Tax Rebate U S 87a For Huf Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount

87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an individual Tax Rebate Under Section 87A Find out Who can claim Income Tax Rebate u s 87A for FY 2023 24 AY 2024 25 and FY 2022 23 AY 2023 24 A tax rebate on an income of Rs 7 lakh has been introduced in the new tax

Tax Rebate U S 87a For Huf

Tax Rebate U S 87a For Huf

https://i.ytimg.com/vi/DwFvkMZgBmc/maxresdefault.jpg

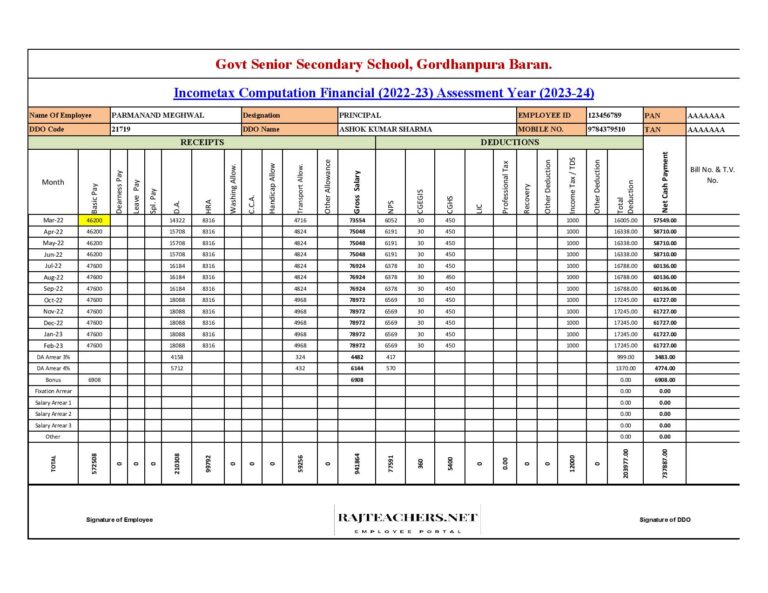

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Income Tax Sec 87A Amendment Rebate YouTube

https://i.ytimg.com/vi/sg50vzyjXQY/maxresdefault.jpg

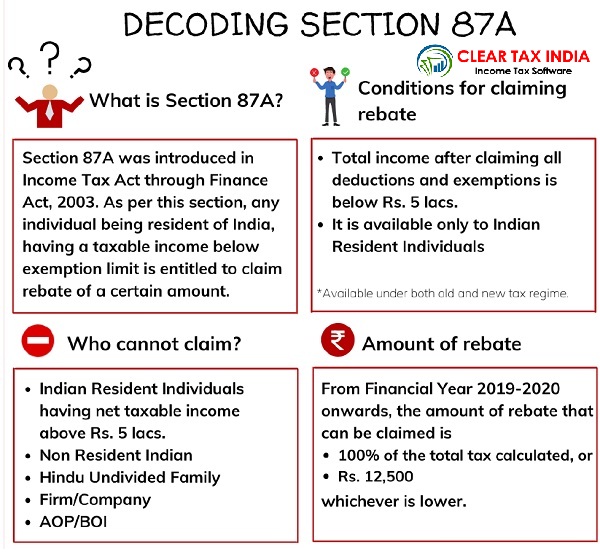

Claim tax rebate under Section 87A only when the income does not exceed 5 lakhs The maximum rebate under section 87A for AY 2024 25 FY 2023 24 is 25 000 under the new Income Tax Rebate under section 87A helps reduce tax liability for individuals meeting specific income criteria The rebate amount differs based on income levels It is only

You can claim rebate u s 87A if your taxable income is within Rs 5 00 lacs for the old tax regime and within Rs 7 00 lacs for the new tax regime The section 87A rebate will be the tax payable or Rs 12500 Rs 25000 Section 87A of the Income Tax Act of 1961 provides a rebate on income tax to resident individual taxpayers This section is designed to provide relief to taxpayers with income lower than the

Download Tax Rebate U S 87a For Huf

More picture related to Tax Rebate U S 87a For Huf

Rebate U s 87A

https://media.licdn.com/dms/image/C5112AQHGhIc7iVAbrg/article-cover_image-shrink_600_2000/0/1523954816383?e=2147483647&v=beta&t=BtH1y3BpTu4KevMTicf4-bfJurzHAXOcHYOEp8_GexA

Income Tax Rebate Under Section 87A

http://bemoneyaware.com/wp-content/uploads/2016/04/ITR-87a-rebate.png

Income Tax Rebate Meaning Types How To Calculate HDFC Life

https://www.hdfclife.com/content/dam/hdfclifeinsurancecompany/knowledge-center/images/tax/section-87A.jpg

Rebate under section 87A of the Income Tax Act helps taxpayers to reduce their tax liability Resident individuals with a net taxable income less than or equal to INR 5 00 000 can Non resident individual taxpayers are not eligible for rebate u s 87A Partnership firms LLP HUF Companies etc are not eligible under section 87A The tax rebate allowed

For the fiscal years 2021 22 and 2022 23 AY 2022 23 and AY 2023 24 senior citizens with taxable income up to Rs 5 00 000 can claim a tax rebate u s 87A The rebate amount is either Rs 12 500 or the amount of tax payable Rebate u s 87A is not available to HUF Even the Non Resident are not eligible for tax rebate as this rebate is available to residents only There is a ceiling on the total income for

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

Income Tax Calculation For Central Government Employees

https://rajteachers.net/wp-content/uploads/2022/12/Income-Tax-Calculation-for-Central-Government-Employees-768x593.jpg

https://tax2win.in/guide/section-87a

Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount

https://economictimes.indiatimes.com/wealth/tax/...

87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an individual

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Section 87A Tax Rebate Under Section 87A Rebates Financial

Tax Rebate Under Section 87A In Old New Tax Regime FinCalC

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

Rebate U s 87A Of I Tax Act Income Tax

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Tax Planning V Financial Services

Tax Rebate U S 87a For Huf - Section 87A of the Income Tax Act of 1961 provides a rebate on income tax to resident individual taxpayers This section is designed to provide relief to taxpayers with income lower than the