Tax Rebate On National Saving Certificate Web 19 mai 2022 nbsp 0183 32 19 May 2022 The interest earned or accrued on a National Savings Certificate NSC is taxable For taxation purposes it should be added to the taxable

Web 18 juin 2019 nbsp 0183 32 There is no upper limit for investments in the National Saving Certificates but investments of up to Rs 1 5 lakhs in NSC s is Web 13 juil 2022 nbsp 0183 32 Tax Benefit of NSC Investment You can avail of a tax rebate up to Rs 1 50 000 by investing in NSC under sec 80c of Income

Tax Rebate On National Saving Certificate

Tax Rebate On National Saving Certificate

https://1.bp.blogspot.com/-PR4G_KF3CgI/UhWpARwn8AI/AAAAAAAAADo/HZx1n34vgPI/s1600/NSC.jpg

National Savings Certificate NSC 1 5

https://www.mppeb.org/wp-content/uploads/2022/08/National-Savings-Certificates-.png

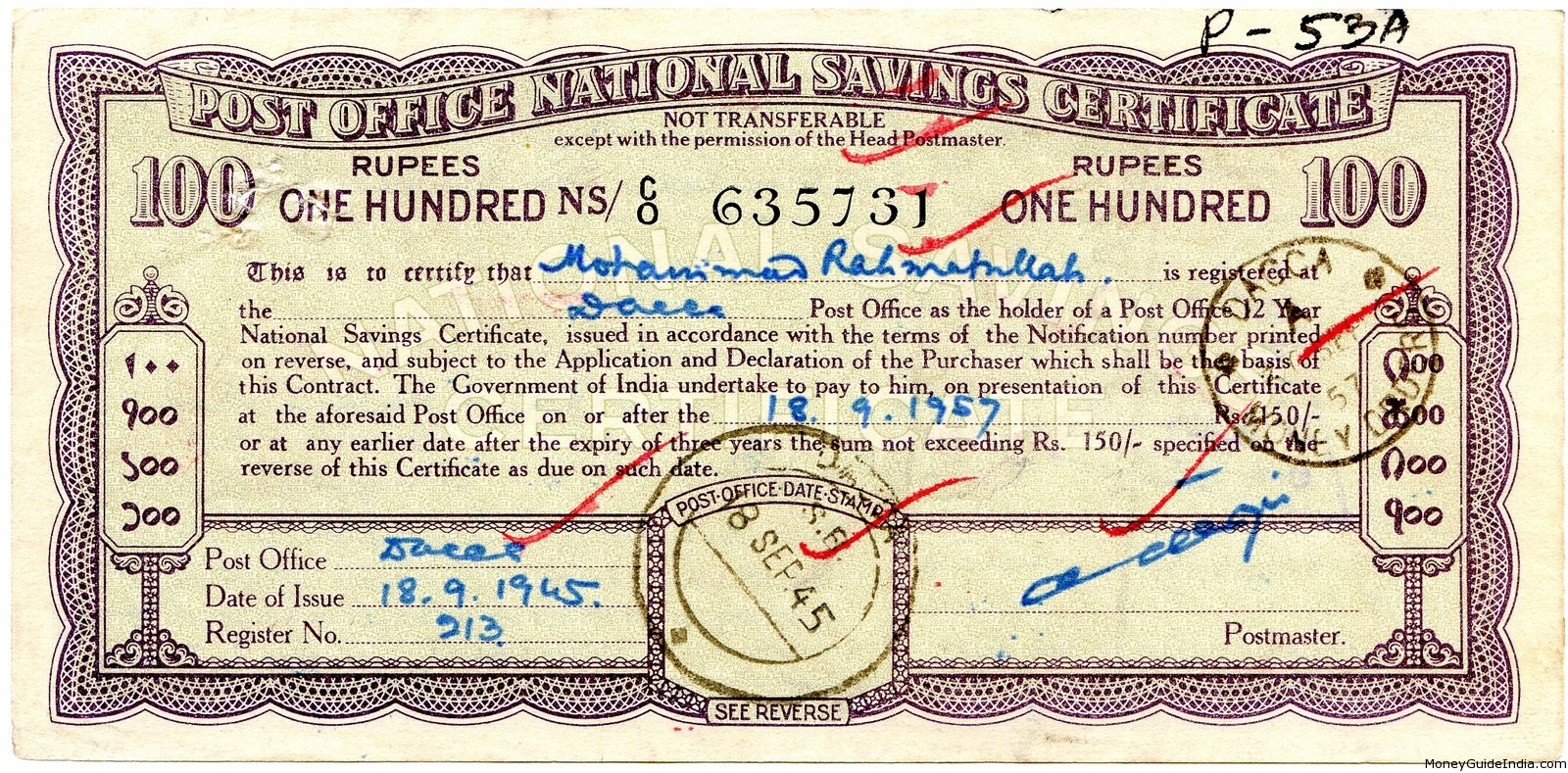

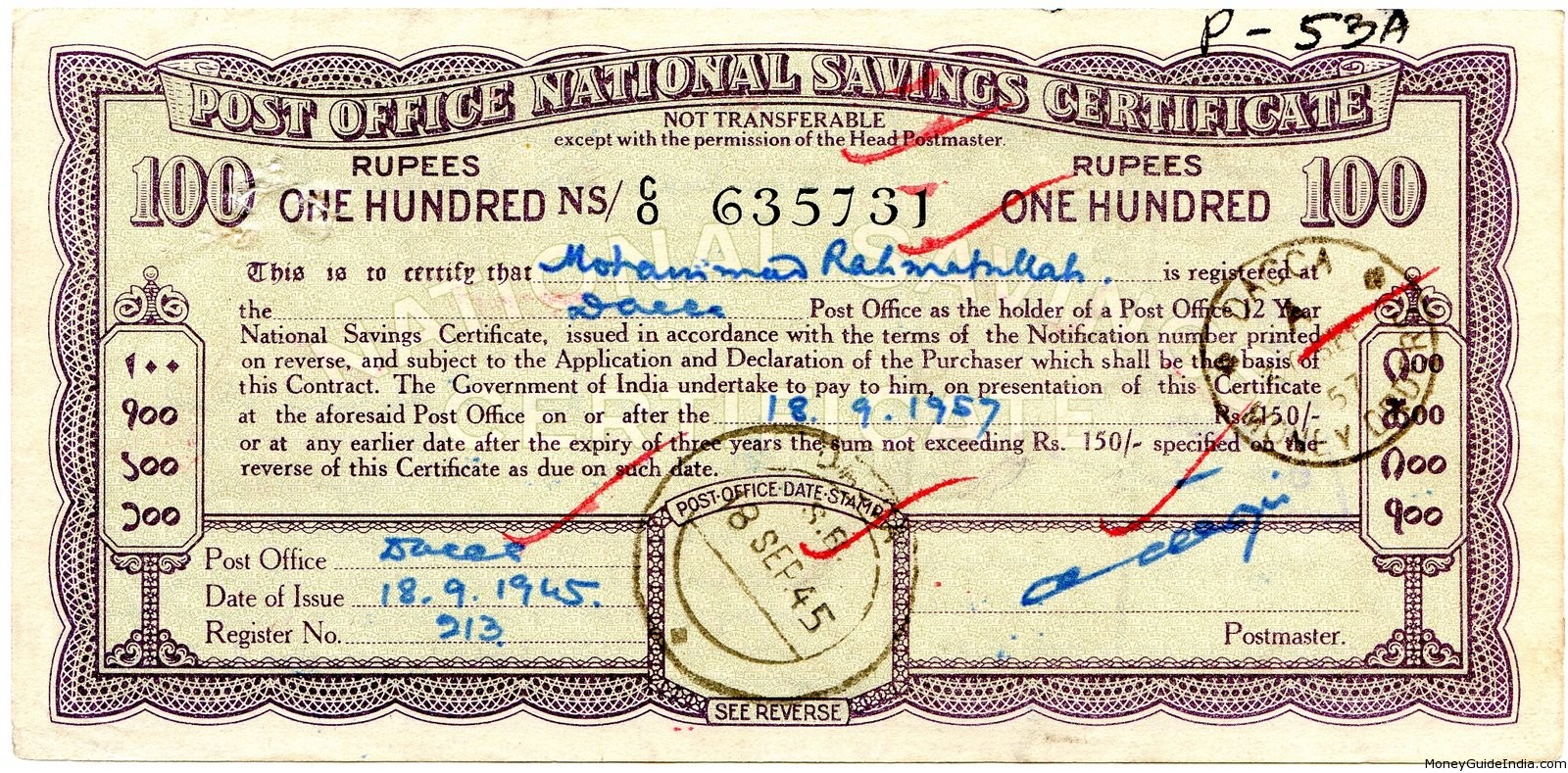

Post Office National Saving Certificate A Good Investment Option

https://www.smartwomanworld.com/wp-content/uploads/2016/12/national-saving-certificate-672x443.png

Web The Minimum Amount to be invested in National Savings Certificate is Rs 100 and there is no maximum limit on the amount to be invested in the NSC A person can invest any Web 9 mars 2023 nbsp 0183 32 NSC National Savings Certificate is a savings scheme that primarily encourages small to mid income investors to invest along with availing tax benefits

Web 22 sept 2022 nbsp 0183 32 Tax advantage with NSC Investments made towards National Savings Certificate are eligible for a deduction under Section 80C up to a maximum limit of 1 5 lakhs in a financial year Thus you Web Tax rebate under Section 80C Investors can claim a tax rebate on their NSC investment under Section 80C of the Income Tax Act of 1961 While there is no maximum limit on

Download Tax Rebate On National Saving Certificate

More picture related to Tax Rebate On National Saving Certificate

National Saving Certificate NSC In Hindi Post Office

https://i.pinimg.com/736x/09/94/aa/0994aab43994df4e26579505f79abded.jpg

National Saving Schemes Interest Rates Go Up Money SAMAA

https://i.samaaenglish.tv/wp-content/uploads/2021/06/National-Saving-Certificates-.jpeg

NSC National Savings Certificate Interest Rate Eligibility And

https://govtsevaa.com/wp-content/uploads/2020/12/National-Saving-Certificate.jpg

Web 22 sept 2022 nbsp 0183 32 Investors can claim a deduction for the investments made in the National Savings Certificate up to 1 5 lakhs per annum under Section 80C of the ITA The interest on NSC for the first 4 years can also be Web 8 mai 2022 nbsp 0183 32 Yes you can claim deduction for investments made in National Saving Certificates under Section 80 C up to Rs 1 50 lakh in a year along with other eligible

Web National Saving Certificate NSC Current interest rate 7 9 Contribution and tax savings investment limit There is no restriction on the amount of investment you can make in Web 19 d 233 c 2019 nbsp 0183 32 Tax treatment of NSC Investment and Interest on NSC Deposits up to Rs 1 50 lakh in NSC qualify for Deduction Section 80C of the Income Tax Act Accrued

Short Term Savings Certificates National Savings

http://savings.gov.pk/wp-content/uploads/sht.jpg

What Are Post Office NSC Or National Savings Certificate

http://bemoneyaware.com/wp-content/uploads/2014/02/nsc.jpg

https://www.valueresearchonline.com/stories/50859/what-is-the-tax...

Web 19 mai 2022 nbsp 0183 32 19 May 2022 The interest earned or accrued on a National Savings Certificate NSC is taxable For taxation purposes it should be added to the taxable

https://tax2win.in/guide/nsc-national-saving…

Web 18 juin 2019 nbsp 0183 32 There is no upper limit for investments in the National Saving Certificates but investments of up to Rs 1 5 lakhs in NSC s is

What Is NSC And How It Compares With Other Similar Schemes

Short Term Savings Certificates National Savings

National Savings Slashed Profit Rates For The Third Time This Year

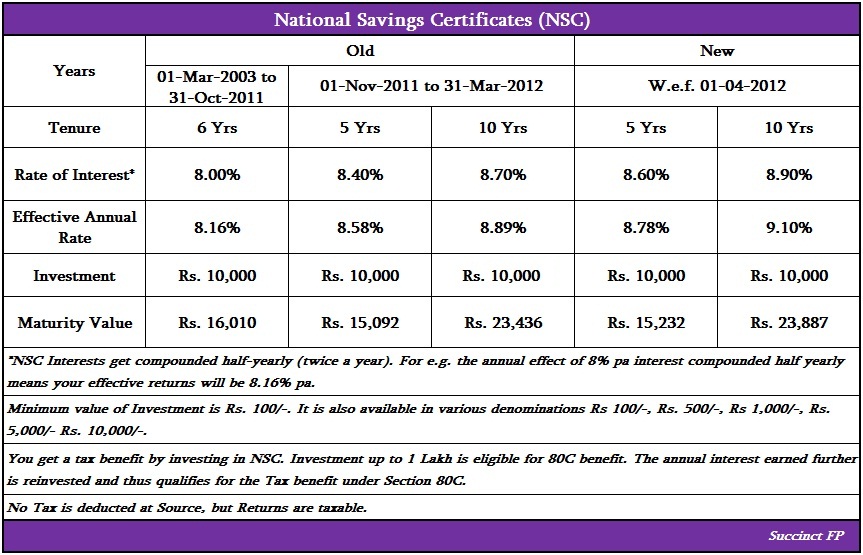

National Savings Certificates NSC Succinct FP

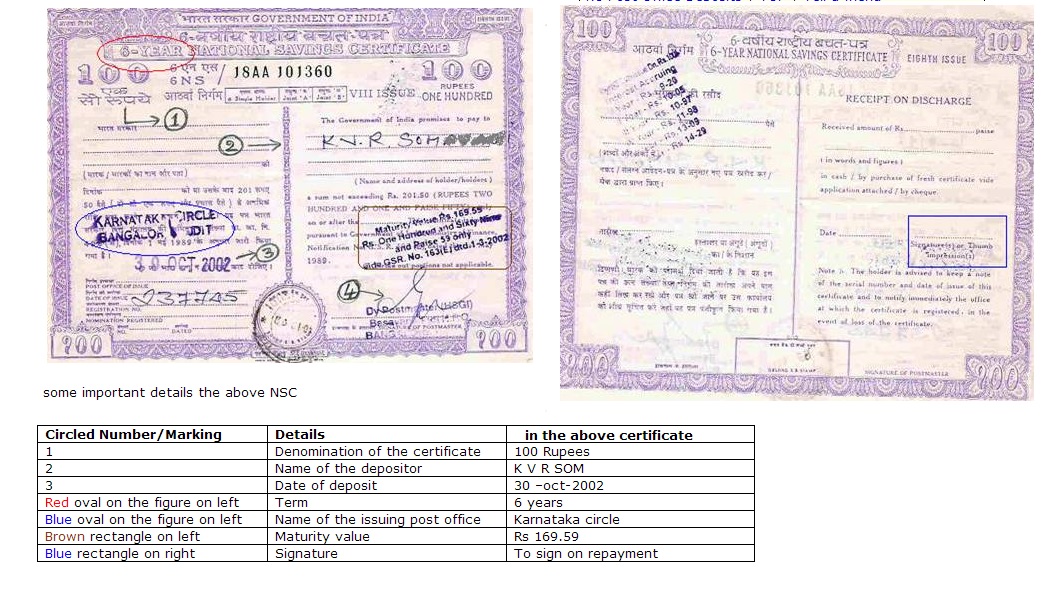

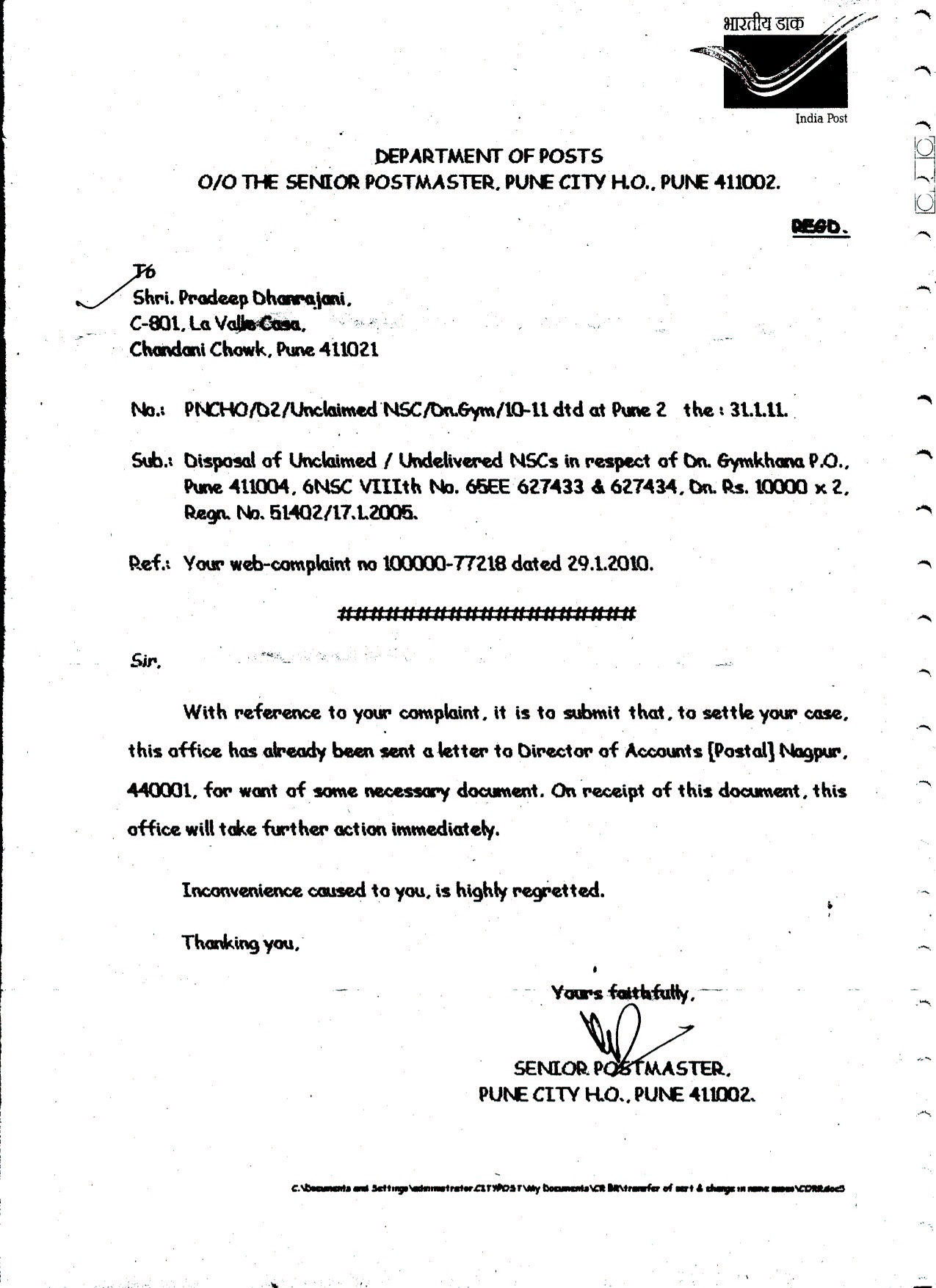

National Savings Certificate Issue Of Certificates From Indian Post

National Savings Certificate

National Savings Certificate

National Savings Certificate NSC Procedure For Applying NSC In India

Profit Without Income Tax On National Savings Certificates Accounts

About The National Savings Certificate NeoGrowth Lending Simplified

Tax Rebate On National Saving Certificate - Web 2 mai 2022 nbsp 0183 32 Tax Benefits As per Section 80C of the IT Act an individual may claim Rs 1 5 lakh maximum as a tax deduction for investing in NSC Types This scheme offers two