Tax Rebate On Second Housing Loan Web Know hoe the tax benefits on a second home loan work Save more on taxes while fulfilling your dream of owning a second property Check eligibility and apply now

Web 24 janv 2022 nbsp 0183 32 For maintenance purposes and general upkeeps the owner of that let out property can claim a tax rebate of 30 Under Section 24 of IT Act one can avail income tax benefit on interest payment of the Web 9 janv 2021 nbsp 0183 32 Interest repayment of loan taken for residential house property Maximum Rs 1 50 000 followed by a given condition a Loan sanctioned period is between

Tax Rebate On Second Housing Loan

Tax Rebate On Second Housing Loan

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Web 5 f 233 vr 2023 nbsp 0183 32 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh let out property there is no Web 11 janv 2023 nbsp 0183 32 Yes you claim deductions on two home loans within the specific limit under Section 24 Rs 2 lakhs per annum if the properties are self occupied Only for your first home you can claim benefits under

Web The tax laws not only allow you deduction for interest but also allow you rebate for repayment of the principal amount under certain circumstances As per provisions of Section 80C an individual and an HUF can claim up Web 21 mars 2021 nbsp 0183 32 Under the income tax laws there are no restrictions on the number of houses for which you can claim the tax benefits for home loan Whether you have one home loan or more the deduction

Download Tax Rebate On Second Housing Loan

More picture related to Tax Rebate On Second Housing Loan

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Know How To Claim Tax Benefits On Second Home Loan PNB Housing

https://www.pnbhousing.com/wp-content/uploads/2022/12/cropped-Know-How-to-Claim-Tax-Benefits-on-Second-Home-Loan.png

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

Web Tax benefits on a Home Loan for a second home If you buy a second home on Home Loan you can even avail of tax deductions on it While deductions under Section 80C Web 24 d 233 c 2019 nbsp 0183 32 Yes it is possible to get tax benefit on the second home loan in the same financial year The tax benefit on two home loans taken for the purchase of two self occupied properties can be claimed under

Web As you can see income tax rebate on home loans can lead to massive savings for an individual But what happens in case of a joint home loan Which of the borrower is Web 21 d 233 c 2022 nbsp 0183 32 The Indian Government allows tax rebates on second home loans under two sections of the Income Tax laws Section 80C and Section 24 The following

FREE 8 Loan Receipt Templates Examples In MS Word PDF

https://images.sampletemplates.com/wp-content/uploads/2017/05/Housing-Loan-Receipt.jpg

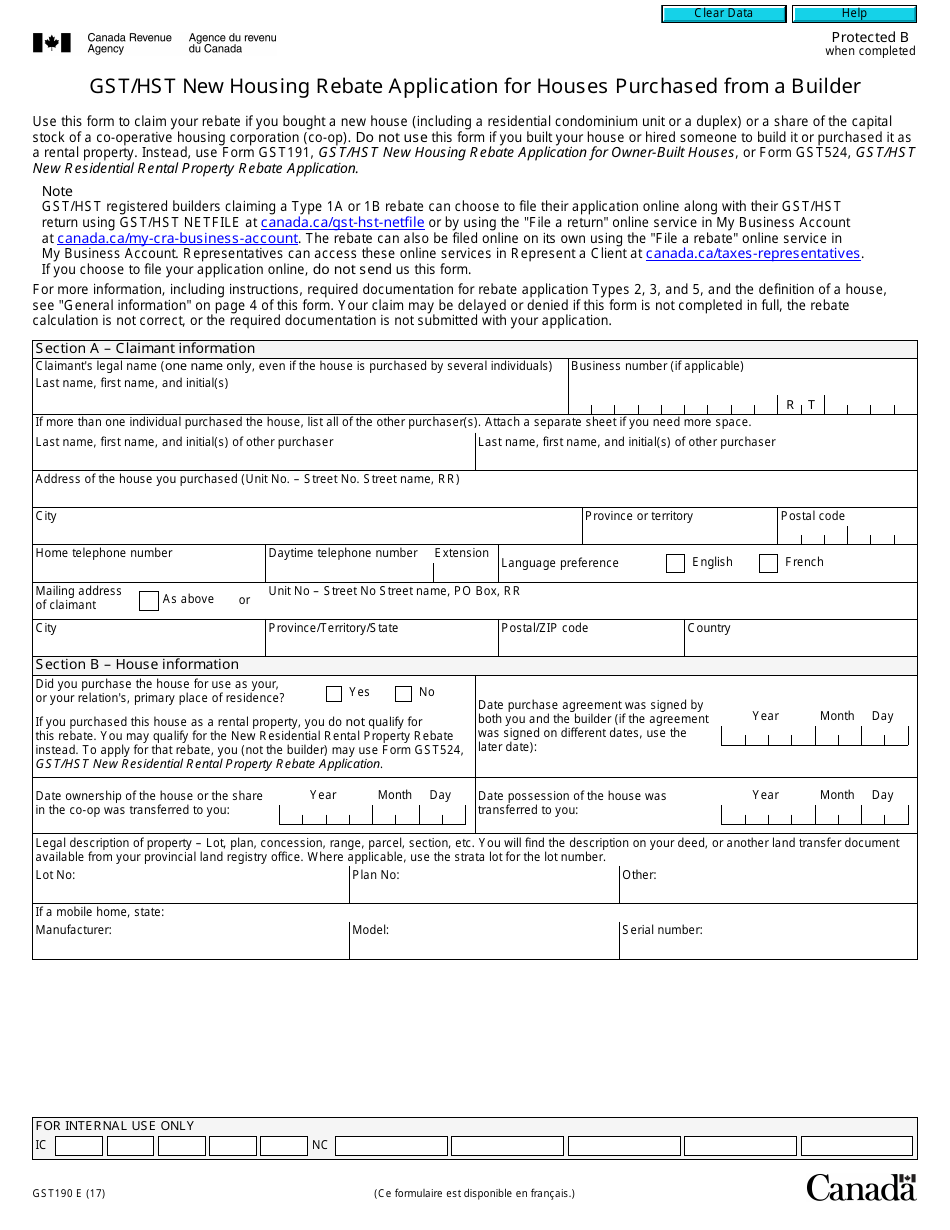

Form GST190 Download Fillable PDF Or Fill Online Gst Hst New Housing

https://data.templateroller.com/pdf_docs_html/1867/18672/1867279/form-gst190-gst-hst-new-housing-rebate-application-for-houses-purchased-from-a-builder-canada_print_big.png

https://www.icicibank.com/blogs/home-loan/ta…

Web Know hoe the tax benefits on a second home loan work Save more on taxes while fulfilling your dream of owning a second property Check eligibility and apply now

https://navi.com/blog/second-home-loan

Web 24 janv 2022 nbsp 0183 32 For maintenance purposes and general upkeeps the owner of that let out property can claim a tax rebate of 30 Under Section 24 of IT Act one can avail income tax benefit on interest payment of the

New Housing Tax Rebate Canada Home Tax Rebate Rebates Tax Canada

FREE 8 Loan Receipt Templates Examples In MS Word PDF

Ontario New Housing Rebate Form By State Printable Rebate Form

How To Get A Second Home Loan For Rental Income

Tax Benefits On Second Home Loan Tax Exemption On 2nd Home Loan PNB

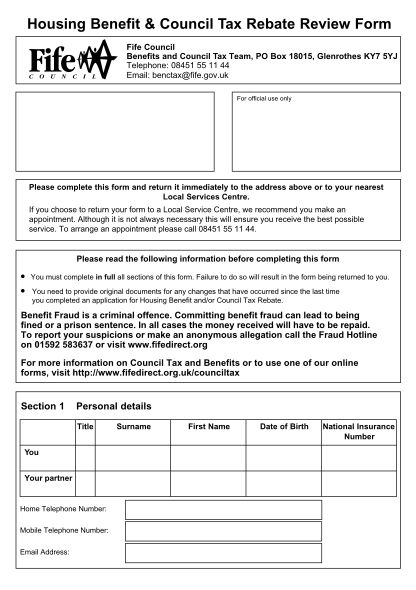

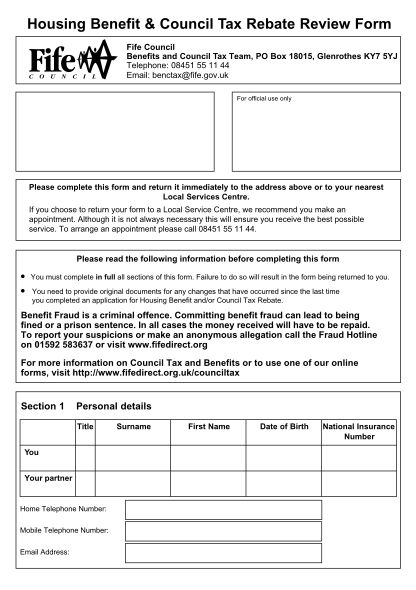

84 Can You Apply For Housing Benefit Online Page 3 Free To Edit

84 Can You Apply For Housing Benefit Online Page 3 Free To Edit

New Home HST Rebate HST Housing Rebate Ontario Canada Home Tax

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

Tax Rebate On Second Housing Loan - Web Here s how you can get a tax break on your second mortgage Section 80C Under Section 80C you can claim a deduction on the principal amount up to Rs 1 5 lakh This