Tax Rebate On Personal Loan Interest Web 29 mars 2021 nbsp 0183 32 Since personal loans are loans and not income they aren t considered taxable income and therefore you don t need to report them on your income taxes However there are some instances where

Web 10 mars 2023 nbsp 0183 32 You can claim deductions of up to Rs 30 000 per year on the interest Web 27 janv 2023 nbsp 0183 32 In most cases personal loans do not have tax deductible interest This is because you can t deduct personal expenses on your income taxes Babener says So if you use the personal loan for

Tax Rebate On Personal Loan Interest

Tax Rebate On Personal Loan Interest

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

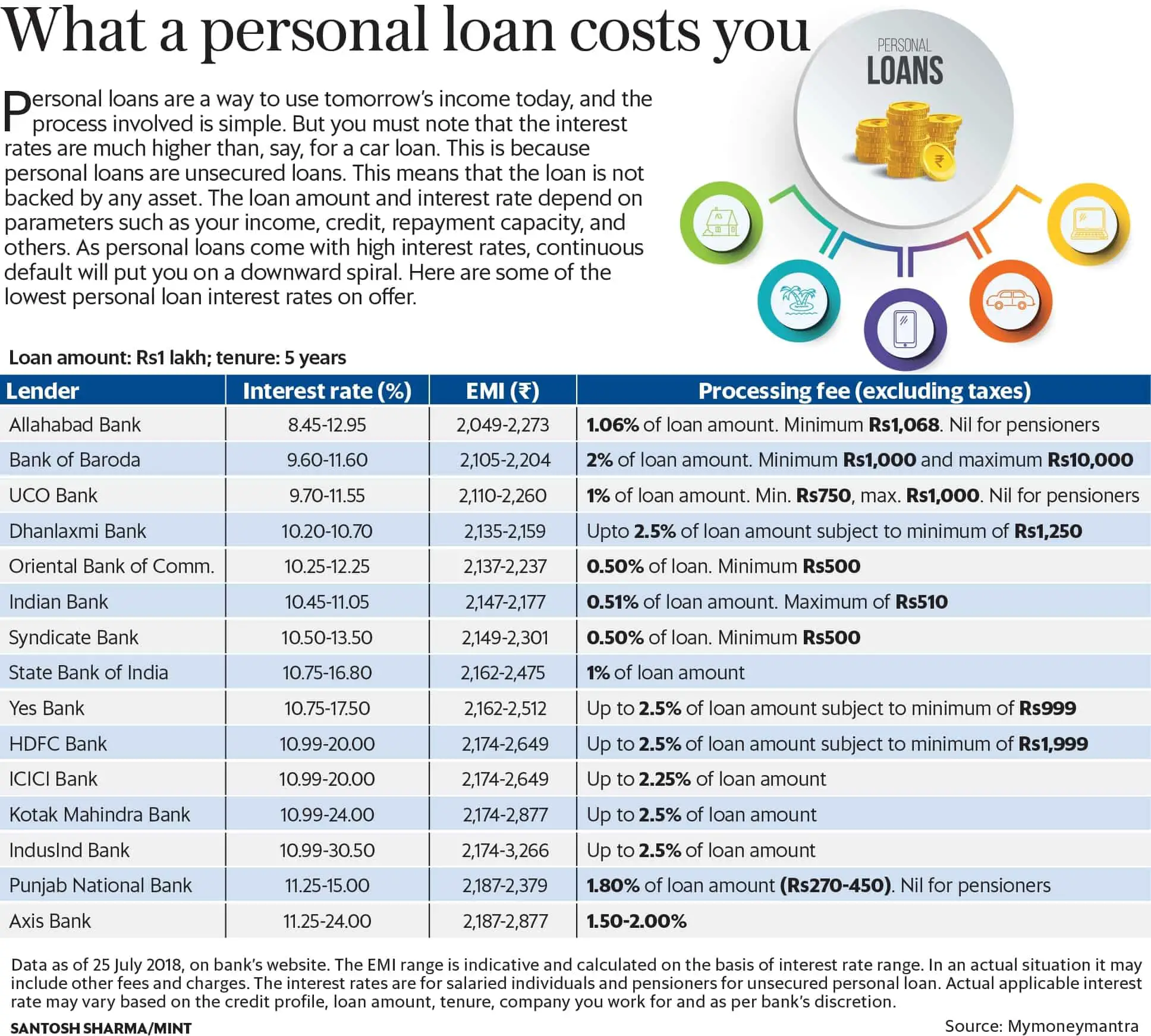

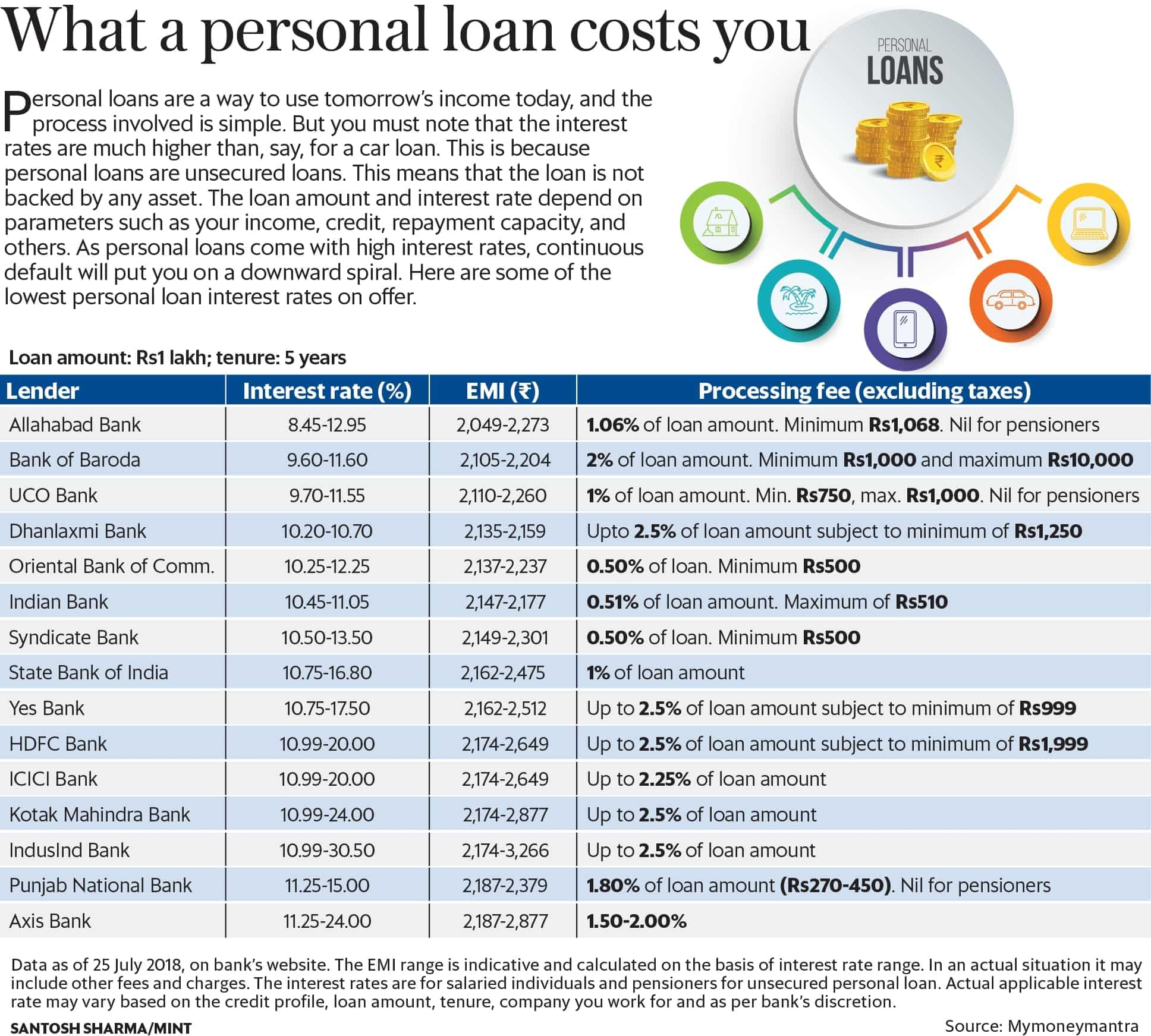

Interest Rates For Personal Loans UnderstandLoans

https://www.understandloans.net/wp-content/uploads/personal-loan-interest-rates-emis-and-charges-a-ready-reckoner.jpeg

Paying Off Student Loans Don t Forget This 2500 Deduction Frugaling

https://i1.wp.com/frugaling.org/wp-content/uploads/2014/01/StudentLoan1098-E.jpg

Web If you have availed a personal loan to invest in your business and have repaid the same Web 10 f 233 vr 2023 nbsp 0183 32 The short answer is unfortunately no The interest paid on personal

Web 3 juil 2022 nbsp 0183 32 Answer No tax benefits are available for repayment of a personal loan However interest paid on a personal loan can be claimed as a deduction depending on the ultimate use of the Web 23 janv 2020 nbsp 0183 32 Personal loans for tax deductible purposes like higher education home remodeling or business expansion can be deducted Sections 80C and 24 of the Income Tax Act provide tax relief The

Download Tax Rebate On Personal Loan Interest

More picture related to Tax Rebate On Personal Loan Interest

What Does Rebate Lost Mean On Student Loans

https://studentloanhero.com/wp-content/uploads/f21d66bc-bb4b-4eb4-8ba2-066e3aa6040a_pasted20image200.png

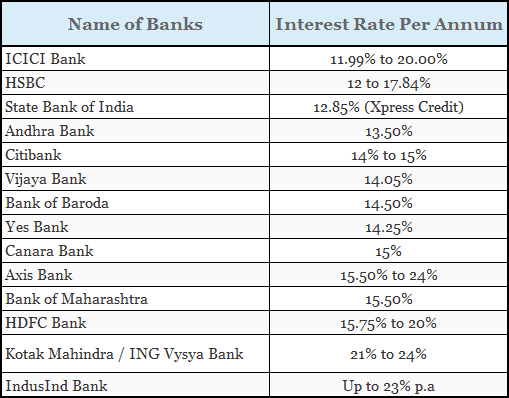

Personal Student Loans Told Me In Five Minutes KSP

http://simpleinterest.in/wp-content/uploads/2015/06/Personal-Loans-Interest-Rates.png

Review Of Fido Loans Apk Ideas Rivergambiaexpedition

https://i.pinimg.com/originals/b7/04/0f/b7040fce085c54337a780ffde783f042.jpg

Web 24 f 233 vr 2023 nbsp 0183 32 In most cases the interest payments on personal loans aren t tax Web One can avail tax benefits from their personal loan if they have used the personal loan

Web 25 mars 2022 nbsp 0183 32 If one is to answer the question about the possibilities of a tax rebate on personal loan the simple answer would be No The Income tax Act of India has rules for tax deductions and exemptions on Web 6 avr 2023 nbsp 0183 32 For instance if you pay 163 5 000 in interest payments on a loan you ve taken

TLRY Tilray Short Interest And Earnings Date Annual Report Aug 2021

https://financeai.com/stock/securities/nasdaq-tlry/chart?ts=loan-rebate-rate

CARV Carver Bancorp Short Interest And Earnings Date Annual Report

https://financeai.com/stock/securities/nasdaq-carv/chart?ts=loan-rebate-rate

https://www.forbes.com/advisor/personal-loa…

Web 29 mars 2021 nbsp 0183 32 Since personal loans are loans and not income they aren t considered taxable income and therefore you don t need to report them on your income taxes However there are some instances where

https://cleartax.in/s/tax-benefits-on-personal-loan

Web 10 mars 2023 nbsp 0183 32 You can claim deductions of up to Rs 30 000 per year on the interest

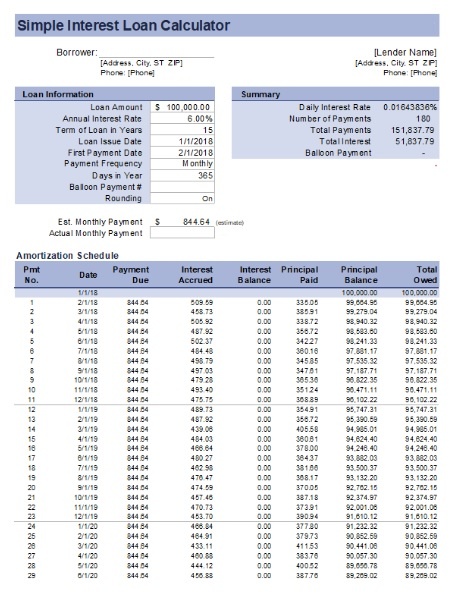

Amortization Schedule Template Free Word Templates

TLRY Tilray Short Interest And Earnings Date Annual Report Aug 2021

Interest Rates Unsubsidized Student Loans Noviaokta Blog

Compare Personal Loan Interest Rates 2020 All Banks

How To Estimate Auto Loan Rates

NNDM Nano Dimension Short Interest And Earnings Date Annual Report

NNDM Nano Dimension Short Interest And Earnings Date Annual Report

Pin On Tigri

Calculate Car Loan Interest Malaysia Car Loan Calculator With Rebate

Low Interest On Personal Loans 2022 Cuanmologi

Tax Rebate On Personal Loan Interest - Web 30 sept 2020 nbsp 0183 32 No repayments on a personal loan are not tax deductible Just as