Tax Rebate Section 80d Section 80D of the Income tax Act 1961 allows an individual to claim deduction from gross taxable income The deduction can be claimed if an individual has paid medical insurance premium during

The Central Government of India provides provisions for taxpayers to claim deductions and benefits in respect to health insurance premium paid under Section 80D of the Income Tax Act Under Section 80D of the Income Tax Act you can get a tax deduction of up to Rs 25 000 each year for health insurance premiums For senior citizens this increases

Tax Rebate Section 80d

Tax Rebate Section 80d

https://financialexpresswpcontent.s3.amazonaws.com/uploads/2019/04/Insurance-Cover.jpg

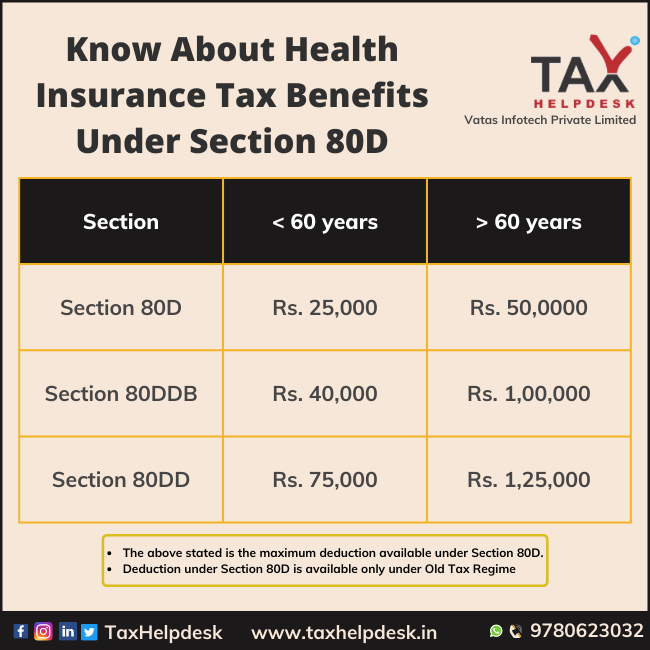

Know About Health Insurance Tax Benefits Under Section 80D

https://www.taxhelpdesk.in/wp-content/uploads/2022/04/Know-About-Health-Insurance-Tax-Benefits-Under-Section-80D.png

Income Tax Act 1961 Section 80D Insurance Benefit Tax Rebate

https://i.ytimg.com/vi/H-NGI-11AKQ/maxresdefault.jpg

Tax Benefit Under Section 80D Policyholders who have opted for a health related rider such as Critical Illness Surgical Care or Hospital Care Rider with their Your total income after reducing the deductions under chapter VI A Section 80C 80D and so on does not exceed Rs 5 lakh in an FY The tax rebate is limited to Rs 12 500 This means if your total tax

As per the Income Tax Act 1961 one can avail 80D deductions on the medical insurance premium paid which reduces the overall tax payable amount To reap the benefits learn crucial details Section 80D of the Income Tax Act allows individuals and Hindu Undivided Families HUFs to claim deductions on payments made towards medical insurance

Download Tax Rebate Section 80d

More picture related to Tax Rebate Section 80d

Section 80D Income Tax Act Dialabank Best Offers

https://www.dialabank.com/wp-content/uploads/2019/11/Section-80D.jpg

Income Tax Rebate Under Section 87A Legalraasta

https://www.legalraasta.com/blog/wp-content/uploads/2021/08/Income-tax-rebate-tax-deduction-and-exemption-scaled.jpg

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

Deduction under section 80D of the Income Tax Act is available in addition to the deduction of INR 1 50 Lakhs available collectively under section 80C section Utilize Tax2win s Section 80D Tax Deduction Calculator to estimate your health insurance premium savings Find out about eligibility and benefits for tax deductions

Section 80D of Income Tax Act Individuals can claim for deduction under Section 80D on payment of insurance for oneself spouse dependent children One can claim deduction According to Section 80D of the Income Tax Act of 1961 senior citizens in India are eligible for the health insurance tax benefits These benefits may be claimed

Deduction Under Section 80D Medical Insurance Tax Saving YouTube

https://i.ytimg.com/vi/rLNZXvzHDFs/maxresdefault.jpg

Section 80D Twin Treat Of Medical Cover And Tax Rebate

https://www.hdfcergo.com/images/default-source/health-insurance/ergo-health_5.jpg

https://economictimes.indiatimes.com…

Section 80D of the Income tax Act 1961 allows an individual to claim deduction from gross taxable income The deduction can be claimed if an individual has paid medical insurance premium during

https://www.forbes.com/advisor/in/tax/…

The Central Government of India provides provisions for taxpayers to claim deductions and benefits in respect to health insurance premium paid under Section 80D of the Income Tax Act

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Deduction Under Section 80D Medical Insurance Tax Saving YouTube

All You Need To Know About Section 80D Of Income Tax Act Ebizfiling

IndiaNivesh Section 80 Deductions Income Tax Deductions Under

Section 80DD Of Income Tax Act Deductions For Disabled Persons Tax2win

Section 80D Deduction For Medical Insurance Health Checkups 2019

Section 80D Deduction For Medical Insurance Health Checkups 2019

Section 80D Deductions Income Tax Rebate For Physically Handicapped

What Is Section 80D Of Income Tax Act How To Claim Deduction U s 80D

Section 80d Get A Medical Cover And Tax A Rebate

Tax Rebate Section 80d - Your total income after reducing the deductions under chapter VI A Section 80C 80D and so on does not exceed Rs 5 lakh in an FY The tax rebate is limited to Rs 12 500 This means if your total tax