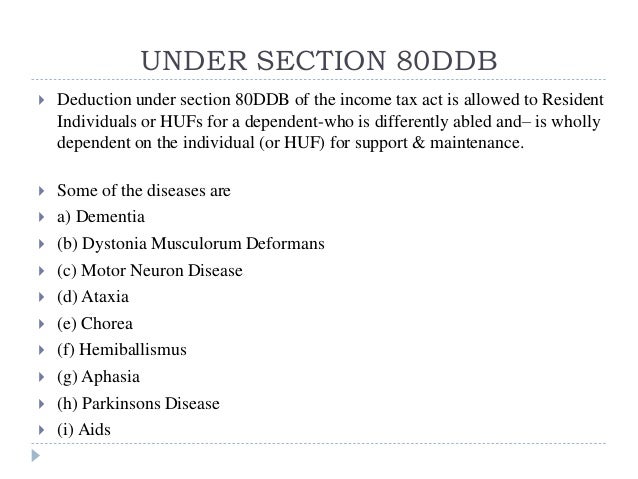

Tax Rebate Under Section 80ddb Web 17 juil 2019 nbsp 0183 32 Section 80DDB is a very important section of the Income Tax Act under which tax benefit can be claimed of Rs 1 00 000 in case of senior citizens and Rs

Web 7 janv 2022 nbsp 0183 32 Indian residents or HUFs can claim 80DDB deductions on medical expenditures for specified diseases under section 80DDB Note that the amount of Web 6 juil 2023 nbsp 0183 32 Section 80DDB provides that if an individual or a HUF has incurred medical expenses for treatment of a specified disease or ailment such expense is allowed as a deduction subject to such

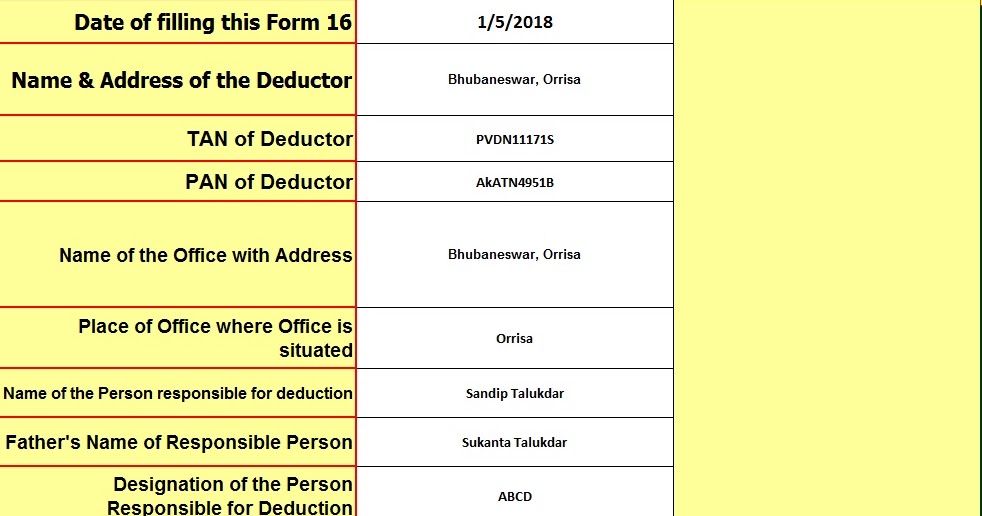

Tax Rebate Under Section 80ddb

Tax Rebate Under Section 80ddb

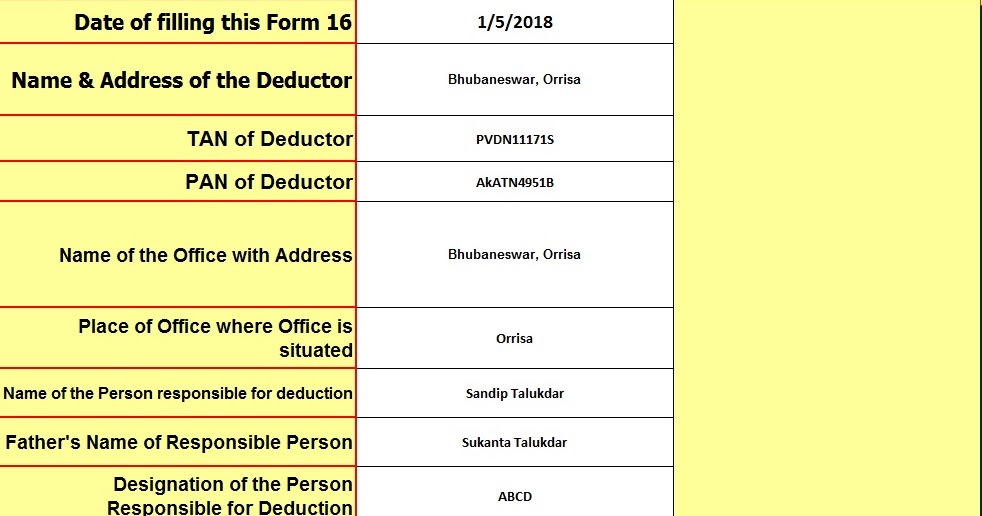

https://4.bp.blogspot.com/-XYcrpcR1NgY/WpbQAo1nC8I/AAAAAAAAGpA/4RxYIZsplHAVLds8_H1yZqFIHG2x7RlmwCLcBGAs/w1200-h630-p-k-no-nu/Master%2BForm%2B16%2BA%2526B%2BPage%2B1.jpg

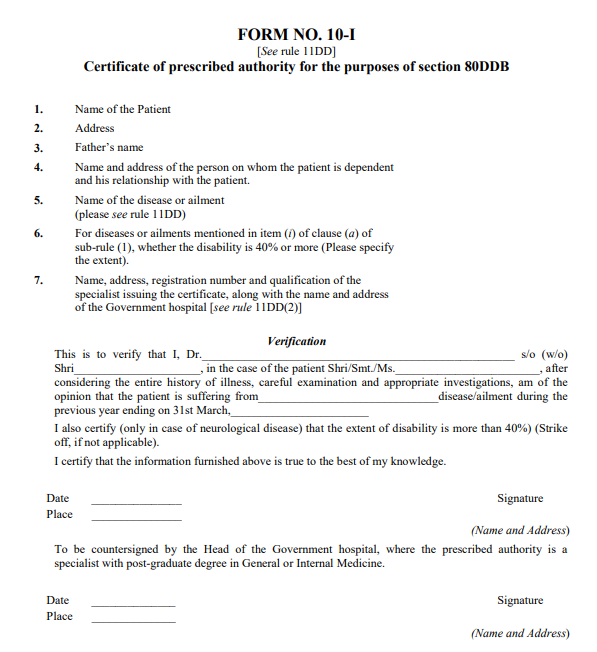

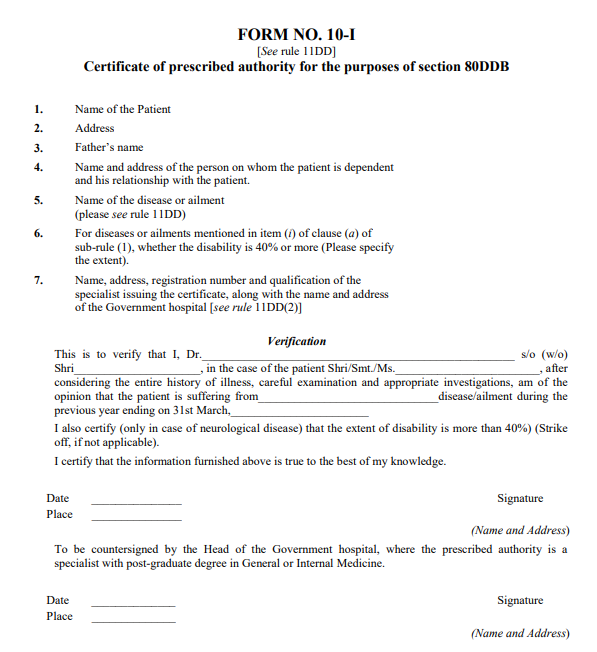

FORM 80DDB PDF

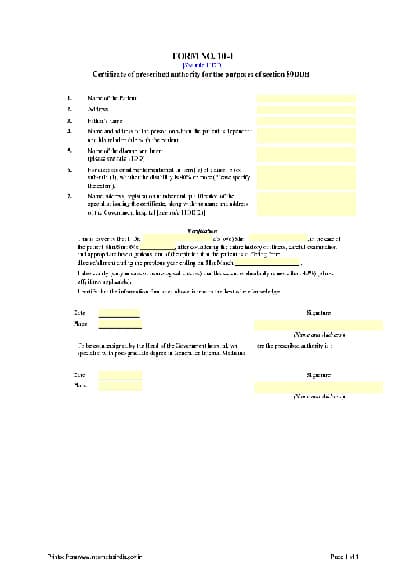

https://www.paisabazaar.com/wp-content/uploads/2017/06/Section-80DDB-Form-Format.png

![]()

Income Tax Deduction For Medical Treatment IndiaFilings

https://cdn.shortpixel.ai/client/q_glossy,ret_img,w_985/https://www.indiafilings.com/learn/wp-content/uploads/2017/10/Diseases-Eligible-for-Deduction-under-Section-80DDB.png

Web 29 juin 2018 nbsp 0183 32 Amount of deduction under section 80DDB Amount of deduction will be lower of the following a mount actually paid on Web Section 80DDB of Income Tax Act covers deductions on expenses incurred while availing medical treatment for specific ailments or disorders It states that if an individual or HUF

Web 15 mars 2019 nbsp 0183 32 Medical expenditures for certain specified diseases provide tax benefits under the Income tax Act Section 80D 80DD and 80DDB and 80U of the act provide tax benefits Here are rules you must know to Web 18 nov 2021 nbsp 0183 32 Updated on 12 Jul 2023 Section 80DDB of the Income Tax Act 1961 has gained its popularity in recent years You can claim a tax deduction against the

Download Tax Rebate Under Section 80ddb

More picture related to Tax Rebate Under Section 80ddb

Section 80DDB Tax Deduction Based On Medical Treatment Of Specified

https://www.succinctfp.com/wp-content/uploads/2020/06/80DDB-Deduction_Tax-Deduction-based-on-Medical-Treatment-of-specified-Diseases-or-Ailments.png

PDF Section 80DDB Deduction Certificate Form PDF Download In English

https://instapdf.in/wp-content/uploads/pdf-thumbnails/small/10i-pdf-270.jpg

Section 80 Deduction Deduction U s 80DD 80DDB 80U SMART TAX

https://i0.wp.com/blog.tax2win.in/wp-content/uploads/2019/03/Section-80DDB-Deductions.jpg?resize=1024%2C762&ssl=1

Web 15 sept 2020 nbsp 0183 32 23 Aug 2022 Views Method is not allowed for the requested route Taxpaying individuals who spend on medical expenses for treatment of specified Web Under Section 80DDB of the Income Tax Act 1961 taxpayers can claim deduction for medical treatment of certain specified ailments for self or dependent This type of

Web Under the Section 80DDB an individual can claim for deduction up to Rs 40 000 If an individual on behalf of whom such medical expenditure is incurred is a senior citizen Web 26 nov 2020 nbsp 0183 32 A deduction up to maximum of 75 000 will be allowed under the section The maximum deduction limit increases to 1 25 lakh in case of cases of severe disability

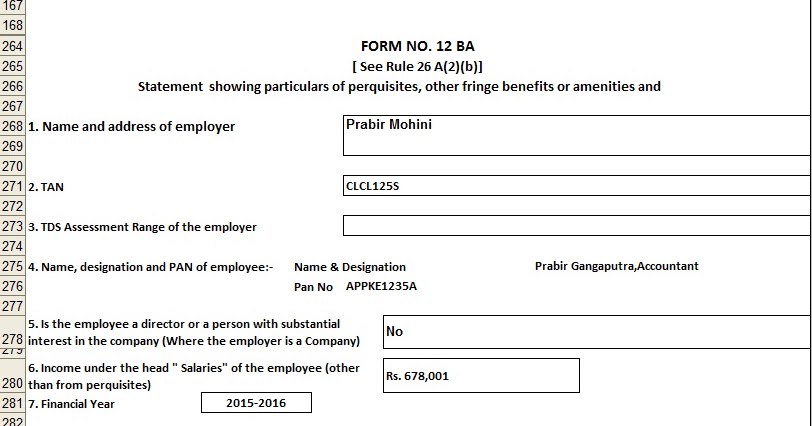

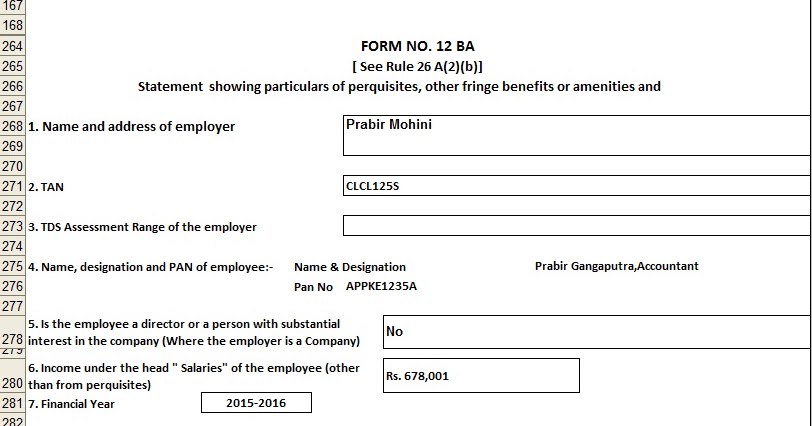

How To Claim IT Deduction Under Section 80DDB Which Is Now Becomes Easy

https://3.bp.blogspot.com/-U86ck01YIWA/Vmmg-OHP_3I/AAAAAAAAAs0/lWJ85UTccq0/w1200-h630-p-k-no-nu/12BA.jpg

Tax Planning And Deductions Under The Income Tax Act

https://image.slidesharecdn.com/taxplanning-180620091744/95/tax-planning-and-deductions-under-the-income-tax-act-7-638.jpg?cb=1529486485

https://tax2win.in/guide/section-80ddb

Web 17 juil 2019 nbsp 0183 32 Section 80DDB is a very important section of the Income Tax Act under which tax benefit can be claimed of Rs 1 00 000 in case of senior citizens and Rs

https://navi.com/blog/everything-about-section-80ddb

Web 7 janv 2022 nbsp 0183 32 Indian residents or HUFs can claim 80DDB deductions on medical expenditures for specified diseases under section 80DDB Note that the amount of

What Are Sections 80DD 80DDB And 80U All About Rupiko

How To Claim IT Deduction Under Section 80DDB Which Is Now Becomes Easy

46 INFO HOW TO GET 80DDB CERTIFICATE WITH VIDEO TUTORIAL Certificate

Health Insurance Tax Benefits Under Section 80D

Section 80D Income Tax Deduction For Medical Insurance Preventive

Saving Income Tax By Using Income Tax Act Section 80 Deductions

Saving Income Tax By Using Income Tax Act Section 80 Deductions

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

Section 80DDB Deductions For Specified Diseases And Ailments

Deduction From Gross Total Income Section 80C To 80U Graphical Table

Tax Rebate Under Section 80ddb - Web 1 f 233 vr 2022 nbsp 0183 32 quot Section 80DD of the Income Tax Act provides for a deduction for residents for maintenance of disabled dependents Relief for persons with disabled dependents is