Tax Rebate Upto 5 Lakh Web If you earn up to Rs 7 5 lakh you do not have to pay any income tax under the new income tax regime Here s the calculation Your total income Rs 7 50 000 Standard deduction

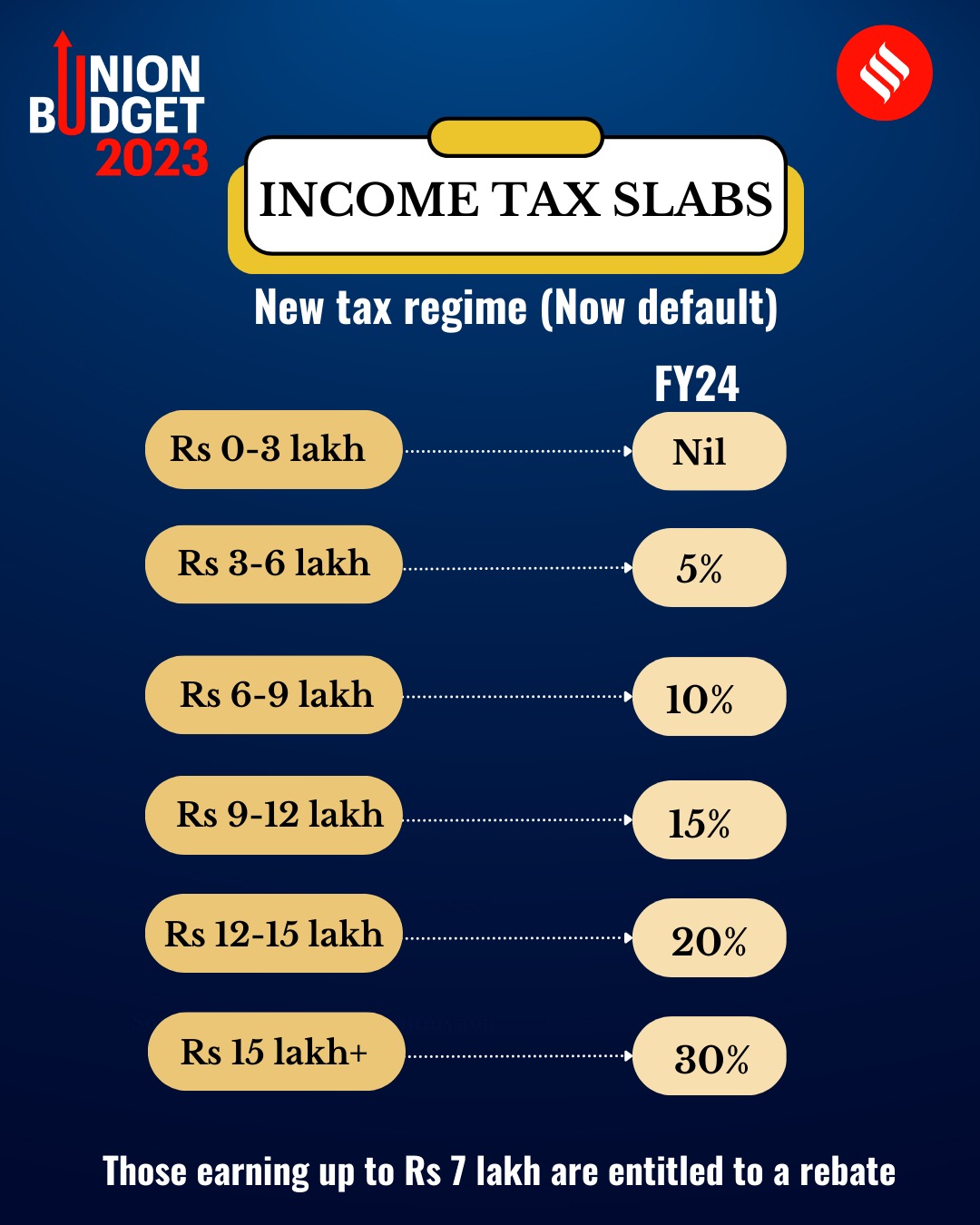

Web 28 oct 2022 nbsp 0183 32 The truth is if your income exceeds Rs 2 5 lakh you do need to pay income tax However if it doesn t exceed Rs 5 lakh this tax liability is cancelled out by a tax rebate In other words if your net taxable Web 1 f 233 vr 2023 nbsp 0183 32 In a huge relief to salaried and middle class Union Finance Minister Nirmala Sitharaman while presenting Union Budget 2023 24 in Parliament today said the income tax rebate has been extended on

Tax Rebate Upto 5 Lakh

Tax Rebate Upto 5 Lakh

https://i.ytimg.com/vi/osZhd7aceEk/maxresdefault.jpg

Upto INR 5 Lakh Income Tax Rebate For 1st time Homebuyers Check How

https://blog.saginfotech.com/wp-content/uploads/2022/01/5-lakh-income-tax-rebate-1st-time-homebuyers.jpg

A Detailed Guide On Income Tax Rebate Upto Rs 5 Lakh

https://www.righthorizons.com/wp-content/uploads/2019/03/Tax-Rebate-upto-Rs-5-lakh_-3.png

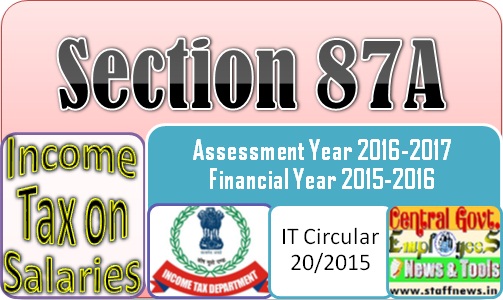

Web As per present Section 87A an individual is entitled to tax rebate upto Rs 2 500 if his total income does not exceed Rs 3 50 lakhs This rebate is available only for the individual Web 2 mai 2020 nbsp 0183 32 a Assessee must be a Resident Individual Note Please note that non resident are not eligible for tax rebate and this rebate is only available to Individual assesses

Web 2 f 233 vr 2023 nbsp 0183 32 Tax Rebate on Income upto 5 Lakh under Section 87A Similar to Tax Exemption Every budget and every successive government proposes a rebate of tax for a certain level of income At Present the Web 1 mars 2019 nbsp 0183 32 What does full tax rebate for those with taxable income of Rs 5 lakh mean Read the example below Let us assume you a person below 60 years has a taxable income of Rs 5 lakh As per income tax slabs

Download Tax Rebate Upto 5 Lakh

More picture related to Tax Rebate Upto 5 Lakh

A Detailed Guide On Income Tax Rebate Upto Rs 5 Lakh

https://www.righthorizons.com/wp-content/uploads/2019/03/Blog-1-P5.png

No Tax Upto 5 Lakhs Is Just A Myth Tax Rebate Explained Under

https://i.ytimg.com/vi/6bGn6P55Dcc/maxresdefault.jpg

Interim Budget 2019 Updates FM Goyal Says It s Rebate For Income Upto

https://english.cdn.zeenews.com/sites/default/files/taxbracket.jpg

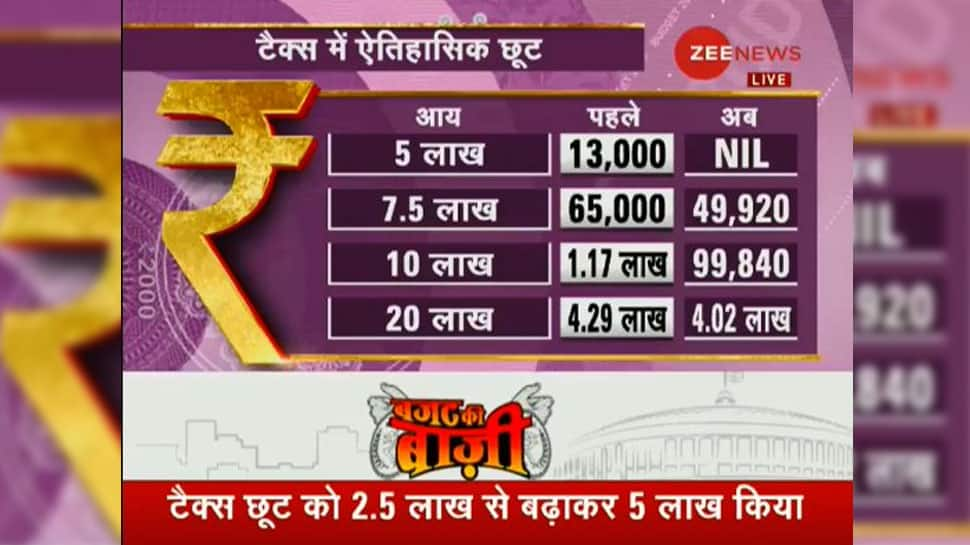

Web Income upto Rs 5 Lakh to get full tax rebate higher standard deduction proposed Individual taxpayers having taxable annual income up to Rs 5 lakhs will get full tax rebate and Web No Income Tax up to Rs 7 5 Lakh And slab wise details are also mentioned in the above image Tax rebate is Rs 0 with old regime since taxable income goes above Rs 5 lakh

Web 1 f 233 vr 2023 nbsp 0183 32 Budget 2023 proposes to increase rebate under Section 87A in such a way that taxpayers who earlier had to pay zero income on income up to Rs 5 lakh will now Web 2 f 233 vr 2023 nbsp 0183 32 As part of its Budget 2023 announcement Finance Minister Nirmala Sitharaman said that the tax rebate has been extended on income up to Rs 7 lakh in

Section 87A Rebate Of Rs 2000 For Income Upto Rs 5 Lakh IT

http://3.bp.blogspot.com/-N5qZQBSxOzA/VpvGSSD0ccI/AAAAAAAADZo/pjGA5C0jPxU/s1600/section-87a%252Bit%252Bcircular%252B20%252B2015.jpg

Reality Of No Income Tax Upto 5 Lakhs Here Is The Truth About Budget

https://i.ytimg.com/vi/ceSopHAZKkk/maxresdefault.jpg

https://economictimes.indiatimes.com/wealth/tax/new-income-tax-slabs...

Web If you earn up to Rs 7 5 lakh you do not have to pay any income tax under the new income tax regime Here s the calculation Your total income Rs 7 50 000 Standard deduction

https://www.tomorrowmakers.com/tax-plannin…

Web 28 oct 2022 nbsp 0183 32 The truth is if your income exceeds Rs 2 5 lakh you do need to pay income tax However if it doesn t exceed Rs 5 lakh this tax liability is cancelled out by a tax rebate In other words if your net taxable

Interim Budget 2019 20 Full Tax Rebate On Income Upto Rs 5 Lakh Under

Section 87A Rebate Of Rs 2000 For Income Upto Rs 5 Lakh IT

Save Up To 5 Lakhs In Taxes Part 1 Of Tax Planning Key Terms

0 Tax Up To 5 Lakhs II Rebate Sec 87A A Y 2020 21 II Tax

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Tax Rebate For Income Upto Rs 5 Lakh No Change In Slabs India News News

Budget 2019 20 No Tax Upto Rs 5 Lakh 1 5 Lakh For Saving Standard

Union Budget 2023 Income Tax Slabs New Tax Regime Is Default Rebate

Tax Rebate Upto 5 Lakh - Web 1 mars 2019 nbsp 0183 32 What does full tax rebate for those with taxable income of Rs 5 lakh mean Read the example below Let us assume you a person below 60 years has a taxable income of Rs 5 lakh As per income tax slabs