Tax Rebate Taxable Web 9 sept 2023 nbsp 0183 32 taxes taxable income Will Your State Rebate Check Be Taxed for 2023 Here s what the IRS says about taxing state stimulus checks and other special state

Web As mentioned earlier the tax law considers rebates as ordinary discounts where the retailer or manufacturer reduces the price of an item to reward their customers Therefore such Web Generally speaking the IRS considers transaction related points or rewards as rebates and not as taxable income Think of the rebate as a discount you ll receive on your purchase

Tax Rebate Taxable

Tax Rebate Taxable

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

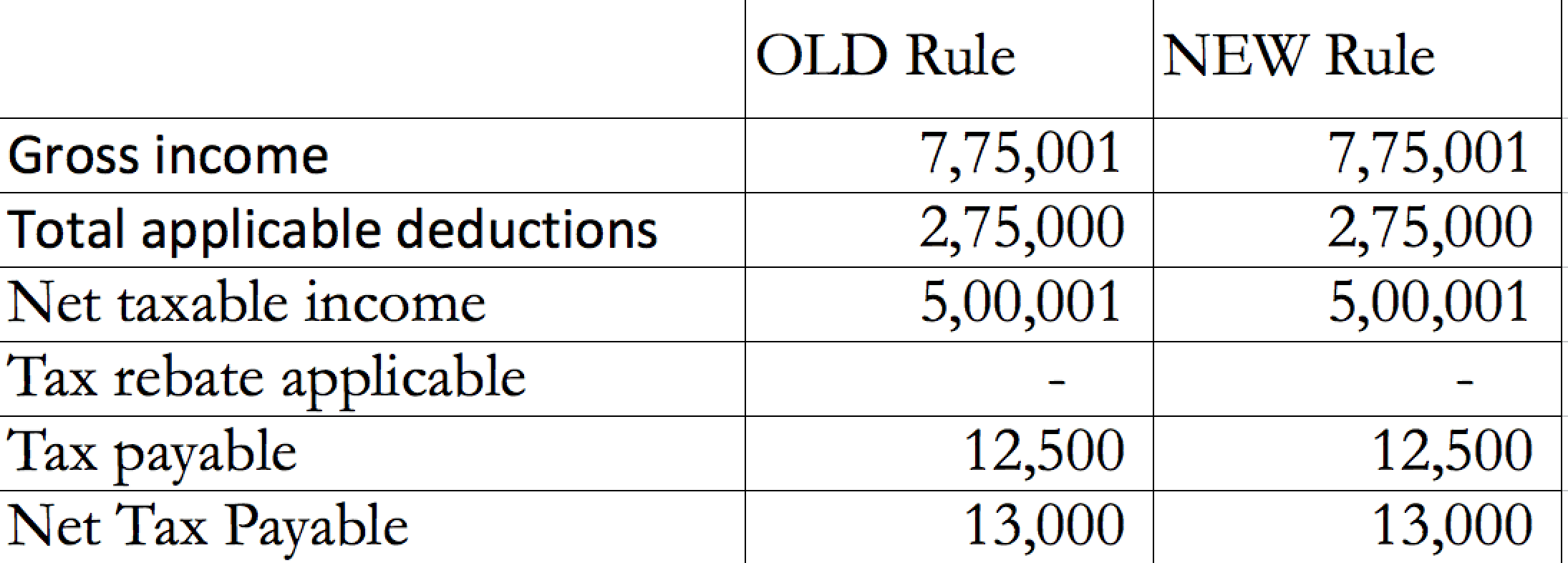

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Tips To Finding Tax Rebates Without The Hassle

https://cdn.techgyd.com/tax-rebate.jpg

Web 6 f 233 vr 2023 nbsp 0183 32 Are State Tax Refunds And Rebates Federally Taxable It Depends Amber Gray Fenner Contributor I cover individual tax issues and IRS developments Feb 6 Web 11 mars 2023 nbsp 0183 32 Residents in four states Georgia Massachusetts South Carolina and Virginia need to pay federal taxes on their state rebates if they itemized deductions in

Web 10 f 233 vr 2023 nbsp 0183 32 If you received a state tax rebate or payment in 2022 it s unclear whether the funds are taxable on your federal return The IRS last week told affected taxpayers Web 10 f 233 vr 2023 nbsp 0183 32 IRS issues guidance on state tax payments to help taxpayers IR 2023 23 Feb 10 2023 WASHINGTON The Internal Revenue Service provided details today

Download Tax Rebate Taxable

More picture related to Tax Rebate Taxable

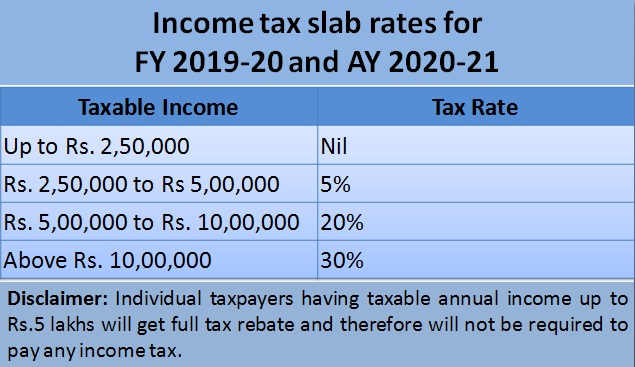

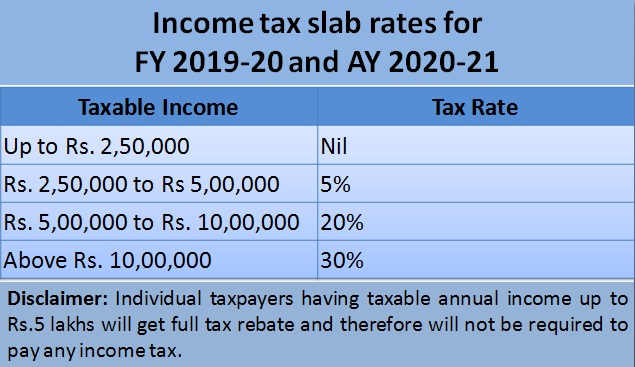

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

https://i.pinimg.com/originals/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

https://1.bp.blogspot.com/-qh1AR8nq79Y/XSdFFK--RCI/AAAAAAAAJ88/-dhKKjr_UCce2k6QpcrxXwK6TKpllSbuACLcBGAs/s640/Tax%2BSlab%2Bfor%2BA.Y.%2B20120-21.jpg

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/pdfresizer.com-pdf-crop-page-001.jpg?resize=720%2C400&ssl=1

Web 9 f 233 vr 2023 nbsp 0183 32 Feb 9 2023 If you re one of the millions of taxpayers who received a one time tax payment from your state last year the Internal Revenue Service has some Web 24 juil 2023 nbsp 0183 32 February 13th update On Friday evening the IRS announced that rebates in most states would not be tax A tax is a mandatory payment or charge collected by local

Web 10 f 233 vr 2023 nbsp 0183 32 February 10 2023 6 34 PM MoneyWatch Taxpayers in more than 20 states who received tax rebates last year got some guidance from the IRS after the Web 8 f 233 vr 2023 nbsp 0183 32 If you qualify for special checks or rebates related to either tax surpluses or inflation in 2022 you might want to hold off on filing your tax return the Internal Revenue Service IRS says

Travelling Expenses Tax Deductible Malaysia Paul Springer

https://d3q48uqppez4lq.cloudfront.net/wp-content/uploads/2020/12/malaysia-tax-relief-2020-mypf.png

Section 87A Tax Rebate Under Section 87A

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

https://www.kiplinger.com/taxes/will-your-state-rebate-check-be-taxed

Web 9 sept 2023 nbsp 0183 32 taxes taxable income Will Your State Rebate Check Be Taxed for 2023 Here s what the IRS says about taxing state stimulus checks and other special state

https://donotpay.com/learn/are-rebates-taxable

Web As mentioned earlier the tax law considers rebates as ordinary discounts where the retailer or manufacturer reduces the price of an item to reward their customers Therefore such

Income Tax Slabs Gambaran

Travelling Expenses Tax Deductible Malaysia Paul Springer

Corporate Tax Rate 2019 Phil Bower

Standard Deduction For 2021 22 Standard Deduction 2021

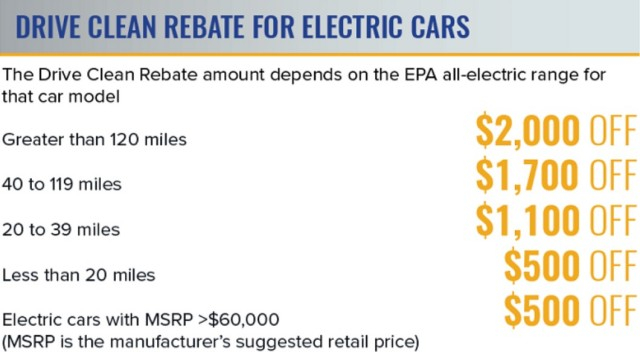

Are Car Rebates Taxable In New York 2022 Carrebate

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

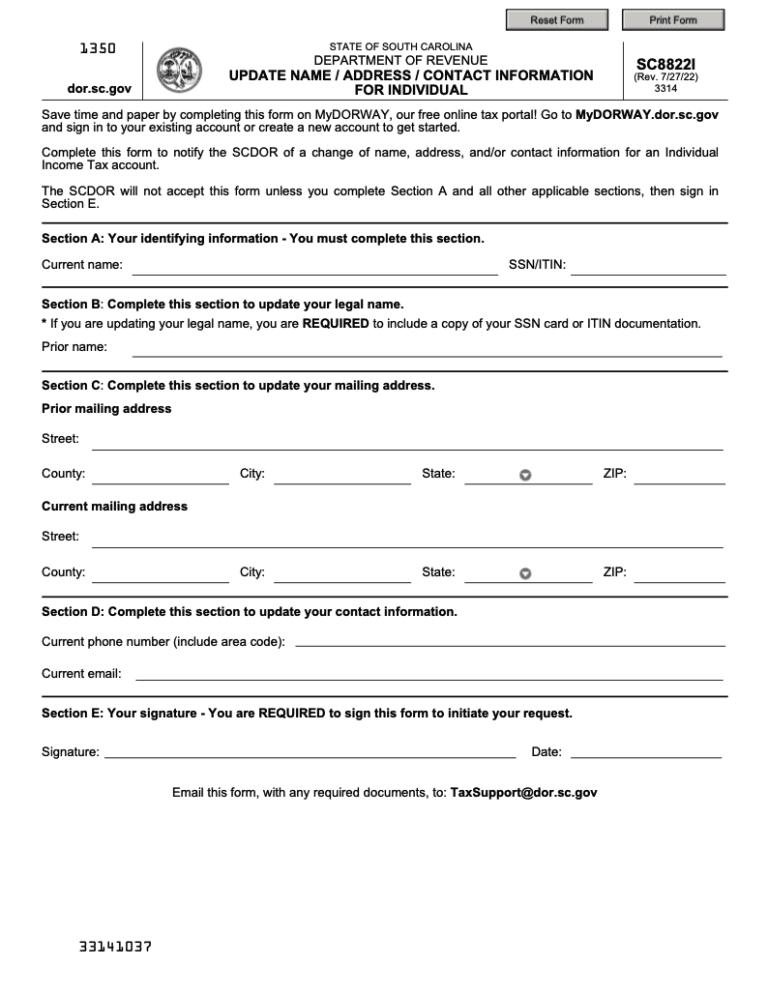

SC State Tax Rebate 2023 Eligibility And Claiming Process Explained

Is Property Tax Rebate Taxable Iras PRORFETY

IRS Has Decided That The Tax Rebate That Idahoans Received In 2022 Is

Tax Rebate Taxable - Web 10 f 233 vr 2023 nbsp 0183 32 If you received a state tax rebate or payment in 2022 it s unclear whether the funds are taxable on your federal return The IRS last week told affected taxpayers