Tax Rebate On Second Home Loan India Web 9 janv 2021 nbsp 0183 32 1 One flat is given on rent of Rs 15000 per month For this flat home loan interest per annum is Rs 1 41 859 2 Second flat is also given on rent of Rs 15000 per month The approximate home loan interest for this flat is Rs 2 00 000 What

Web Tax Benefits on Second Home Loan The Government made a significant amendment to the financial budget for FY 2019 20 in which taxpayers have been allowed to declare two houses as self occupied As a result Web Tax Benefits for Second Home Loan People who own two homes are eligible for a wide range of second home loan tax benefits Let s examine these advantages in greater detail and the tax benefit on second home

Tax Rebate On Second Home Loan India

Tax Rebate On Second Home Loan India

https://i.ytimg.com/vi/pjIaJTYVEhc/maxresdefault.jpg

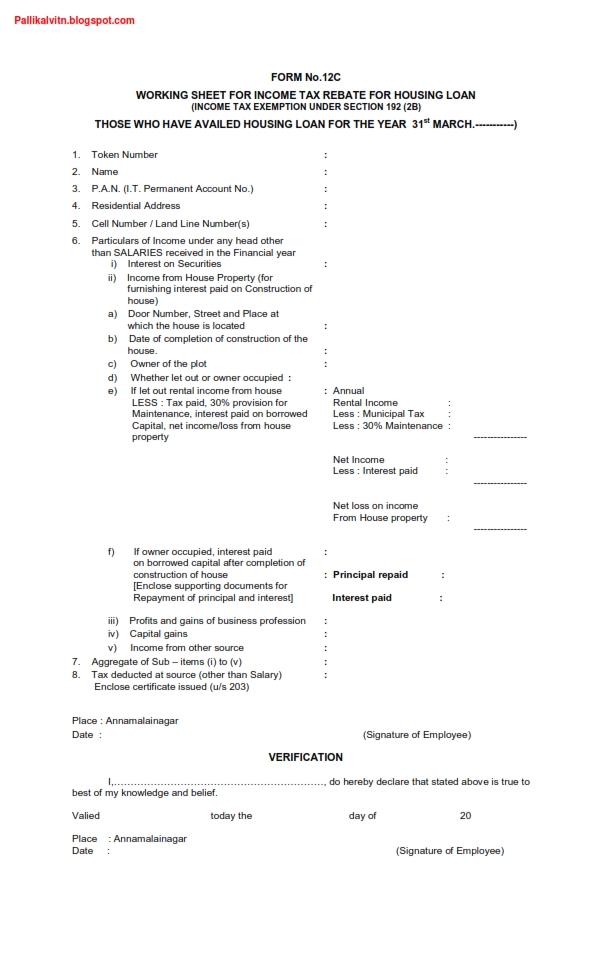

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Complete Guide On Second Home Loan Tax Benefit In India

https://favesblog.com/wp-content/uploads/2023/02/Featured-Image.jpg

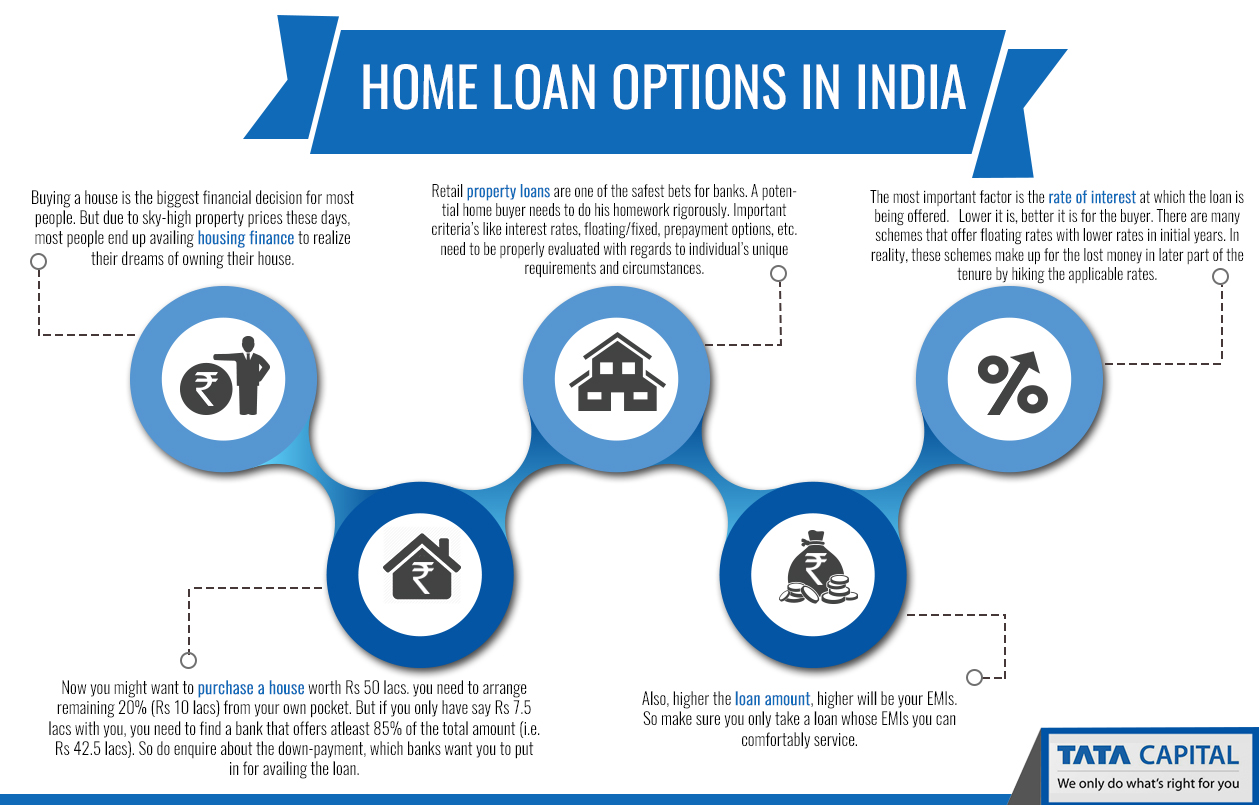

Web 28 mars 2017 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax benefit Web 21 mars 2021 nbsp 0183 32 Under the income tax laws there are no restrictions on the number of houses for which you can claim the tax benefits for home loan Whether you have one home loan or more the deduction allowable

Web There are two possibilities here Both residences are self occupied According to the most recent budget provisions the second property cannot be considered rent As a result both properties will be considered self occupied The total interest paid on both residences Web 11 avr 2023 nbsp 0183 32 Tax deduction on home loan principal under section 80C of the Income Tax Act 1961 Under section 80C of the Income Tax Act 1961 you get tax benefits on the home loan principal repayments made

Download Tax Rebate On Second Home Loan India

More picture related to Tax Rebate On Second Home Loan India

Know How To Claim Tax Benefits On Second Home Loan PNB Housing

https://www.pnbhousing.com/wp-content/uploads/2022/12/cropped-Know-How-to-Claim-Tax-Benefits-on-Second-Home-Loan.png

What Are The Income Tax Benefits On Second Home Loan In India

https://i0.wp.com/www.thewealthwisher.com/wp-content/uploads/2012/05/Home-Loan-Details4.gif?resize=506%2C177

How To Claim Tax Benefit For Second Home Loan

https://qph.fs.quoracdn.net/main-qimg-c7b2ac726b60b6fa2aeaea32e58e3c6e

Web If you buy a second home on Home Loan you can even avail of tax deductions on it While deductions under Section 80C on the principal amount of the loan may not be available in case of your second house you can enjoy tax benefits on the interest Web 17 janv 2022 nbsp 0183 32 There are tax benefits of availing of a second home loan The principal portion of all your Home Loan EMIs can be claimed as a deduction up to Rs 1 50 lakh per financial year under Section 80C of the Income Tax Act 1961

Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less than 45 lakh can still claim Web Income Tax Benefits on Home Loans The Income Tax Act 1961 offers various provisions for a tax rebate on home loans The following are the three major areas where such a borrower can claim exemptions Principal repayment of home loans can net annual tax

Lodesignsllc Home Loan 2Nd House

https://www.indiabullshomeloans.com/uploads/blog/blognew.png

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

https://taxguru.in/income-tax/income-tax-benefits-deductions-second...

Web 9 janv 2021 nbsp 0183 32 1 One flat is given on rent of Rs 15000 per month For this flat home loan interest per annum is Rs 1 41 859 2 Second flat is also given on rent of Rs 15000 per month The approximate home loan interest for this flat is Rs 2 00 000 What

https://www.icicibank.com/blogs/home-loan/t…

Web Tax Benefits on Second Home Loan The Government made a significant amendment to the financial budget for FY 2019 20 in which taxpayers have been allowed to declare two houses as self occupied As a result

5 Tax Benefits Of Taking NRI Home Loans In India SavingsFunda

Lodesignsllc Home Loan 2Nd House

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Income Tax Rebate On Home Loan Fy 2019 20 A design system

Second Home Loan Vs Investment Property InvestmentProGuide

Home Loan Tax Rebate

Home Loan Tax Rebate

A Complete Guide On Tax Rebate On Second Home Loan Derek Time

What Is Home Loan In India Eligibility Types And Benefits

Tax Benefit On Second Home Loan

Tax Rebate On Second Home Loan India - Web 21 mars 2021 nbsp 0183 32 Under the income tax laws there are no restrictions on the number of houses for which you can claim the tax benefits for home loan Whether you have one home loan or more the deduction allowable