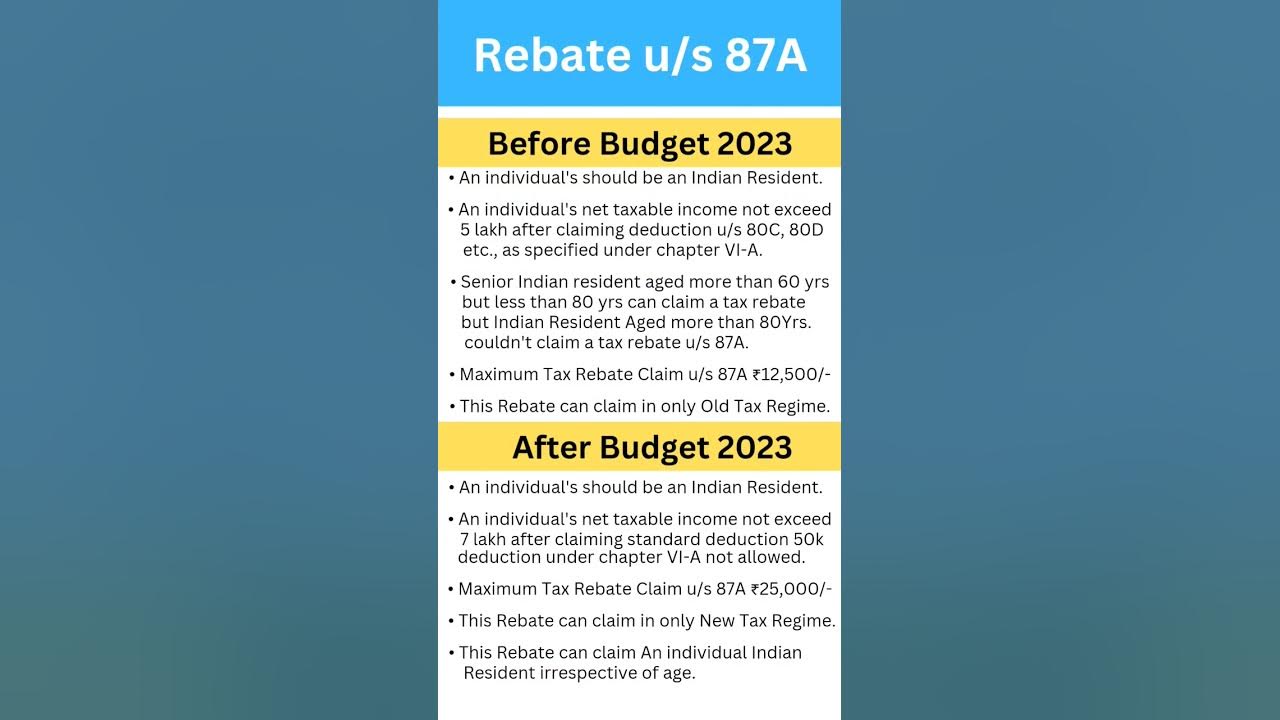

Tax Rebate U S 87a For Ay 2023 23 Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an

Web 14 sept 2019 nbsp 0183 32 Rebate u s 87A for FY 2023 24 AY 2024 25 Budget 2023 proposed several amendments and the aim was to make the new tax regime more lucrative For Web 3 f 233 vr 2023 nbsp 0183 32 The Budget 2023 has revised the threshold limit of tax rebate u s 87A for the new tax regime Before we get into discussing about how Section 87A rebate is calculated lets first see How much rebate can be

Tax Rebate U S 87a For Ay 2023 23

Tax Rebate U S 87a For Ay 2023 23

https://i.ytimg.com/vi/wZNZ6YgMsIc/maxresdefault.jpg

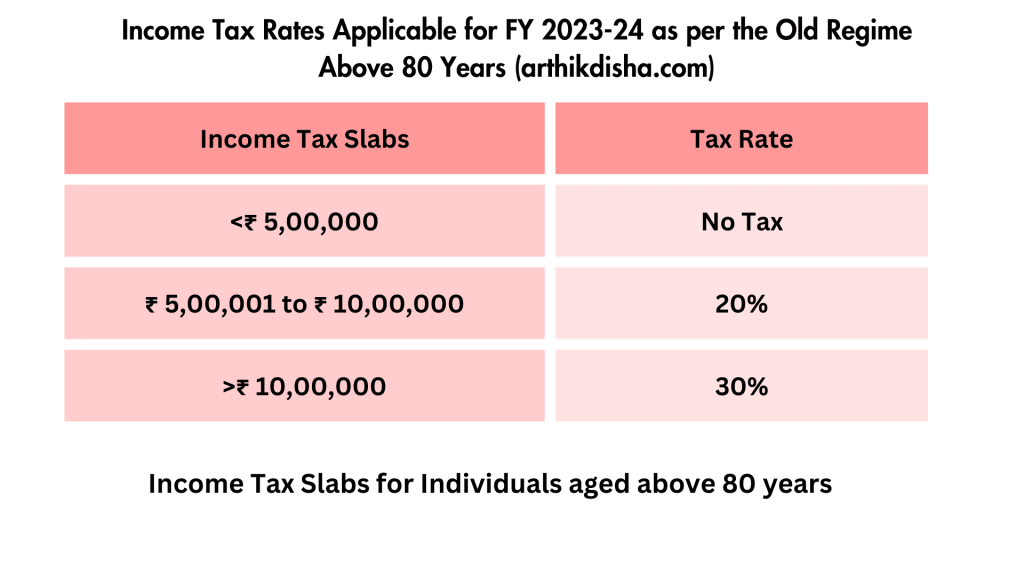

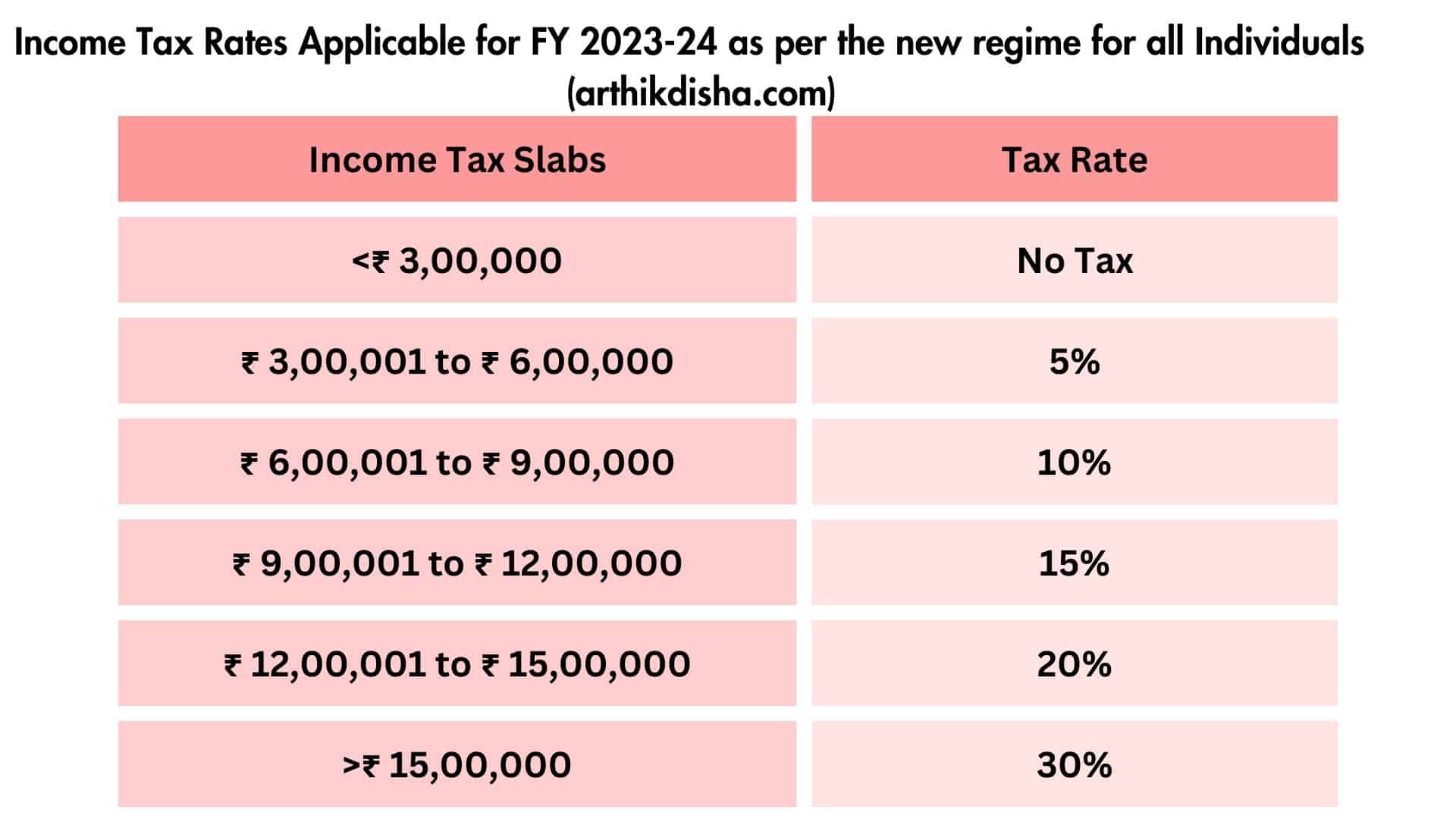

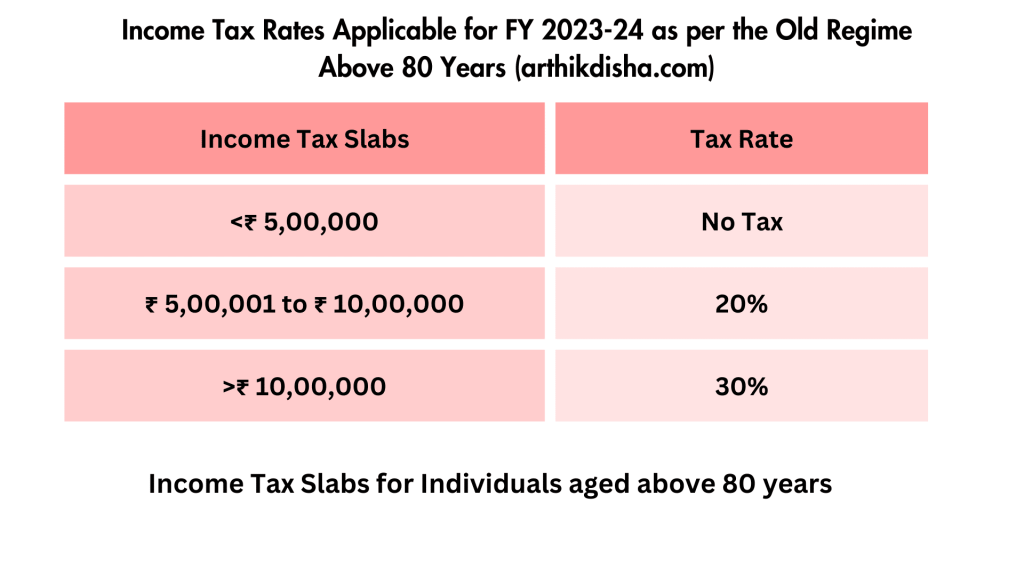

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://arthikdisha.com/wp-content/uploads/2023/06/Income-Tax-Rates-Applicable-for-FY-2023-24-as-per-the-Old-Regime-Above-80-Years-arthikdisha.com_-1024x576.png

Rebate U S 87A Limit Before Budget 2023 After Budget 2023 gst

https://i.ytimg.com/vi/vEDAGw8xo24/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYGiBaKH8wDw==&rs=AOn4CLB7VtFEC8HS_0IJESIBduMU1Vja2A

Web 10 f 233 vr 2023 nbsp 0183 32 Budget 2023 announced that individuals will not have to pay any tax if the taxable income does not exceed Rs 7 lakh in a financial year The maximum limit of rebate available under section 87A of the Income Web 20 f 233 vr 2023 nbsp 0183 32 Step 1 In the first step calculate the total income you earned during this financial year For example A Y 2022 23 Income earned from 01 04 2021 to 31 03

Web 1 f 233 vr 2023 nbsp 0183 32 Section 87A Rebate for AY 2023 24 Income Tax Rebate under section 87A of Income Tax Act 1961 provides a rebate from income tax up to Rs 12500 to an individual resident assessee whose total Web 2 f 233 vr 2023 nbsp 0183 32 In Budget 2023 the tax rebate for individuals has been increased to INR 25 000 which means individuals having taxable income up to INR 7 00 000 can claim

Download Tax Rebate U S 87a For Ay 2023 23

More picture related to Tax Rebate U S 87a For Ay 2023 23

Rebate Under Sec 87A On Basic Income Tax PY 2022 23 AY 2023 24

https://i.ytimg.com/vi/iBVPuOeMqvo/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGMgYyhjMA8=&rs=AOn4CLAkxwuVfXRiwLFdgZ5yJ77kkzr3_g

Everything You Need To Know About 87a Rebate Ay 2023 20 And How To Use

https://i0.wp.com/www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-section-87a-tax-rebate-fy-2019-20-how-to-check-rebate-eligibility-from-87a-rebate-ay-2023-20-post.jpg?w=979&ssl=1

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://arthikdisha.com/wp-content/uploads/2023/05/SmartSelect_20230524_092144_Microsoft-365-Office-1024x948.jpg

Web Example If your total income for FY 2022 23 does not exceed 5 00 000 then you will be eligible to claim rebate in income tax u s 87A up to 12 500 at the time of filing your Income Tax Return for AY 2023 24 Web The Section 87A rebate for 2023 is Rs 12 500 for the old tax regime and Rs 25 000 for the new tax regime This means that if your total income is less than Rs 5 lakhs in 2023

Web 4 ao 251 t 2023 nbsp 0183 32 Eligibility amp Rebate U S 87A Restrict for FY 2023 24 The edge restrict us 87A is Rs 12 500 or Rs 25 000 relying on the kind of tax regime you go for Solely Web However no 87A rebate will be available if your total income for the fiscal is higher than Rs 5 lakh For the current financial year 2022 2023 AY 2023 2024 if your total taxable

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2022 23 In Hindi

https://i.ytimg.com/vi/jocxPhsi0f0/maxresdefault.jpg

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://arthikdisha.com/wp-content/uploads/2023/06/Income-Tax-Rates-Applicable-for-FY-2023-24-as-per-the-new-regime-for-HUF-and-all-Individuals-1.jpg

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an

https://tax2win.in/guide/section-87a

Web 14 sept 2019 nbsp 0183 32 Rebate u s 87A for FY 2023 24 AY 2024 25 Budget 2023 proposed several amendments and the aim was to make the new tax regime more lucrative For

Know New Rebate Under Section 87A Budget 2023

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2022 23 In Hindi

How To Avail NIL TAX For 7 Lakhs Income In New Tax Regime Budget 2023

Rebate Under Section 87A Of Income Tax Section 87A Of Income Tax

Rebate U s 87A

Section 87A Of The Income Tax Act In 2023 Budgeting Rebates Tax

Section 87A Of The Income Tax Act In 2023 Budgeting Rebates Tax

REBATE U s 87A Under Income Tax B Ca Cs Cma And Ignou Exams With

Sec 87A Rebate Income Tax Malayalam AY 2022 23 CA Subin VR YouTube

Section 87A Rebate For AY 2024 25 As Per Union Budget 2023 24

Tax Rebate U S 87a For Ay 2023 23 - Web 2 f 233 vr 2023 nbsp 0183 32 In Budget 2023 the tax rebate for individuals has been increased to INR 25 000 which means individuals having taxable income up to INR 7 00 000 can claim