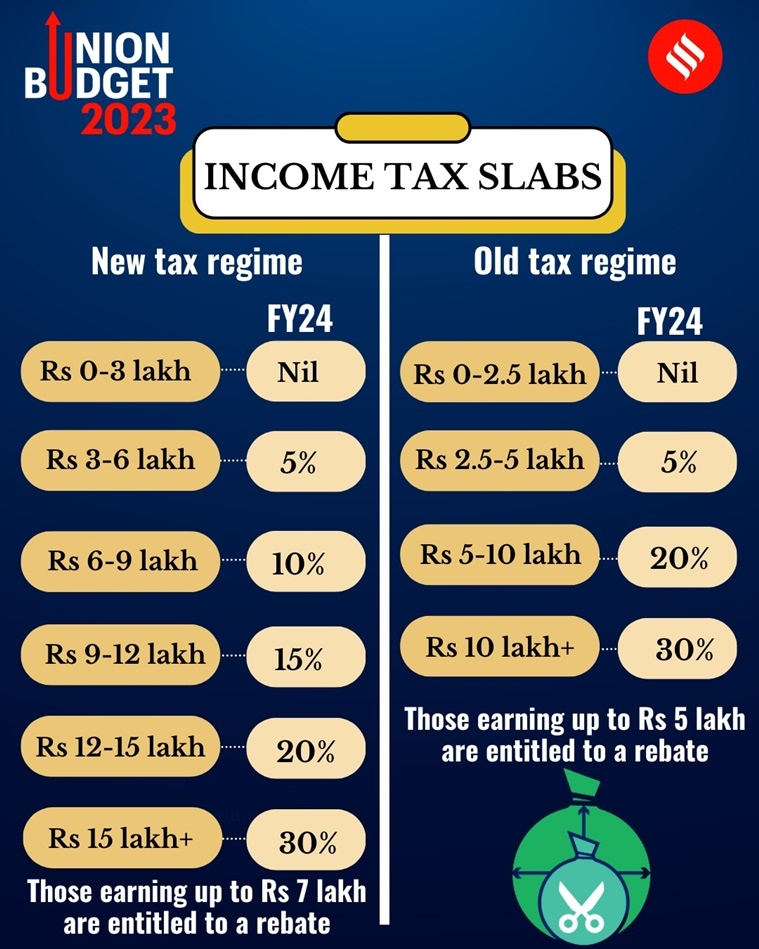

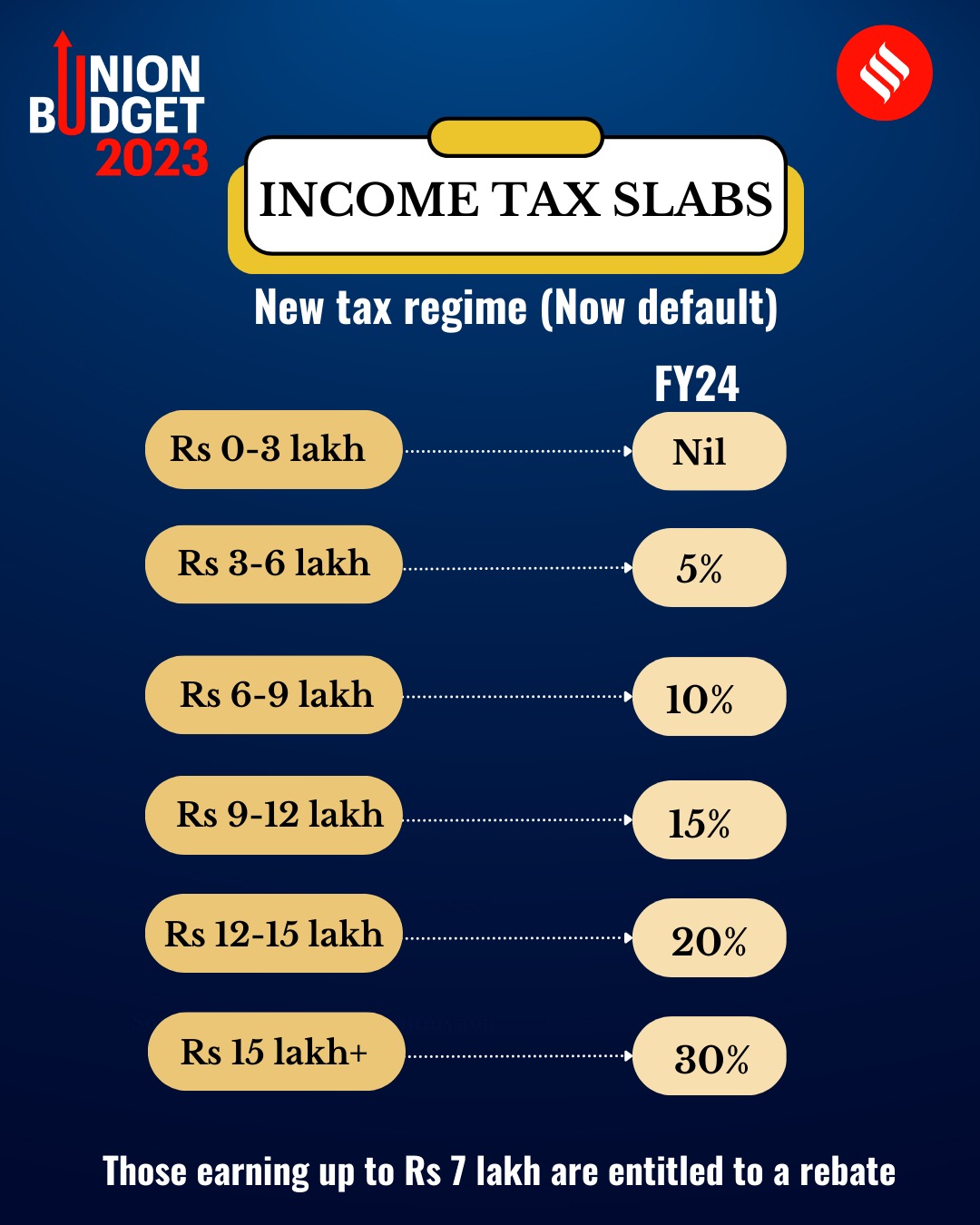

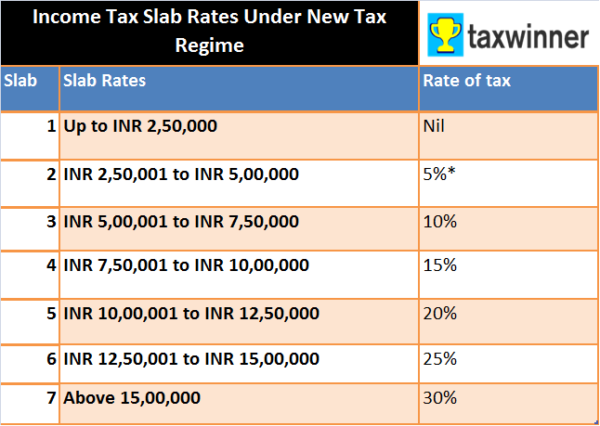

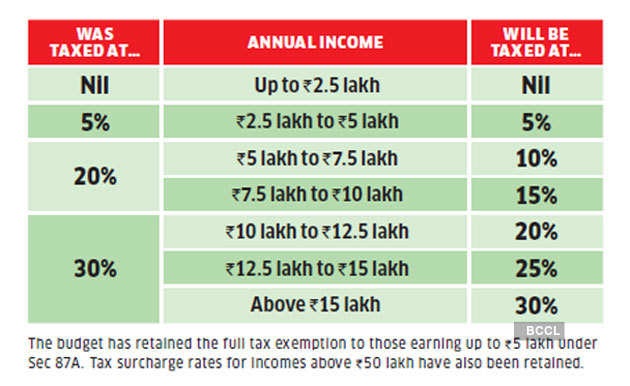

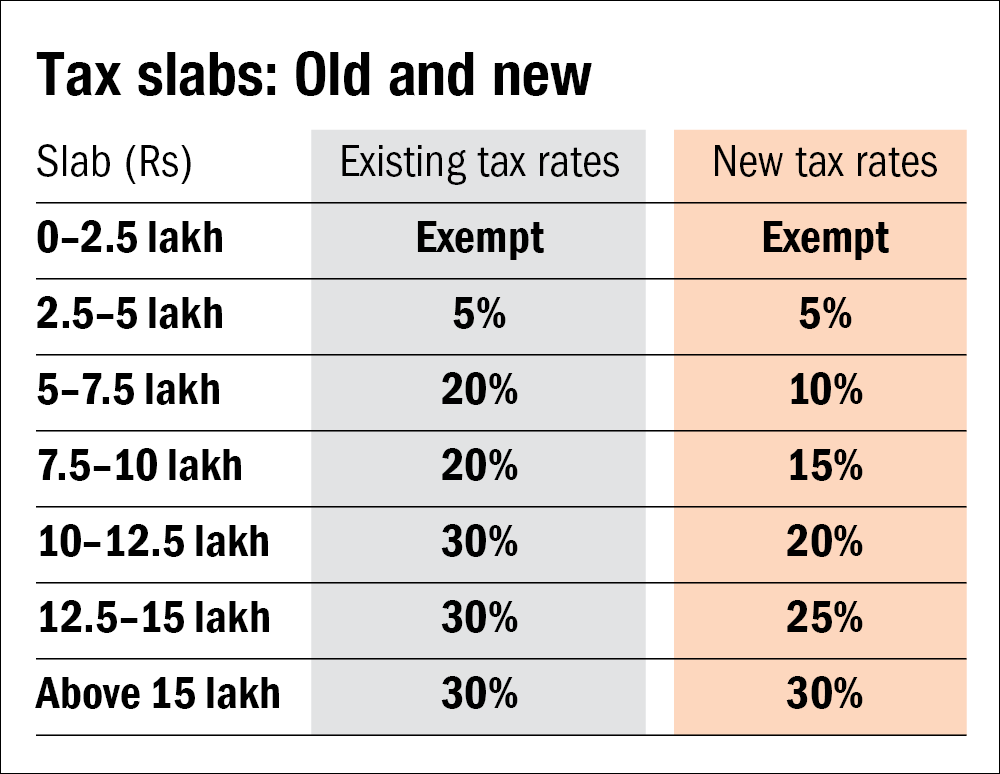

Tax Rebate Slabs Web 4 f 233 vr 2023 nbsp 0183 32 The number of income tax slabs has been reduced from six to five The tax rebate under Section 87A hiked to taxable income level

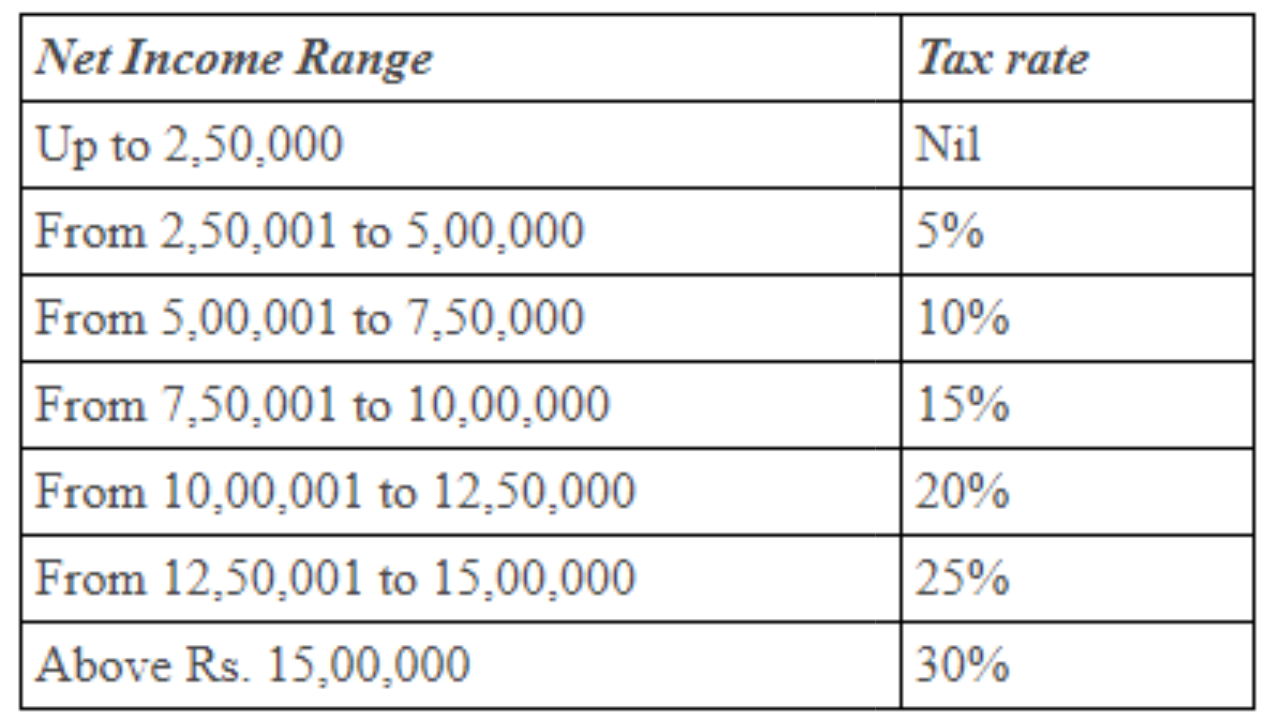

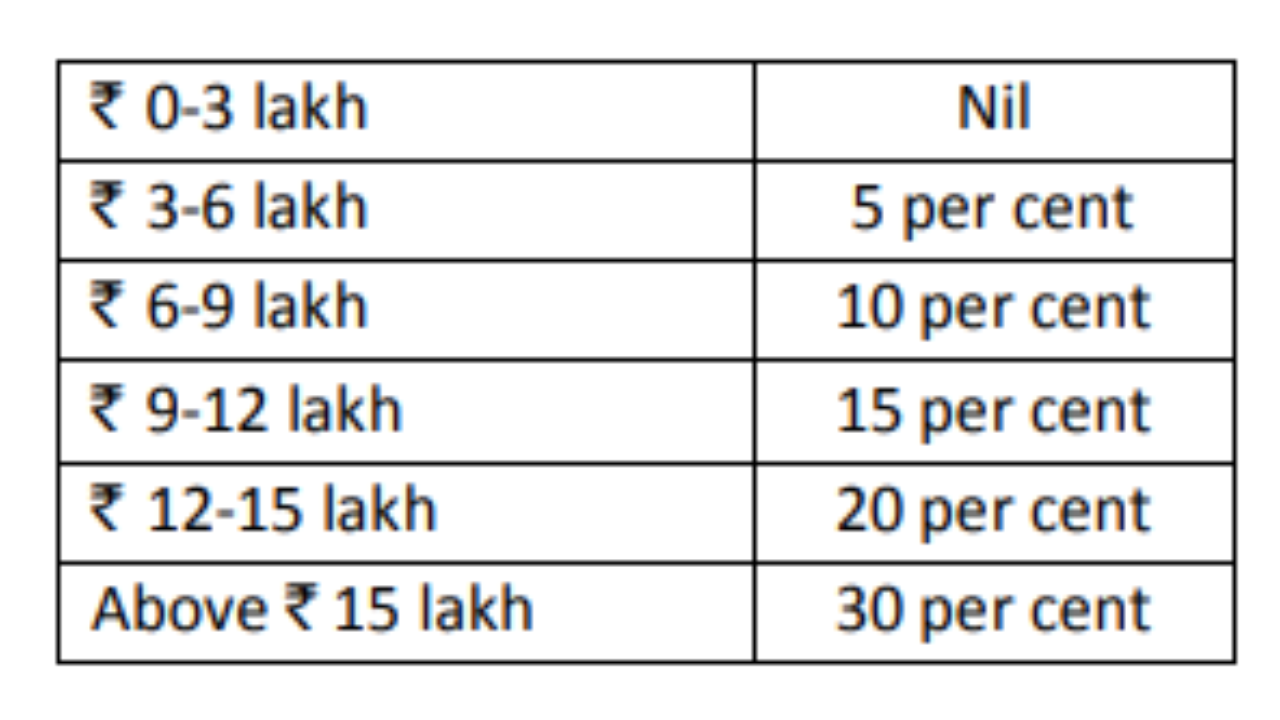

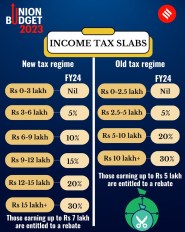

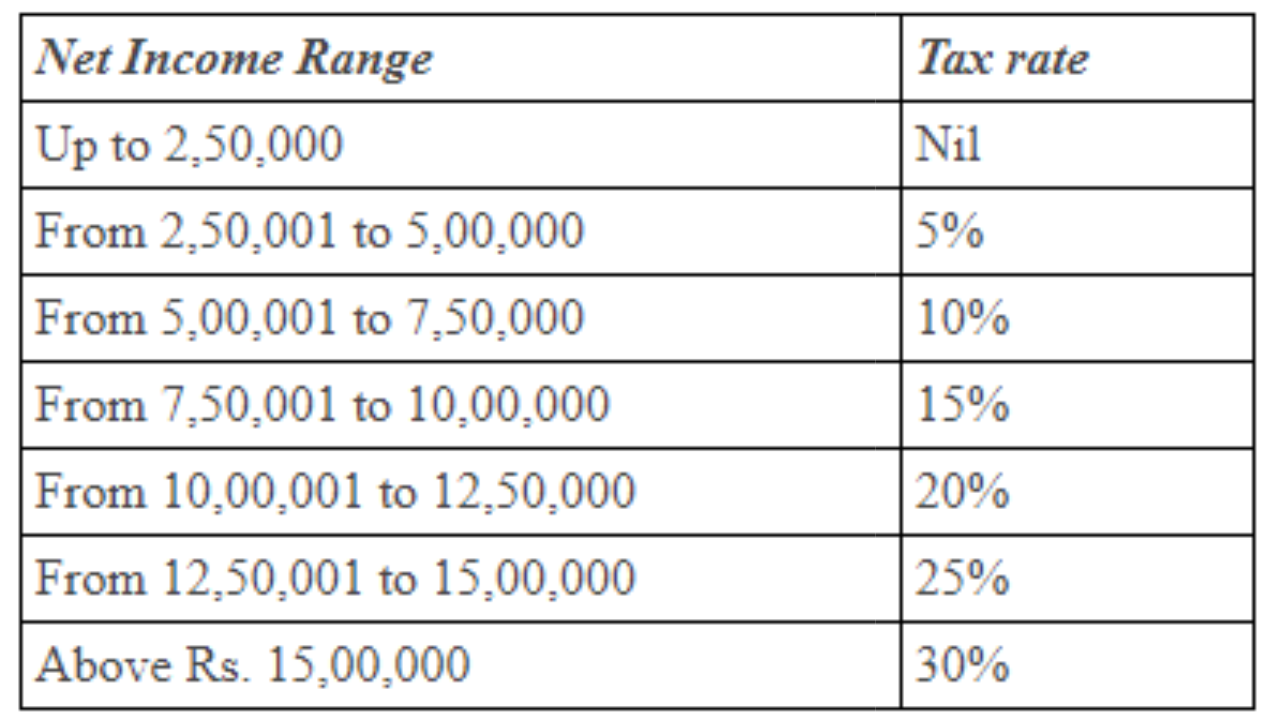

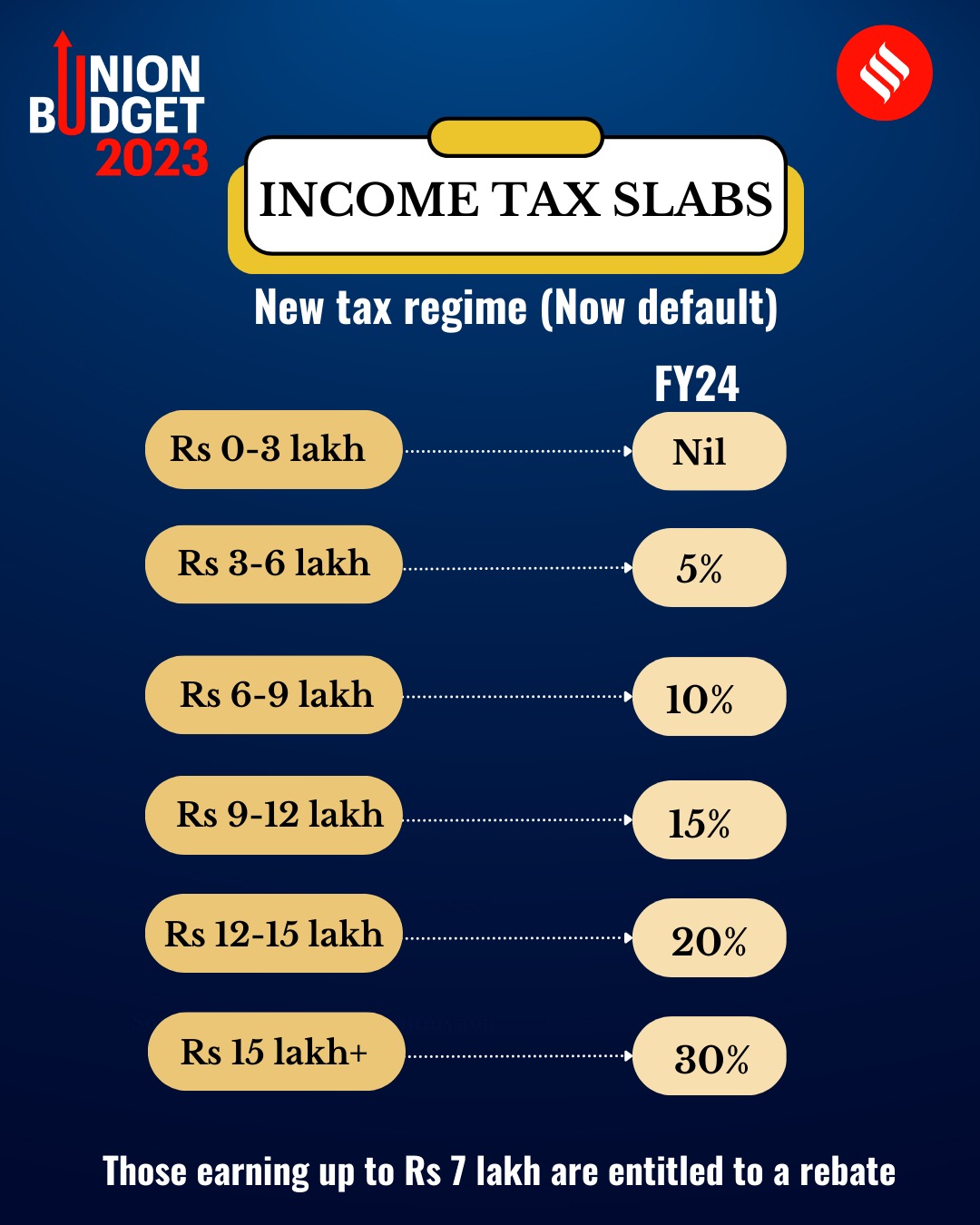

Web New Tax Regime u s 115BAC Income Tax Slab Income Tax Rate Income Tax Slab Income Tax Rate Up to 3 00 000 Nil Up to 2 50 000 Nil 3 00 001 5 00 000 Web 2 f 233 vr 2023 nbsp 0183 32 Budget 2023 pushed for greater adoption of the new tax regime in a big way by reducing the number of tax slabs increasing the basic exemption limit raising the

Tax Rebate Slabs

Tax Rebate Slabs

https://images.indianexpress.com/2023/02/tax-slabs-759.jpg

New Income Tax Regime Changes In Tax Slabs And Rebate Limits See

https://static.tnn.in/photo/msid-101208345/101208345.jpg

Income Tax Slab Rate For New Tax Regime Fy 2020 21 Gambaran

https://i2.wp.com/www.askbanking.com/wp-content/uploads/2020/04/income-tax-slabs.jpg?fit=660%2C440&ssl=1

Web 2 f 233 vr 2023 nbsp 0183 32 Income Tax Slab 2023 24 discussed with New Tax Regime vs Old Tax Regime comparison Check out income tax calculation income tax rebate amp tax benefit in budget 2023 Web 6 sept 2023 nbsp 0183 32 A tax rebate is a refund to the taxpayer when the liability is less than the tax paid Taxpayers can avail a tax rebate on their Income tax if the tax they owe is less than the total amount of the withholding Taxes

Web 2 f 233 vr 2023 nbsp 0183 32 As part of its Budget 2023 announcement Finance Minister Nirmala Sitharaman said that the tax rebate has been extended on income up to Rs 7 lakh in new tax regime as per Section 87A as against Rs 5 Web Income Tax Slabs for Women below 60 years of age Income Tax Slab for Women Under New Regime FY 2023 24 The Union Budget 2023 proposed the new tax regime as the

Download Tax Rebate Slabs

More picture related to Tax Rebate Slabs

Income Tax Slab For Ay 2019 20 Income Tax Slab For Fy 2018 2018 08 02

https://static.wixstatic.com/media/78f35a_bd55247cf7cc4428b1d9d1697f6e5542~mv2.png/v1/fill/w_600,h_237,al_c,q_85,usm_0.66_1.00_0.01,enc_auto/Tax Slabs2_FY 2019-20_PNG.png

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

https://4.bp.blogspot.com/-ygld82QNGGs/Xd_7fFpO9WI/AAAAAAAAJBU/w2H37lRhli4Tk4pgjN-Ra8So_O_t_RJ-wCK4BGAYYCw/s1600/slab_rate_%25281%2529-20190201043639.png

New Income Tax Regime Changes In Tax Slabs And Rebate Limits See

https://static.tnn.in/photo/msid-101208384/101208384.jpg

Web 1 f 233 vr 2023 nbsp 0183 32 The income tax rebate limit available for salaried and individual taxpayers under the new income tax regime has been hiked to Rs 7 lakh from the present Rs 5 Web 1 f 233 vr 2023 nbsp 0183 32 Income tax slabs under the new tax regime have been reduced to five in FY 2023 24 from six Further the basic exemption limit has been hiked to Rs 3 lakh from Rs 2 5 earlier under the new income

Web 13 f 233 vr 2023 nbsp 0183 32 From tweaking the number of slabs to increasing the rebate the Budget 2023 has proposed a host of changes in the new income tax regime While announcing Web 1 f 233 vr 2023 nbsp 0183 32 Personal Income Tax rebate limit increased to Rs 7 lakh no tax for income up to Rs 7 lakh Standard deduction of Rs 50 000 for salaried individuals deduction for

Union Budget 2023 Income Tax Slabs New Tax Regime Is Default Rebate

https://images.indianexpress.com/2023/02/WhatsApp-Image-2023-02-01-at-1.02.55-PM.jpeg?resize=324

New Tax Rates And Slabs Under The New Tax Regime Kdk Softwares Gambaran

https://taxwinner.in/wp-content/uploads/2020/02/new-tax-regime-slab-rates-taxwinner-1-600x426.png

https://economictimes.indiatimes.com/wealth/t…

Web 4 f 233 vr 2023 nbsp 0183 32 The number of income tax slabs has been reduced from six to five The tax rebate under Section 87A hiked to taxable income level

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

Web New Tax Regime u s 115BAC Income Tax Slab Income Tax Rate Income Tax Slab Income Tax Rate Up to 3 00 000 Nil Up to 2 50 000 Nil 3 00 001 5 00 000

Budget 2023 Here Are The Fresh New Income Tax Regime Slabs India Today

Union Budget 2023 Income Tax Slabs New Tax Regime Is Default Rebate

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

Income Tax Rebate 10 7 Slab 2 5

Standard Deduction For 2021 22 Standard Deduction 2021

Standard Deduction For 2021 22 Standard Deduction 2021

New Income Tax Slabs Will You Gain By Switching To New Regime 10 02

Senior Citizen Income Tax Calculation 2023 24 Examples New Tax Slabs

Will Tax Slabs Change In 2023 The Latest Updates Taxes Made Easy

Tax Rebate Slabs - Web 2 f 233 vr 2023 nbsp 0183 32 As part of its Budget 2023 announcement Finance Minister Nirmala Sitharaman said that the tax rebate has been extended on income up to Rs 7 lakh in new tax regime as per Section 87A as against Rs 5