Tax Rebate On Second Home Loan Web 24 janv 2022 nbsp 0183 32 For maintenance purposes and general upkeeps the owner of that let out property can claim a tax rebate of 30 Under Section 24 of IT Act one can avail income tax benefit on interest payment of the

Web 4 lignes nbsp 0183 32 Calculate the tax benefit on a second Home Loan in advance to save time and unnecessary Web If you buy a second home on Home Loan you can even avail of tax deductions on it While deductions under Section 80C on the principal amount of the loan may not be

Tax Rebate On Second Home Loan

Tax Rebate On Second Home Loan

https://propertyadviser.in/assets/front/images/real-estate-news/s1/income-tax-rebate-on-home-loan-819-s1.jpg

How To Claim Tax Benefit For Second Home Loan

https://qph.fs.quoracdn.net/main-qimg-c7b2ac726b60b6fa2aeaea32e58e3c6e

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

https://i.pinimg.com/originals/07/68/e8/0768e843fce468a6a866abfdec4820d1.jpg

Web 9 janv 2021 nbsp 0183 32 1 One flat is given on rent of Rs 15000 per month For this flat home loan interest per annum is Rs 1 41 859 2 Second flat is also given on rent of Rs 15000 Web You can deduct a typical 30 percent interest on a home loan and municipal taxes from that You can deduct up to Rs 2 lakhs from your other sources of income Home Loan

Web 11 janv 2023 nbsp 0183 32 The government offers various tax rebates especially if the property has been purchased using a home loan to make property purchases more lucrative for home buyers investors In this article we Web Income tax rebate on home loan Perks of tax advantaged home loans with second homes Second homeowners may take advantage of tax breaks on interest that become

Download Tax Rebate On Second Home Loan

More picture related to Tax Rebate On Second Home Loan

Tax Benefits On Second Home Loan Know How To Claim HDFC Bank YouTube

https://i.ytimg.com/vi/pjIaJTYVEhc/maxresdefault.jpg

Everything You Must Know About Second Home Loan Tax Benefit In India

https://www.nobroker.in/blog/wp-content/uploads/2022/08/Second-Home-Loan-Tax-Benefit-1.jpg

Illinois Tax Rebate Tracker Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/illinois-tax-rebate-2022-cray-kaiser-1.png

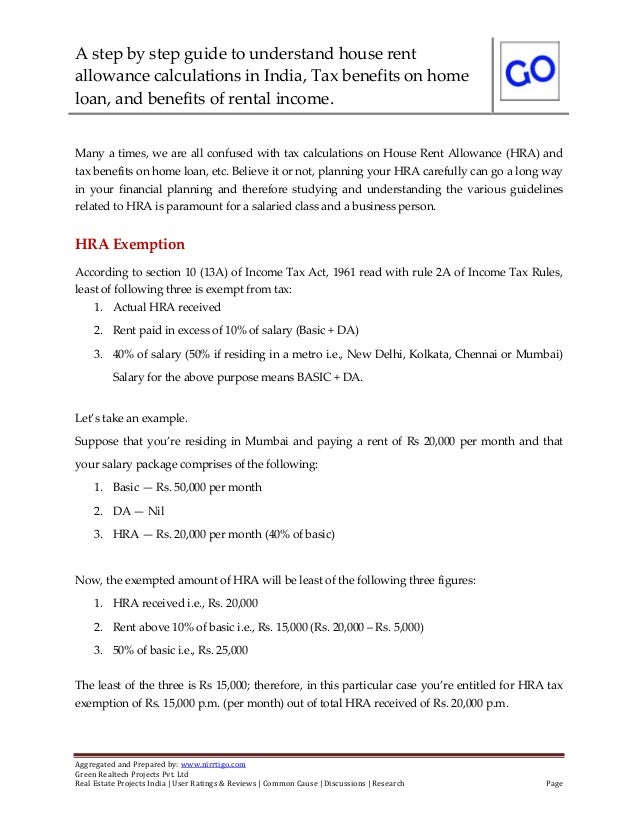

Web 21 d 233 c 2022 nbsp 0183 32 The Indian Government allows tax rebates on second home loans under two sections of the Income Tax laws Section 80C and Section 24 The following paragraphs explain the key features of both Must Web 5 f 233 vr 2023 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax

Web You can claim deduction for interest payable on a loan taken for purchase construction repair or renovation of any property whether commercial or residential under Section 24 b This deduction on interest payment is Web 20 mai 2016 nbsp 0183 32 E g if you have taken second home loan and it has Rs 2 5 Lakhs as interest and Rs 1 Lakh as principal amount you can claim this Rs 2 5 Lakhs as an income tax

Complete Guide On Second Home Loan Tax Benefit In India

https://favesblog.com/wp-content/uploads/2023/02/Featured-Image.jpg

A Complete Guide On Tax Rebate On Second Home Loan Derek Time

https://www.derektime.com/wp-content/uploads/2019/02/home-loan-768x432.jpg

https://navi.com/blog/second-home-loan

Web 24 janv 2022 nbsp 0183 32 For maintenance purposes and general upkeeps the owner of that let out property can claim a tax rebate of 30 Under Section 24 of IT Act one can avail income tax benefit on interest payment of the

https://www.icicibank.com/blogs/home-loan/t…

Web 4 lignes nbsp 0183 32 Calculate the tax benefit on a second Home Loan in advance to save time and unnecessary

Know How To Claim Tax Benefits On Second Home Loan PNB Housing

Complete Guide On Second Home Loan Tax Benefit In India

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

FHFA High Balance Second Home Loan Changes 2022 New Season Mortgage

Pin On Canada Home Tax Rebate

Application For Rebate Of Property Taxes Niagara Falls Ontario

Application For Rebate Of Property Taxes Niagara Falls Ontario

Home Loan Tax Rebate 5

How To Calculate Tax Rebate On Home Loan Grizzbye

New Housing Tax Rebate Canada Home Tax Rebate Rebates Tax Canada

Tax Rebate On Second Home Loan - Web On Tax Benefits for Second Home Loan There are a slew of tax benefits for those who own two houses But there will not be any such perk if you have already repaid your