Tax Rebate Policy In India Web 2 f 233 vr 2023 nbsp 0183 32 As part of its Budget 2023 announcement Finance Minister Nirmala Sitharaman said that the tax rebate has been extended on income up to Rs 7 lakh in new tax regime as per Section 87A as against Rs 5

Web 1 avr 2016 nbsp 0183 32 Last reviewed 13 June 2023 Tax incentive provisions normally have conditions applicable for the period within which the preferred activity should be Web 1 f 233 vr 2023 nbsp 0183 32 Budget 2023 Income tax rebate increased to Rs 7 lakh under new regime says FM Sitharaman FM Sitharaman announces big relief

Tax Rebate Policy In India

Tax Rebate Policy In India

https://www.relakhs.com/wp-content/uploads/2019/02/Latest-income-tax-slab-rates-FY-2018-19-AY-2019-20-Tax-rates-for-individuals-budget-2019-2020-pic.jpg

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

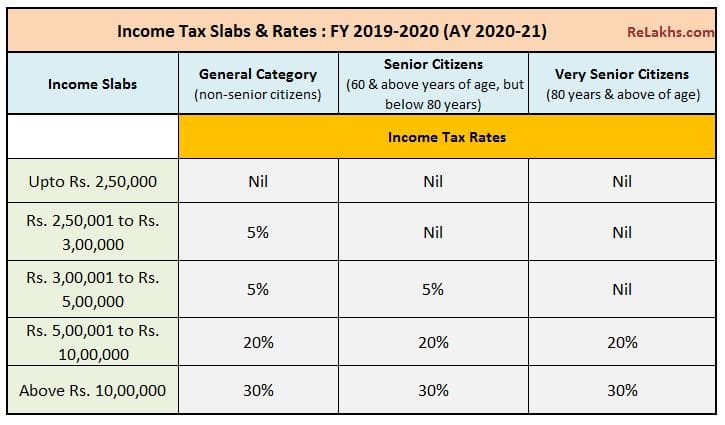

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

https://4.bp.blogspot.com/-ygld82QNGGs/Xd_7fFpO9WI/AAAAAAAAJBU/w2H37lRhli4Tk4pgjN-Ra8So_O_t_RJ-wCK4BGAYYCw/s1600/slab_rate_%25281%2529-20190201043639.png

Web India offers tax relief at both the central and state level Additional incentives are available to investors in specific sectors while India s special economic zones SEZs offer their Web 1 f 233 vr 2023 nbsp 0183 32 Budget 2023 Income Tax rebate limit raised to 7 lakh from 5 lakh Finance Minister Nirmala Sitharaman announces that there will not be any new tax for income up to 3 lakh reduces the number of I T

Web 2 f 233 vr 2023 nbsp 0183 32 With a hike in the basic exemption limit and rebate and tweaks to the income tax slabs Sitharaman has made the new income tax regime attractive for salaried Web 13 juin 2023 nbsp 0183 32 Resident individuals are eligible for a tax rebate of the lower of the income tax or INR 12 500 where the total income does not exceed INR 500 000 However in case

Download Tax Rebate Policy In India

More picture related to Tax Rebate Policy In India

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

https://enterslice.com/learning/wp-content/uploads/2019/06/Tax-Rebate-under-Section-87-A.jpg

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

Daily current affairs

http://www.benevolentacademy.com/wp-content/uploads/2023/03/budget-2023-income-tax-india-tv-4-1675237269.jpg

Web 1 f 233 vr 2023 nbsp 0183 32 Business Budget Union Budget 2023 income tax slabs New tax regime is default rebate increased from Rs 5 lakh to Rs 7 lakh quot Currently those with an income of Rs 5 lakhs do not pay any income Web Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose taxable income is less than Rs 5 lakh in Financial Year 2022 23 The maximum amount

Web 2 f 233 vr 2023 nbsp 0183 32 The revised Income tax slabs under new tax regime for FY 2023 24 AY 2024 25 How much is the basic exemption limit hiked under the revised new tax Web 2 f 233 vr 2023 nbsp 0183 32 Income tax rebate limit has been increased from Rs 5 lakh to Rs 7 lakh under new tax regime The fiscal deficit target for this fiscal will be 5 9 percent of GDP

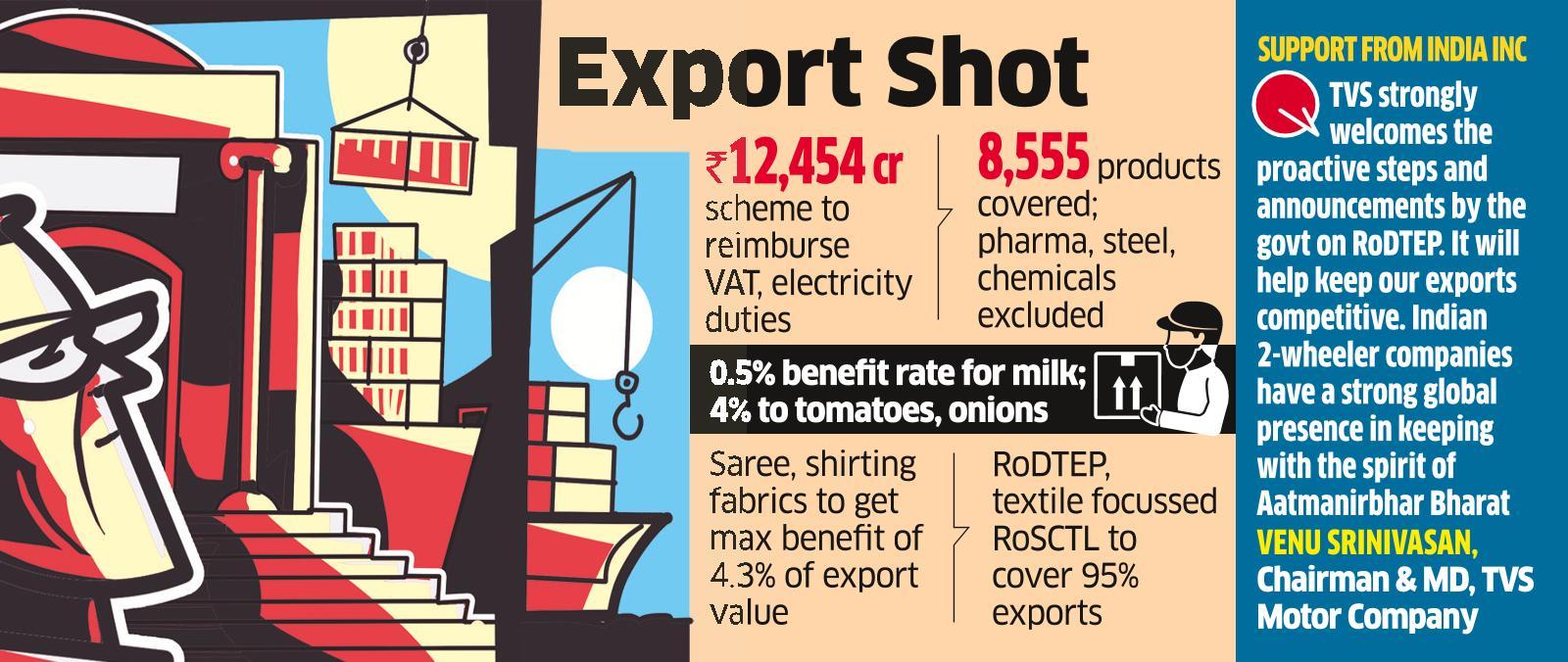

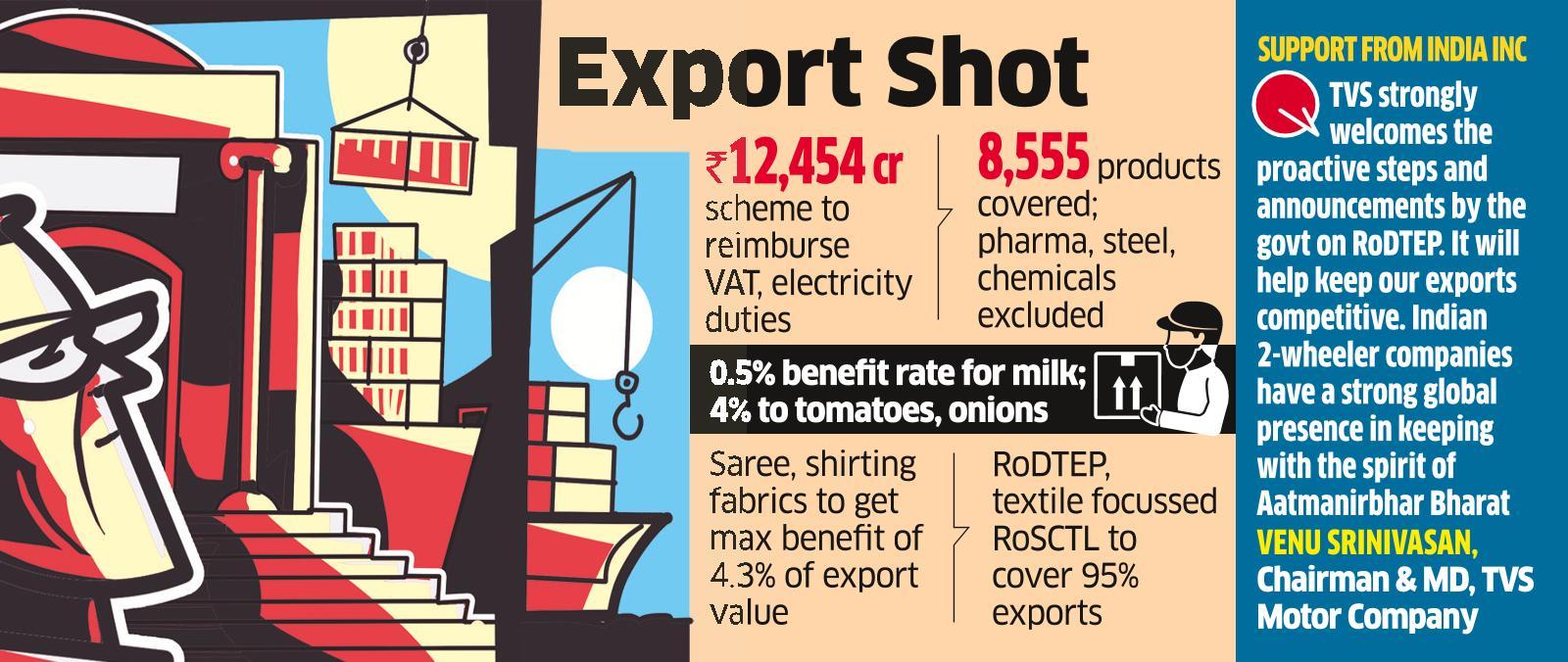

RoDTEP Scheme RoDTEP India Notifies Duty Rebate Rates To Give Exports

https://img.etimg.com/photo/msid-85410544,quality-100/.jpg

Income Tax Slab For FY 2022 23 New Income Tax Rates Slabs In India

https://www.canarahsbclife.com/content/dam/choice/blog-inner/images/difference-of-slab-rates-between-new-tax-regime-and-old-tax-regime1.jpg

https://www.cnbctv18.com/personal-finance/b…

Web 2 f 233 vr 2023 nbsp 0183 32 As part of its Budget 2023 announcement Finance Minister Nirmala Sitharaman said that the tax rebate has been extended on income up to Rs 7 lakh in new tax regime as per Section 87A as against Rs 5

https://taxsummaries.pwc.com/india/corporate/tax-credits-and-incentives

Web 1 avr 2016 nbsp 0183 32 Last reviewed 13 June 2023 Tax incentive provisions normally have conditions applicable for the period within which the preferred activity should be

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

RoDTEP Scheme RoDTEP India Notifies Duty Rebate Rates To Give Exports

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Tax Benefit Of Buying Health Insurance In India For NRI Section 80D

Incometax Individual Income Taxes Urban Institute This Service

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

Tax What Is Tax Taxation In India Tax Calculation

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Property Tax Rebate Application Printable Pdf Download

Tax Rebate Policy In India - Web India offers tax relief at both the central and state level Additional incentives are available to investors in specific sectors while India s special economic zones SEZs offer their