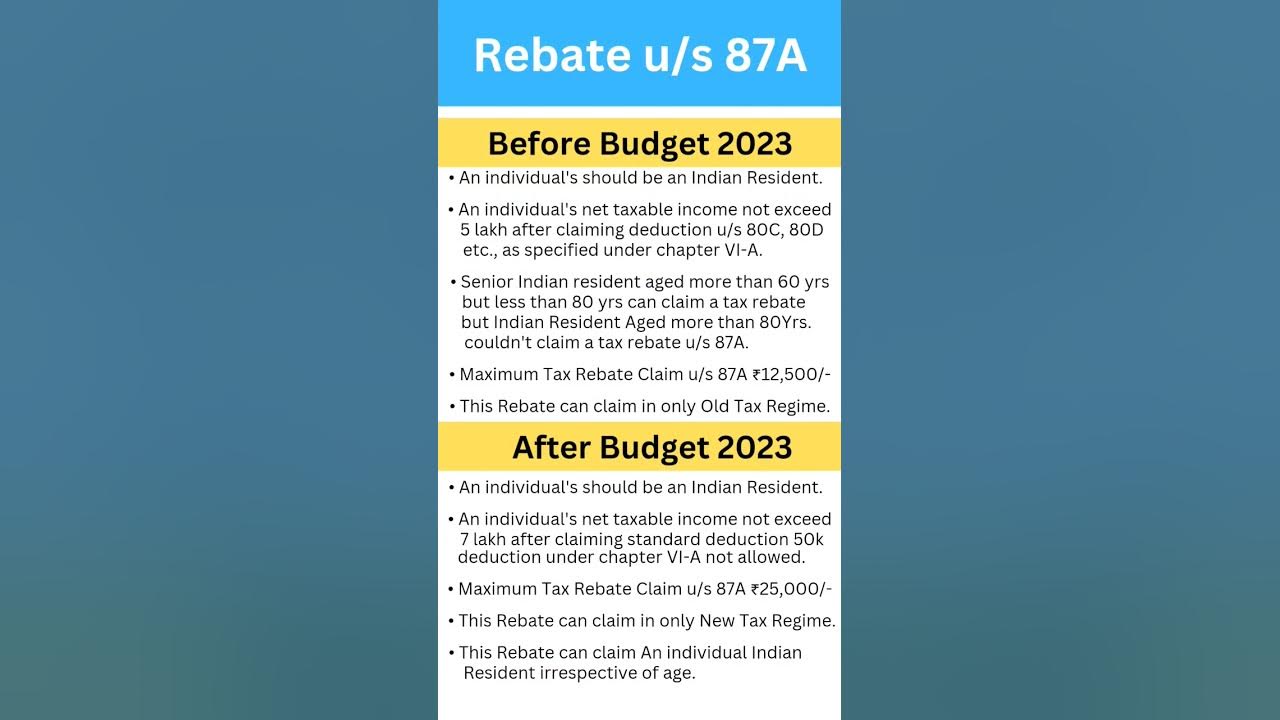

Tax Rebate U S 87a For Fy 2023 23 Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an

Web 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under Web 3 f 233 vr 2023 nbsp 0183 32 Therefore the Section 87A Tax rebate is available under both new and old tax regimes for FY2023 24 So you can claim Sec 87A Rebate of Rs 25 000 under the new tax regime and Rs 12 500 under the old tax

Tax Rebate U S 87a For Fy 2023 23

Tax Rebate U S 87a For Fy 2023 23

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/pdfresizer.com-pdf-crop-page-001.jpg?resize=720%2C400&ssl=1

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://arthikdisha.com/wp-content/uploads/2023/05/SmartSelect_20230524_092144_Microsoft-365-Office-1024x948.jpg

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

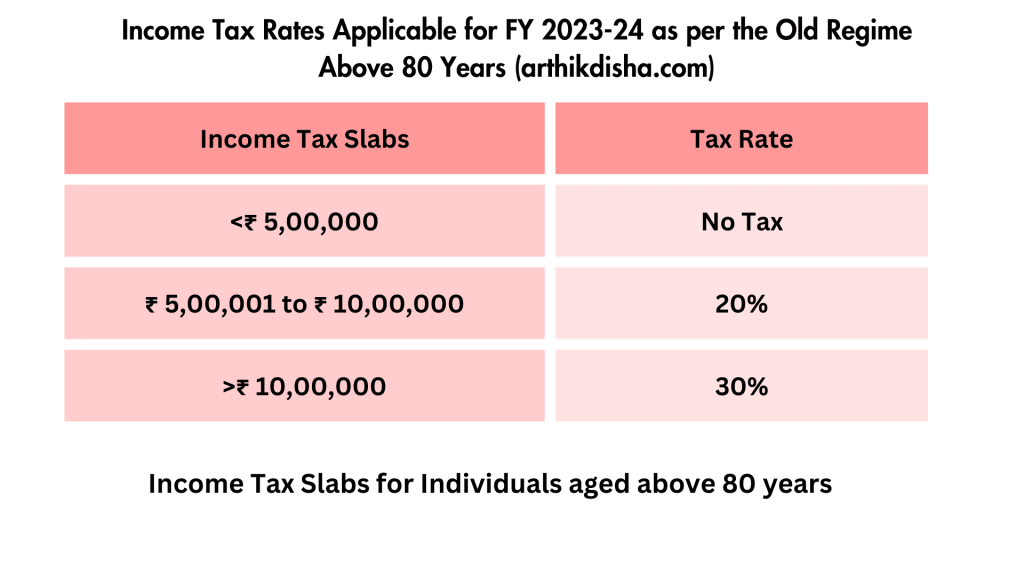

https://arthikdisha.com/wp-content/uploads/2023/06/Income-Tax-Rates-Applicable-for-FY-2023-24-as-per-the-Old-Regime-Above-80-Years-arthikdisha.com_-1024x576.png

Web 4 juin 2023 nbsp 0183 32 Presently rebate is allowed u s 87A of Rs 12 500 in old regime of Income Tax if any resident individual whose total income during the previous year does not exceed Rs 5 00 000 Rebate is available Web Section 87A Eligibility Criteria for FY 2022 23 and FY 2023 24 An individual can claim a tax rebate us 87A provided he or she meets the following conditions The individual must be

Web 10 avr 2023 nbsp 0183 32 Under the Budget 2023 the tax rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh for the new tax regime Thus an individual Web 2 f 233 vr 2023 nbsp 0183 32 In Budget 2023 the tax rebate for individuals has been increased to INR 25 000 which means individuals having taxable income up to INR 7 00 000 can claim

Download Tax Rebate U S 87a For Fy 2023 23

More picture related to Tax Rebate U S 87a For Fy 2023 23

Section 87A New Rebate 87A Of Income Tax In Budget 2023 Tax Save

https://i.ytimg.com/vi/TYfP6LlV2QU/maxresdefault.jpg

Everything You Need To Know About 87a Rebate Ay 2023 20 And How To Use

https://i0.wp.com/www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-section-87a-tax-rebate-fy-2019-20-how-to-check-rebate-eligibility-from-87a-rebate-ay-2023-20-post.jpg?w=979&ssl=1

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

Web 10 f 233 vr 2023 nbsp 0183 32 The maximum limit of rebate available under section 87A of the Income tax Act 1961 has been increased to Rs 25 000 from Rs 12 500 in Budget 2023 Getty Images 3 6 Who are eligible for this rebate under Web 18 juil 2023 nbsp 0183 32 A Taxpayer can claim the benefit of rebate under section 87A for FY 2022 23 and 2023 24 only if the following conditions are satisfied You are a resident individual

Web 19 avr 2023 nbsp 0183 32 What is Tax Rebate u s 87a for FY 2023 24 The maximum rebate amount under Section 87A for FY 2023 24 is Rs 12 500 for those who opt for the old tax regime Web Union Budget 2023 Update On 1 February 2023 finance minister Nirmala Sitharaman delivered the Union Budget 2023 in parliament Under the New Tax Regime Section 87a

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A.jpg?ssl=1

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an

https://tax2win.in/guide/section-87a

Web 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

Income Tax Rebate U s 87A For The Financial Year 2022 23

Rebate U S 87A Limit Before Budget 2023 After Budget 2023 gst

Section 87A Of The Income Tax Act In 2023 Budgeting Rebates Tax

.png)

Rebate U s 87A Income Tax Rebate Under Section 87A JR Compliance Blogs

Rebate Under Sec 87A On Basic Income Tax PY 2022 23 AY 2023 24

Rebate Under Sec 87A On Basic Income Tax PY 2022 23 AY 2023 24

Section 87A Rebate Income Tax Act Claim Rebate For FY 2019 20 AY

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

Tax Rebate U S 87a For Fy 2023 23 - Web 20 f 233 vr 2023 nbsp 0183 32 20 02 2023 by Alert Tax Team Updates Rebate 87A for AY 2024 25 The alternative tax regime increased the section 87A rebate from Rs 5 Lakhs to Rs 7