Tax Rebate On Self Education Fees Web 10 mai 2023 nbsp 0183 32 Une r 233 duction d imp 244 t sur frais de scolarit 233 allant de 61 224 183 euros Le montant de la r 233 duction d imp 244 ts s 233 l 232 ve 224 61 euros par enfant au coll 232 ge 224 153 euros

Web Can You Claim Self Education Expenses as Tax Deductions Email address Required You must have spent the money yourself and weren t reimbursed The expenses must Web This calculator will check your eligibility to claim a deduction and helps you to estimate the deduction you can claim for work related self education expenses It can be used for

Tax Rebate On Self Education Fees

Tax Rebate On Self Education Fees

https://www.aib.edu.au/wp-content/uploads/2019/03/self-education.png

Here s How You Calculate Your Adjusted Gross Income AGI

https://flyfin.tax/_next/image?url=https:%2F%2Fdem95u0op6keg.cloudfront.net%2Fflyfin-website%2Fself-employment-resources%2FThreeTaxBenefitsDesktop.png&w=2048&q=100

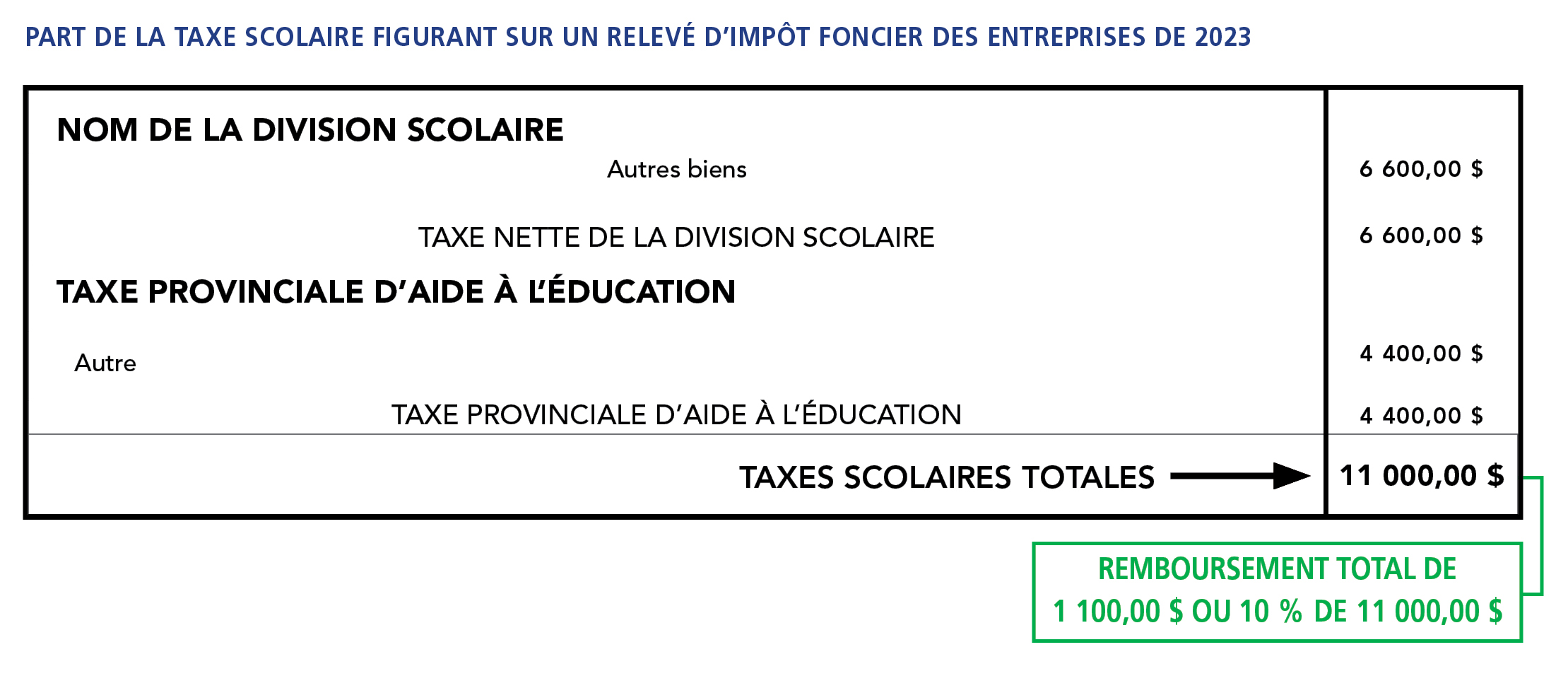

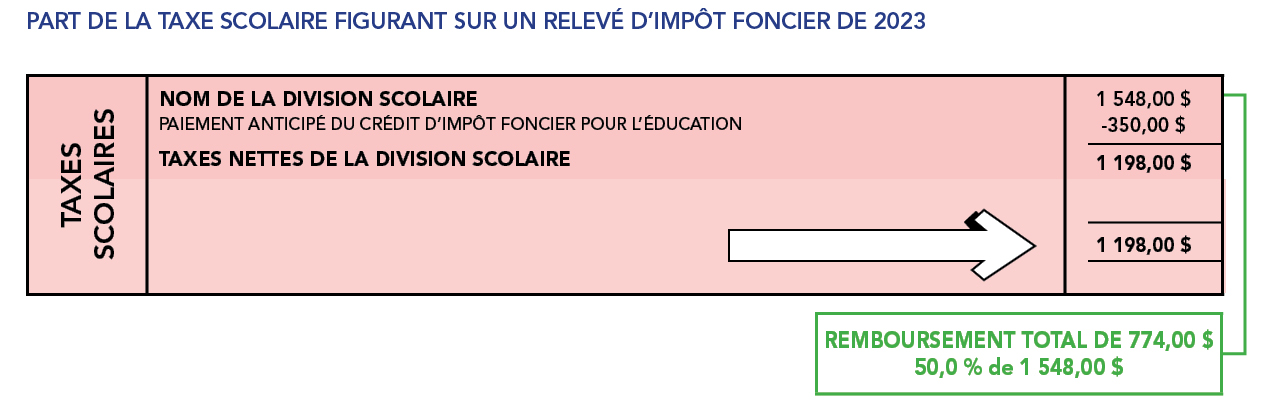

Tax And Fee Measures Budget 2022 Province Of Manitoba

https://uatweb22.gov.mb.ca/budget2022/img/Illustrative school tax portion of a 2022 business property tax statement.png

Web 10 sept 2018 nbsp 0183 32 An individual is eligible to claim a tax deduction for tuition fees paid to any university college or other educational institution in India for two children It is Web 5 janv 2023 nbsp 0183 32 Limit Only applicable to a child s education Specific Courses Affiliated Institution What Is the Maximum Deduction for Tuition and Fees Which Educational

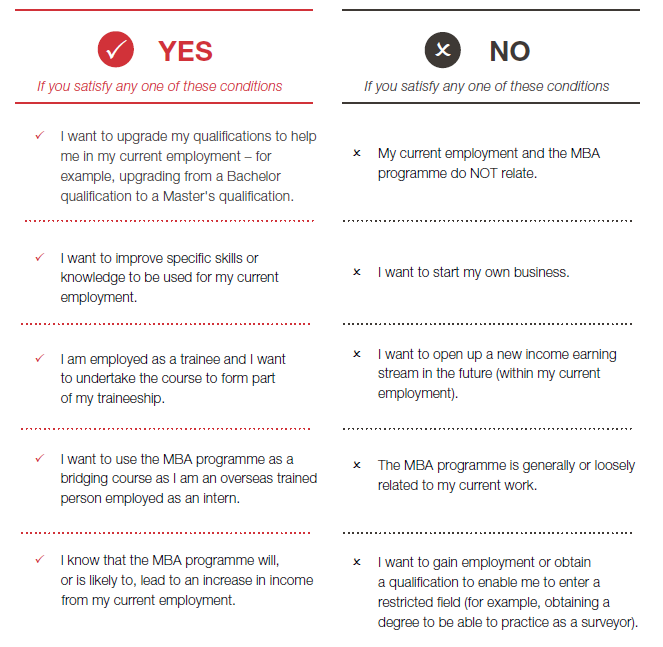

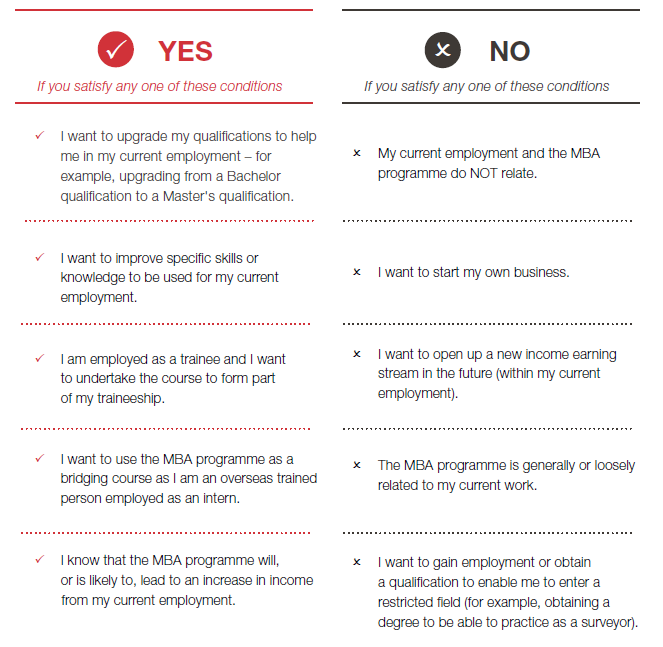

Web A refund of qualified education expenses may reduce adjusted qualified education expenses for the tax year or require repayment recapture of a credit claimed in an Web You can claim a deduction for self education expenses if the education relates to your employment activities On this page What are self education expenses Eligibility to

Download Tax Rebate On Self Education Fees

More picture related to Tax Rebate On Self Education Fees

Property Taxes Will Look A Little Different Thanks To Education Rebate

https://golden-west-archive-content.s3.amazonaws.com/content/portageonline/images/property_tax.jpg

Province Du Manitoba Imp t Foncier Pour L ducation

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/white-slip-school-taxes-2023.fr.jpg

More Tax Credits More Rebates Education Magazine

https://i0.wp.com/educationmagazine.ie/wp-content/uploads/2023/01/Irish-Tax-Rebates-36-1.jpg?resize=727%2C1024&ssl=1

Web 17 f 233 vr 2017 nbsp 0183 32 When you pay your kids tuition fees it qualifies for income deduction and also helps in reducing your tax liability Here is how you can claim this tax benefit under Web 3 oct 2021 nbsp 0183 32 Three types of income tax benefits available for education 4 min read 03 Oct 2021 09 11 AM IST Balwant Jain Income tax benefit It is important to note that the

Web 22 f 233 vr 2008 nbsp 0183 32 if it is self financed then u will not get any rebate the section 80E of IT act clearly shows that rebate can be avalied on the intrest paid on loan in previous year Web 25 f 233 vr 2021 nbsp 0183 32 This means that as a parent you are not permitted to claim any deduction on fees paid towards educating yourself or anyone else spouse relatives etc other than

Facebook

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=509005338070573

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

https://content.govdelivery.com/attachments/fancy_images/ILDOR/2022/08/6364888/tax-rebates-082922-facebook_original.jpg

https://www.letudiant.fr/lifestyle/aides-financieres/frais-de...

Web 10 mai 2023 nbsp 0183 32 Une r 233 duction d imp 244 t sur frais de scolarit 233 allant de 61 224 183 euros Le montant de la r 233 duction d imp 244 ts s 233 l 232 ve 224 61 euros par enfant au coll 232 ge 224 153 euros

https://gizmodo.com.au/2022/06/can-you-claim-self-education-expenses...

Web Can You Claim Self Education Expenses as Tax Deductions Email address Required You must have spent the money yourself and weren t reimbursed The expenses must

More Tax Credits More Rebates Education Magazine

Education Property Tax Rebate Continues In 2022 City Of Portage La

Illinois Tax Rebate Tracker Rebate2022

Province Du Manitoba Imp t Foncier Pour L ducation

Uniform Tax Rebate What It Covers And How Much You Can Claim

Uniform Tax Rebate What It Covers And How Much You Can Claim

Tax Rebate Digital Tax Filing Taxes Tax Services

Union Budget 2022 23 From Tax Rebates To Special Allocation For EdTech

Tax Rebates Goselfemployed co

Tax Rebate On Self Education Fees - Web 13 f 233 vr 2023 nbsp 0183 32 Feb 13 2023 at 9 36 a m Educational Tax Credits and Deductions If you re paying back student loans you may be able to deduct up to 2 500 in interest