Tax Rebate Under Section 80dd Web Deduction Under Section 80DD Assessment Year Whether handicapped dependent is claiming deduction under section 80U Yes No Status Residential Status Please

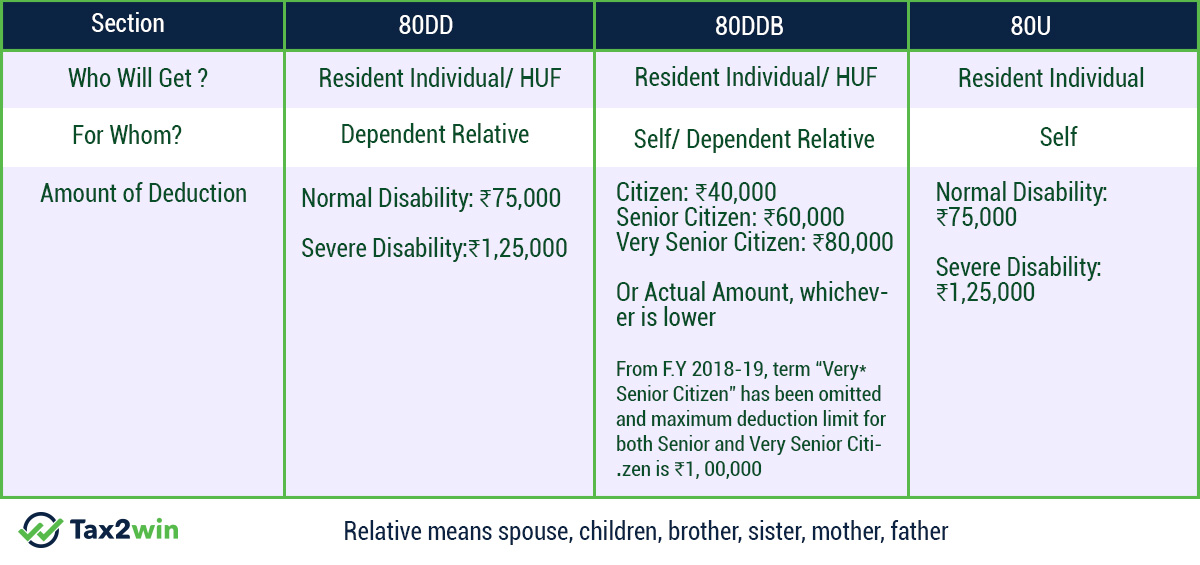

Web 22 sept 2019 nbsp 0183 32 As per section 80DD the assessee is eligible to claim a deduction of INR 75 000 from his gross total income However in case Web 20 juil 2019 nbsp 0183 32 Section 80DD is the deduction available to the resident individual or HUF for the medical treatment of a disabled dependent The

Tax Rebate Under Section 80dd

Tax Rebate Under Section 80dd

https://blog.tax2win.in/wp-content/uploads/2018/07/80DD-80DDB-80U.jpg

6 Tax Saving Tips And Tricks For Salaried Employees RTDS Blog

https://d3lcqajn87g6dy.cloudfront.net/wp-content/uploads/2019/07/tax-deductions-under-section-80D.png

Section 80D Income Tax Deduction For Medical Insurance Preventive

https://blog.tax2win.in/wp-content/uploads/2019/03/Section-80D-Income-Tax-Deduction-For-Medical-Insurance-Preventive-Check-Up-1024x866.jpg

Web 1 f 233 vr 2022 nbsp 0183 32 quot Section 80DD of the Income Tax Act provides for a deduction for residents for maintenance of disabled dependents Relief for persons with disabled dependents is Web 13 sept 2023 nbsp 0183 32 All Indian residents can claim tax deductions under Section 80DD of the Income Tax Act 1961 on the medical treatment of their dependent and disabled family

Web Tax deduction under Section 80DD of the Income Tax Act can be claimed by individuals who are residents of India and HUFs for the medical treatment of a dependant with Web 11 juin 2018 nbsp 0183 32 If the dependent disabled has 80 or above disability the deduction amount is Rs 1 25 000 What documents are Required to Claim Deduction under Section 80DD

Download Tax Rebate Under Section 80dd

More picture related to Tax Rebate Under Section 80dd

Anything To Everything Income Tax Guide For Individuals Including

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

Income Tax Deduction Income Tax Standard Deduction 2019 2020

https://www.policybazaar.com/images/section-80d.jpg

80D Tax Deduction Under Section 80D On Medical Insurance

https://www.bajajfinservmarkets.in/content/dam/bajajfinserv/banner-website/tax-savings/section-80d.png

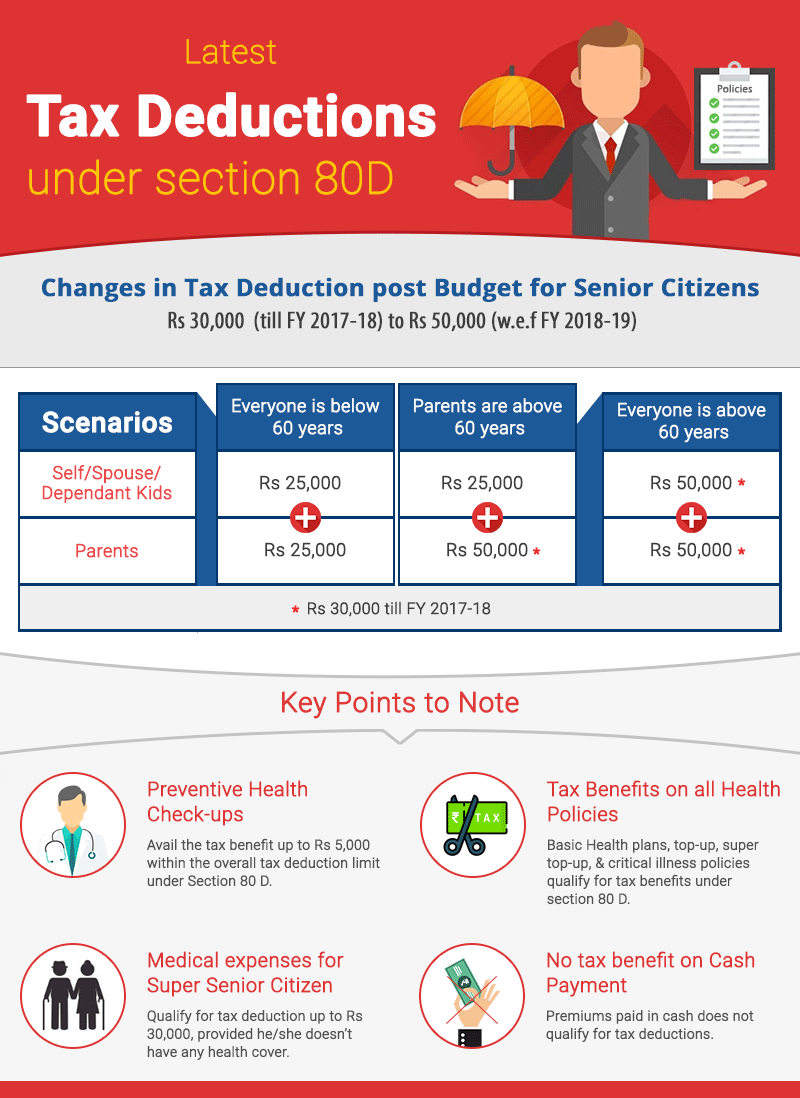

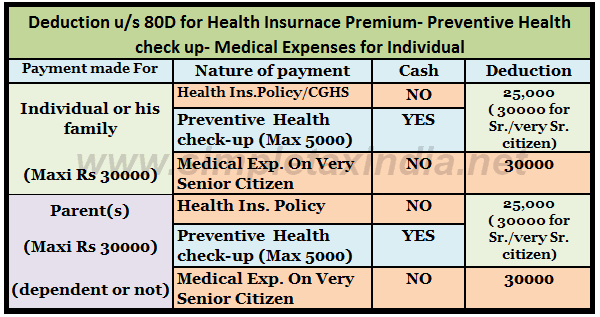

Web 27 d 233 c 2021 nbsp 0183 32 What is Deduction Under Section 80DD An assessee or a taxpayer can claim a tax deduction during the financial year against Any amount paid for medical Web 22 mars 2023 nbsp 0183 32 Certain health ailments and health conditions are covered under Section 80DDB like cancer neurological disorder AIDS etc under this senior citizens can

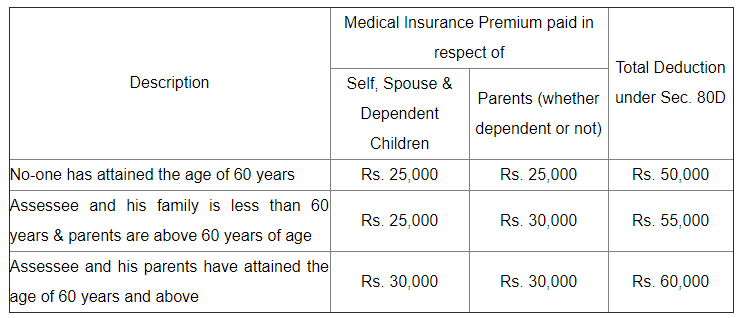

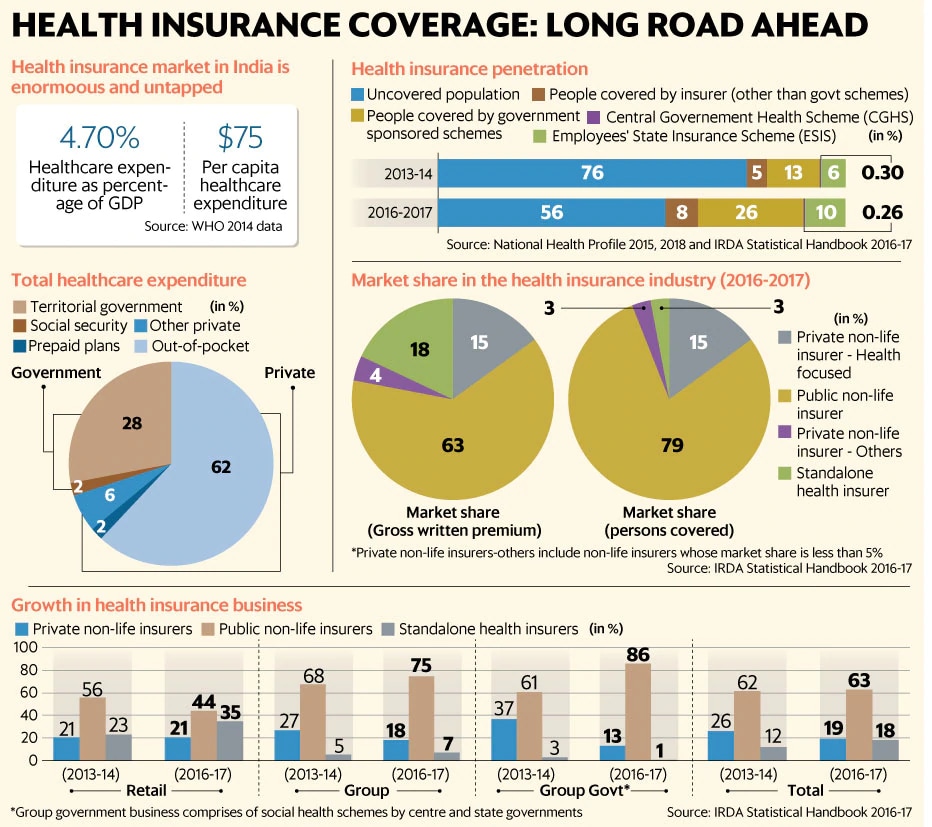

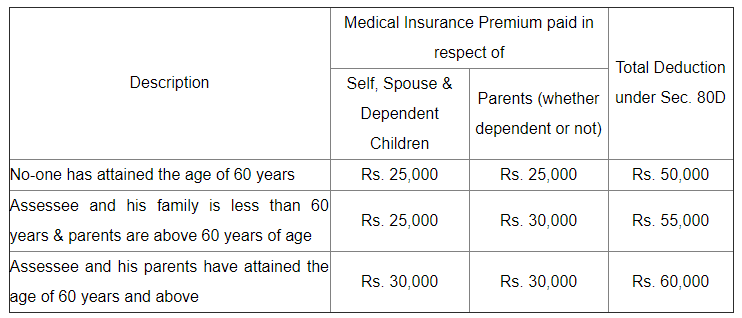

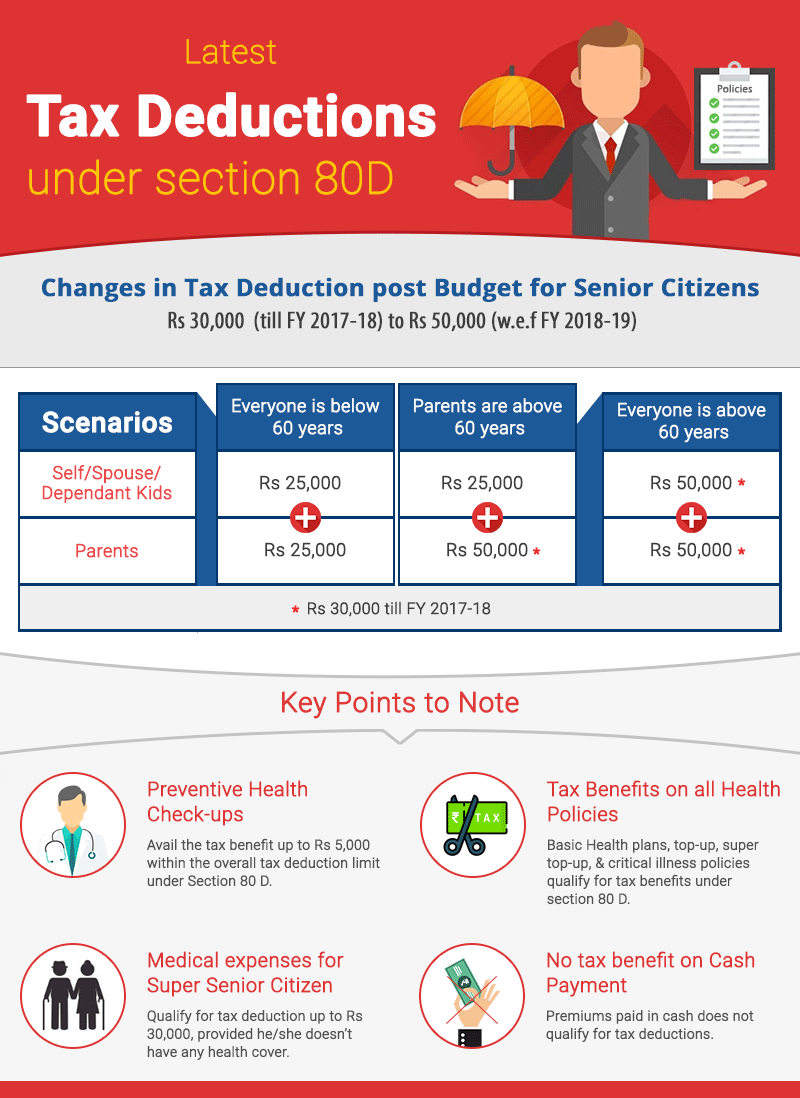

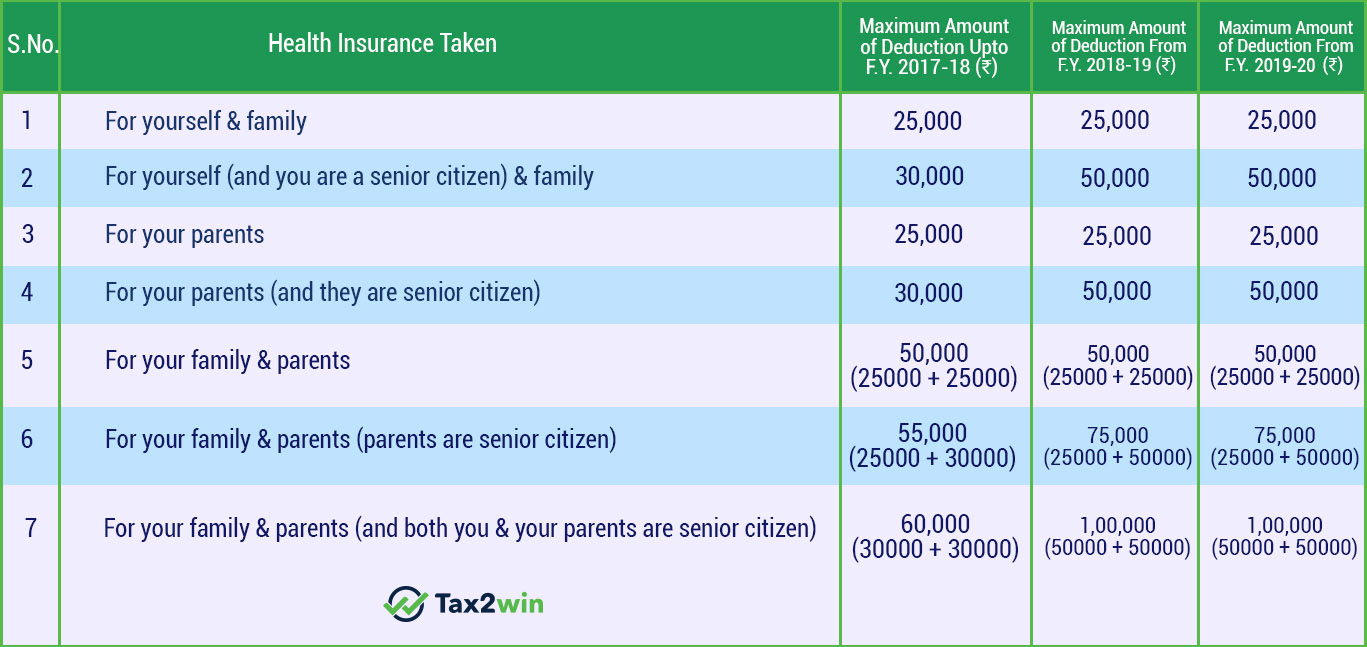

Web 26 nov 2020 nbsp 0183 32 Section 80D of the IT Act allows a deduction of up to 5 000 in respect of payment made towards preventive health check up of self spouse dependent children or parents made during the Web 9 juil 2018 nbsp 0183 32 What Expenses are eligible for deduction under Section 80DD Expenditure for the medical treatment including nursing training and rehabilitation of a disabled

New Tax Benefits Under Section 80D ComparePolicy

https://www.comparepolicy.com/blogs/wp-content/uploads/2018/02/Tax-Deduction-under-Section-80D.png

Health Insurance Tax Benefits Under Section 80D

https://www.policybazaar.com/images/IncomeTax/section-80d-income-tax-act.jpg

https://incometaxindia.gov.in/Pages/tools/deduction-under-section-80dd...

Web Deduction Under Section 80DD Assessment Year Whether handicapped dependent is claiming deduction under section 80U Yes No Status Residential Status Please

https://taxguru.in/income-tax/deduction-secti…

Web 22 sept 2019 nbsp 0183 32 As per section 80DD the assessee is eligible to claim a deduction of INR 75 000 from his gross total income However in case

Saving Income Tax By Using Income Tax Act Section 80 Deductions

New Tax Benefits Under Section 80D ComparePolicy

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Section 80D Income Tax Deduction For Medical Insurance Preventive

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

80DD FORM PDF

80DD FORM PDF

Income Tax Deductions 1 Section 80D 80DD 80DDB 80E 80G 80GG 80U 80CCD1B

Deduction From Gross Total Income Section 80C To 80U Graphical Table

How To Claim Health Insurance Under Section 80D From 2018 19

Tax Rebate Under Section 80dd - Web 10 juil 2018 nbsp 0183 32 How much amount is allowed to Ram for deduction Amount of Deduction Ram is eligible for 80DD deduction for FY 2017 18 of 75 000 if Shyam has normal