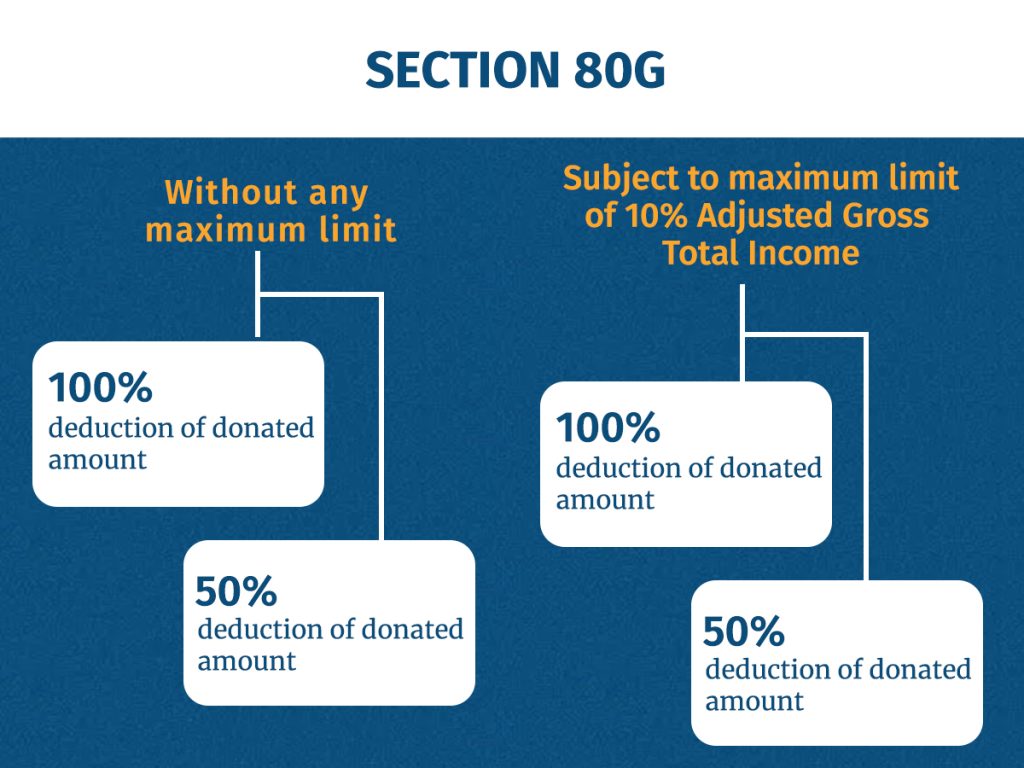

Tax Rebate Under 80g Web Section 80G of the Income Tax Act primarily deals with donations made towards charity with an aim to provide tax incentives to individuals indulging in philanthropic activities

Web 11 juin 2019 nbsp 0183 32 Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals Web 12 avr 2023 nbsp 0183 32 Section 80G of the Income Tax Act 1961 allows taxpayers to save tax by donating money to eligible charitable institutions By donating to eligible institutions and organisations taxpayers can claim deductions

Tax Rebate Under 80g

Tax Rebate Under 80g

https://www.careindia.org/wp-content/uploads/2022/05/Secton80g-1024x768.jpg

PPT Factual Statements About 80G Registration PowerPoint Presentation

https://image6.slideserve.com/11601545/tax-bene-ts-under-section-80g-n.jpg

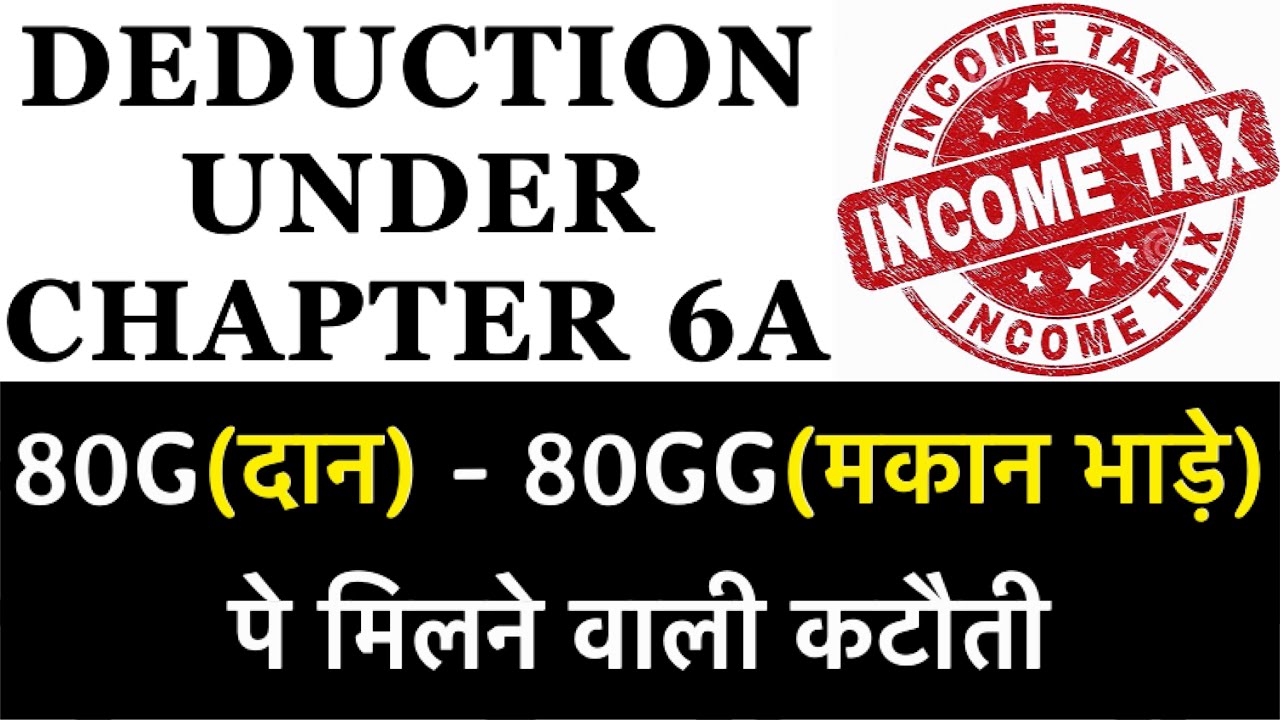

Deduction Under Chapter 6A Of Income Tax Act Section 80G Donation

https://i.ytimg.com/vi/RGGSOvKOk_U/maxresdefault.jpg

Web 10 janv 2019 nbsp 0183 32 Here is how you do it 1 Download and fill in Form 16 A from the income tax department website 2 Enter your name PAN Web 28 juin 2018 nbsp 0183 32 1 Deduction U s 80G is Allowable to all kind of Assessee 2 Deduction U s 80G on Donation to Foreign Trust 3 Deduction U s 80G on Donation to Political Parties 4 Only donation made to prescribed funds

Web 9 f 233 vr 2023 nbsp 0183 32 Last updated on February 9th 2023 Section 80G of income tax act allows tax deductions on donations made to certain organizations and relief funds This deduction encourages taxpayers to donate and Web 7 sept 2021 nbsp 0183 32 Under Section 80G a deduction of 50 per cent or 100 per cent of the amount contributed can be availed as a deduction Note that depending on the gross total

Download Tax Rebate Under 80g

More picture related to Tax Rebate Under 80g

Income Tax Rebate Under Section 80 G Issued By Income Tax Department

https://cppunjab.org/wp-content/uploads/2023/05/AAEAC9089NF20231_signed-1_page-0001-724x1024.jpg

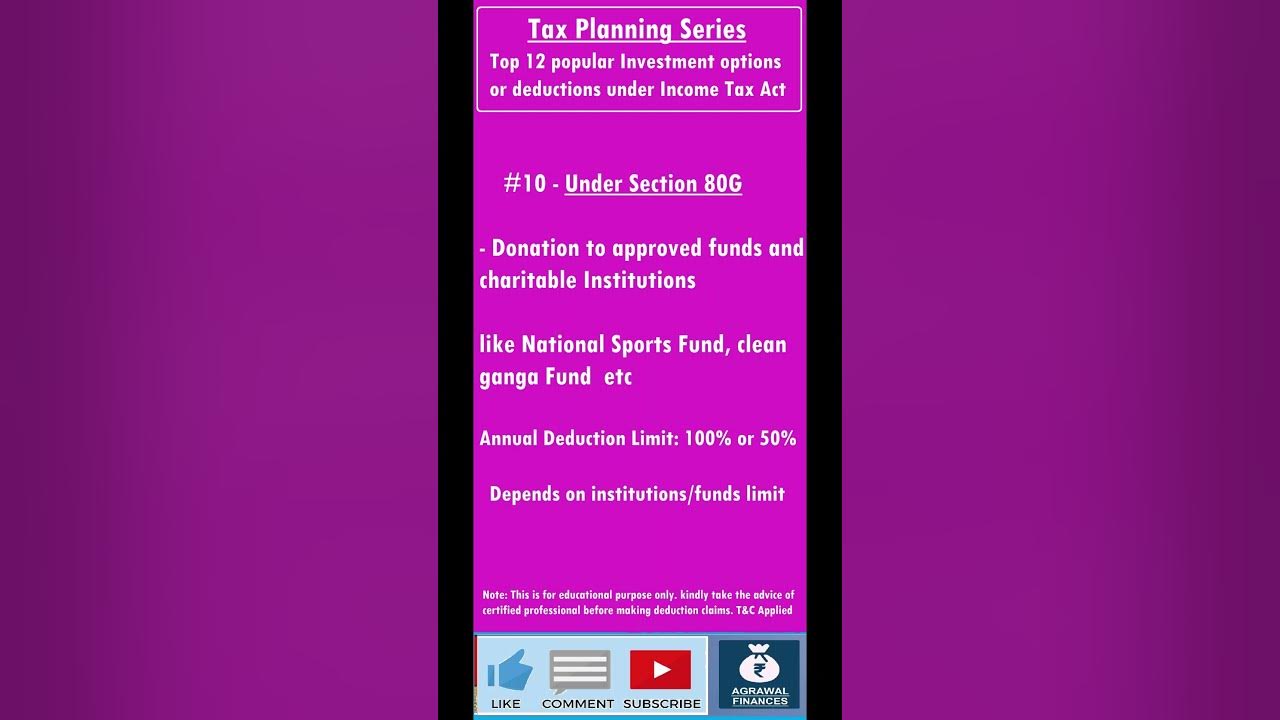

10 Section 80G SAVE MONEY Claim deduction 100 FULL AMOUNT REBATE

https://i.ytimg.com/vi/4IIJJwZhwZ4/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYfyATKHkwDw==&rs=AOn4CLDs0U9X0idomlEmdivpVGal3fezFg

ITR Filing How To Claim Tax Deduction On Donations Under Section 80G

https://mintgenie.livemint.com/_next/image?url=https:%2F%2Fimages.livemint.com%2Fimg%2F2023%2F06%2F13%2F1260x709%2Fde5944be-2dbc-11ed-b999-718f354f2123_1664332773224_1664332773224_1686653089745.jpg&w=3840&q=100

Web Maximum Limit for Deduction under Section 80G In some cases there is no maximum limit for the deduction which can be claimed for donations made under section 80G Web Section 80G of the Income Tax Act allows the assessee to claim deductions from their taxable income for the donation they make to charitable entities that are approved by the

Web 21 juil 2020 nbsp 0183 32 Section 80G is basically a donation tax exemption which means that you can do some good work by donating money and you will be able to save on tax at the same time Under the Income Tax Act you Web 30 janv 2023 nbsp 0183 32 All the donations made to the PM CARES Fund will be eligible for 100 tax exemption under Section 80G of the Income Tax Act 1961 It should be noted that no

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Certificate Of Order Under Section 80G Income Tax Act 1961 Income Tax

https://i.pinimg.com/originals/65/ab/c1/65abc11f10c32f6c14b7da8b691c1ea9.jpg

https://www.bankbazaar.com/tax/deduction-under-section-80g.html

Web Section 80G of the Income Tax Act primarily deals with donations made towards charity with an aim to provide tax incentives to individuals indulging in philanthropic activities

https://tax2win.in/guide/80g-deduction-donations-to-charitable-institutions

Web 11 juin 2019 nbsp 0183 32 Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals

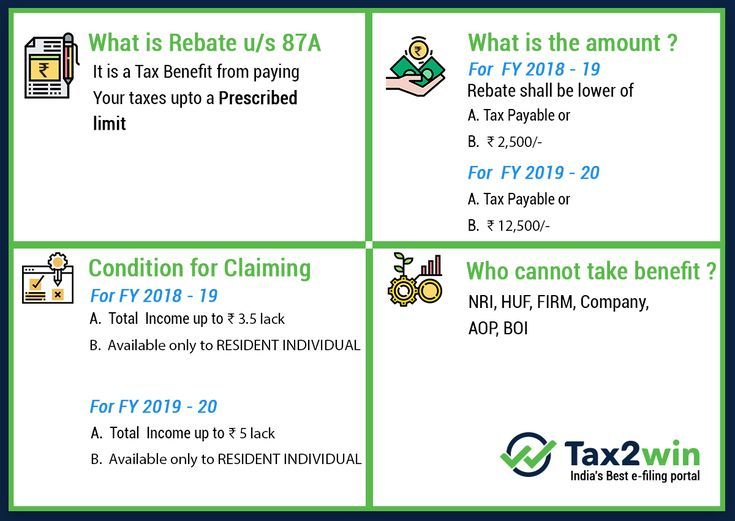

Section 87A Tax Rebate Under Section 87A Rebates Financial

DEDUCTION UNDER SECTION 80C TO 80U PDF

PDF MODULE 2020 PF ESI Reports In Excel Sheet Live Payroll

How To Save Tax Under 80G Donate Now For Tax Exemption ActionAid India

Gst User Id And Password Reset Letter Format Letter To Bank For IPIN

Muth Encourages Eligible Residents To Apply For Extended Property Tax

Muth Encourages Eligible Residents To Apply For Extended Property Tax

Scam Involving 150 Council Tax Rebate Doing The Rounds In Cornwall

Illinois Tax Rebate Tracker Rebate2022

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

Tax Rebate Under 80g - Web 9 mars 2022 nbsp 0183 32 Section 80G of the Income Tax Act IT Act allows you to claim a deduction on donations to specified funds and institutions This reduces your overall tax liability