Tax Rebate On Savings Interest Web 11 mai 2023 nbsp 0183 32 Guidance Claim a refund of Income Tax deducted from savings and investments English Cymraeg Apply for a repayment of tax on your savings interest

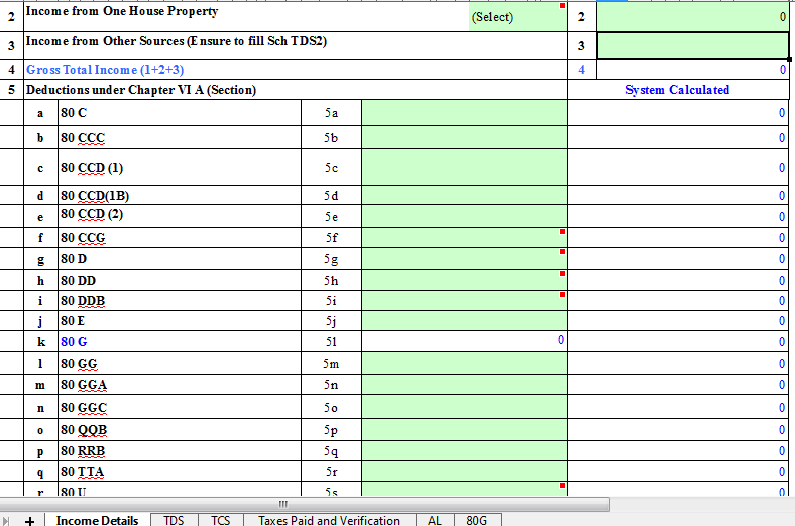

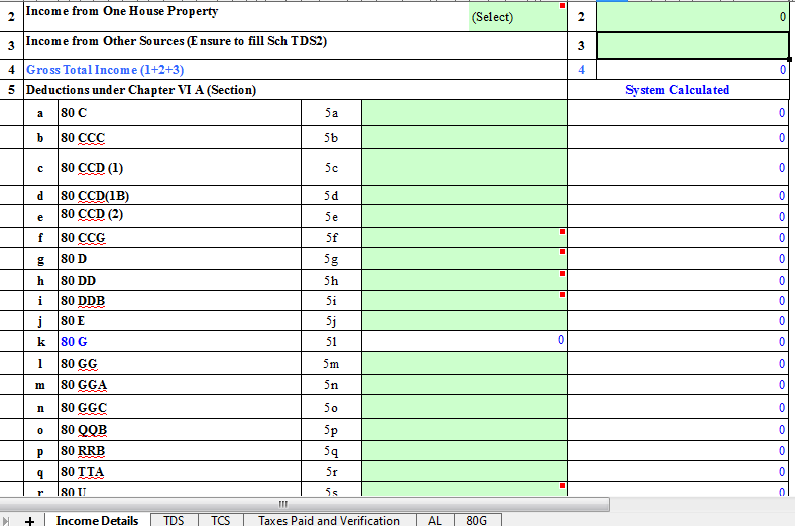

Web 6 avr 2023 nbsp 0183 32 Since 6 April 2016 most people have no tax to pay on interest they receive from a bank or building society account due to the personal savings allowance PSA of 163 1 000 or 163 500 for higher rate Web 6 mars 2023 nbsp 0183 32 Savings Account interest is taxable at your slab rate However interest up to Rs 10 000 is exempt from tax under Section 80TTA This tax exempt limit is Rs 50 000 for senior citizens under

Tax Rebate On Savings Interest

Tax Rebate On Savings Interest

https://taxadda.com/wp-content/uploads/ITR-1-1.png

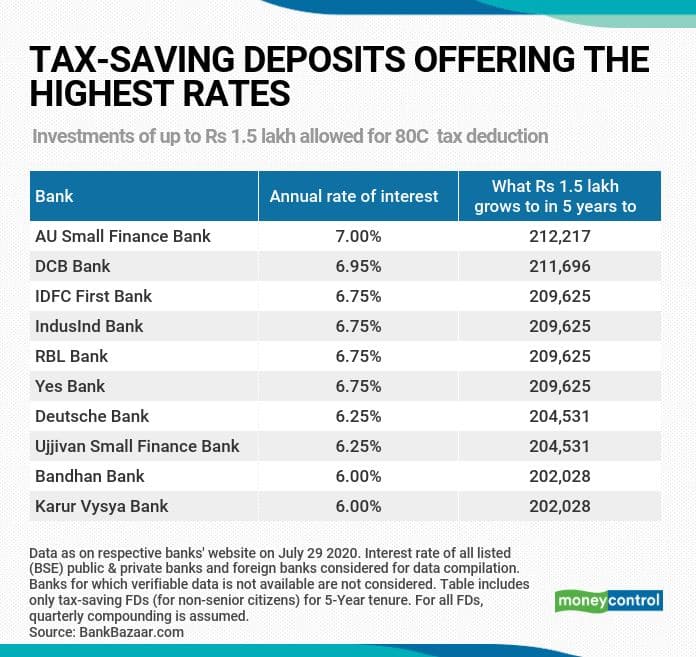

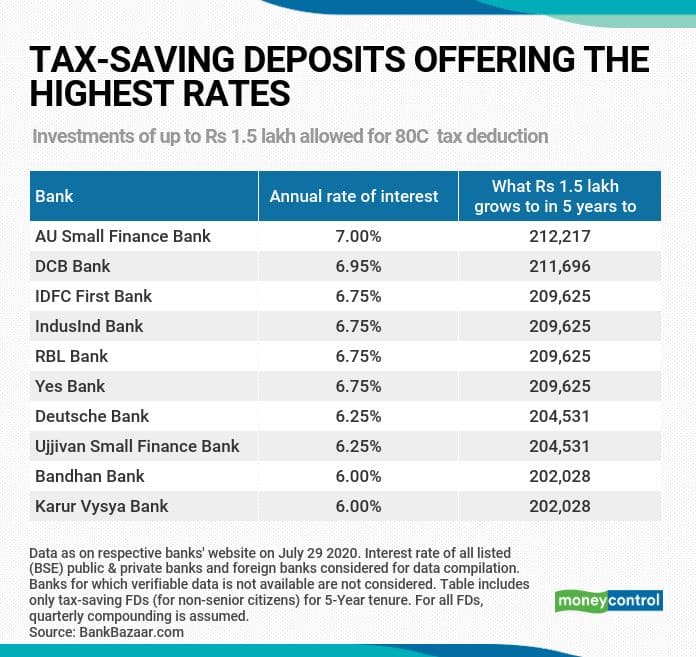

10 Tax saving Fixed Deposits That Offer The Best Interest Rates 10 Tax

https://images.moneycontrol.com/static-mcnews/2020/07/FD-July-31.jpg

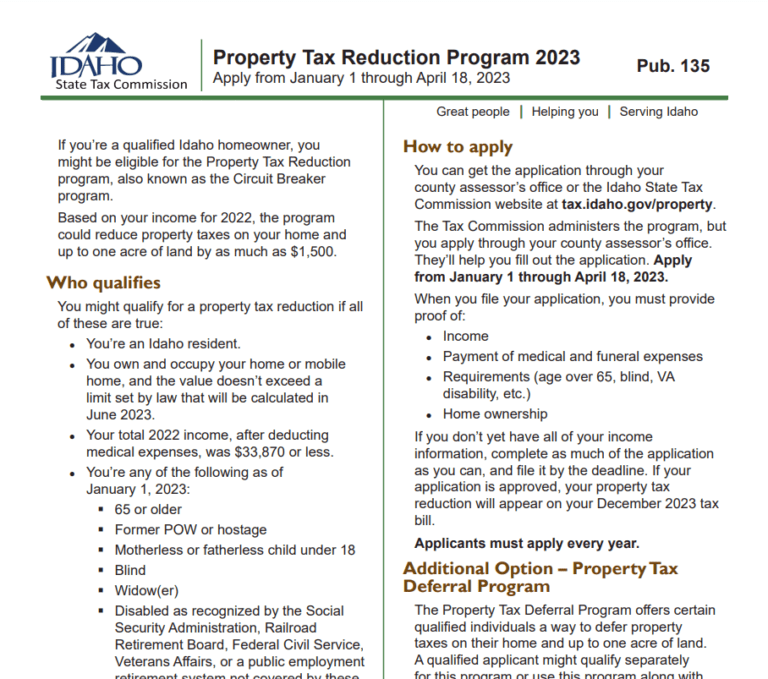

Idaho Tax Rebate 2023 Your Comprehensive Guide To Saving Money

https://printablerebateform.net/wp-content/uploads/2023/03/Idaho-Tax-Rebate-2023-768x679.png

Web If you earn more than 163 17 750 from non savings income you can earn 163 1 000 in savings interest tax free If all of your income is from savings interest you can earn up to Web 26 avr 2023 nbsp 0183 32 If your savings account has 10 000 and earns 0 2 interest you are only taxed on the 20 interest the bank pays you You are not taxed on the 10 000 or principal amount Exceptions to

Web 10 mars 2022 nbsp 0183 32 Savings account interest will be taxed at the same marginal income tax rate as the rest of your earned income Here s a look at the tax rates for the 2022 tax Web Whether you get a PSA depends on your tax status Basic rate taxpayers can earn up to 163 1 000 of interest tax free each tax year If you re a higher rate taxpayer you get a 163 500 allowance Additional rate taxpayers don t

Download Tax Rebate On Savings Interest

More picture related to Tax Rebate On Savings Interest

![]()

Free Savings Tracker For Couponers

http://thecouponproject.com/wp-content/uploads/2013/12/savingstracker.jpg

Tax Credits Rebates Savings Tax Credits Rebates Savings

https://i.pinimg.com/originals/77/52/bd/7752bd24938ffe21ec3151a2f12cd758.png

Here Are 10 Tax saving Fixed Deposits Offering High Interest Rates

https://11xi.in/uploads/images/image_750x_5ef95fef8646a.jpg

Web 6 avr 2023 nbsp 0183 32 Danielle Richardson What is the personal savings allowance Since April 2016 savers have been able to grow their money tax free thanks to the personal savings allowance This allowance varies Web 6 avr 2023 nbsp 0183 32 One way to escape falling into the savings interest tax trap is by making use of your tax free cash ISA allowance as well as an ordinary savings account Cash ISAs

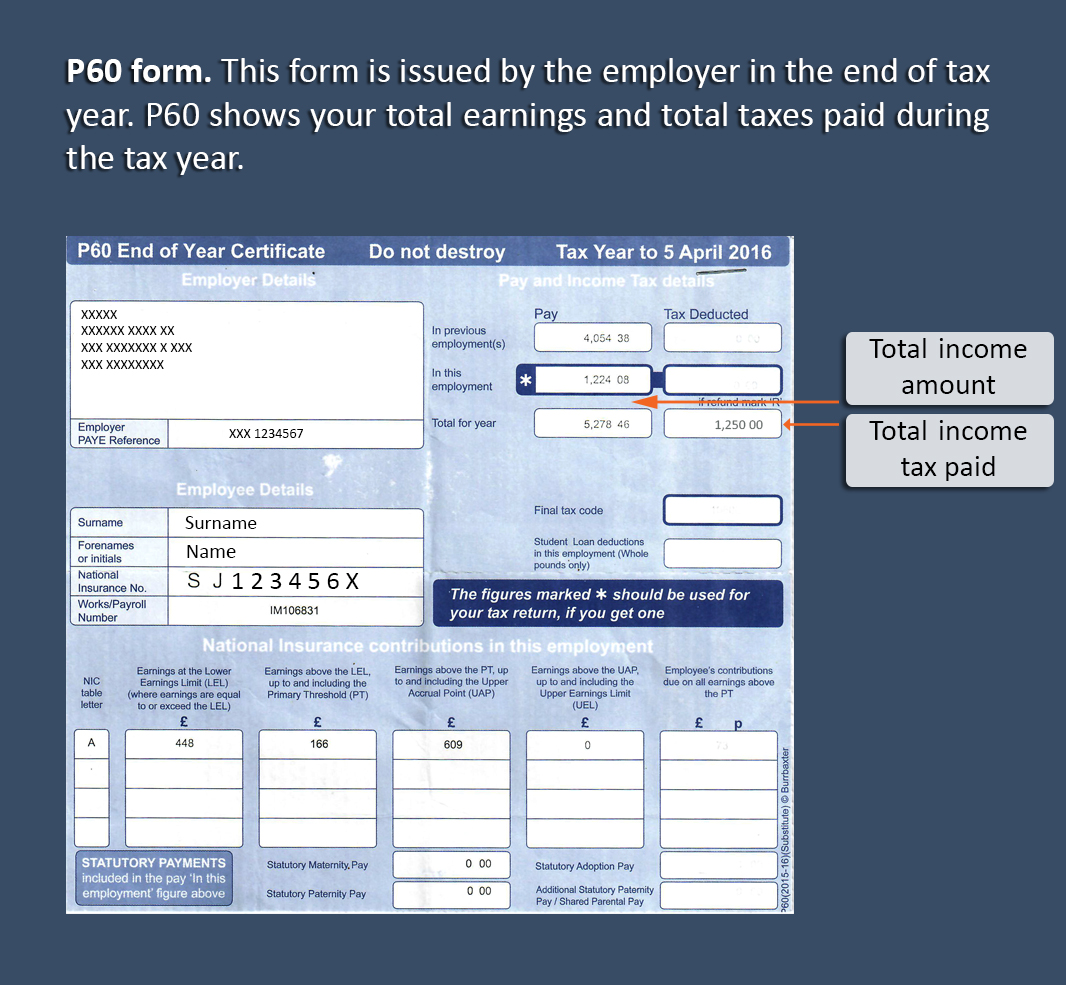

Web Savings Interest tax rebate A tax rebate can be due on income tax paid on savings interest with the R40 form needing to be submitted to HMRC for each tax year of your Web 17 avr 2014 nbsp 0183 32 If you have paid tax on your savings you might have paid too much Find out what tax you should be paying and how to claim it back

Bank Savings Account Interest Rate

https://i1.wp.com/blog.investyadnya.in/wp-content/uploads/2020/07/Savings-Account-Interest-Rates-of-Small-Finance-Banks-August-2020.png?fit=1316%2C874&ssl=1

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

https://www.gov.uk/guidance/claim-a-refund-of-income-tax-deducted-from...

Web 11 mai 2023 nbsp 0183 32 Guidance Claim a refund of Income Tax deducted from savings and investments English Cymraeg Apply for a repayment of tax on your savings interest

https://www.litrg.org.uk/.../how-do-i-claim-ba…

Web 6 avr 2023 nbsp 0183 32 Since 6 April 2016 most people have no tax to pay on interest they receive from a bank or building society account due to the personal savings allowance PSA of 163 1 000 or 163 500 for higher rate

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Bank Savings Account Interest Rate

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Can I Claim Ppi Back From My Catalogue

IRAS Tax Savings For Married Couples And Families

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

You Need A High Interest Savings Account Here s Why High Interest

Oregon Solar Power For Your House Rebates Tax Credits Savings Tax

P55 Tax Rebate Form By State Printable Rebate Form

Tax Rebate On Savings Interest - Web Whether you get a PSA depends on your tax status Basic rate taxpayers can earn up to 163 1 000 of interest tax free each tax year If you re a higher rate taxpayer you get a 163 500 allowance Additional rate taxpayers don t