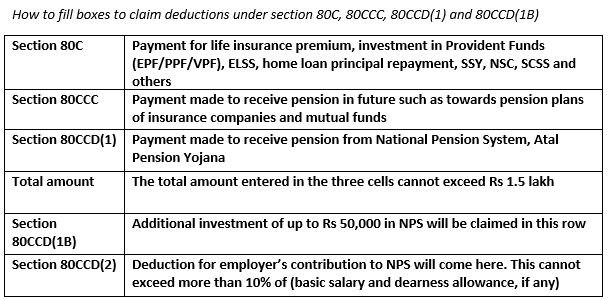

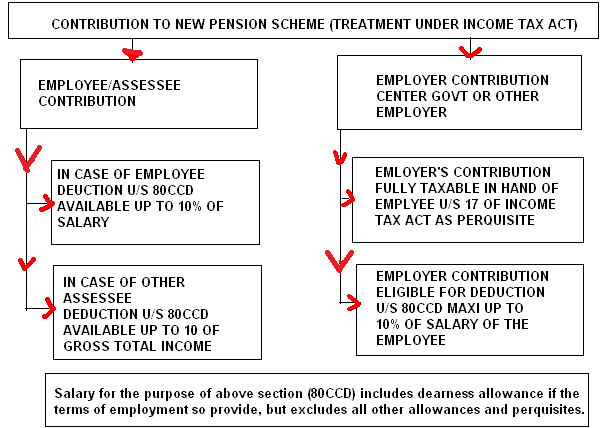

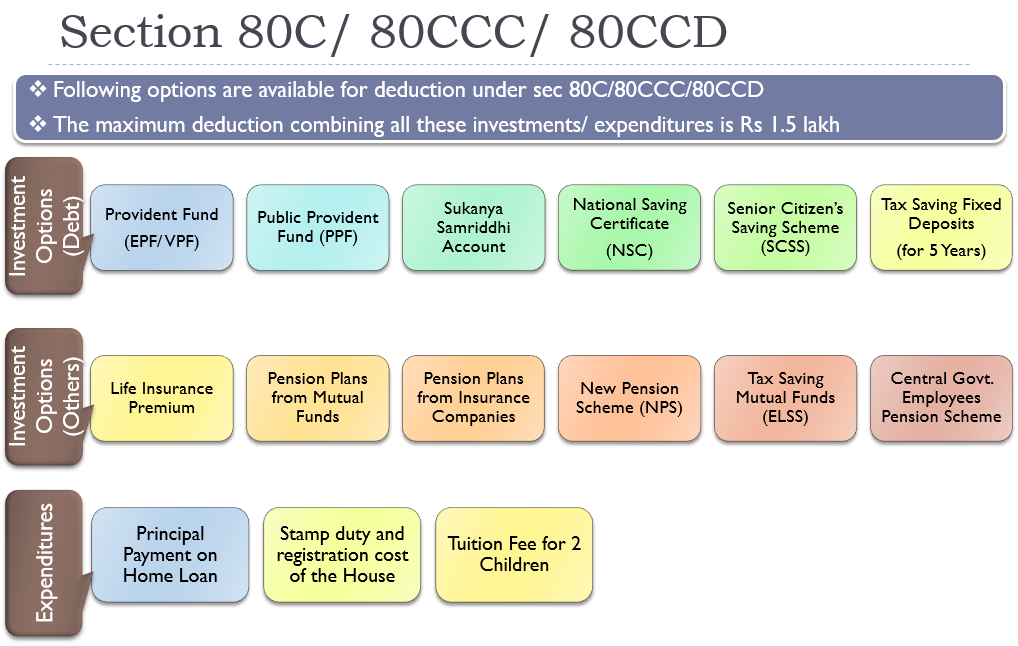

Tax Rebate Under 80c Web 21 juil 2020 nbsp 0183 32 Deduction under Section 80C Section 80CCC Section 80CCD Maximum amount of Income Tax deduction Rs 1 50 000 Rs 50 000 Deduction under Section 80C In order to calculate total income

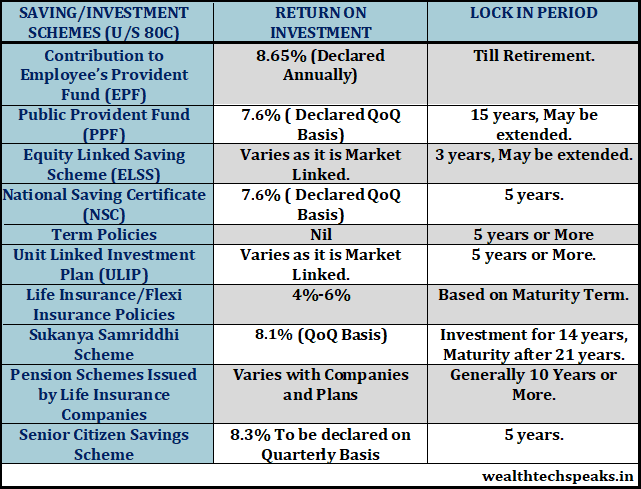

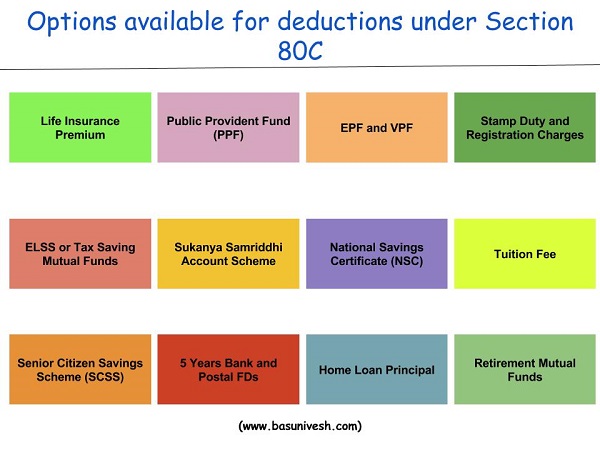

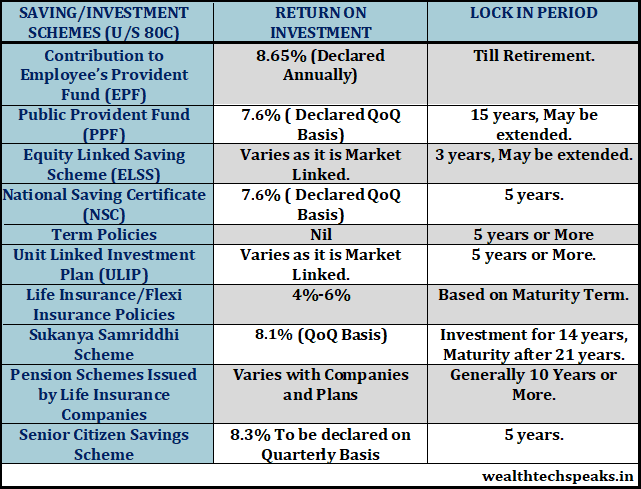

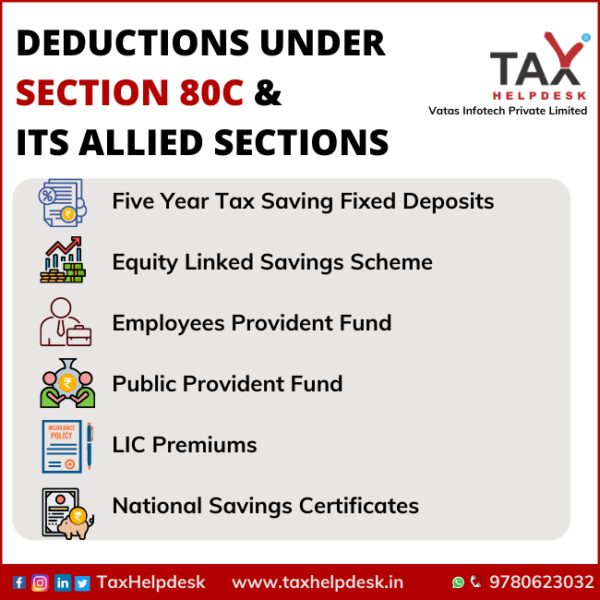

Web 3 janv 2023 nbsp 0183 32 Section 80C An individual can claim a deduction up to INR 1 5 lakh of the total income under Section 80C Rebate under section Web 28 mars 2019 nbsp 0183 32 Section 80C This section provides a deduction of up to Rs 1 5 lakh for investments in specified instruments such as EPF PPF NSC ELSS tax saving fixed

Tax Rebate Under 80c

Tax Rebate Under 80c

https://wealthtechspeaks.in/wp-content/uploads/2017/04/Tax-Deduction-Under-Section-80C.png

Tax Deduction Under Section 80C 80CCC 80CCD How To Earn Money Through

https://enskyar.com/img/Blogs/Tax-deduction-under-section-80C-80CCC-and-80CCD.jpg

Deduction Under Section 80C Its Allied Sections

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/DEDUCTIONS-UNDER-SECTION-80C-80CCC-80CCD1-80CCD1b-80CCD2--819x1024.png

Web Tax Saving Calculator Calculate Deductions under 80C Lower your tax liability through tax exemptions Section 80C allows you to be eligible for tax deduction up to Rs 1 5 lakh Web 4 janv 2020 nbsp 0183 32 04 Jan 2020 2 491 305 Views 839 comments Articles deals with deduction under Section 80C of the Income Tax Act and explains who is eligible for deduction Eligible Investments Limit for deduction who

Web 11 sept 2023 nbsp 0183 32 Section 80C of the Income Tax Act allows for certain expenditures and investments to be exempt from income tax If you plan your investments across different Web 21 sept 2022 nbsp 0183 32 The Income Tax Act of 1961 allows a maximum deduction of 1 50 000 per annum under Section 80C which includes other tax deductibles like insurance premiums interest on education or housing

Download Tax Rebate Under 80c

More picture related to Tax Rebate Under 80c

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

How To Claim Health Insurance Under Section 80D From 2018 19

https://myinvestmentideas.com/wp-content/uploads/2018/04/80C-Deductions-list-min.jpg

Complete Guide On Income Tax Deduction U s 80C 80CCD 80CCC 80CCG

https://financialcontrol.in/wp-content/uploads/2018/08/Deduction-under-section-80C.jpg

Web Tax benefit of 54 600 46 800 under Section 80C amp 7 800 under Section 80D is calculated at the highest tax slab rate of 31 2 including Cess excluding surcharge on Web 3 ao 251 t 2023 nbsp 0183 32 Section 80C is the most popular income tax deduction for tax saving 80C deduction limit for current 2022 23 AY 2023 24 is Rs 1 50 000 For claiming the tax

Web 27 janv 2017 nbsp 0183 32 Deduction under section 80C is not only available for investments but also for specified expenditures made by the taxpayer However in order to claim the Web Deduction under Section 80C is capped at Rs 1 5 lakh By doing so you can reduce your income tax liability depending on the tax bracket that you fall under Whatever the tax

Section 80C Income Tax Deduction Under Section 80C Tax2win

https://blog.tax2win.in/wp-content/uploads/2019/03/80C-Deduction-in-respect-of-LIP-PF-PPF-NSC-etc-1024x819.jpg

Deduction Under Section 80C A Complete List BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2016/07/Section-80C-Options.jpg

https://taxguru.in/income-tax/section-80c-80c…

Web 21 juil 2020 nbsp 0183 32 Deduction under Section 80C Section 80CCC Section 80CCD Maximum amount of Income Tax deduction Rs 1 50 000 Rs 50 000 Deduction under Section 80C In order to calculate total income

https://www.fincash.com/l/tax/tax-rebate

Web 3 janv 2023 nbsp 0183 32 Section 80C An individual can claim a deduction up to INR 1 5 lakh of the total income under Section 80C Rebate under section

Budget 2014 Impact On Money Taxes And Savings

Section 80C Income Tax Deduction Under Section 80C Tax2win

Deduction Under Section 80C Its Allied Sections

Investing Can Be Interesting Financial Awareness Deduction Under

Income Tax Deductions Under Section 80

HOW TO SAVE TAX UNDER SECTION 80 C WHAT COMES UNDER SECTION 80C FULL

HOW TO SAVE TAX UNDER SECTION 80 C WHAT COMES UNDER SECTION 80C FULL

Download Complete Tax Planning Guide In PDF For Salaried And Professionals

Tax Saving Under Section 80C English YouTube

Treatment Of PF In Section 80C Chapter 5 Income From Salary Deduc

Tax Rebate Under 80c - Web Section 80CCC Income Tax Deductions on Pension Fund Contributions Section 80CCC of the Income Tax Act of 1961 allows for annual deductions of up to Rs 1 5 lakh for