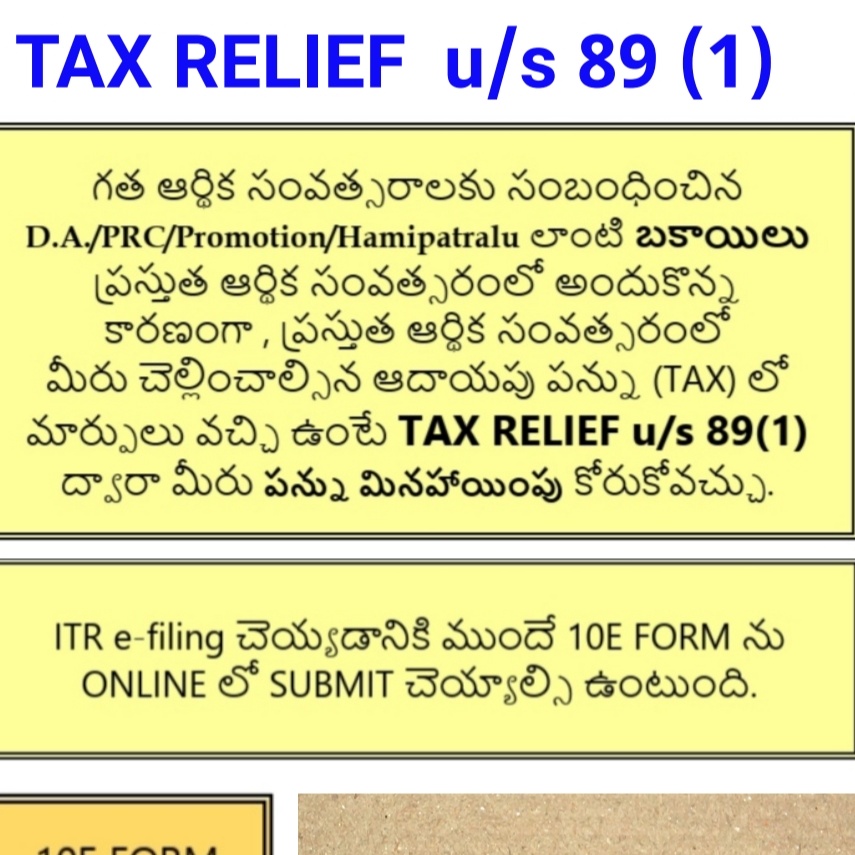

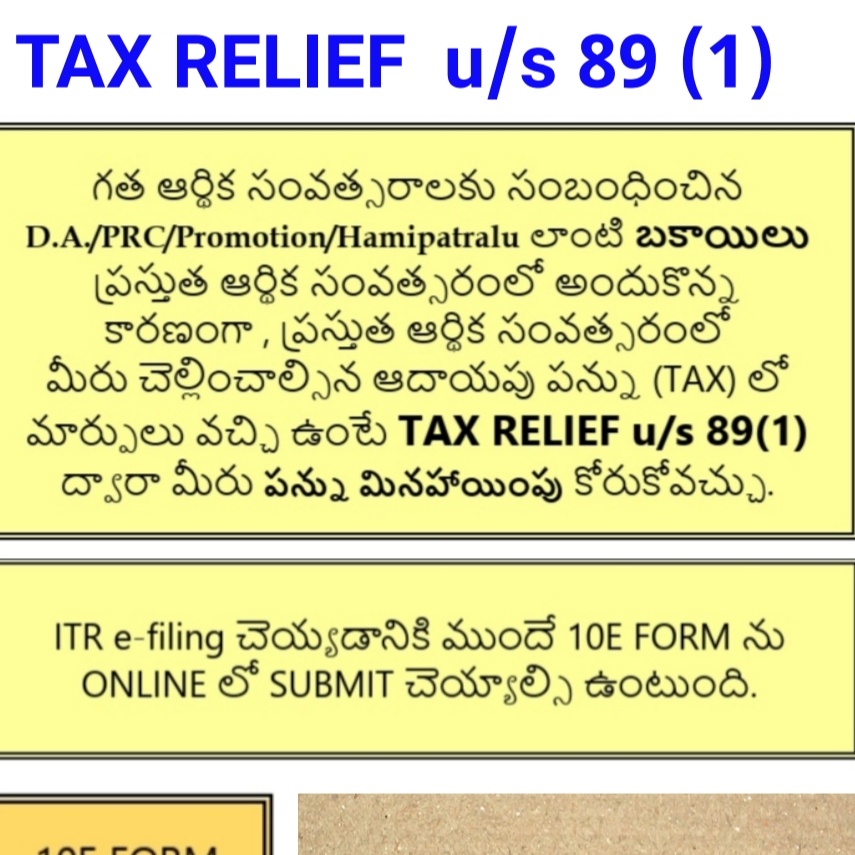

Tax Rebate U S 89 Web The government to avoid the problem of over taxation due to advance or arrear of salary allows you to claim a tax relief u s 89 To claim this relief Form 10E is required There can be times when you do not receive your

Web Any one who has received arrears of salary allowances pension and likes to avail tax relief u s 89 1 i e treating the amount of arrears for taxability to the period of Web 1 oct 2021 nbsp 0183 32 CA ROHIT VISHNOI 10 7K subscribers Subscribe 21K views 1 year ago arrear u Incometax How to calculate arrears Tax relief on arrear u s 89 1 AY 21

Tax Rebate U S 89

Tax Rebate U S 89

https://1.bp.blogspot.com/-mGVyFlaKZmg/YDEX-u40vLI/AAAAAAAAht8/N3zA4fpxAKofXgvy3dc9JOcETOI5uxvQwCLcBGAsYHQ/s855/Screenshot_20210220-193707__01.jpg

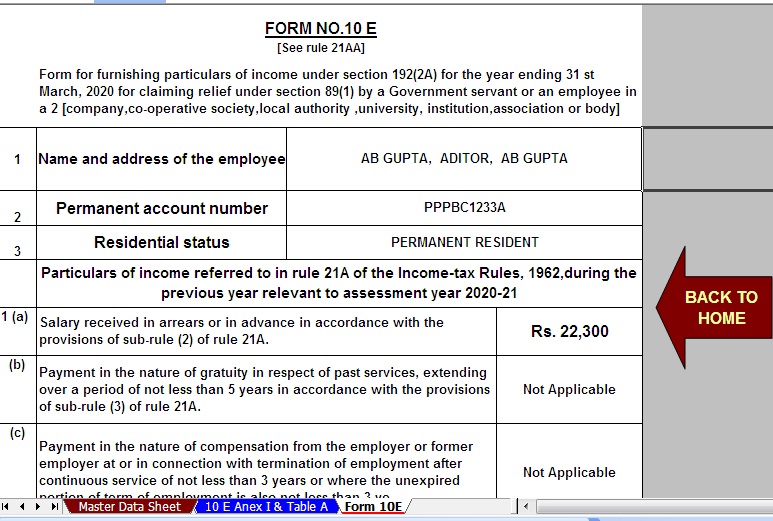

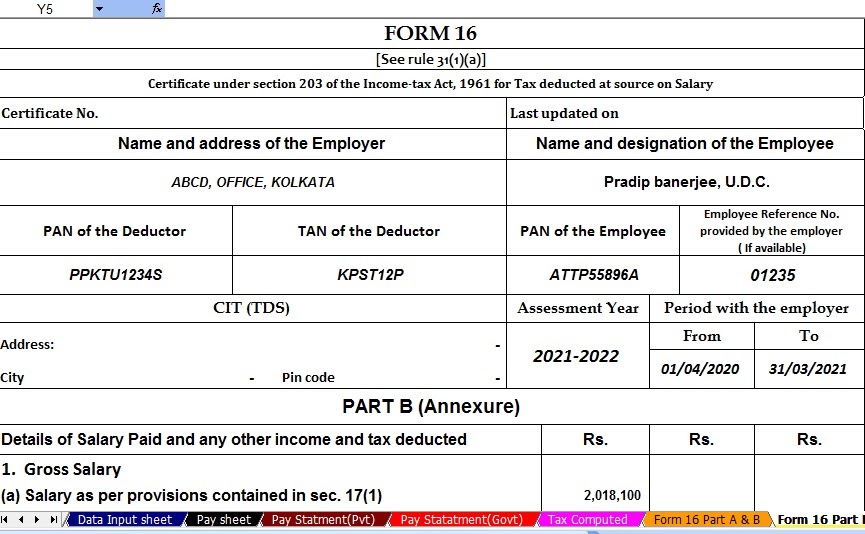

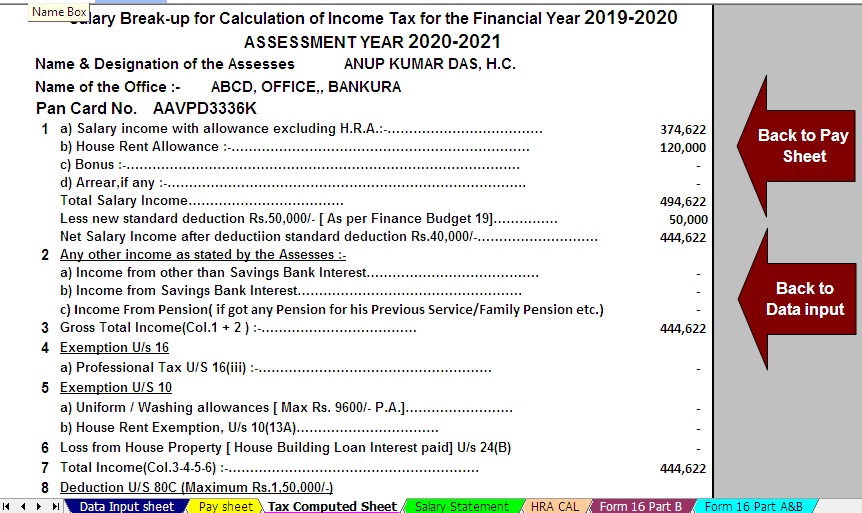

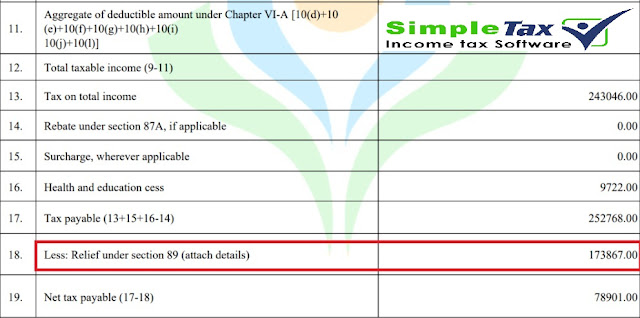

Relief Under Section 89 1 For Arrears Of Salary Itaxsoftware

https://1.bp.blogspot.com/-tZFrTAS5gvo/XhUd-5p6j3I/AAAAAAAALfQ/Bb1lpmHCvMk08MD2EPLY5qHVFx-Gt0TlgCNcBGAsYHQ/s1600/Picture%2B5%2Bof%2BArrears%2BRelief%2BCalculator%2B%2B19-20.jpg

Download Auto Calculate Income Tax Arrears Relief Calculator U s 89 1

https://1.bp.blogspot.com/-Ipsw29iUnkc/XuXc-jYh0sI/AAAAAAAANdM/-Y63uNNLCDYYME4lvkjYUc1f27RxYOyjgCNcBGAsYHQ/s1600/2.jpg

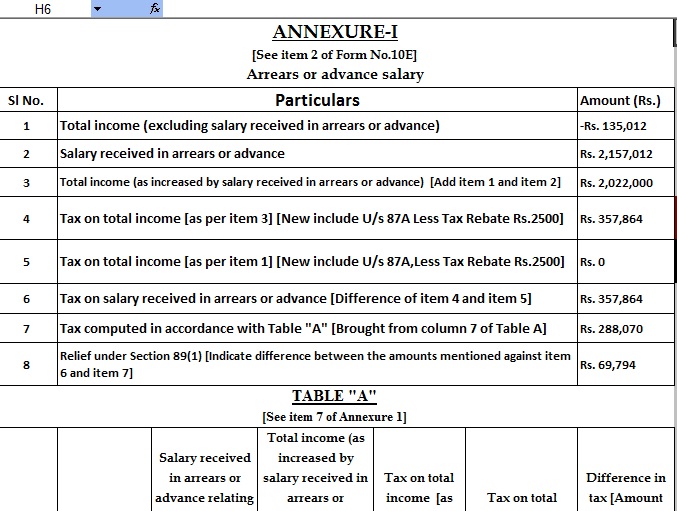

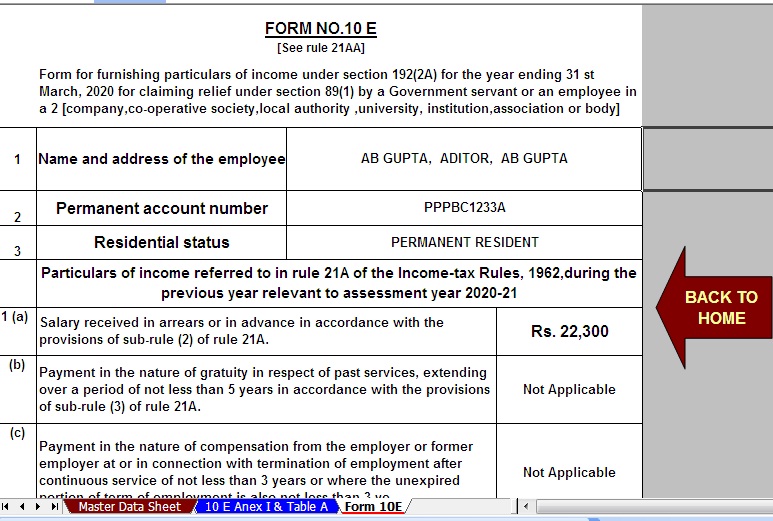

Web Amount in Rs Salary received in arrear Rule 21A 2 Enter details Gratuity received for past services extending a period of not less than 5 years but less than 15 years Rule Web Here are the steps to calculate relief under section 89 1 of the Income tax Act 1961 Calculate tax payable on total income including arrears in the year in which it is received Calculate tax payable on total income

Web 28 mai 2012 nbsp 0183 32 A Relief can be claimed u s 89 1 if gratuity is received in excess of limits specified The cases in which the relief is admissible is divided into three categories a 194 Web If in case of receipt of past salary salary in advance or receipt of family pension in arrears you are allowed some tax relief under section 89 1 Here s how you can calculate the

Download Tax Rebate U S 89

More picture related to Tax Rebate U S 89

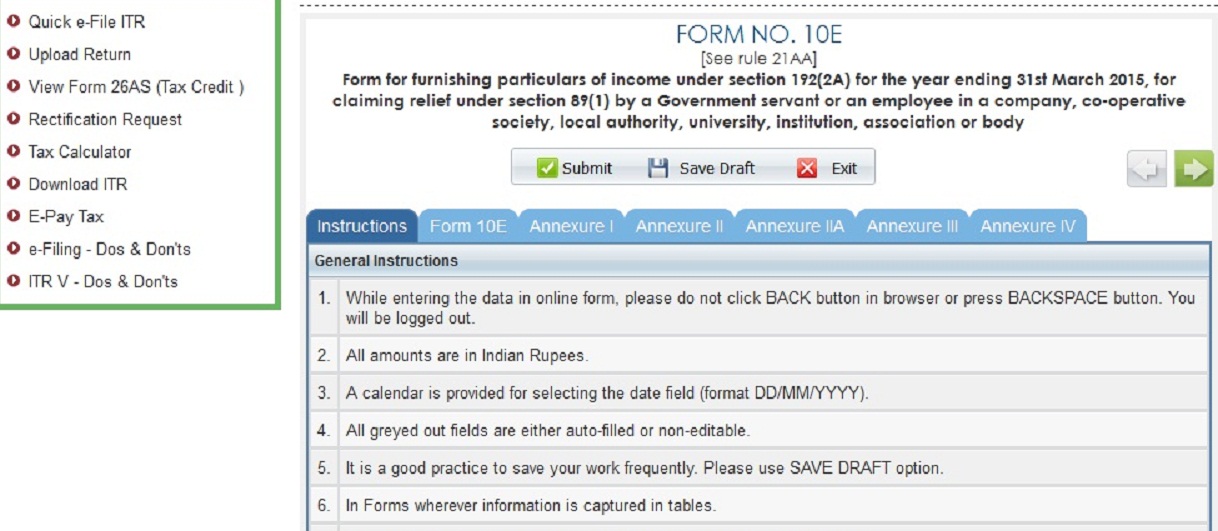

Now It Is Compulsory To Upload 10E Form For Claim Relief U s 89 1 To

https://2.bp.blogspot.com/-wrcqm6PmAiE/VhU1EyN4OmI/AAAAAAAADPY/y4q-1wC5op0/w1200-h630-p-k-no-nu/other.gif

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

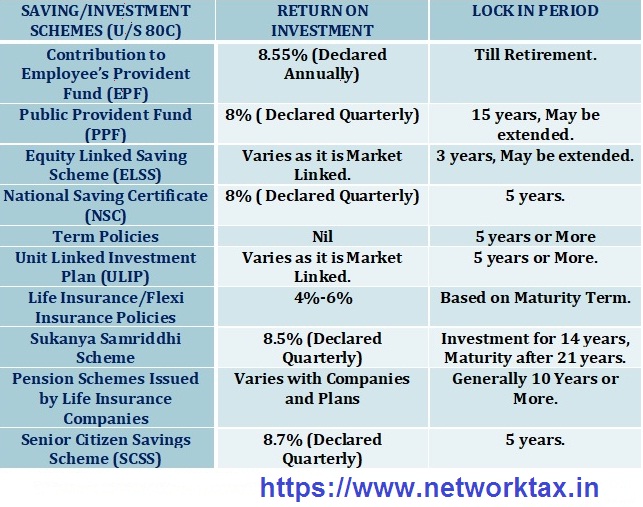

https://1.bp.blogspot.com/-mRQaYQLP59U/X1BnNR-2zcI/AAAAAAAAOSo/EWOnKzg142kD8ZJUWja_MuANbn2VPKdWgCNcBGAsYHQ/s1600/picture%2Bfor%2Bincome%2Btax%2B80C.jpg

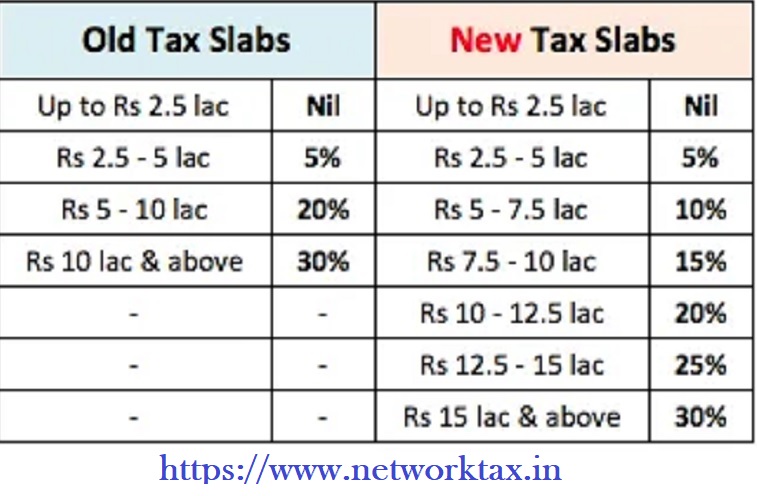

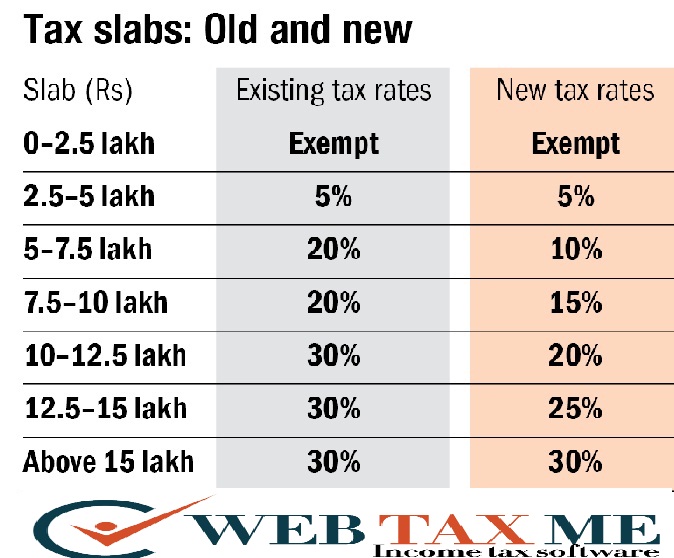

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

https://1.bp.blogspot.com/-FA5sF9RVbPs/X1BnDNbfM8I/AAAAAAAAOSk/xMZjeJeXwBQcSU_kLIeub9xWgP1PLULrgCNcBGAsYHQ/s1600/New%2BTax%2BSlab%2Bfor%2BA.Y.2021-22.jpg

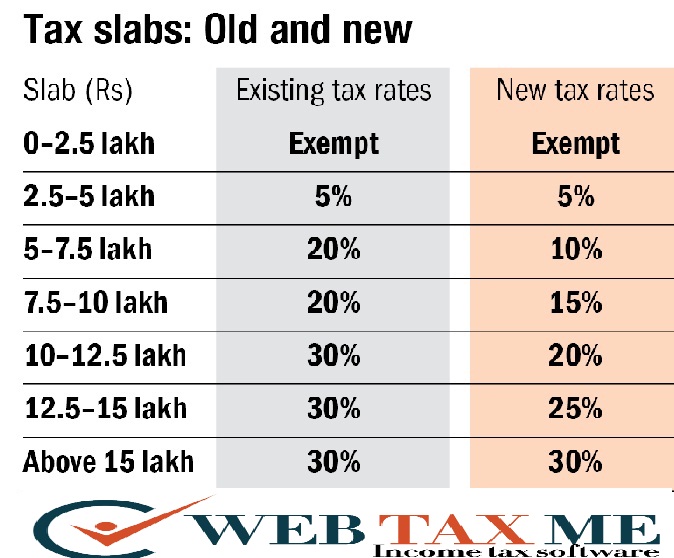

Web 3 ao 251 t 2023 nbsp 0183 32 Rebate u s 87A Relief u s 89 Applies to income earned from all heads of Income Applies only to Income under the head salaries No separate form is required to Web 8 mai 2023 nbsp 0183 32 Section 89 1 of the Income Tax Act offers relief from receipt of past income in the current year for any change in taxation laws The relief is provided by recalculating

Web Download Auto Calculate Income Tax Arrears Relief Calculator U s 89 1 with Form 10E for the F Y 2023 24 Individuals living under the existing tax regime with a total income of Web 15 oct 2022 nbsp 0183 32 The relief under section 89 1 is allowable in the assessment year in which the arrears or the advance is received by the employee Pay revisions particularly in

Auto Fill Income Tax Arrears Relief Calculator U S 89 1 Form 10 E

https://1.bp.blogspot.com/-WNbzW3vHzPY/YKcjm3EuZeI/AAAAAAAAQj4/w-C4R0Odnkwawvb4faY_SuKT5ZuBm1EGgCNcBGAsYHQ/s674/Picture%2B1.jpg

Procedure To Claim Relief U s 89 1 Or How To Upload 10E Form

http://4.bp.blogspot.com/-CHUVF97EzEk/VjQzDfQyoxI/AAAAAAAACOc/Znm4x-7SCTg/s640/1.gif

https://www.canarahsbclife.com/tax-university…

Web The government to avoid the problem of over taxation due to advance or arrear of salary allows you to claim a tax relief u s 89 To claim this relief Form 10E is required There can be times when you do not receive your

https://maxutils.com/income/calculate-tax-relief-us89

Web Any one who has received arrears of salary allowances pension and likes to avail tax relief u s 89 1 i e treating the amount of arrears for taxability to the period of

Auto Fill Income Tax Arrears Relief Calculator U S 89 1 Form 10 E

Auto Fill Income Tax Arrears Relief Calculator U S 89 1 Form 10 E

How To E filing For Upload 10E Form For Claim Relief U s 89 1 To The

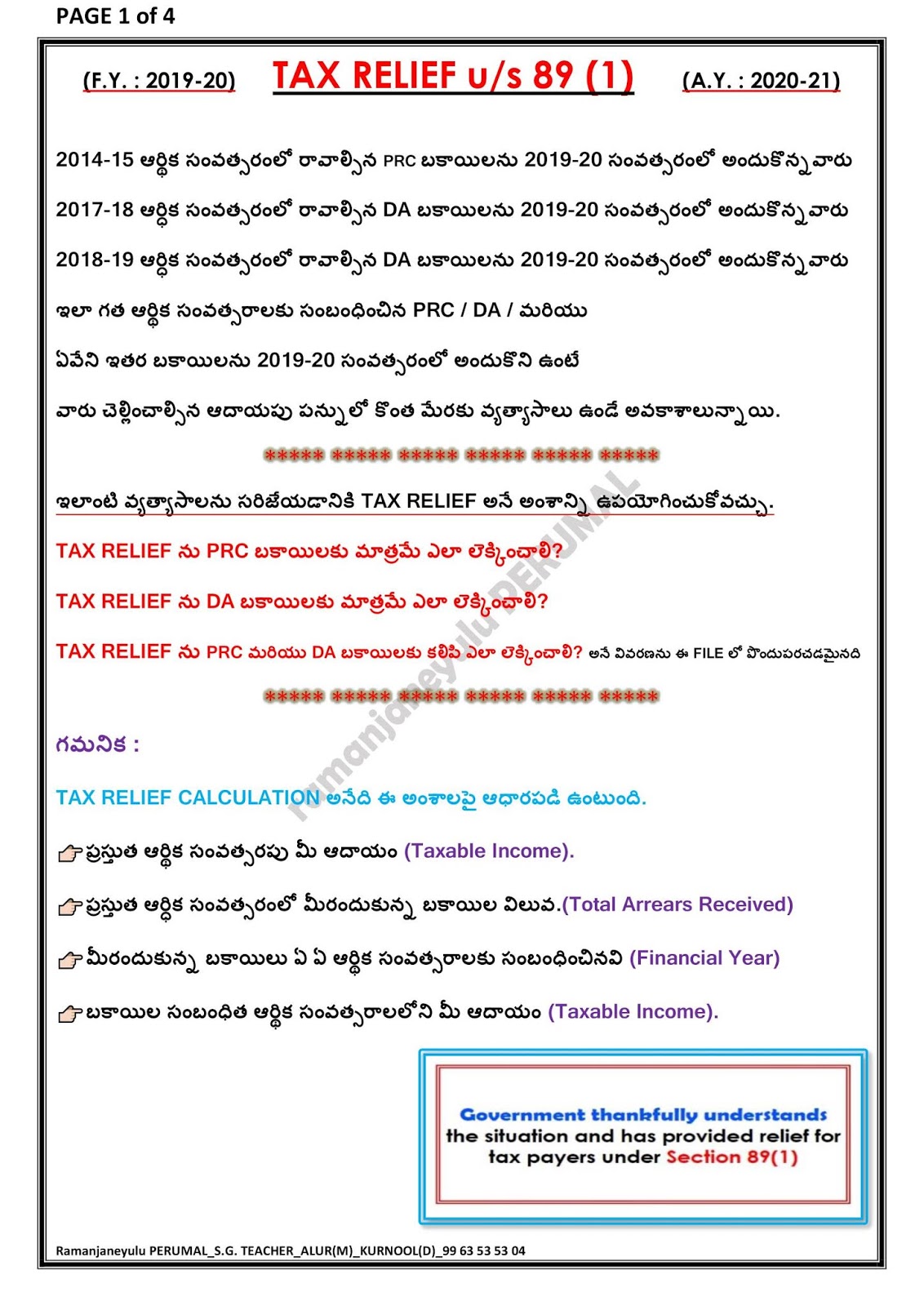

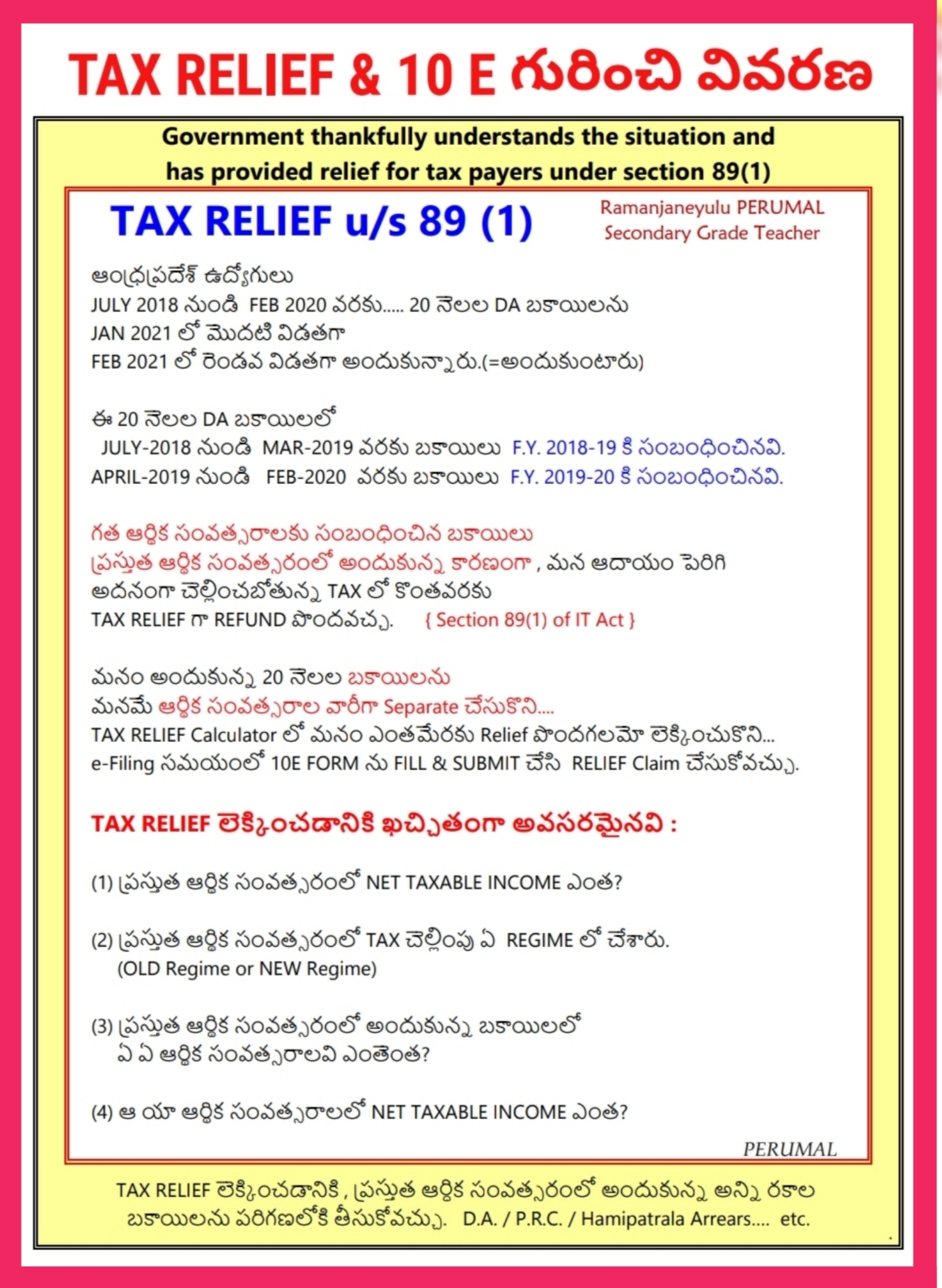

TAX RELIEF U s 89 1 Explination By Ramanjaneyulu Perumal MANNAMweb

Revised Tax Rebate Under Sec 87A After Budget 2019 With Automated

Tax Deduction On Employee Salary Arrears U S 89 With Calculation

Tax Deduction On Employee Salary Arrears U S 89 With Calculation

2 Relief U s 89 Income Tax Bcom Mcom Nta Net Jrf YouTube

TAX RELIEF U S 89 1 APEdu

DOWNLOAD 89 1 ARREARS RELIEF CALCULATOR F Y 2021 22 And A Y 2022 23

Tax Rebate U S 89 - Web Amount in Rs Salary received in arrear Rule 21A 2 Enter details Gratuity received for past services extending a period of not less than 5 years but less than 15 years Rule