Tax Rebate On Plug In Hybrid Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles and New Clean Vehicles Attach to your tax return

Web 17 ao 251 t 2022 nbsp 0183 32 All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based on the capacity of the battery used to power the vehicle View requirements State and or local incentives may also apply Web All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500

Tax Rebate On Plug In Hybrid

Tax Rebate On Plug In Hybrid

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/california-clean-vehicle-rebate-project-for-plug-in-hybrid-cars-youtube-8.jpg?resize=840%2C473&ssl=1

Federal Plug In Hybrid Rebate Used Cars 2022 Carrebate

https://www.californiarebates.net/wp-content/uploads/2023/04/federal-plug-in-hybrid-rebate-used-cars-2022-carrebate-6.jpg

Fillable Online PLUG IN HYBRID VEHICLE CHARGING STATION REBATE

https://www.pdffiller.com/preview/568/706/568706519/large.png

Web 16 mai 2022 nbsp 0183 32 If you purchased a new all electric vehicle EV or plug in hybrid electric vehicle PHEV during or after 2010 you may be eligible for a federal income tax credit of up to 7 500 according to the U S Web 5 mai 2023 nbsp 0183 32 The Inflation Reduction Act passed in August 2022 changed the eligibility criteria for plug in hybrid electric vehicles PHEVs to qualify for the clean vehicle tax credit As of August 16 th 2022 only PHEVs

Web 18 avr 2023 nbsp 0183 32 The only exception is compact Plug In Hybrid Electric Vehicles PHEVs which would have the tax credit capped at 7 000 The IRS issued a safe harbor notice for 2023 that all EVs have an incremental cost of at least 7 500 except compact PHEVs which have an incremental cost of 7 000 Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed once in a

Download Tax Rebate On Plug In Hybrid

More picture related to Tax Rebate On Plug In Hybrid

Boulder Hybrids Bouldering Prius Repair

https://i.pinimg.com/originals/a3/99/3b/a3993bcb2c5bb85f35221f1f9c33b01b.jpg

Table 1 From Characterizing Plug In Hybrid Electric Vehicle Consumers

https://ai2-s2-public.s3.amazonaws.com/figures/2017-08-08/df7ed74b4fa0f1b23b4eca4d9c9e319a6e4a4324/3-Table1-1.png

California Rebates For Hybrid Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/california-drops-ev-rebates-for-cars-over-60k-plug-ins-below-35-miles-1.jpg?resize=840%2C416&ssl=1

Web 17 avr 2023 nbsp 0183 32 Escape Plug in Hybrid Yes 80 000 3 750 2022 Ford Motor Company Lincoln Corsair Grand Touring Yes 80 000 3 750 2022 Ford Motor Company Lincoln Aviator Grand Touring Yes 80 000 7 500 2023 Ford Motor Company Ford F 150 Lightning Standard Range Battery Yes 80 000 7 500 2023 Ford Motor Company Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh

Web 25 juil 2023 nbsp 0183 32 You may qualify for an EV tax credit of up to 7 500 according to the IRS if you buy a new qualified plug in EV or fuel cell electric vehicle The credit is available to individuals and their Web 8 ao 251 t 2023 nbsp 0183 32 The idea in theory is quite simple per the IRS You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric

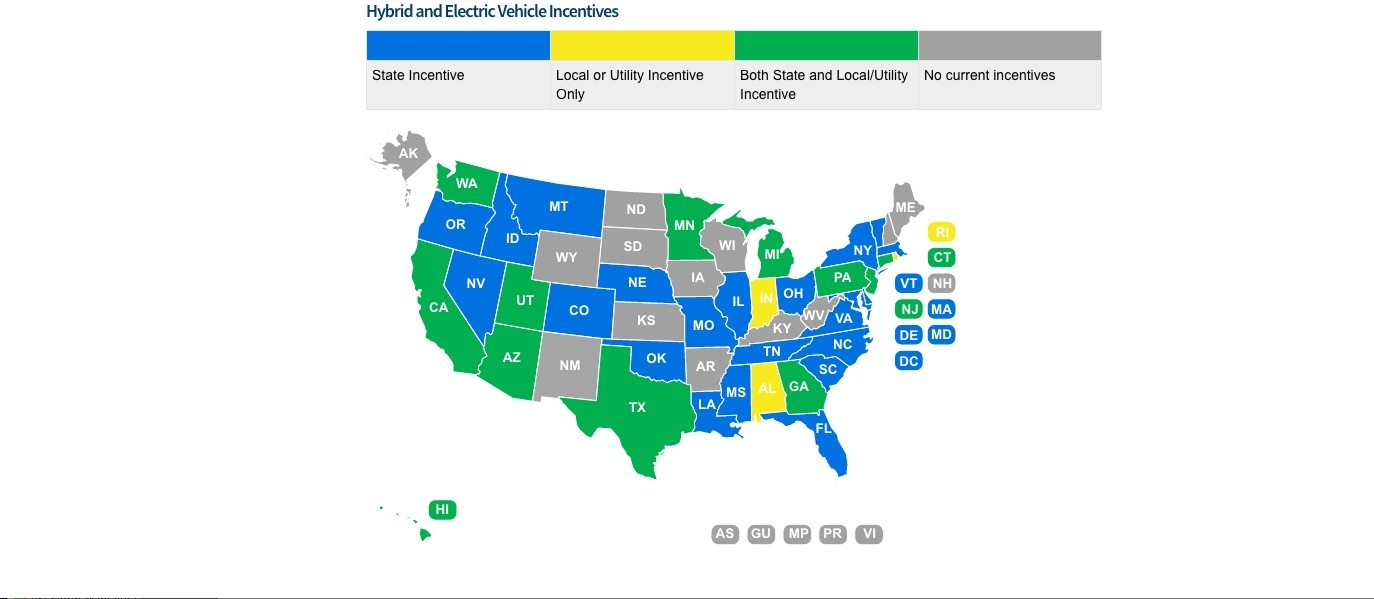

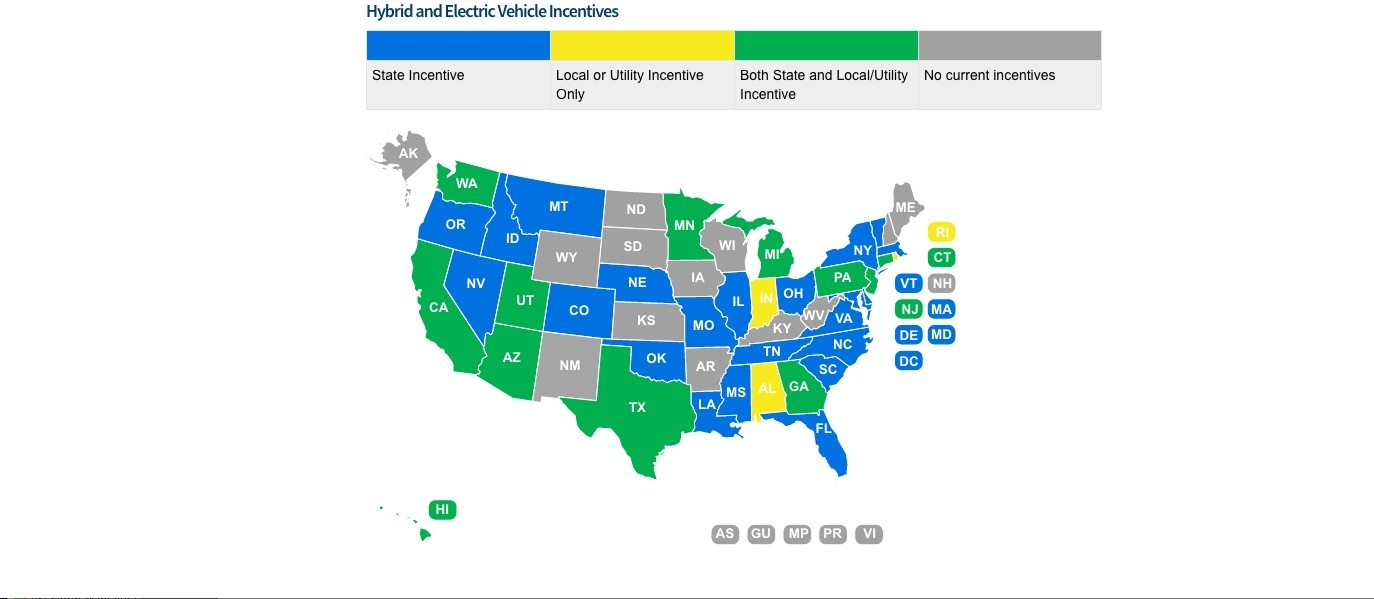

Electric Car Rebates By State ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/08/electric-car-and-plug-in-hybrid-incentives-in-the-usa-a-quick-guide.jpg

Budget 2023 India May Allow Income Tax Rebate On Electric Vehicles

https://images.cnbctv18.com/wp-content/uploads/2022/09/391310908-e1663242150789-1019x573.jpg

https://www.irs.gov/pub/irs-pdf/f8936.pdf

Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles and New Clean Vehicles Attach to your tax return

https://fueleconomy.gov/feg/tax2022.shtml

Web 17 ao 251 t 2022 nbsp 0183 32 All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based on the capacity of the battery used to power the vehicle View requirements State and or local incentives may also apply

The Florida Hybrid Car Rebate Save Money And Help The Environment

Electric Car Rebates By State ElectricRebate

Florida Offering 5 000 Rebates For Plug in Hybrid Prius Conversions

Massachusetts Rebates For Hybrid Cars 2023 Carrebate

Tax Rebates For Toyota Avalon Hybrid Car 2022 Carrebate Rebate2022

Tax Rebate On Hybrid Cars 2022 Colorado 2023 Carrebate

Tax Rebate On Hybrid Cars 2022 Colorado 2023 Carrebate

Federal Rebate Hybrid Car 2023 Carrebate

New Rebates For Battery Electric And Plug in Hybrid Vehicles Announced

Ford Rebates 2022 Fusion FordRebates

Tax Rebate On Plug In Hybrid - Web 5 mai 2023 nbsp 0183 32 The Inflation Reduction Act passed in August 2022 changed the eligibility criteria for plug in hybrid electric vehicles PHEVs to qualify for the clean vehicle tax credit As of August 16 th 2022 only PHEVs