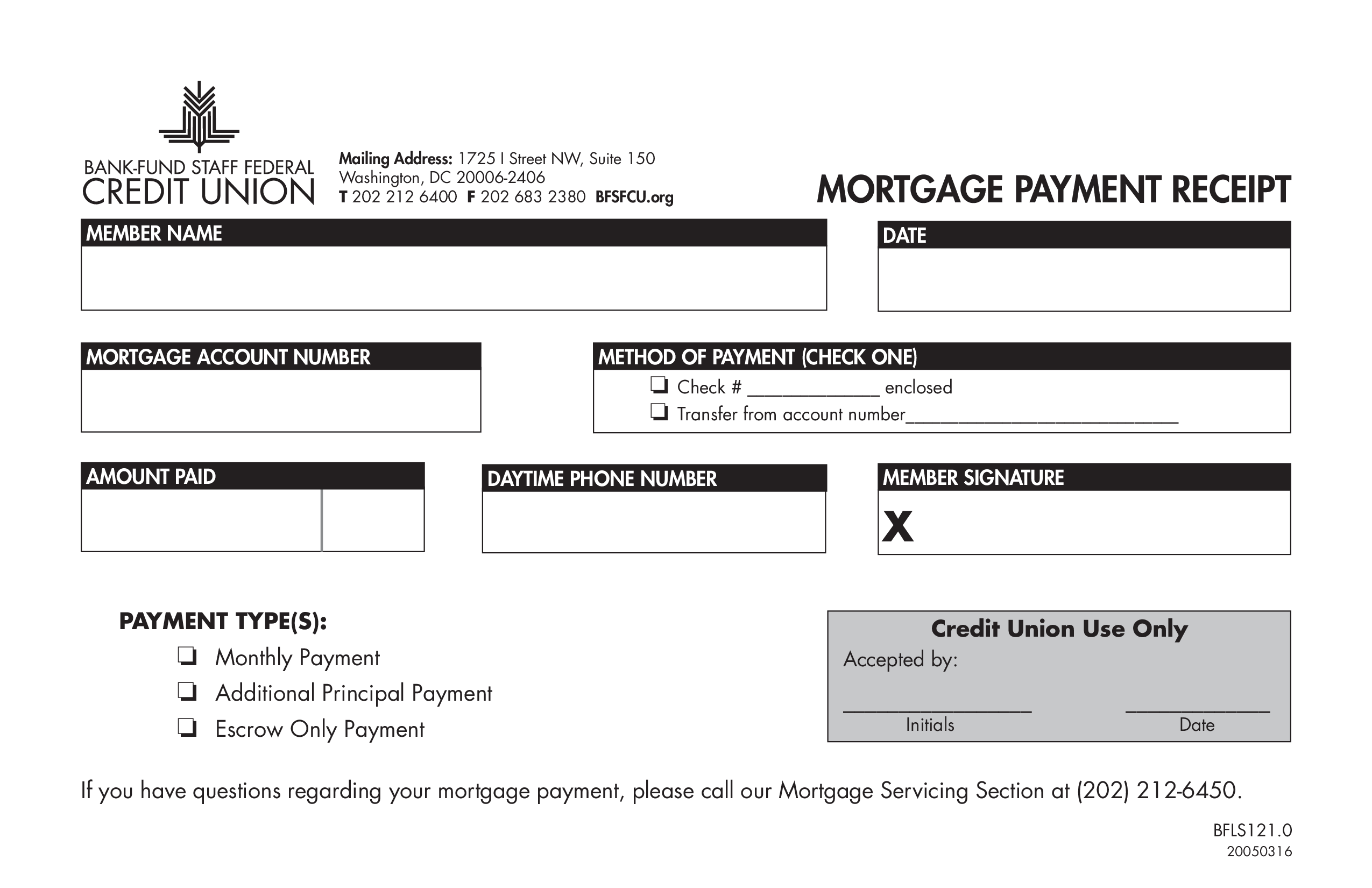

Mortgage Payment Receipt Templates At Allbusinesstemplates

https://www.allbusinesstemplates.com/thumbs/0f0f32b9-1132-48f1-943c-cc3470a4f666_1.png

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Pin On Hypotec Home News

https://i.pinimg.com/originals/a1/a1/3d/a1a13d78ae6541d2c8ac25fd9669ee53.png

Web Mortgage Tax Rebate If your are an owner occupant of a property in the Netherlands you can get part of the financing costs refunded The rules for the refund are gradually Web 13 janv 2022 nbsp 0183 32 This section provides Loan Against Property Tax benefits to the salaried individual The borrower can avail of a tax benefit of up to Rs 2 Lakhs if they allocate the funds to obtain a new residential property The

Web Income tax rebate on home loan Joint mortgage deductions Borrowers may deduct up to Rs 2 lakhs in interest and Rs 1 5 lakh in principle from their house loan but only if they Web 20 janv 2021 nbsp 0183 32 The short answer is yes You can claim the interest charged on your home loan as a deduction when completing your income tax return However you need to be

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

https://i.pinimg.com/originals/07/68/e8/0768e843fce468a6a866abfdec4820d1.jpg

Pin On Forms

https://i.pinimg.com/originals/82/59/91/825991aefa41486fbb0d1e0a0232c682.png

https://www.thebalancemoney.com/home-mortgage-interest-tax-deductio…

Web 4 janv 2023 nbsp 0183 32 Mortgage interest is tax deductible on mortgages of up to 750 000 unless the mortgage was taken out before Dec 16 2017 then it s tax deductible on mortgages

https://www.gov.uk/guidance/changes-to-tax-relief-for-residential...

Web 20 juil 2016 nbsp 0183 32 The reduction is the basic rate value currently 20 of the lower of finance costs costs not deducted from rental income in the tax year this will be a proportion of

Mortgage Amortization Calculator Extra Payments Spreadsheet Spreadsheet

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Mortgage Calculator With Taxes Insurance PMI HOA Extra Payments

Is A Reverse Mortgage Beneficial Reverse Mortgage California

54 FORM FOR HOME MORTGAGE INTEREST DEDUCTION DEDUCTION HOME MORTGAGE

Home Loan Tax Benefits In India Important Facts

Home Loan Tax Benefits In India Important Facts

Illinois Tax Rebate Tracker Rebate2022

E Books MATRIXFREEDOM By Iain Clifford Learn To Discharge Your

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Tax Rebate On Mortgage Loan - Web 19 janv 2023 nbsp 0183 32 The tax relief landlords get on a buy to let mortgage interest has now ended as of April 2020 Instead you ll receive a tax credit based on 20 of your mortgage interest payments We help you