Tax Rebate Under 80c For Senior Citizen Web 26 mars 2021 nbsp 0183 32 Il est r 233 serv 233 aux personnes 226 g 233 es de plus de 65 ans au 31 d 233 cembre 2021 domicili 233 es en France L abattement d imp 244 t pour les personnes 226 g 233 es est surtout

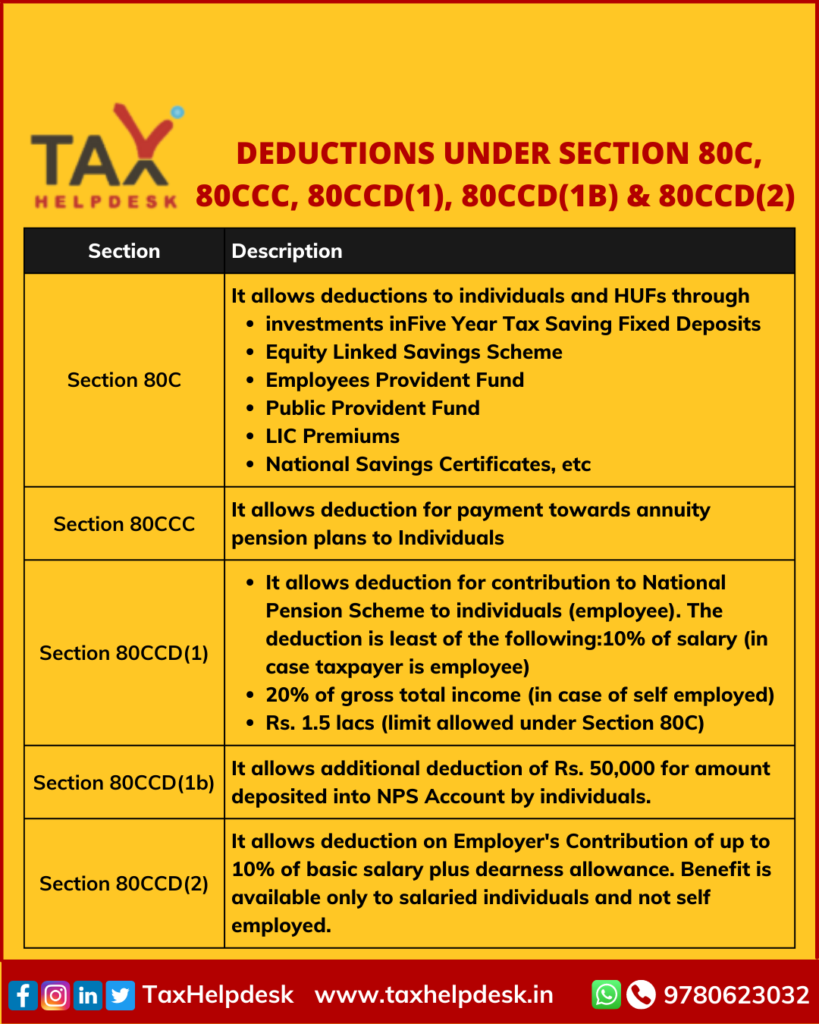

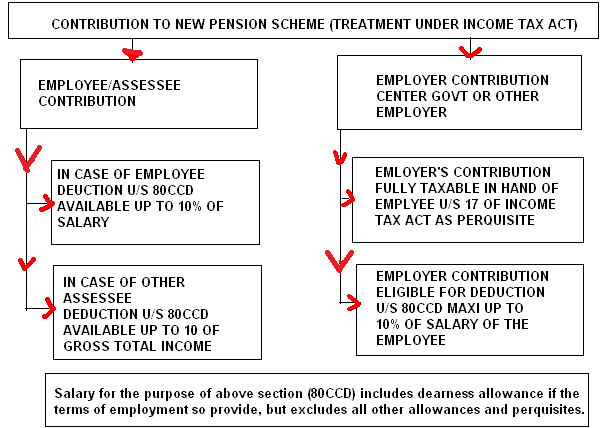

Web Senior and Super Senior Citizens can opt for the Old Tax Regime or the New Tax Regime with lower rate of taxation u s 115 BAC of the Income Tax Act The taxpayer opting for Web 13 juin 2019 nbsp 0183 32 Section 80C is the most popular income tax deduction for tax saving 80C deduction limit for current 2022 23 AY 2023 24 is Rs 1 50 000 For claiming the tax

Tax Rebate Under 80c For Senior Citizen

Tax Rebate Under 80c For Senior Citizen

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/DEDUCTIONS-UNDER-SECTION-80C-80CCC-80CCD1-80CCD1b-80CCD2--819x1024.png

Section 80C Deduction Under Section 80C In India Paisabazaar

https://www.paisabazaar.com/wp-content/uploads/2017/04/Section80C-infographic-Content.jpg

Deduction Under Section 80C A Complete List BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2016/07/Section-80C-Options.jpg

Web 3 janv 2023 nbsp 0183 32 An individual can claim a deduction up to INR 1 5 lakh of the total income under Section 80C Rebate under section 80C is only available for HUF and individuals Web 28 d 233 c 2022 nbsp 0183 32 For senior citizens of 60 to under 80 years of age the standard exemption ceiling is set at Rs 3 lakhs while super senior citizens above 80 are exempt up to Rs 5

Web Les seniors qui travaillent devront s acquitter d une nouvelle taxe institu 233 e par l accord sur l assurance ch 244 mage du 22 mars dernier Il s agit d une contribution sp 233 cifique de Web 22 d 233 c 2022 nbsp 0183 32 Currently the Senior Citizen Savings Scheme scheme interest rate is 8 2 Investments in this scheme are eligible for tax deductions under Section 80C of the

Download Tax Rebate Under 80c For Senior Citizen

More picture related to Tax Rebate Under 80c For Senior Citizen

Budget 2014 Impact On Money Taxes And Savings

http://i1.wp.com/apnaplan.com/wp-content/uploads/2014/07/Investments-to-Save-Tax-under-Section-80C.png?fit=757%2C475

Income Tax Deductions Available For The Financial Year 2017 18

http://wealthtechspeaks.in/wp-content/uploads/2017/04/Tax-Deduction-Under-Section-80C.png

Tax Deduction Under Section 80C 80CCC 80CCD How To Earn Money Through

https://enskyar.com/img/Blogs/Tax-deduction-under-section-80C-80CCC-and-80CCD.jpg

Web Under Section 80C there is an overall ceiling of Rs 1 5 lakh on the amount of income tax saving benefits you can enjoy As mentioned above the provisions cover a number of Web 12 juil 2023 nbsp 0183 32 No section 80TTB is not a part of the deduction under section 80C Section 80TTB covers deduction against interest on deposits for senior citizens Section 80C

Web 12 juil 2023 nbsp 0183 32 Yes FD interest up to Rs 50 000 is tax exempt for a senior citizen under section 80TTB However an individual taxpayer can claim a deduction under section Web Senior citizens over 60 years of age can invest in the Senior Citizens Savings Scheme and save tax by claiming deduction up to Rs 1 50 000 under Section 80C This scheme

How To Claim Health Insurance Under Section 80D From 2018 19

https://myinvestmentideas.com/wp-content/uploads/2018/04/80C-Deductions-list-min.jpg

Section 80C Income Tax Deduction Under Section 80C Tax2win

https://blog.tax2win.in/wp-content/uploads/2019/03/80C-Deduction-in-respect-of-LIP-PF-PPF-NSC-etc-1024x819.jpg

https://filien-online.com/aides-financieres/abattement-impot-personnes...

Web 26 mars 2021 nbsp 0183 32 Il est r 233 serv 233 aux personnes 226 g 233 es de plus de 65 ans au 31 d 233 cembre 2021 domicili 233 es en France L abattement d imp 244 t pour les personnes 226 g 233 es est surtout

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-2

Web Senior and Super Senior Citizens can opt for the Old Tax Regime or the New Tax Regime with lower rate of taxation u s 115 BAC of the Income Tax Act The taxpayer opting for

Section 80D Deductions For Medical Health Insurance For Fy 2021 22

How To Claim Health Insurance Under Section 80D From 2018 19

Investing Can Be Interesting Financial Awareness Deduction Under

Investing Can Be Interesting Financial Awareness Deduction Under

Senior Citizens Savings Scheme 2021 Post Office Savings Scheme

Senior Citizens Savings Scheme 2021 Post Office Savings Scheme

Senior Citizens Savings Scheme 2021 Post Office Savings Scheme

Saving tax Under Section 80C The Administration Wishes To Encourage

HOW TO SAVE TAX UNDER SECTION 80 C WHAT COMES UNDER SECTION 80C FULL

DEDUCTION UNDER SECTION 80C TO 80U PDF

Tax Rebate Under 80c For Senior Citizen - Web 3 janv 2023 nbsp 0183 32 An individual can claim a deduction up to INR 1 5 lakh of the total income under Section 80C Rebate under section 80C is only available for HUF and individuals