Tax Rebate On Ppi Claim Web 27 avr 2023 nbsp 0183 32 You normally have four years from the end of the tax year in which the overpayment arose to claim a refund So if you received your PPI refund in 2022 23 you have until 5 April 2027 to submit a claim If

Web UK income if you live abroad interest from savings or payment protection insurance PPI income from a life or pension annuity foreign income You cannot claim a refund using Web Claiming a Tax Refund on my PPI Payout CAN I CLAIM A TAX REFUND ON MY PPI PAYOUT Have you had a PPI payout Well you could still be owed 163 100 s Keep

Tax Rebate On Ppi Claim

Tax Rebate On Ppi Claim

https://debtcamel.co.uk/wp-content/uploads/2016/12/r40-reclaim-tax-on-income-from-savings.gif

Can I Claim Ppi Back From My Catalogue

http://ambertax.com/wp-content/uploads/P60-form-1.jpg

Do You Want To Claim PPI Tax Back Here s How It Works Gowing Law

https://i.ibb.co/M2TW3M8/What-can-you-get-paid-back-for-a-PPI-Claim.png

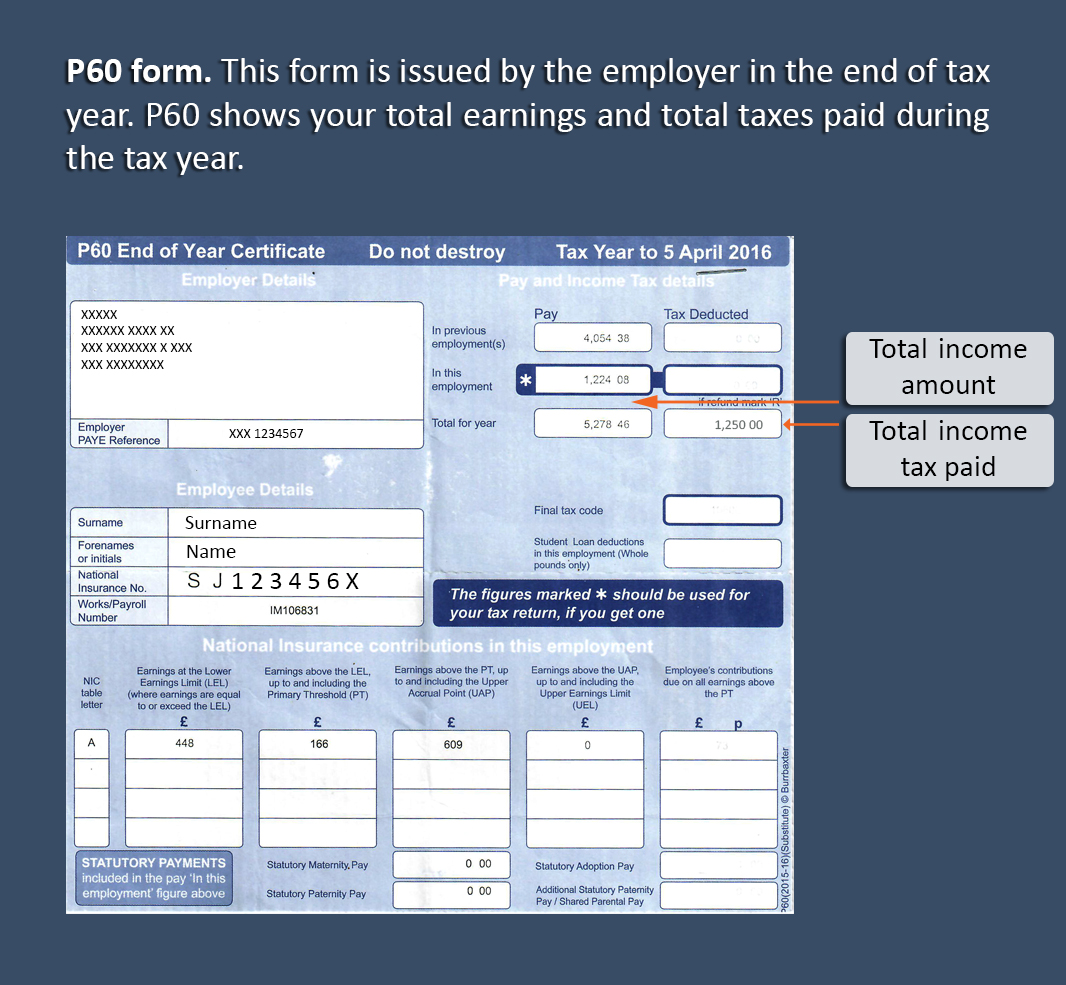

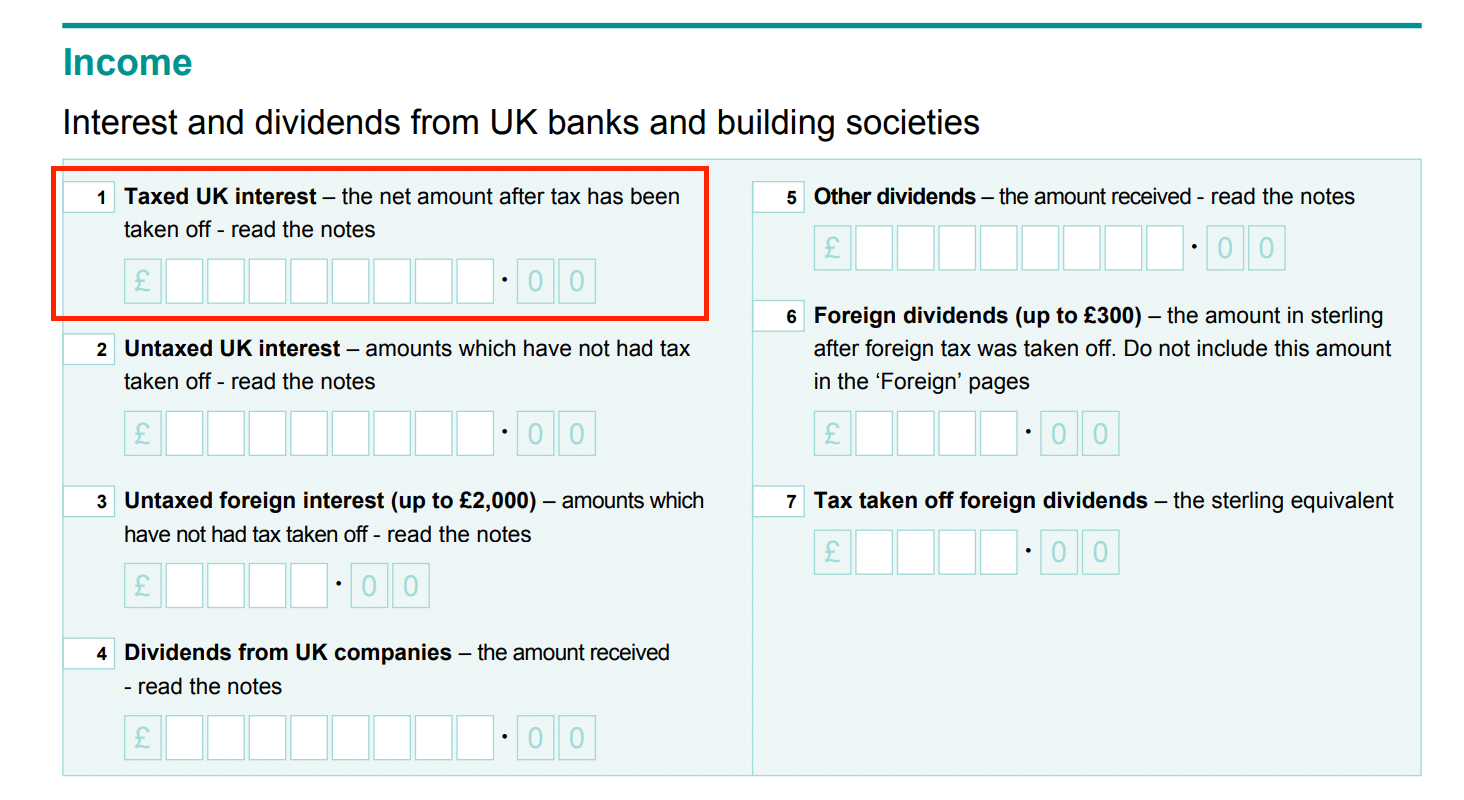

Web To claim your PPI tax rebate HMRC need you to complete an R40 form which is specifically for claiming back a tax refund from savings and investments You can complete the R40 Web 3 avr 2023 nbsp 0183 32 you have paid too much tax on interest from your savings and investments including purchased life annuities or PPI payouts and you are resident for tax purposes in the UK You have four years

Web 30 mars 2022 nbsp 0183 32 Wed 30 Mar 2022 02 00 EDT In December my neighbour was notified by HM Revenue and Customs that she was entitled to a rebate of 163 324 for the tax year Web 12 sept 2023 nbsp 0183 32 A refund of the PPI you paid If the bank outrageously added an extra loan to your original loan just to pay for the PPI you get back any interest you were charged on this extra loan You get

Download Tax Rebate On Ppi Claim

More picture related to Tax Rebate On Ppi Claim

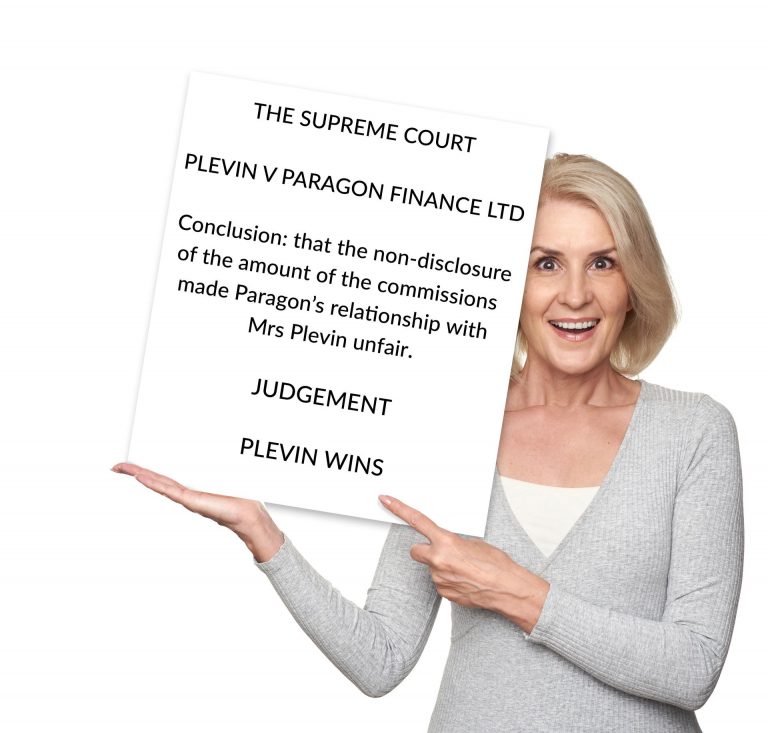

What Could Make Me Eligible For A PPI Tax Reclaim Gowing Law

https://i.ibb.co/QnxsKqC/Evidence-needed-for.png

Can I Still Claim PPI PPI Rebates

https://www.ppirebates.co.uk/wp-content/uploads/can-i-still-claim-ppi.jpg

PPI Tax Rebate Page 2 MoneySavingExpert Forum

https://us-noi.v-cdn.net/6031891/uploads/editor/eo/m6cbfsgn8cbg.jpg

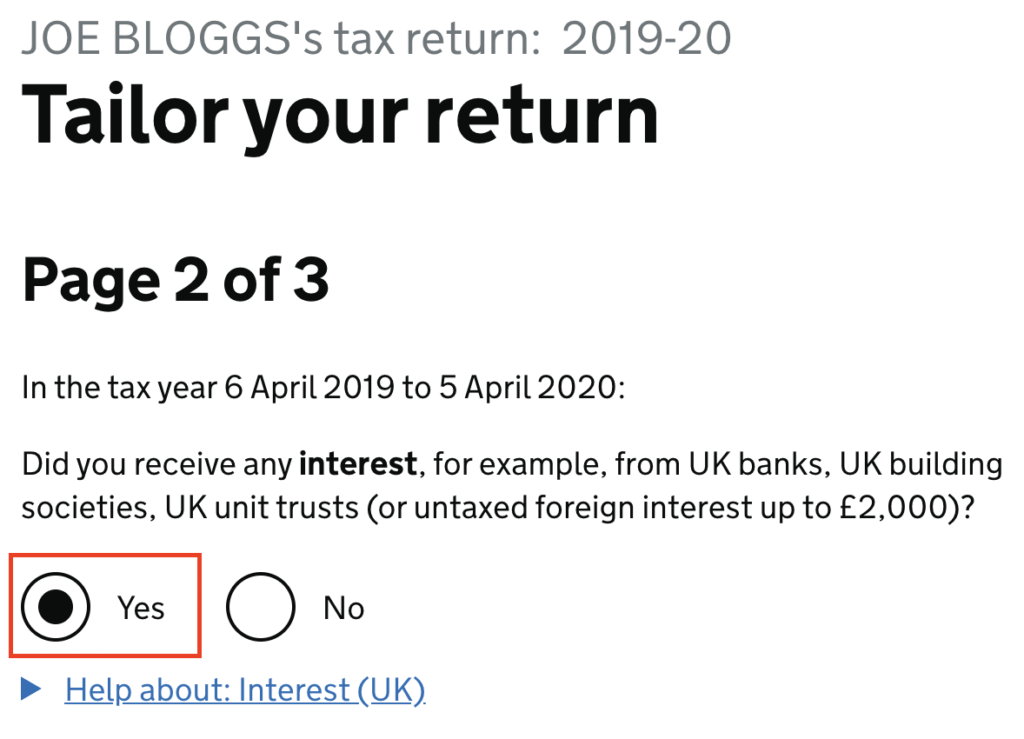

Web 21 oct 2020 nbsp 0183 32 October 21 2020 7 00 am Dear Gareth I have been getting calls telling me that I m owed some tax back from HMRC on a PPI refund I received The company that called will charge 39 per cent for Web 19 mars 2021 nbsp 0183 32 To reclaim any tax you re due on PPI payouts you ll need to fill out the R40 form on the GOV UK website You can make a claim using the online service or fill in

Web 3 nov 2021 nbsp 0183 32 You can only reclaim PPI tax going back four tax years as well as the current one So as we re now in the 2021 22 tax year that means the furthest you can claim Web If you have had a successful claim from your lender s for Mis Sold Payment Protection Insurance PPI since April 2019 you may be entitled to a rebate from HM Revenue amp

HMRC PPI Tax Refund In UK EmployeeTax

https://employeetax.co.uk/wp-content/uploads/2020/07/PNG.png

Claiming Tax Back On Your PPI Refund PPI Rebates

https://www.ppirebates.co.uk/wp-content/uploads/tax-rebate.jpg

https://www.litrg.org.uk/tax-guides/tax-basics/…

Web 27 avr 2023 nbsp 0183 32 You normally have four years from the end of the tax year in which the overpayment arose to claim a refund So if you received your PPI refund in 2022 23 you have until 5 April 2027 to submit a claim If

https://www.gov.uk/claim-tax-refund

Web UK income if you live abroad interest from savings or payment protection insurance PPI income from a life or pension annuity foreign income You cannot claim a refund using

How To Declare A PPI Refund On Your Tax Return PPI Rebates

HMRC PPI Tax Refund In UK EmployeeTax

Posted 26th August 2021 By By Ilyas Patel

The Top Reasons Why You Need A Solicitor To Help You With PPI Tax

Claim Your PPI Tax Rebate Your Claim Matters

How To Claim and Increase Your P800 Refund Tax Rebates

How To Claim and Increase Your P800 Refund Tax Rebates

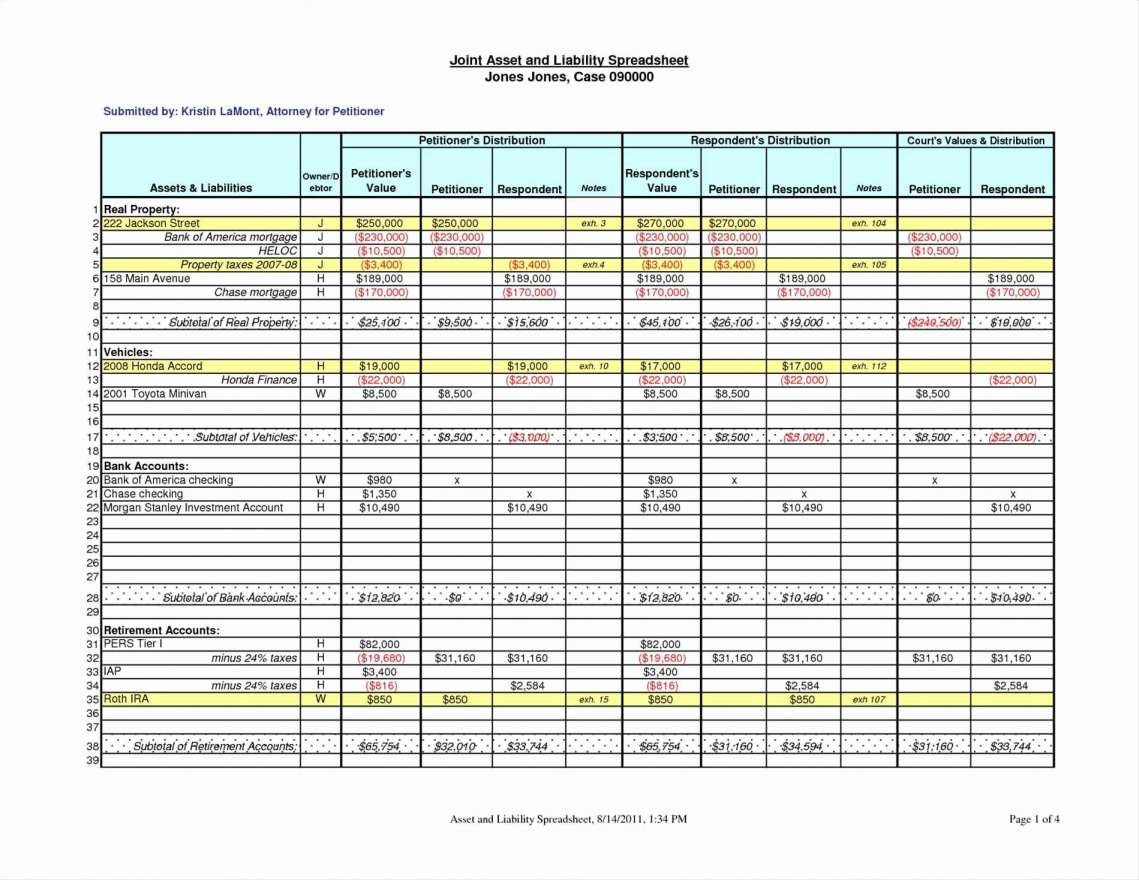

Ppi Claims Calculator Spreadsheet Google Spreadshee Ppi Claim

How To Declare A PPI Refund On Your Tax Return PPI Rebates

Have You Paid Excessive Tax On Your PPI Refund Instant Bazinga

Tax Rebate On Ppi Claim - Web 30 mars 2022 nbsp 0183 32 Wed 30 Mar 2022 02 00 EDT In December my neighbour was notified by HM Revenue and Customs that she was entitled to a rebate of 163 324 for the tax year