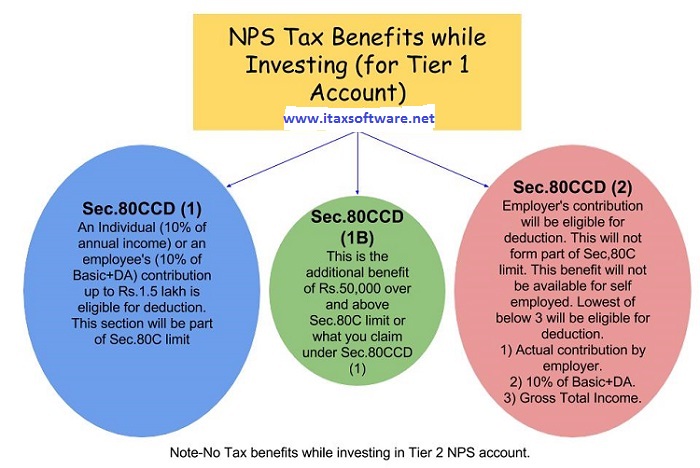

Tax Rebate Other Than 80c Web 26 d 233 c 2022 nbsp 0183 32 Best 10 Tax Saving Investment Options Other Than 80C 1 Tax saving with NPS under Section 80CCD 1B Taxpayers can save additional tax by investing up to

Web 3 avr 2023 nbsp 0183 32 Under Section 80C you will be able to claim up to Rs 1 50 000 for your contribution an additional deduction of Rs 50 000 under Section 80CCD makes it a total Web 21 mars 2020 nbsp 0183 32 In this article let s take a look at the tax saving options other than Section 80C to turn you into a smart tax saver 1 Section 80CCD National Pension Scheme

Tax Rebate Other Than 80c

Tax Rebate Other Than 80c

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

What Are The Tax Saving Options Other Than 80 C 80C

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhF3pKhk47PKh8qNt69pKcLBGTBKkFs3-y7QVd7HELfzLkO2f33F1ZjNGTItz6-vkWXZj7Vseb6D4venu67-fZgMy70dnuZF5uQ5gxNMRA0isK75C7LhbKZyKdwRkuEGr6M1_lHY8UFnXCXIDNG9TFBb6K89xHpj49XsXWVUB_s2dd_iLUHa2ubr7V3fw/s1920/20230221_154454_0000.png

Income Tax Saving Options Other Than 80C In Hindi Future Generali

https://i.ytimg.com/vi/1KL7ecIvZBY/maxresdefault.jpg

Web 24 mars 2017 nbsp 0183 32 The tax rebate is limited to Rs 12 500 This means if your total tax payable is less than Rs 12 500 then you will not have to pay any tax However if you opt for the Web Section 80C is the most well known provision of the Income Tax Act of 1961 under which a rebate of up to Rs 1 5 Lakh is granted on several loan products and other investment

Web 4 f 233 vr 2023 nbsp 0183 32 Income tax calculator In National Pension System NPS scheme an earning individual is given an additional 50 000 tax deduction under Section 80CCD 1B Web How to Save Tax Other Than 80c Section 80C of the Income Tax Act allows you to claim a deduction of up to Rs 1 5 lac from your total taxable income This is an excellent way to

Download Tax Rebate Other Than 80c

More picture related to Tax Rebate Other Than 80c

Tax Savings Options Other Than Sec 80C For FY 2017 18 BasuNivesh

http://www.basunivesh.com/wp-content/uploads/2017/06/Tax-Savings-options-other-than-Sec.80C-for-FY-2017-18.jpg

Illinois Tax Rebate Tracker Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/illinois-tax-rebate-2022-cray-kaiser-1.png

Save Tax Other Than 80C Tips And Tricks To Save Tax Legally

https://i.ytimg.com/vi/0k8jHhY9Z5A/maxresdefault.jpg

Web 5 janv 2020 nbsp 0183 32 You may be knowing that the maximum tax rebate possible under section 80C is limited to just Rs 1 50 000 per annum as of now If you have already exhausted this limit and want to save more on tax you are Web 27 avr 2023 nbsp 0183 32 How to save tax other than section 80C Apart from 80C various other provisions allow deductions to taxpayer as follows 80D for medical insurance premium

Web 30 janv 2022 nbsp 0183 32 Seven ways to get the Section 80C tax rebate Shipra Singh 4 min read 31 Jan 2022 12 00 AM IST Istock Summary Most of the time tax saving instruments are Web Other Tax Saving options beyond Sec 80C amp Sec 80D The most commonly used Sections for tax saving under the Income Tax Act are Section 80C and Section 80D Popular

How To Save Tax Other Than Section 80C 80 C

https://i.ytimg.com/vi/n_OFyxY7HKU/maxresdefault.jpg

Tax Savings Options Other Than Sec 80C For FY 2017 18 With Automated

https://tdstax.files.wordpress.com/2017/09/a61a2-picture2bof2bnps.jpg

https://www.etmoney.com/learn/saving-schemes/beyond-section-80c-10...

Web 26 d 233 c 2022 nbsp 0183 32 Best 10 Tax Saving Investment Options Other Than 80C 1 Tax saving with NPS under Section 80CCD 1B Taxpayers can save additional tax by investing up to

https://cleartax.in/s/how-to-save-tax-other-than-80c

Web 3 avr 2023 nbsp 0183 32 Under Section 80C you will be able to claim up to Rs 1 50 000 for your contribution an additional deduction of Rs 50 000 under Section 80CCD makes it a total

Tax Saving Options Other Than 80C Investments YouTube

How To Save Tax Other Than Section 80C 80 C

Income Tax Calculator Top 5 Tax Saving Tips Other Than Section 80C Benefit

Budget 2014 Impact On Money Taxes And Savings

Reduce Your Tax Liability Beyond Section 80C Jupiter

TAX BENEFITS OTHER THAN 80C Mohindra Investments

TAX BENEFITS OTHER THAN 80C Mohindra Investments

Income Tax Saving Options 80C

5 Tax Saving Options Other Than 80C Zee Business

Blog Anupam Roongta

Tax Rebate Other Than 80c - Web 4 f 233 vr 2023 nbsp 0183 32 Income tax calculator In National Pension System NPS scheme an earning individual is given an additional 50 000 tax deduction under Section 80CCD 1B