Tax Rebate Status 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

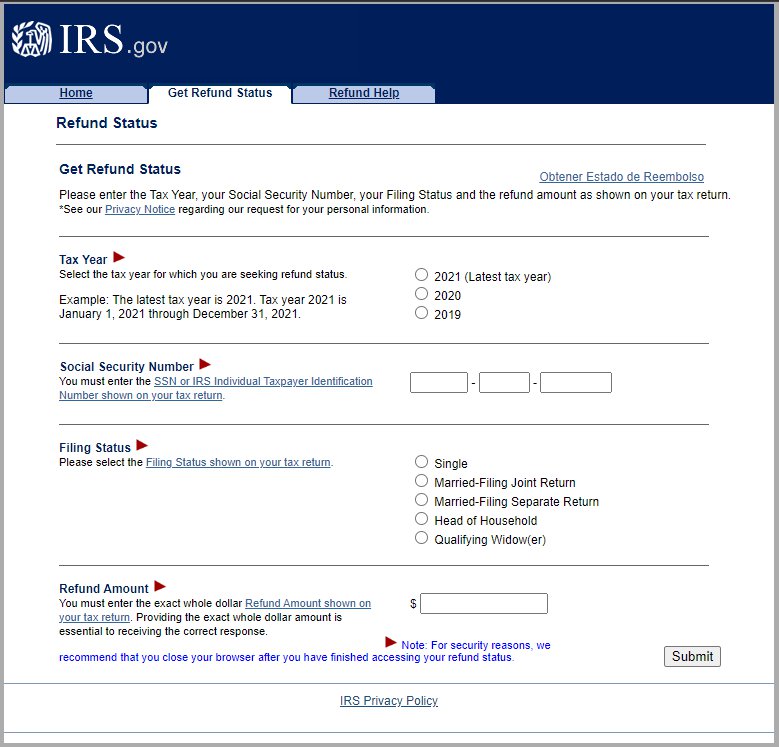

January 24 2024 5 00 AM EST CBS News Many Americans got a shock last year when the expiration of pandemic era federal benefits resulted in their receiving a smaller tax refund check Online filing for the Property Tax Rent Rebate Program is now available for eligible Pennsylvanians to begin claiming rebates on property taxes or rent paid in 2022 Learn More PA Tax Talk PA Tax Talk is the Department of Revenue s blog which informs taxpayers and tax professionals of the latest news and developments from the department

Tax Rebate Status 2024

Tax Rebate Status 2024

https://printablerebateform.net/wp-content/uploads/2023/04/Nebraska-Tax-Rebate-2023-768x678.png

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Martwick Encourages Residents To Check Their Tax Rebate Status Senator Robert Martwick

https://senatormartwick.com/wp-content/uploads/2022/02/Martwick-10-28-2021-768x512.jpg

On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000

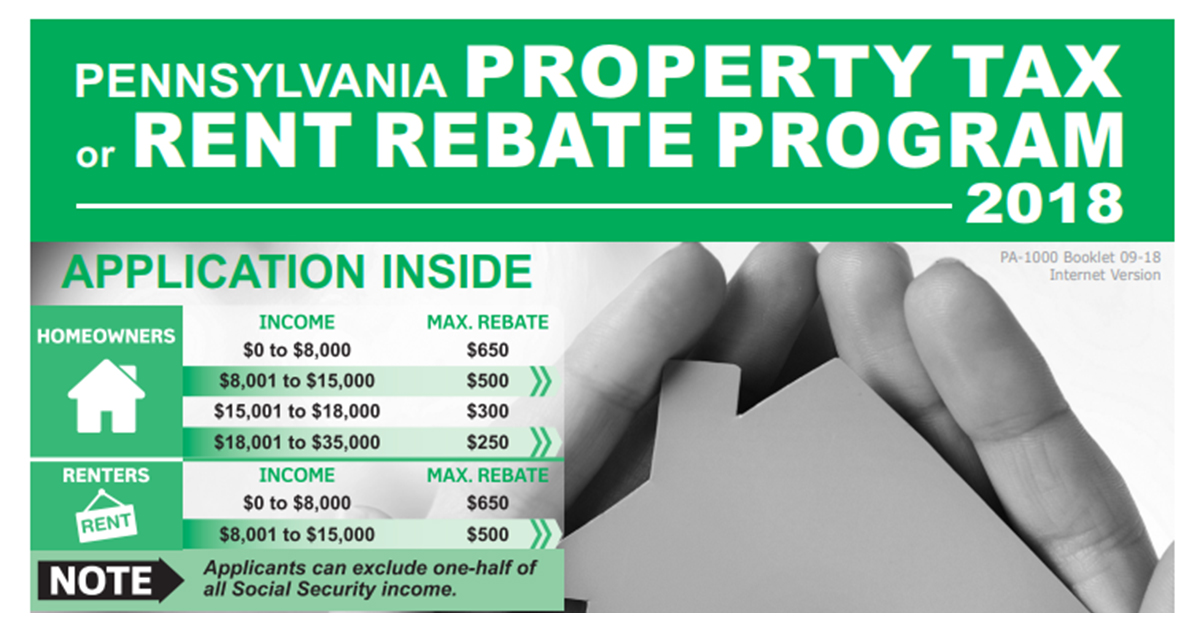

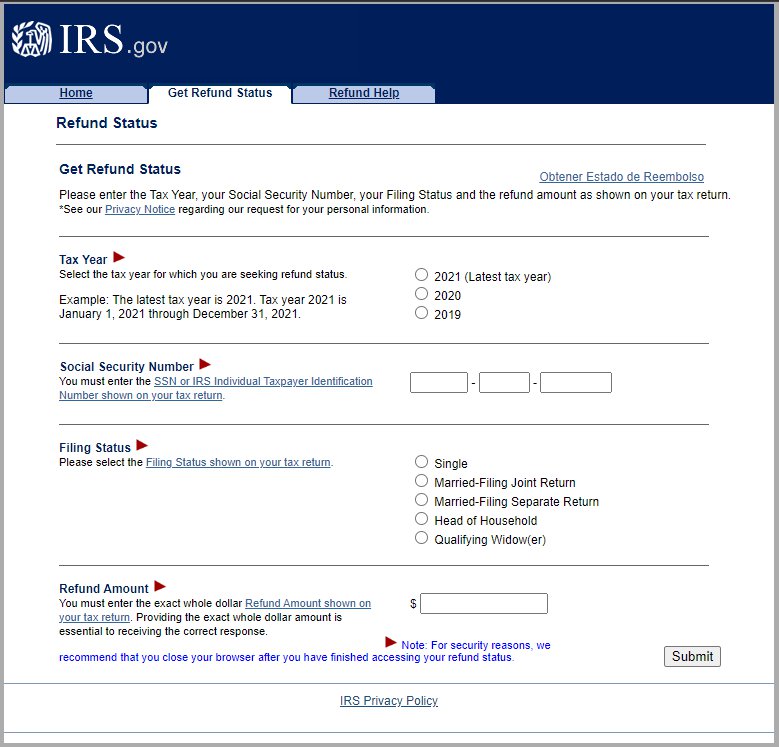

IRS Statements and Announcements Page Last Reviewed or Updated 05 Dec 2023 Eligible individuals can claim the Recovery Rebate Credit on their Form 1040 or 1040 SR These forms can also be used by people who are not normally required to file tax returns but are eligible for the credit The Get ready page on IRS gov outlines steps taxpayers can take now to make filing easier in 2024 Here s what s new and what to consider before filing next year IRS Online Account enhancements

Download Tax Rebate Status 2024

More picture related to Tax Rebate Status 2024

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

https://asset5.scripbox.com/wp-content/uploads/2021/05/tax-rebate.jpg

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/Eligible-2-2048x2048.png

January 23 2024 Image Got an email or text message about a tax refund It s a scam IRS impersonators are at it again This time the scammers are sending messages about your tax refund or tax refund e statement It might look legit but it s an email or text fake trying to trick you into clicking on links so they can steal Strategic Operating Plan In 2024 we re launching a new pilot tax filing service called Direct File If you re eligible and choose to participate file your 2023 federal tax return online for free directly with IRS It will be rolled out in phases and is expected to be more widely available in mid March

Filing Deadline The filing deadline was December 29 2023 Payments will continue to be issued on a rolling basis Most applicants can expect to receive their payment approximately 90 days after filing the application unless we request additional information to process your claim Check the status of your benefit How to Apply Homeowners More families could be eligible for the child tax credit as soon as 2024 if new legislation passes Congress iStock 7 min Comment 295 Congressional negotiators announced a roughly 80 billion

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

https://images.ctfassets.net/ifu905unnj2g/5KwPoo8zZu1ZPIrfn2FdSo/94bf8ce97dc0bc624b3626de0e452578/Screenshot_110422_105531_AM.jpg

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

https://www.moneymgmnt.com/wp-content/uploads/tax-rebate-thailand-2023-1024x565.png

https://www.irs.gov/newsroom/2024-tax-filing-season-set-for-january-29-irs-continues-to-make-improvements-to-help-taxpayers

WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

https://www.cbsnews.com/news/tax-refund-2024-what-to-expect-when-will-i-get/

January 24 2024 5 00 AM EST CBS News Many Americans got a shock last year when the expiration of pandemic era federal benefits resulted in their receiving a smaller tax refund check

Georgia Income Tax Rebate 2023 Printable Rebate Form

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax Calculation Examples FinCalC TV

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

Minnesota Renters Rebate Status Printable Rebate Form Rebate2022

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Income Tax Rebate Under Section 87A

Wondering About Your Idaho Tax Rebate Track Its Status With A New Online Tool Idaho Capital Sun

Section 87A Tax Rebate Under Section 87A Rebates Financial Management Income Tax

Tax Rebate Status 2024 - Keep in mind that the tax deadline will be back to the normal April 15 2024 except for residents of Maine and Massachusetts due to state holidays on April 15 their deadline is April 17