Tax Rebate Rental Property Web 19 oct 2015 nbsp 0183 32 Changes to tax relief for residential property From 6 April 2020 Income Tax relief on all residential property finance costs is restricted to the basic rate of income

Web Tax free exchange of rental property occasionally used for personal purposes If you meet certain qualifying use standards you may qualify for a tax free exchange a like kind or Web The first 163 1 000 of your income from property rental is tax free This is your property allowance Contact HM Revenue and Customs HMRC if your income from property

Tax Rebate Rental Property

Tax Rebate Rental Property

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189519-EYNC86JYEGG20QUA9STL/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_1.jpg

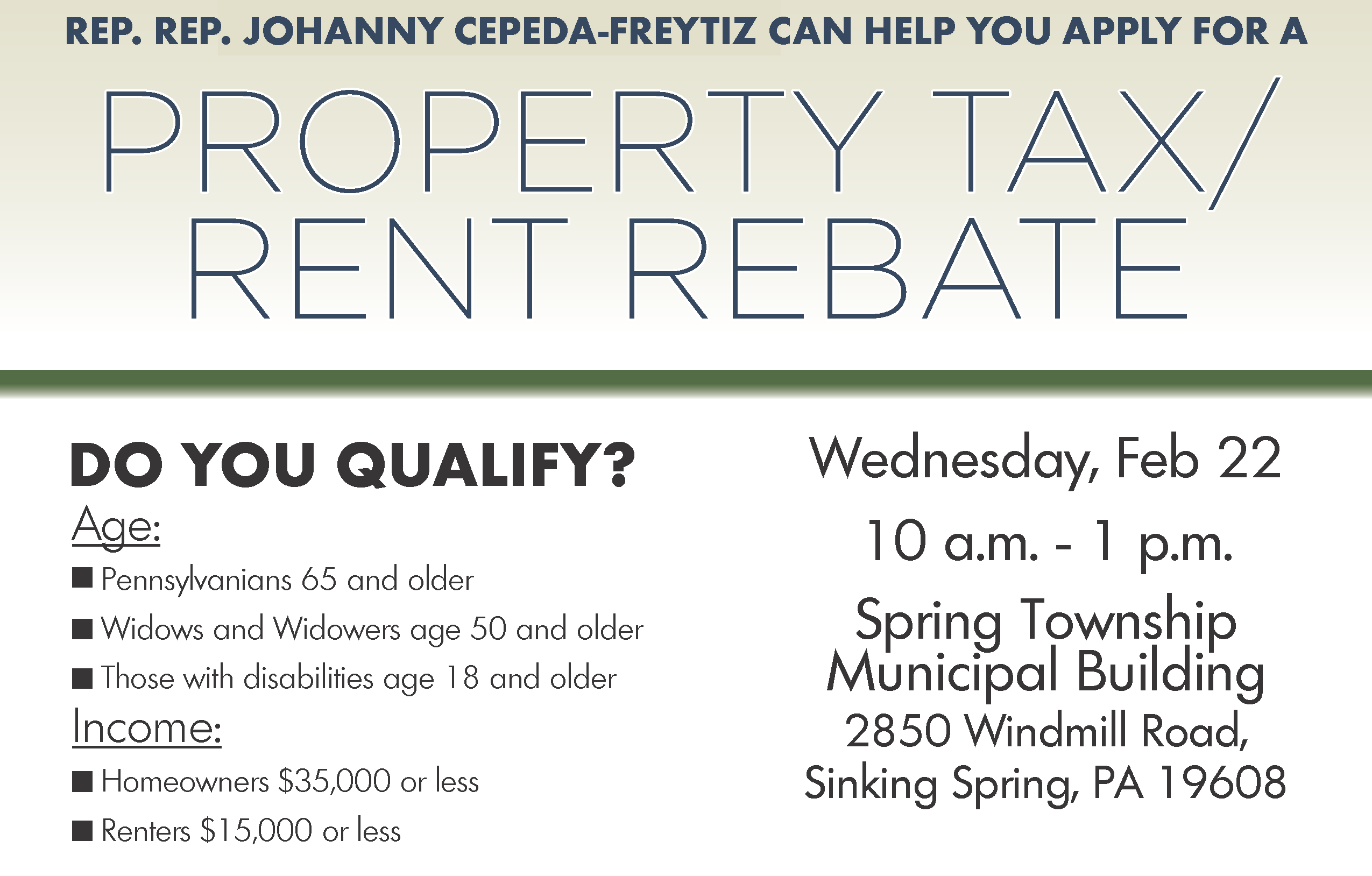

Property Tax Rent Rebate Flyer Township Of Spring

https://www.springtwpberks.org/wp-content/uploads/2023/02/Property-Tax-Rent-Rebate-Flyer.png

Property Tax Rent Rebate Program Maximizing Savings And Support For

https://i0.wp.com/www.rentrebates.net/wp-content/uploads/2023/05/Property-Tax-Rent-Rebate-Program.jpg?ssl=1

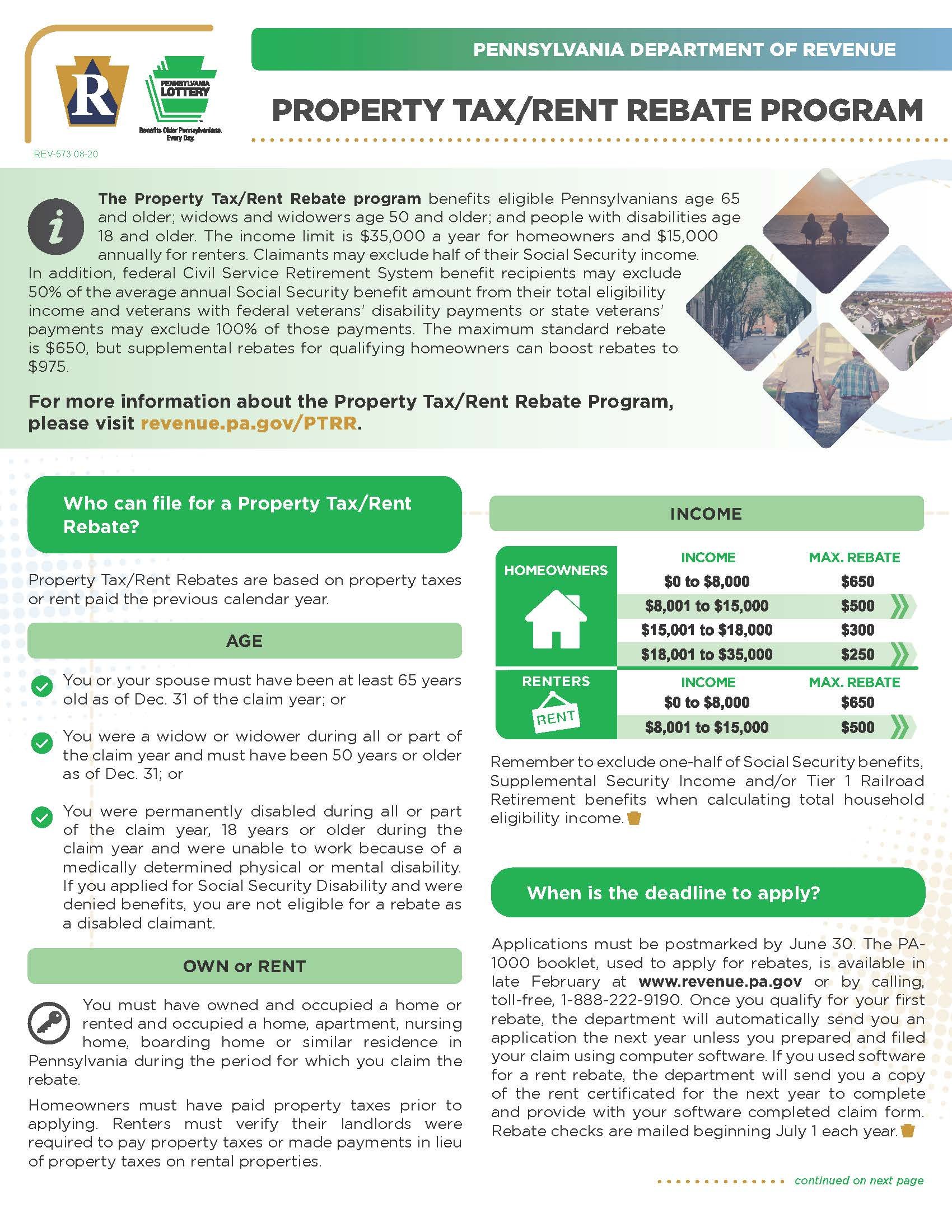

Web 11 f 233 vr 2021 nbsp 0183 32 Tax rebate on private residential leases Publication Date Feb 11 2021 Persons who derive income from a private residential lease which is registered with the Web Property Tax Rent Rebate Program The rebate program benefits eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities

Web 4 janv 2023 nbsp 0183 32 Some examples of allowable expenses you can claim are water rates council tax gas and electricity landlord insurance costs of services including the wages of Web To be eligible for the NRRP rebate the fair market value on the qualifying residential unit must be less than 450 000 when the tax was payable on the purchase or self supply of

Download Tax Rebate Rental Property

More picture related to Tax Rebate Rental Property

Tax Rebate On Rental Property PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/form-pa-1000-download-fillable-pdf-or-fill-online-property-tax-or-rent-9.png?fit=950%2C1222&ssl=1

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

http://static1.squarespace.com/static/5d8d4c603aab2563d4a30208/t/62ebf2c02ff2b767de17f485/1659630272071/2022-8-4+one-time+bonus+rebate+-+property+tax+rebate-insta.jpg?format=1500w

Pa Renters Rebate Status RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/pa-1000-2014-property-tax-or-rent-rebate-claim-free-download-1.png

Web 18 juin 2023 nbsp 0183 32 Tax Rebate Rental Property A Property Tax Rebate is available to property owners in Pennsylvania This program can help reduce your property taxes Web 5 f 233 vr 2023 nbsp 0183 32 Tax Rebate On Rental Property A Property Tax Rebate is available to property owners in Pennsylvania This program can help reduce your property taxes

Web Which rental properties qualify for the GST HST new residential rental property rebate Restrictions Are you a builder for GST HST purposes What is a self supply What is a Web 3 d 233 c 2020 nbsp 0183 32 How to Claim the NRRP Rebate You can make an application within two years after the property closes or sells All applicants must complete Form GST524

Land Transfer Tax Rebate Rental Property PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/property-tax-rebate-pennsylvania-latestrebate-1.png?w=510&h=720&ssl=1

Rent Rebate Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/47/686/47686220/large.png

https://www.gov.uk/guidance/income-tax-when-you-rent-out-a-property...

Web 19 oct 2015 nbsp 0183 32 Changes to tax relief for residential property From 6 April 2020 Income Tax relief on all residential property finance costs is restricted to the basic rate of income

https://www.irs.gov/publications/p527

Web Tax free exchange of rental property occasionally used for personal purposes If you meet certain qualifying use standards you may qualify for a tax free exchange a like kind or

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois

Land Transfer Tax Rebate Rental Property PropertyRebate

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

PA Rent Rebate Form Printable Rebate Form

Older Disabled Residents Can File For Property Tax Rent Rebate Program

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

Renters Rebate Form Printable Rebate Form

Colorado Property Tax And Rent Rebate Formula PropertyRebate

Tax Rebate Rental Property - Web For tenants sub tenants who have received the PT rebate benefit or additional support from their property owners master tenants in the form of rental reduction or rent offsets the