Tax Rebate Solar 2024 Transparent pricing Hassle free tax filing is 50 for all tax situations no hidden costs or fees Maximum refund guaranteed Get every dollar you deserve when you file with this tax

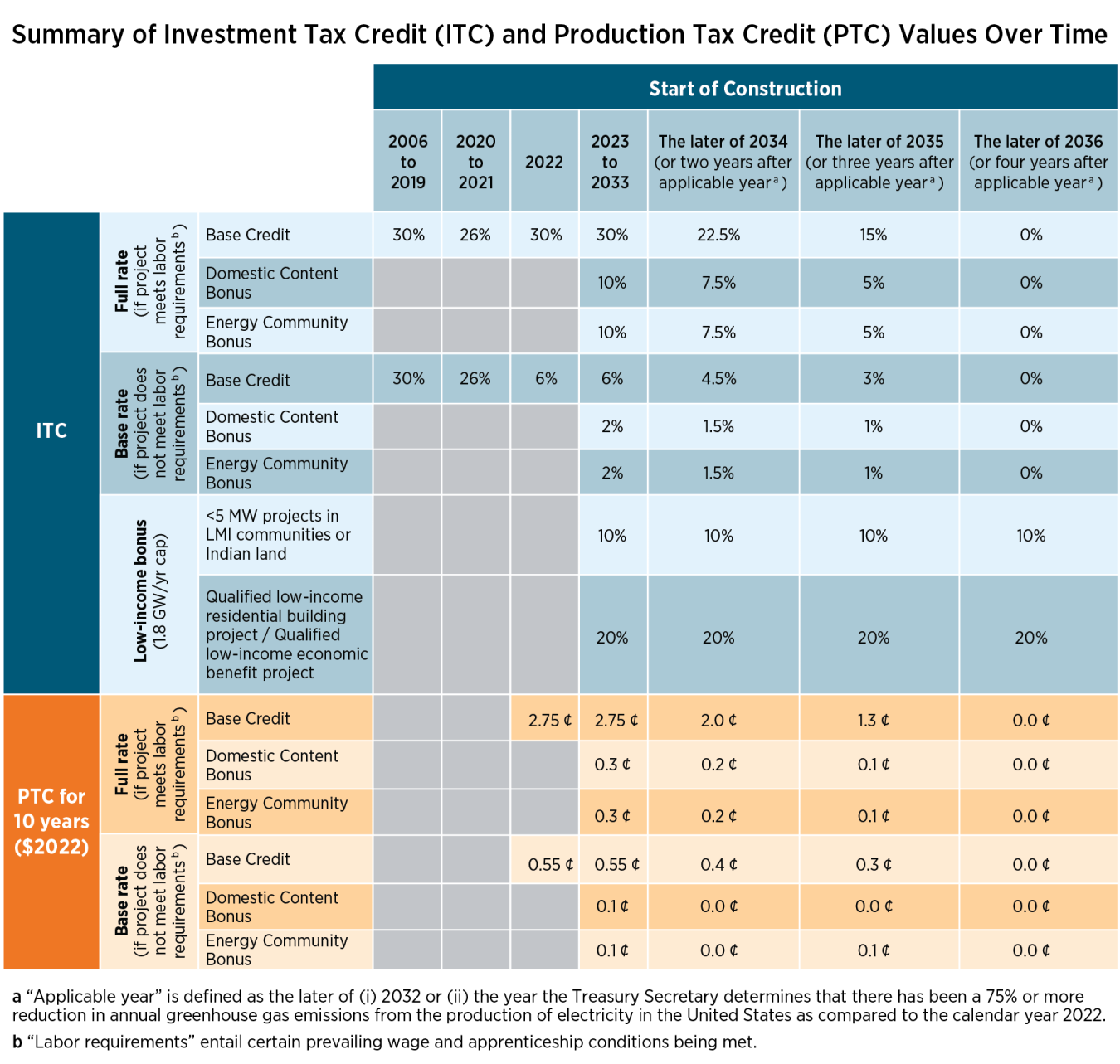

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such as

Tax Rebate Solar 2024

Tax Rebate Solar 2024

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

https://southarkansassun.com/wp-content/uploads/2023/07/QFVDBCFGXJETVNYWYD4CNRMM7E.jpg

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/Eligible-2-2048x2048.png

An average 20 000 solar system is eligible for a solar tax credit of 6 000 The Inflation Reduction Act extended the federal solar tax credit until 2035 To qualify for the federal solar tax credit you must own the solar panels have taxable income and it must be installed at your primary or secondary residence The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar heating

For example if your solar PV system was installed before December 31 2022 cost 18 000 and your utility gave you a one time rebate of 1 000 for installing the system your tax credit would be calculated as follows 0 26 18 000 1 000 4 420 Payment for Renewable Energy Certificates The 2024 program opening next year will unlock additional capacity for this robust demand Act the largest climate investment in history provides a 10 or 20 percentage point boost to the Investment Tax Credit for qualified solar or wind facilities in low income communities The goals of the program are to increase access to clean

Download Tax Rebate Solar 2024

More picture related to Tax Rebate Solar 2024

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

https://www.moneymgmnt.com/wp-content/uploads/tax-rebate-thailand-2023-1024x565.png

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

2024 Guide to solar incentives by state Updated October 10 2023 When it comes to buying solar panels for your home we ve got good news and better news the cost of solar power has fallen over 70 percent in the last 10 years and there are still great solar rebates and incentives out there to reduce the cost even further 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit You can claim the maximum annual credit every year that you make eligible improvements until 2033 The credit is nonrefundable so you can t get back more on the credit than you owe in taxes

The reduced base rate offered to solar systems starting construction in 2022 through 2024 that do not meet the prevailing wage and apprenticeship requirements has a value of 0 3 kWh in 1992 dollars the full value is determined by multiplying the base credit amount of 0 3 cent by the inflation adjustment factor rounding to the nearest Installing renewable energy equipment on your home can qualify you for Residential Clean Energy credit of up to 30 of your total qualifying cost depending on the year the equipment is installed and placed in service 30 for equipment placed in service in tax years 2017 through 2019 26 for equipment placed in service in tax years 2020

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

https://asset5.scripbox.com/wp-content/uploads/2021/05/tax-rebate.jpg

Georgia Income Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023-768x683.png

https://www.nerdwallet.com/article/taxes/solar-tax-credit

Transparent pricing Hassle free tax filing is 50 for all tax situations no hidden costs or fees Maximum refund guaranteed Get every dollar you deserve when you file with this tax

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

Best Tax Rebate Calculator In UK 2022 Business Lug

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

2022 Child Tax Rebate Ends July 31 Access Community Action Agency

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

Income Tax Rebate Under Section 87A

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Illinois Ev Tax Rebate 2023 Tax Rebate

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

How To Increase The Chances Of Getting A Tax Refund CherishSisters

Tax Rebate Solar 2024 - Nebraska s Dollar and Energy Savings Loans program offers fixed rate loans for homeowners across the state through lenders The rates are 5 3 5 or lower and loans can last as long as 15 years