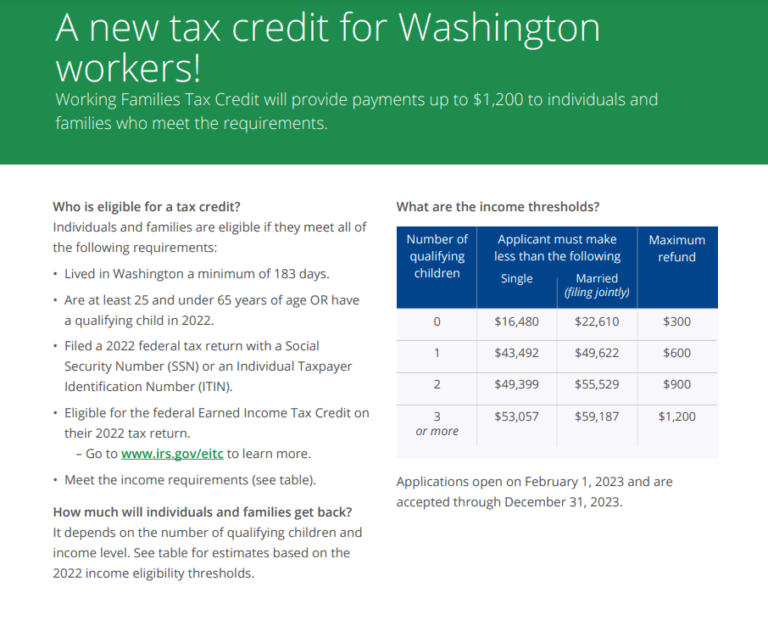

Tax Rebate Washington State Working Families Web What you ll need to apply To apply for the Working Families Tax Credit you will need the following A copy of your federal tax return that you filed with the IRS Your Social Security Number or ITIN and dates of birth for you your spouse and children

Web The maximum credit amount for a single person is 300 with an increase of 300 for each qualifying child up to a maximum of 1 200 for a family with 3 or more children Income eligibility thresholds are based on the 2022 Federal Earned Income Tax Credit Eligibility thresholds may change for future tax years Ways to file Web 18 avr 2021 nbsp 0183 32 Starting in 2023 an estimated 420 000 Washingtonians will receive rebates of between 300 and 1 200 The program modeled after the federal Earned Income Tax Credit EITC is expected to pay

Tax Rebate Washington State Working Families

Tax Rebate Washington State Working Families

https://i2.wp.com/onlinelibrary.wiley.com/cms/asset/bae317d7-a141-4ea3-8e5d-b0f4f65b8329/fisc12207-fig-0003-m.jpg

Jan 6 Terrorist Assault On Twitter RT ElliAdventurer Looks Good To

https://pbs.twimg.com/media/Fa3Lr6rXEAEzztH.jpg

UPDATE GOP Says State Can do Better Than Whitmer s Proposed 500 Tax

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AAQJBtp.img?w=2000&h=1125&m=4&q=86

Web Policy Priorities gt State Budget amp Revenue gt Working Families Tax Credit The Working Families Tax Credit WFTC is a new annual cash tax rebate of up to 1 200 for more than 400 000 Washington state households Web Working Families Tax Credit will provide payments up to 1 200 to individuals and families who meet the requirements Who is eligible for a tax credit Lived in Washington a minimum of 183 days Are at least 25 and under 65 years of

Web 31 janv 2023 nbsp 0183 32 by Jamie Housen on January 31 2023 Seattle Starting on February 1 Seattle residents will be able to apply for a new annual tax credit that will provide payments up to 1 200 for low to moderate income individuals and families in Washington Web 3 f 233 vr 2023 nbsp 0183 32 Washington s Working Families Tax Credit WFTC officially launched on Feb 1 For qualified families this credit will provide for up to a 1 200 cash refund Roughly 400 000 households will qualify The application portal is now open on the state Department of Revenue s website Today s launch marks a major step forward in the progress

Download Tax Rebate Washington State Working Families

More picture related to Tax Rebate Washington State Working Families

Understanding The Washington Tax Rebate 2023 A Comprehensive Guide

https://printablerebateform.net/wp-content/uploads/2023/05/Washington-Tax-Rebate-2023-768x626.png

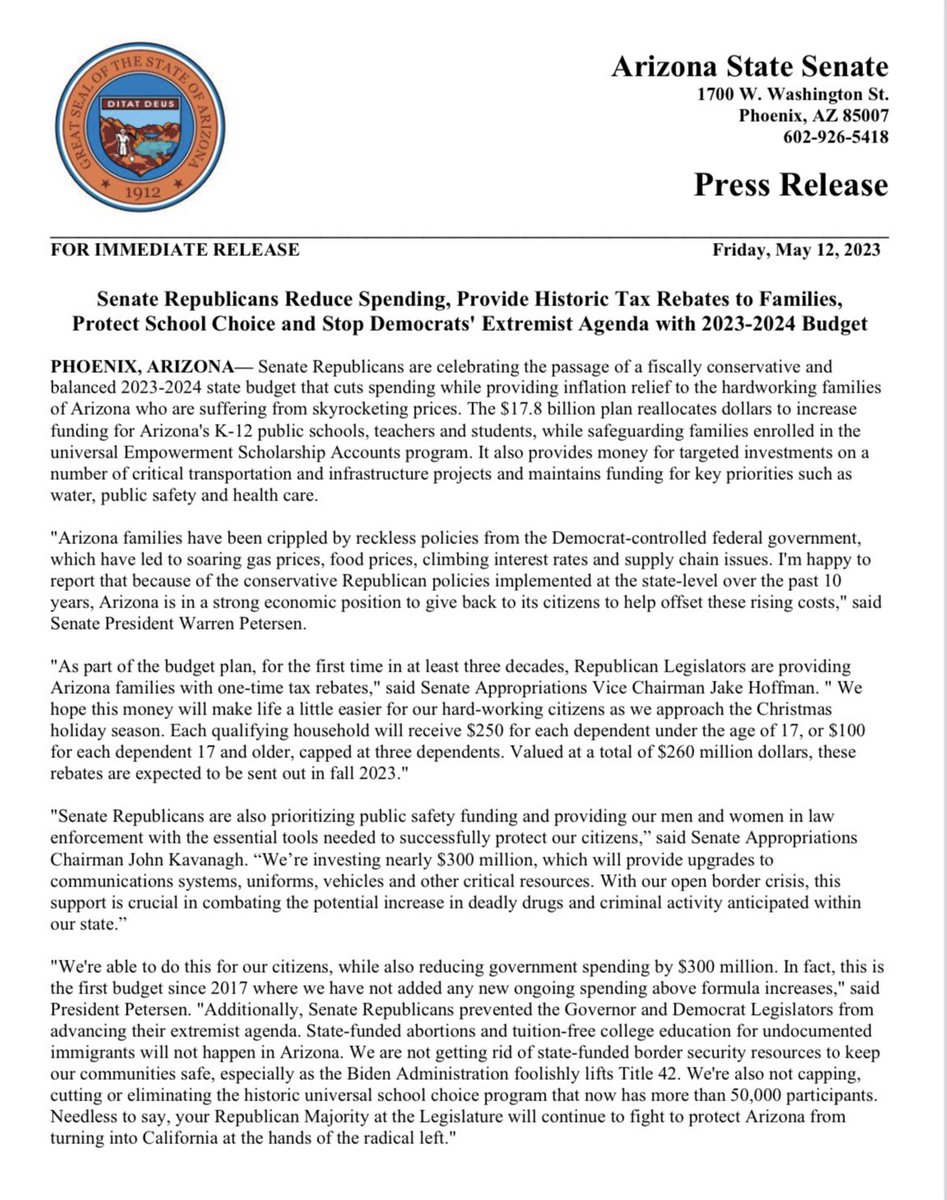

AZSenateRepublicans On Twitter FOR IMMEDIATE RELEASE Senate

https://pbs.twimg.com/media/Fv8rLuUaMAAYDuy.jpg

Electric Car Rebates Washington State 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/ma-tax-rebates-electric-cars-2022-carrebate-2.jpg?w=358&h=537&ssl=1

Web How to Watch a video Where is my Working Families Tax Credit refund Click Check refund status On the Enter Information page enter the SSN or ITIN last 4 digits Date of birth using the MM DD YYYY format and income reported on Line 1z of your federal tax form 1040 or 1040 SR Web 23 f 233 vr 2010 nbsp 0183 32 The WFTR is a step toward making our tax system more equitable Washington state taxes families with low and moderate incomes more than any other state in the country households earning 20 000 a year or less pay 17 percent of their incomes in state and local taxes while the richest 1 percent pay just 3 percent of their

Web Eligibility general Who is eligible for the Working Families Tax Credit Individuals and families are eligible for the Working Families Tax Credit in 2023 if they meet all of the following requirements Lived in Washington a minimum of 183 days in Web Washington passed the Working Families Tax Credit or Recovery Rebate which offers a flat credit to low income households Rate Fully Refundable Flat rate based on household size and income level The amounts by family size are 1 300 for single married with no kids 600 for families with 1 child

Infographic Washington State Working Families Tax Credit

https://workingfamiliescredit.wa.gov/sites/default/files/2022-10/WFTC Requirements Infographic- Spanish.jpg

Illinois Tax Rebate Tracker Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/illinois-tax-rebate-2022-cray-kaiser-1.png

https://workingfamiliescredit.wa.gov/apply

Web What you ll need to apply To apply for the Working Families Tax Credit you will need the following A copy of your federal tax return that you filed with the IRS Your Social Security Number or ITIN and dates of birth for you your spouse and children

https://dor.wa.gov/about/news-releases/2023/applications-now-being...

Web The maximum credit amount for a single person is 300 with an increase of 300 for each qualifying child up to a maximum of 1 200 for a family with 3 or more children Income eligibility thresholds are based on the 2022 Federal Earned Income Tax Credit Eligibility thresholds may change for future tax years Ways to file

Financial Relief For Families How To Get Your Share Of Direct

Infographic Washington State Working Families Tax Credit

300 Bonus Tax Rebate For Thousands Of Families Do You Qualify

Breaking Down The Rebate Will The IRS Make People Pay Taxes On State

States Tapping Historic Surpluses For Tax Cuts And Rebates Washington

Christopher Luxon Announces Childcare Tax Rebate Policy Expected To

Christopher Luxon Announces Childcare Tax Rebate Policy Expected To

Opinion Cadillac Tax Is Bad For Working Families The Washington Post

Washington State Heat Pump Rebate PumpRebate

Whitmer Proposes 500 Rebate Checks For Michigan Working Families

Tax Rebate Washington State Working Families - Web Working Families Tax Credit will provide payments up to 1 200 to individuals and families who meet the requirements Who is eligible for a tax credit Lived in Washington a minimum of 183 days Are at least 25 and under 65 years of