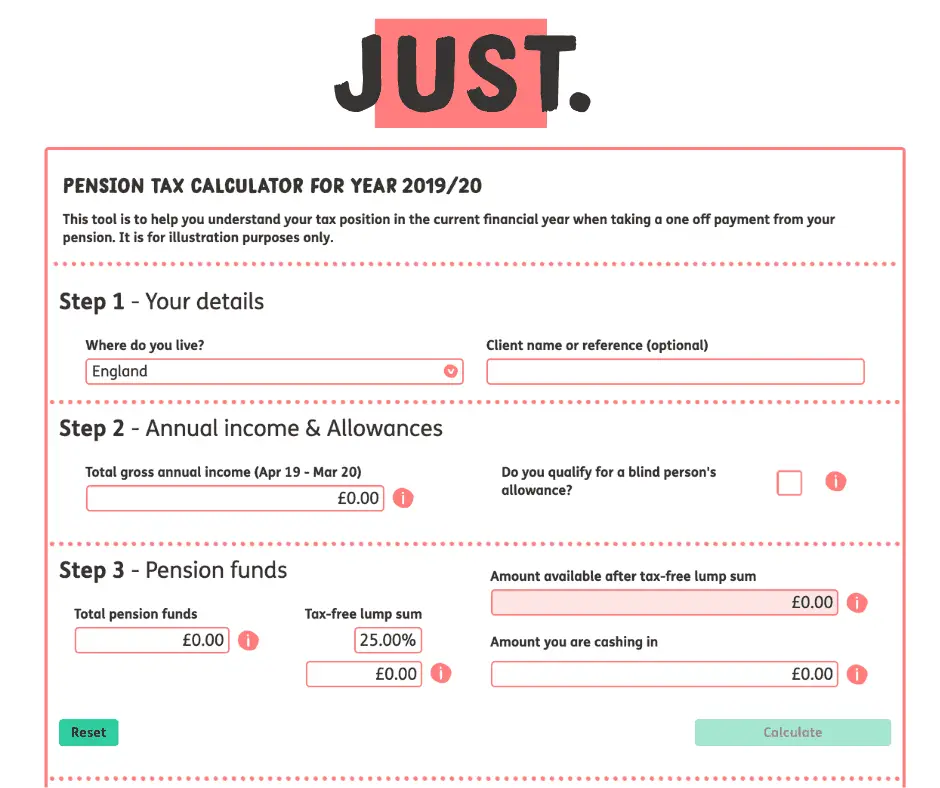

Tax Rebate On Pension Fund Web 6 mars 2023 nbsp 0183 32 Pension tax relief calculator Calculate how much tax relief you can get on your pension in the 2021 22 tax year and see how it compares to 2020 21 and 2019 20 WT Which Money Team When you

Web 7 sept 2023 nbsp 0183 32 Basic rate relief of 20 is automatically added to your pension contributions and paid directly into the fund If you are a higher rate taxpayer things are a little more Web 12 mai 2016 nbsp 0183 32 You can get tax relief on most contributions you make to registered pension schemes some overseas pension schemes You can t claim relief for payments you

Tax Rebate On Pension Fund

Tax Rebate On Pension Fund

https://enskyar.com/img/Blogs/Tax-deduction-under-section-80C-80CCC-and-80CCD.jpg

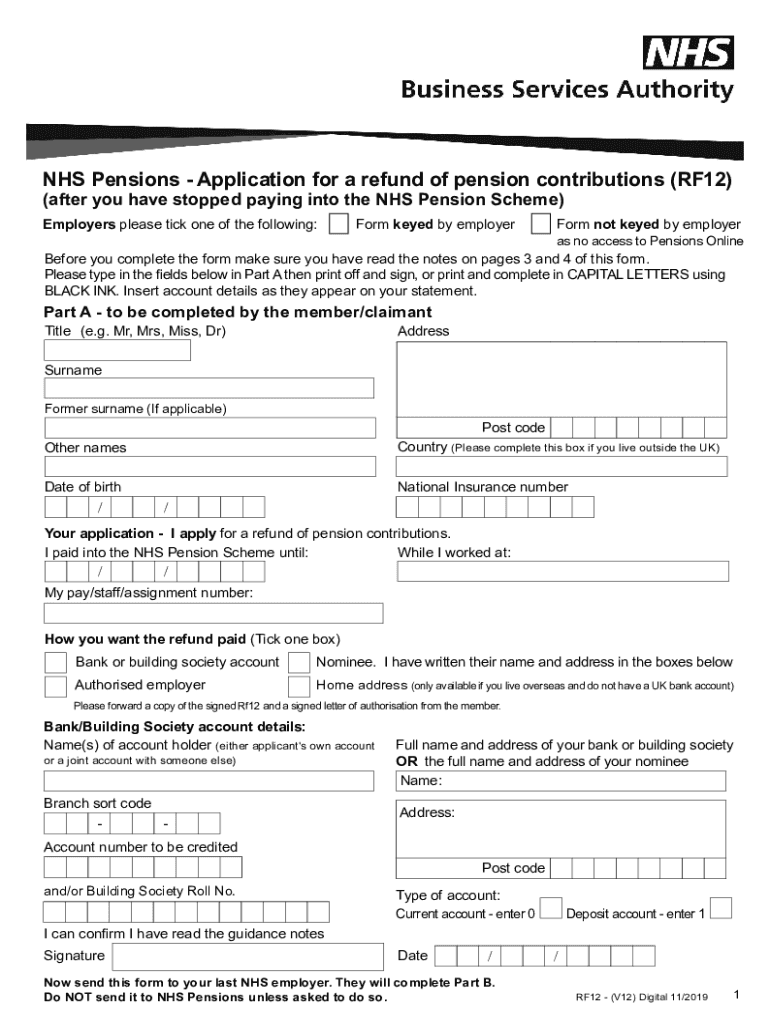

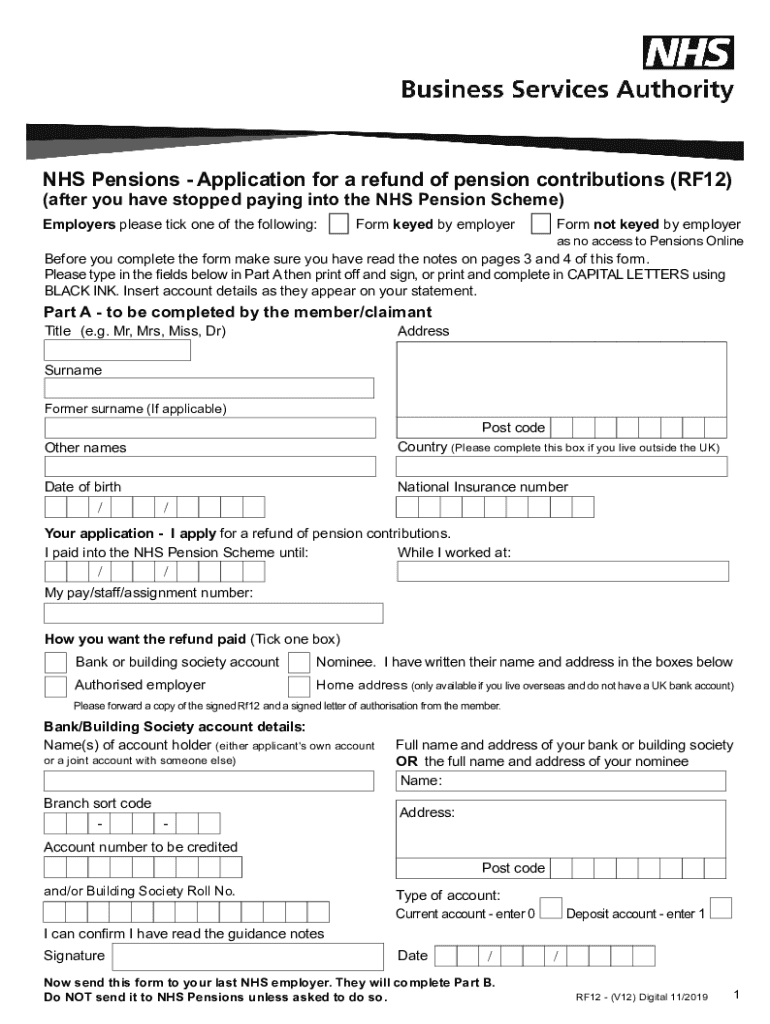

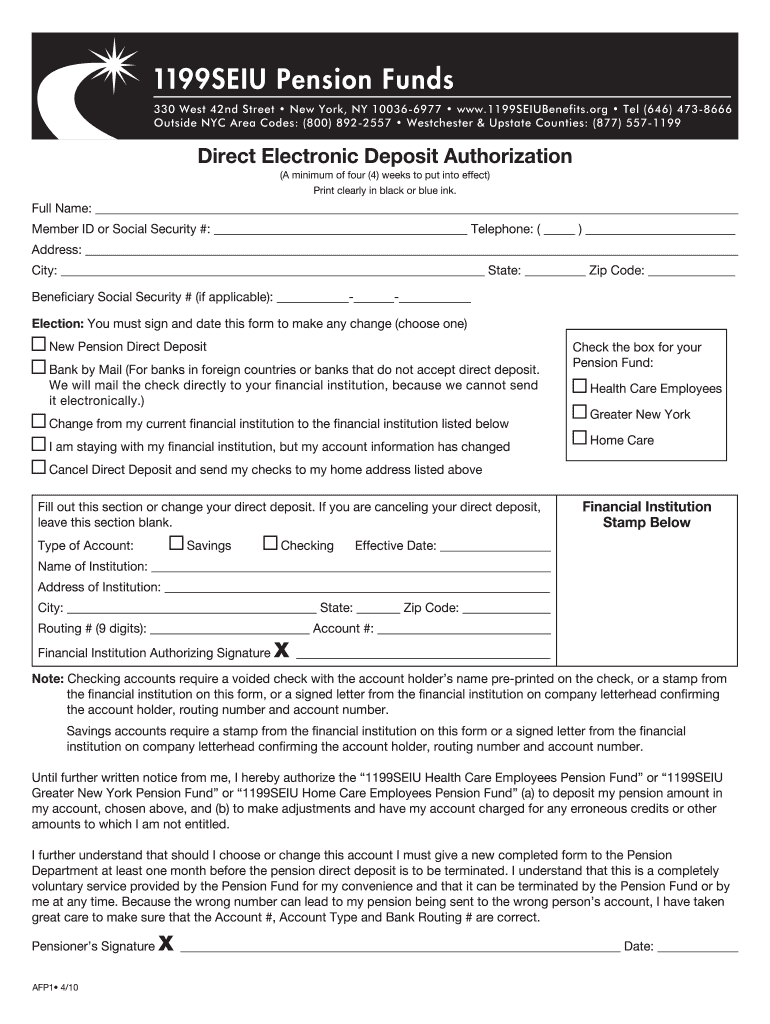

Rf12 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/495/136/495136692/large.png

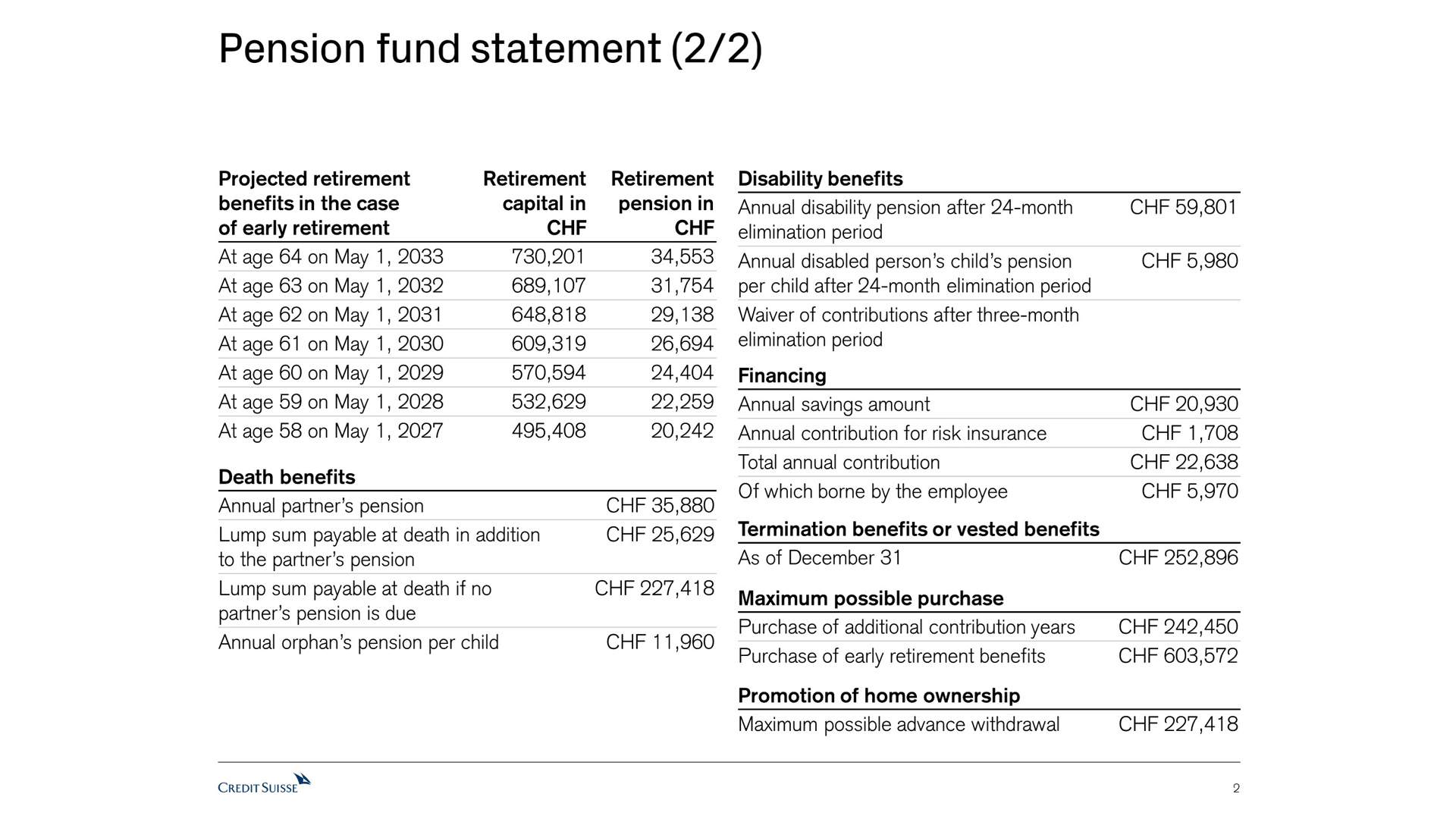

Read And Understand Your Pension Fund Statement Credit Suisse Switzerland

https://www.credit-suisse.com/ch/en/articles/private-banking/pensionskassenausweis-lesen-und-verstehen-201902/_jcr_content/content/image_2038537120/image.revampimg.1920.medium.jpg/ensionskassenausweis-muster-2-en-test.jpg

Web Tax relief on pension contributions There are two ways you can get tax relief on your pension contributions If you re in a workplace pension scheme your employer chooses Web 8 juin 2023 nbsp 0183 32 Le montant des pensions de retraite que vous avez touch 233 es est pr 233 rempli sur votre d 233 claration de revenus en ligne Il vous suffit de v 233 rifier ce montant et de le

Web 6 avr 2023 nbsp 0183 32 Most people can pay in up to 163 60 000 each tax year The annual allowance for contributions to all pensions within any one tax year including tax relief is 163 60 000 This limit applies to the total of your own Web The amount of your UK tax relieved funds in an overseas pension scheme is the aggregate of your pension input amounts in it for each tax year from 2006 to 2007

Download Tax Rebate On Pension Fund

More picture related to Tax Rebate On Pension Fund

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A.jpg?ssl=1

Download Free State Of New Jersey Homestead Rebate Program Software

http://media.nj.com/politics_impact/photo/nj-pension-fund-why-how-4102ec3801e6207c.jpg

Latest NPS Partial Withdrawal Rules 2018 New Revised Norms

https://www.relakhs.com/wp-content/uploads/2016/07/National-Pension-Scheme-How-NPS-Scheme-works-Example-Illustration-pic.jpg

Web If you took your pension on or after 6 April 2023 you ll pay Income Tax on some or all of the lump sum if it is more than 25 of the standard lifetime allowance If you hold lifetime Web Les retrait 233 s b 233 n 233 ficient de l abattement fiscal de 10 sur les pensions de retraite tout comme les autres contribuables qui n optent pas pour la d 233 claration aux frais r 233 els Cet

Web Fiscalit 233 2023 sur les pensions de retraite rentes El 233 ment fiscal D 233 tails Abattement forfaitaire sur les pensions de retraite 10 Montant minimum de l abattement Web 9 sept 2023 nbsp 0183 32 Tax Rebate Calculator AS PER SECTION 63 OF INCOME TAX ORDINANCE For Pension Funds Choose your income type Salaried Non Salaried

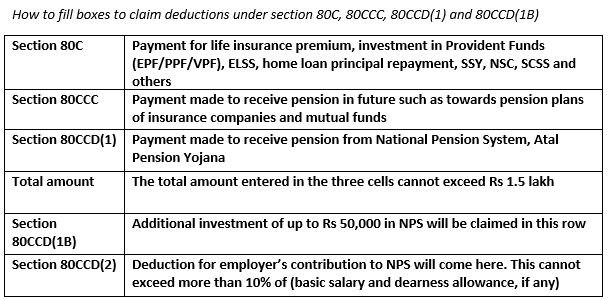

Section 80CCC Deduction For Contribution Towards Pension Funds Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ccc.jpg

The Impact Of Retirement Reform Coming Into Effect On 1 March 2016

https://www.10x.co.za/cloudinary/l2wptrsoegetm7s9w6sc.jpg

https://www.which.co.uk/.../pension-tax-relief …

Web 6 mars 2023 nbsp 0183 32 Pension tax relief calculator Calculate how much tax relief you can get on your pension in the 2021 22 tax year and see how it compares to 2020 21 and 2019 20 WT Which Money Team When you

https://www.unbiased.co.uk/discover/pensions-retirement/managing-a...

Web 7 sept 2023 nbsp 0183 32 Basic rate relief of 20 is automatically added to your pension contributions and paid directly into the fund If you are a higher rate taxpayer things are a little more

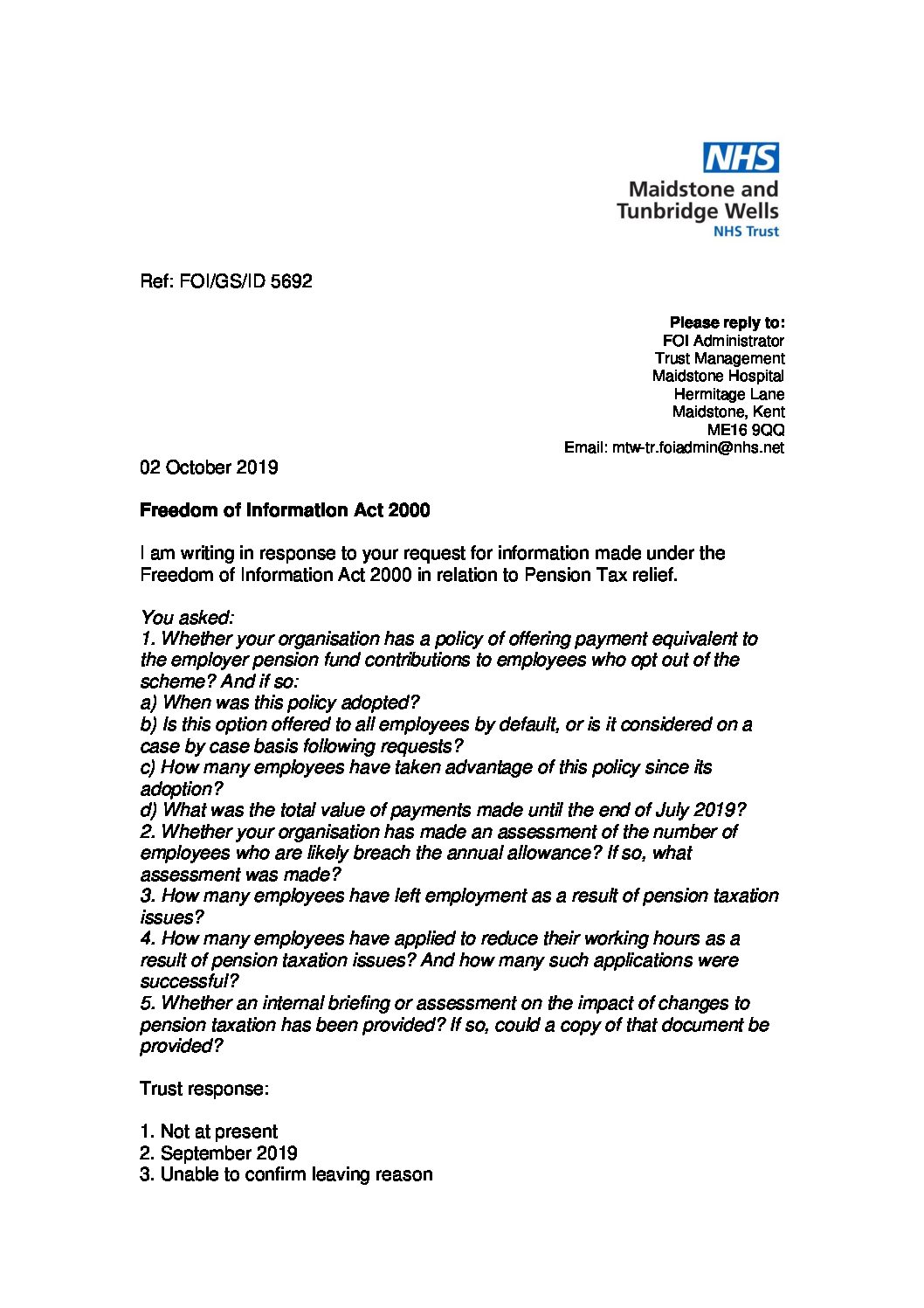

Download Response Pension Tax Relief 021019 Maidstone And Tunbridge

Section 80CCC Deduction For Contribution Towards Pension Funds Tax2win

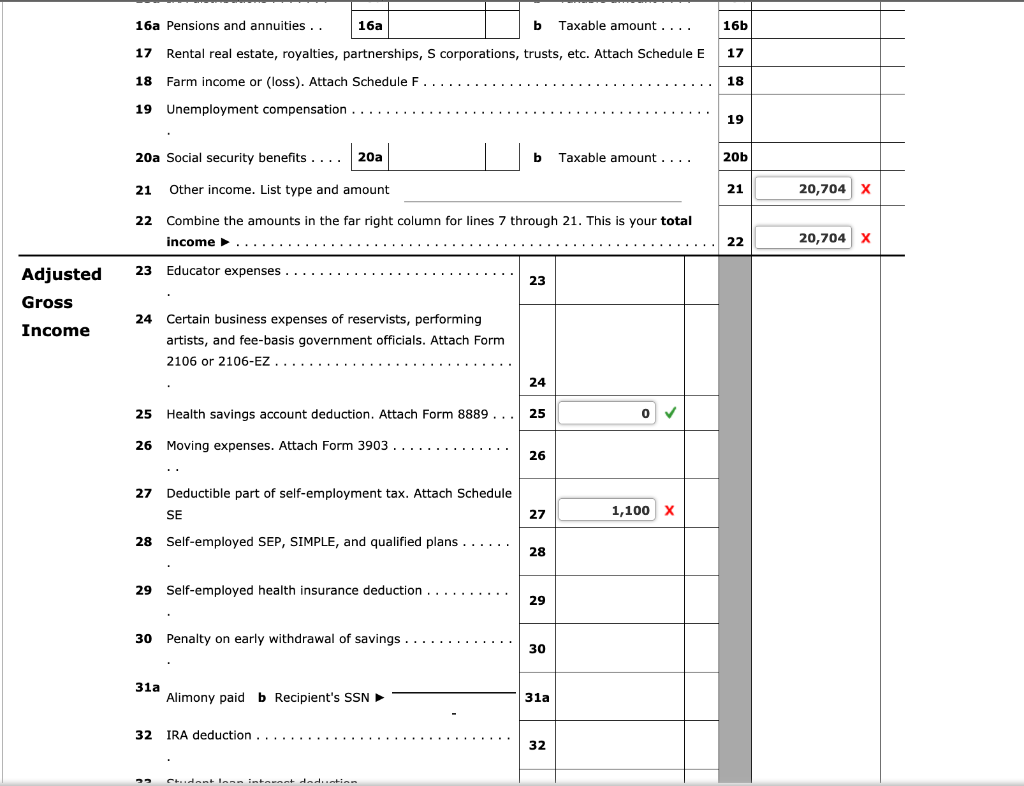

Note This Problem Is For The 2017 Tax Year Janic Chegg

How Are Lump Sum Pensions Taxed TaxesTalk

Illinois Tax Rebate Tracker Rebate2022

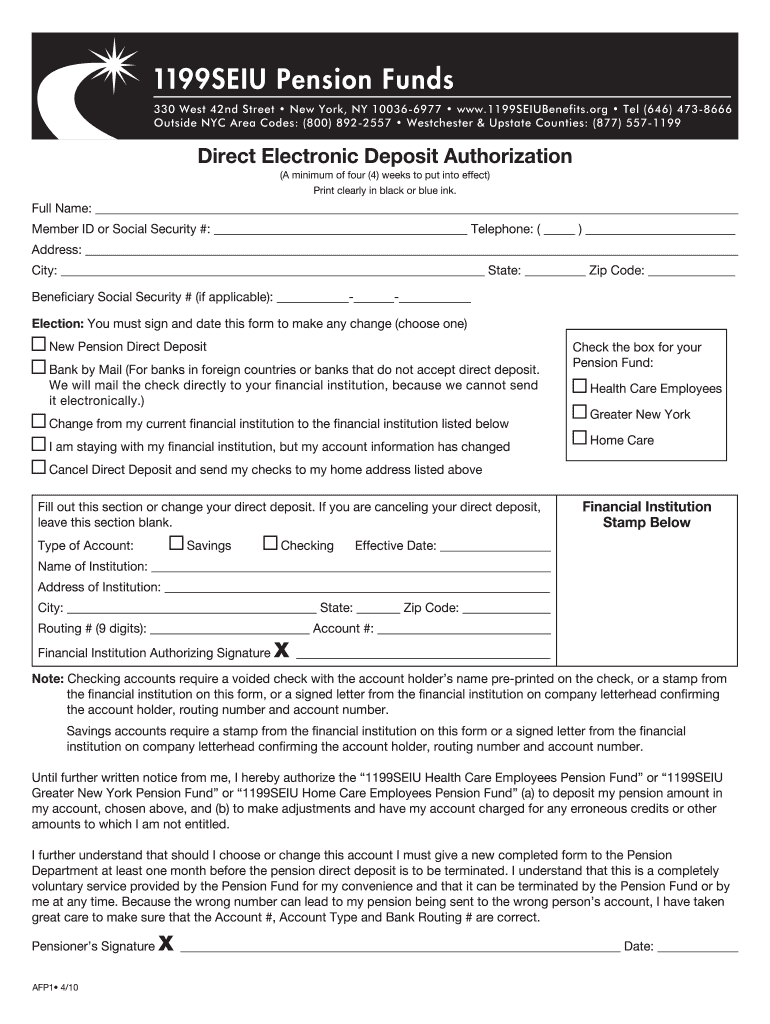

1199 National Benefit Fund Retirement Application Form Fill Out And

1199 National Benefit Fund Retirement Application Form Fill Out And

Solved Janice Morgan Age 24 Is Single And Has No Chegg

The Average Teachers s Tax Rebate Is 200 250 Check If You Are Due

P55 Tax Rebate Form By State Printable Rebate Form

Tax Rebate On Pension Fund - Web 8 juin 2023 nbsp 0183 32 Le montant des pensions de retraite que vous avez touch 233 es est pr 233 rempli sur votre d 233 claration de revenus en ligne Il vous suffit de v 233 rifier ce montant et de le