Tax Rebate Us 87a Web 3 f 233 vr 2023 nbsp 0183 32 To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an individual

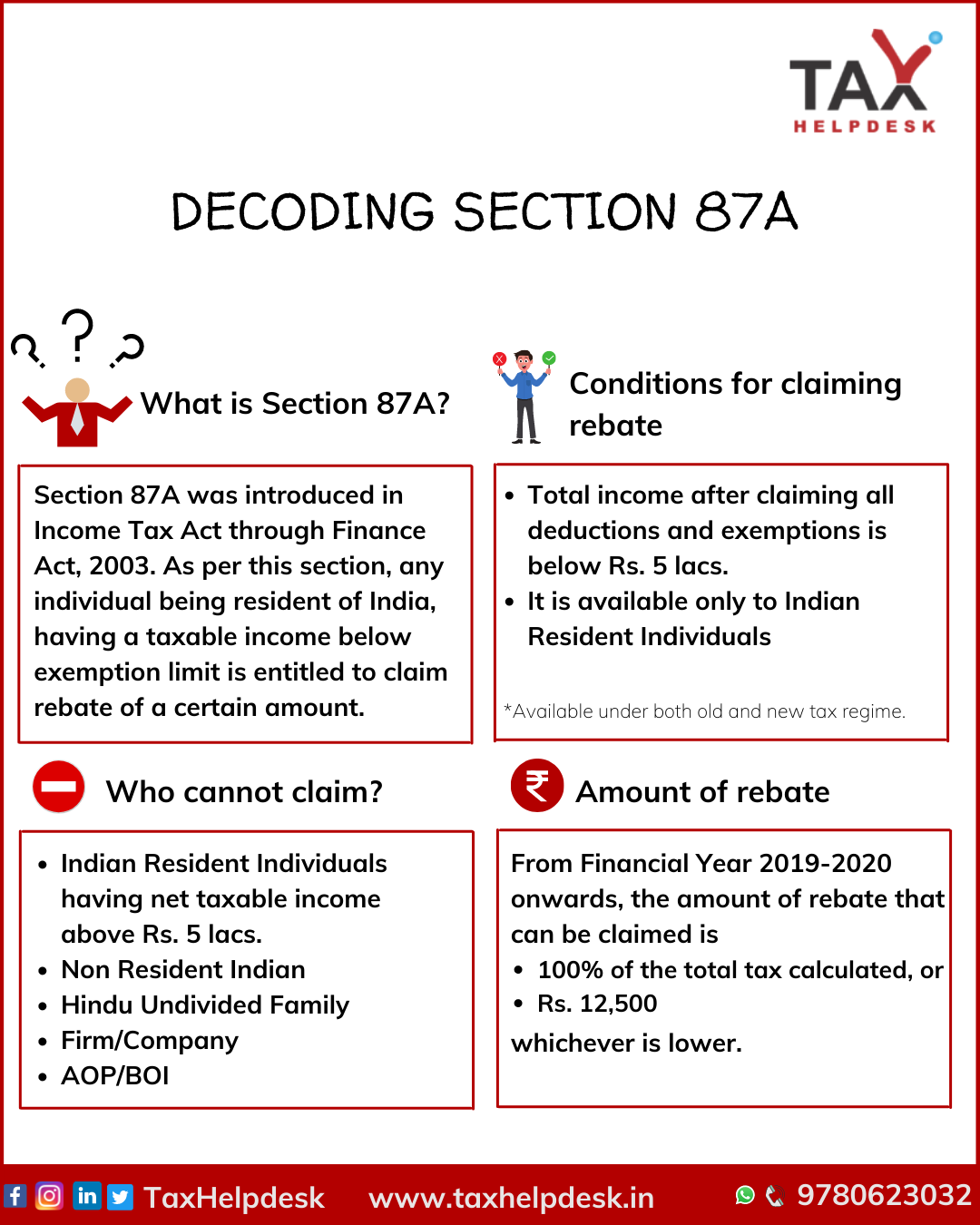

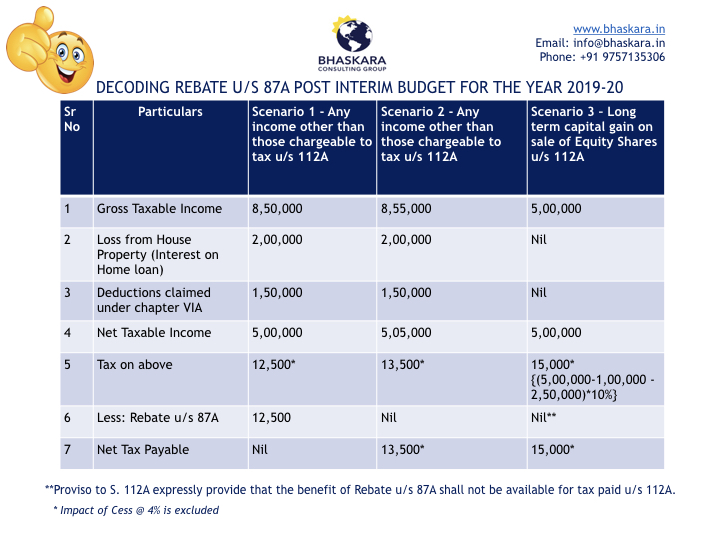

Web 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under Web 6 f 233 vr 2023 nbsp 0183 32 Updated on 6 Feb 2023 The tax rebate u s 87A allows a taxpayer to reduce his her tax liability marginally depending on the net total income In this article we will cover the eligibility steps to claim

Tax Rebate Us 87a

Tax Rebate Us 87a

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

Rebate U s 87A A Y 2019 20 Section 87A Of Income Tax How To Claim

https://i.ytimg.com/vi/KqZNdnxM0Bo/maxresdefault.jpg

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

https://financialcontrol.in/wp-content/uploads/2018/06/Rebate-87A.jpg

Web 2 f 233 vr 2023 nbsp 0183 32 In Budget 2023 the tax rebate for individuals has been increased to INR 25 000 which means individuals having taxable income up to INR 7 00 000 can claim Web Any individual whose annual net income does not exceed Rs 5 Lakh qualifies to claim tax rebate under Section 87a of the Income Tax Act 1961 This implies an individual can

Web VDOM DHTML tml gt What is a rebate under Section 87A and who can claim it Quora Web What is tax rebate u s 87A A tax rebate is a type of discount offered on your tax liability If your annual income net of deductions and exemptions does not exceed INR 5 lakhs

Download Tax Rebate Us 87a

More picture related to Tax Rebate Us 87a

Rebate U s 87A For F Y 2018 2019 Taxable Income Not Exceed 3 5

https://i.ytimg.com/vi/OS6nlwtzz-A/maxresdefault.jpg

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/pdfresizer.com-pdf-crop-page-001.jpg?resize=720%2C400&ssl=1

All You Need To Know About Section 87A At TaxHelpdesk TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/07/DECODING-SECTION-87A.png

Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed Web 2 janv 2021 nbsp 0183 32 The answer is YES Section 87A Tax rebate is available under both new and old tax regimes for FY 2020 21 AY 2021 22 Individuals having taxable income of up to Rs 5 lakh will be eligible for

Web Tax Rebate Under Section 87A Claim Income Tax Rebate for FY 21 22 AY 22 23 What is Insurance What is Superannuation View All FAQs Section 80CCC Section 80DDB Web 4 juin 2023 nbsp 0183 32 Presently rebate is allowed u s 87A of Rs 12 500 in old regime of Income Tax if any resident individual whose total income during the previous year does not

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

https://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

https://financialcontrol.in/wp-content/uploads/2018/06/How-to-calculate-rebate-us-87A.jpg

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an individual

https://tax2win.in/guide/section-87a

Web 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under

Examples Of Rebate U s 87A For A Y 2020 21 And A Y 2019 20 Fully

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

.png)

Rebate U s 87A Income Tax Rebate Under Section 87A JR Compliance Blogs

Decoding Rebate U s 87A Post Interim Budget For The F Y 2019 20

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Section 87A New Rebate 87A Of Income Tax In Budget 2023 Tax Save

Section 87A New Rebate 87A Of Income Tax In Budget 2023 Tax Save

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Tax Rebate Under Section 87A All You Need To Know YouTube

Rebate 87a 87a 87 A 87 A Rebate What Is 87 A Section 87a

Tax Rebate Us 87a - Web Rebate u s 87A Q1 Can a partnership firm or HUF claim rebate under section 87A 23 Aug 2022 17 48 28