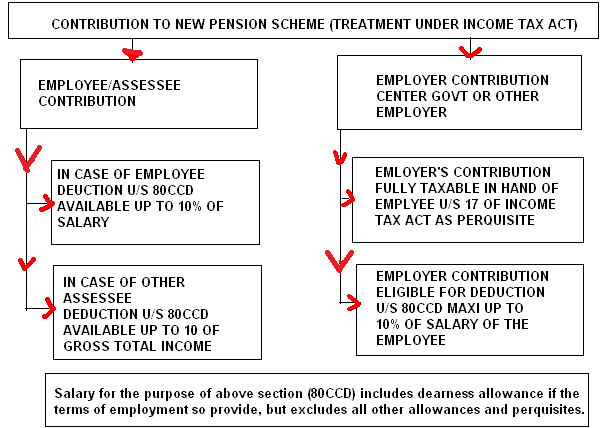

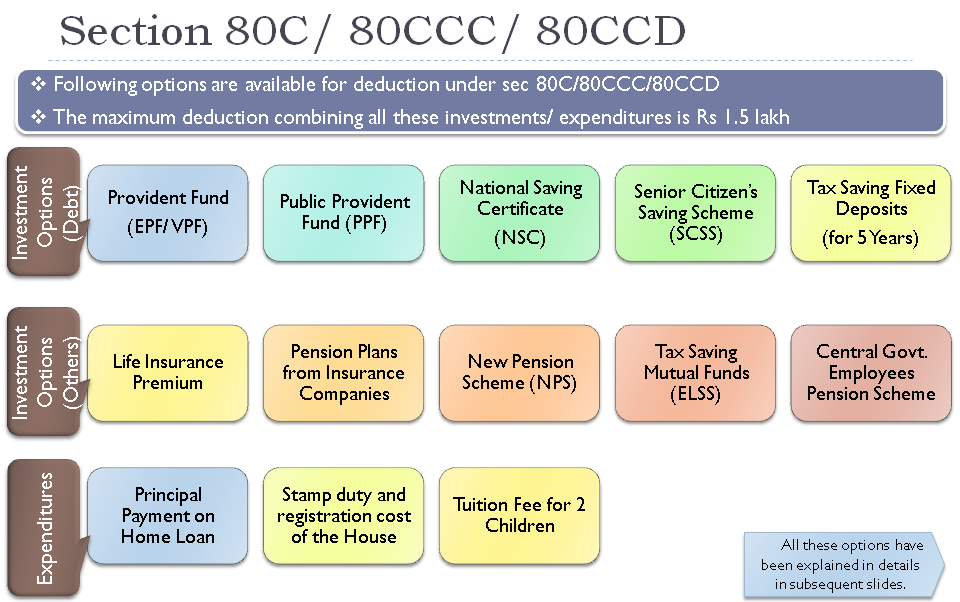

Tax Rebate Under Section 80cce Web Deduction limit under sections 80C 80CCC amp 80CCD Amended and updated notes on section 80CCE of Income Tax Act 1961 as amended by the Finance Act 2022 and

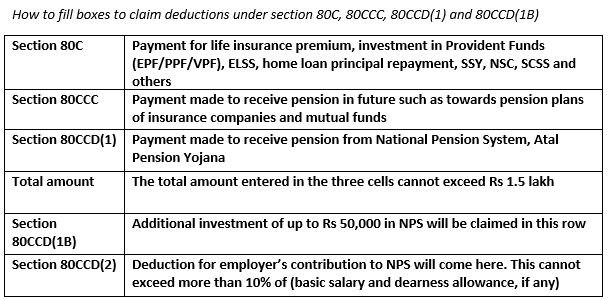

Web 16 janv 2013 nbsp 0183 32 Section 80CCE Limit of deduction under section 80C 80CCC and 80CCD There are other tax saving options like Medical Insurance and Health Checkups Web 26 f 233 vr 2021 nbsp 0183 32 Synopsis If you have exhausted the Rs 1 5 lakh limit under Section 80C then additional tax can be saved by investing Rs 50 000 in NPS This deduction claimed will be over and above Section 80C

Tax Rebate Under Section 80cce

Tax Rebate Under Section 80cce

https://enskyar.com/img/Blogs/Tax-deduction-under-section-80C-80CCC-and-80CCD.jpg

Income Tax Rebate Under Section 80 G Issued By Income Tax Department

http://cppunjab.org/wp-content/uploads/2023/05/AAEAC9089NF20231_signed-1_page-0001-724x1024.jpg

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Web 2 juil 2021 nbsp 0183 32 Section 80CCE permits individuals to deduct up to INR 1 5 lakh from their total gross income before calculating tax payable if this INR 1 5 lakh is perfused in Web 29 juin 2018 nbsp 0183 32 Please note that Limit of deduction Under section 80CCC is enhanced to Rs 1 50 from One Lakh with effect from assessment year 2016 17 and for subsequent assessment years Limit of deduction

Web 19 oct 2012 nbsp 0183 32 Tax Rebate to your Pension Contribution The taxman will give following tax relief under Sections 80C 80CCC and 80CCD to your pension contribution The limit Web 3 mars 2023 nbsp 0183 32 Section 80E Tax Deductions for Interest on Education Loan Section 80E allows a deduction for interest paid on repayment of education loans taken for higher education The deduction u s 80E is not

Download Tax Rebate Under Section 80cce

More picture related to Tax Rebate Under Section 80cce

Investing Can Be Interesting Financial Awareness Deduction Under

http://2.bp.blogspot.com/-I44oM_RBOng/T6L4-Z9ZHWI/AAAAAAAABYU/EgA-9BJYsgM/s1600/Screenshot_1.png

![]()

Section 80C Deduction Under Section 80C In India Paisabazaar

https://cdn.shortpixel.ai/client/q_lossless,ret_img,w_800/https://www.paisabazaar.com/wp-content/uploads/2017/04/Section80C-infographic-Content.jpg

Income Tax Deductions Available For The Financial Year 2017 18

http://wealthtechspeaks.in/wp-content/uploads/2017/04/Tax-Deduction-Under-Section-80C.png

Web 6 f 233 vr 2020 nbsp 0183 32 Enfin le montant total du CITE est maintenant plafonn 233 224 2 400 c 233 libataire ou 4 800 couple plus 120 par personne 224 charge pour toutes vos d 233 penses Web 13 janv 2020 nbsp 0183 32 L article 15 de la loi de finances pour 2020 a prorog 233 et am 233 nag 233 le CITE cr 233 dit d imp 244 t transition 233 nerg 233 tique pour l ann 233 e 2020 Elle conditionne notamment

Web 17 mars 2023 nbsp 0183 32 The maximum deduction that taxpayers can claim under Section 80CCE is Rs 1 5 lakhs However it is important to note that the deduction limit is not exclusive to Section 80CCE but also includes other Web 23 ao 251 t 2021 nbsp 0183 32 Section 80CCE of Income Tax Act Limit on deductions under sections 80C 80CCC and 80CCD The aggregate amount of deductions under section 80C

Investing Can Be Interesting Financial Awareness Deduction Under

http://1.bp.blogspot.com/-jCZvm6QIpBA/T0feIJKL1ZI/AAAAAAAAA5Y/iylKs2iibKk/s1600/80C..jpg

Deductions Under Section 80 Complete Guide Download Excel Sheet

https://financialcontrol.in/wp-content/uploads/2018/06/section-80C.jpg

https://www.aubsp.com/section-80cce-deduction-limit-80c-80ccc-80ccd

Web Deduction limit under sections 80C 80CCC amp 80CCD Amended and updated notes on section 80CCE of Income Tax Act 1961 as amended by the Finance Act 2022 and

https://bemoneyaware.com/tax-saving-options-80c-80d

Web 16 janv 2013 nbsp 0183 32 Section 80CCE Limit of deduction under section 80C 80CCC and 80CCD There are other tax saving options like Medical Insurance and Health Checkups

Income Tax Rebate Under Section 80 G Issued By Income Tax Department

Investing Can Be Interesting Financial Awareness Deduction Under

Deduction Under Section 80C 80CCC 80CCD 1 And 80CCE Under Chapter VI

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

HOW TO SAVE TAX UNDER SECTION 80 C WHAT COMES UNDER SECTION 80C FULL

Saving Income Tax By Using Income Tax Act Section 80 Deductions

Saving Income Tax By Using Income Tax Act Section 80 Deductions

Budget 2014 Impact On Money Taxes And Savings

CHAPTER 11 Tax Deduction To Be Made In Computing Total Income

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Tax Rebate Under Section 80cce - Web 19 oct 2012 nbsp 0183 32 Tax Rebate to your Pension Contribution The taxman will give following tax relief under Sections 80C 80CCC and 80CCD to your pension contribution The limit