Tax Rebates 2024 South Africa A taxpayer is entitled to so called tax rebates that are deducted from tax payable The rebates have the effect of establishing tax thresholds below which no tax is payable For the 2024 tax year i e the tax year commencing on 1 March 2023 and ending on 29 February 2024 the following rebates apply

A tax rebate to individuals for solar PV panels of 25 of the cost for a limited period subject to certain conditions and capped at R15 000 per individual RENEWABLE ENERGY TAX INCENTIVE R23 monthfor 3 months SARS Tax Brackets Tax Tables for 2023 2024 Personal Income Tax In South Africa you are liable to pay income tax if you earn more than R95 750 and you are younger than 65 years If you are 65 or older but younger than 75 years old the tax threshold i e the amount above which income tax becomes payable is R148 217

Tax Rebates 2024 South Africa

Tax Rebates 2024 South Africa

https://printablerebateform.net/wp-content/uploads/2022/02/Primary-Rebate-South-Africa-2022.png

6 Ways You Can Save With Tax Deductions Tax Consulting South Africa

https://www.taxconsulting.co.za/wp-content/uploads/2018/07/6-ways-you-can-save-with-tax-deductions.jpg

Combien Vous Serez Impos En Afrique Du Sud En 2022 En Fonction De Ce Que Vous Gagnez

https://businesstech.co.za/news/wp-content/uploads/2022/02/Tax.png

The medical tax credit is an additional rebate which a taxpayer may claim dependent on the number of dependents on his her medical aid No changes to donations tax Donations tax is still 20 percent on donations up to ZAR 30 million and 25 percent on donations exceeding ZAR 30 million SARS Governments extend tax rebates as a financial respite to slash tax obligations and bolster economic engagement for individuals and businesses These incentives usually align with particular fiscal societal or economic goals established by the government

Big tax risks for South Africa as countdown to Budget 2024 begins National Treasury is entering its close out period ahead of the 2024 Budget with Finance Minister Enoch Godongwana extending Interest from a South African source earned by any natural person under 65 years of age up to R23 800 per annum and persons 65 and older up to R34 500 per annum is exempt from income tax

Download Tax Rebates 2024 South Africa

More picture related to Tax Rebates 2024 South Africa

How To Calculate Tax Rebates In South Africa

https://lunchtimeresult.co.za/wp-content/uploads/2022/12/How-to-Calculate-Tax-Rebates-in-South-Africa.jpg

Understanding Income Tax Reliefs Rebates Deductions And Exemptions In Malaysia

https://ringgitplus.com/en/blog/wp-content/uploads/2020/02/Tax-Rebates-800x534.jpg

Exploring Tax Rebates In South Africa Eligibility And Claim Process SarkariResult SarkariResult

http://www.sarkariexam.com/wp-content/uploads/2023/11/ExploringTaxRebatesinSouthAfrica_EligibilityandClaimProcess.jpg

2023 2024 INDIVIDUAL TAX RATES INDIVIDUAL REBATES Year of assessment ending 29 February 2024 Taxable Income R 0 237 100 237 101 370 500 370 501 512 800 512 801 673 000 673 001 857 900 857 901 1 817 000 1 817 001 and above Rate of Tax R 18 42 678 26 77 362 31 121 475 36 179 147 39 251 258 41 644 489 45 The rebate can be used to offset the individual s personal income tax liability for the 2023 24 tax year up to a maximum of R15 000 per individual This relief will only be available for one

2024 tax year 1 March 2023 29 February 2024 22 February 2023 See changes from last year Taxable income R Rates of tax R 1 237 100 18 of taxable income 237 101 370 500 42 678 26 of taxable income above 237 100 370 501 512 800 How Much is Tax Rebate in South Africa The tax year starts on 1 March and ends on 28 9 February the following year Now we are in the 2024 tax year which commenced on 1 March 2023 and ends on 29 February 2024 The following are the types of tax rebates available in South Africa The primary rebate is R17 235 for all people

South Carolina To Issue Individual Income Tax Rebates In 2022

https://www.websterrogers.com/wp-content/uploads/2022/08/Tax-Rebate-e1660164324345.jpg

Tax Rebates Key To Resuscitating Local Sports Kenya

https://static.africa-press.net/kenya/sites/28/2022/03/img-6231fad746546.jpg

https://taxsummaries.pwc.com/south-africa/individual/other-tax-credits-and-incentives

A taxpayer is entitled to so called tax rebates that are deducted from tax payable The rebates have the effect of establishing tax thresholds below which no tax is payable For the 2024 tax year i e the tax year commencing on 1 March 2023 and ending on 29 February 2024 the following rebates apply

https://www.taxconsulting.co.za/tax-guide-2023-2024/

A tax rebate to individuals for solar PV panels of 25 of the cost for a limited period subject to certain conditions and capped at R15 000 per individual RENEWABLE ENERGY TAX INCENTIVE

Mississippi To Receive Up To 500 One Time Tax Rebates In 2023 South Arkansas Sun

South Carolina To Issue Individual Income Tax Rebates In 2022

LHDN IRB Personal Income Tax Rebate 2022

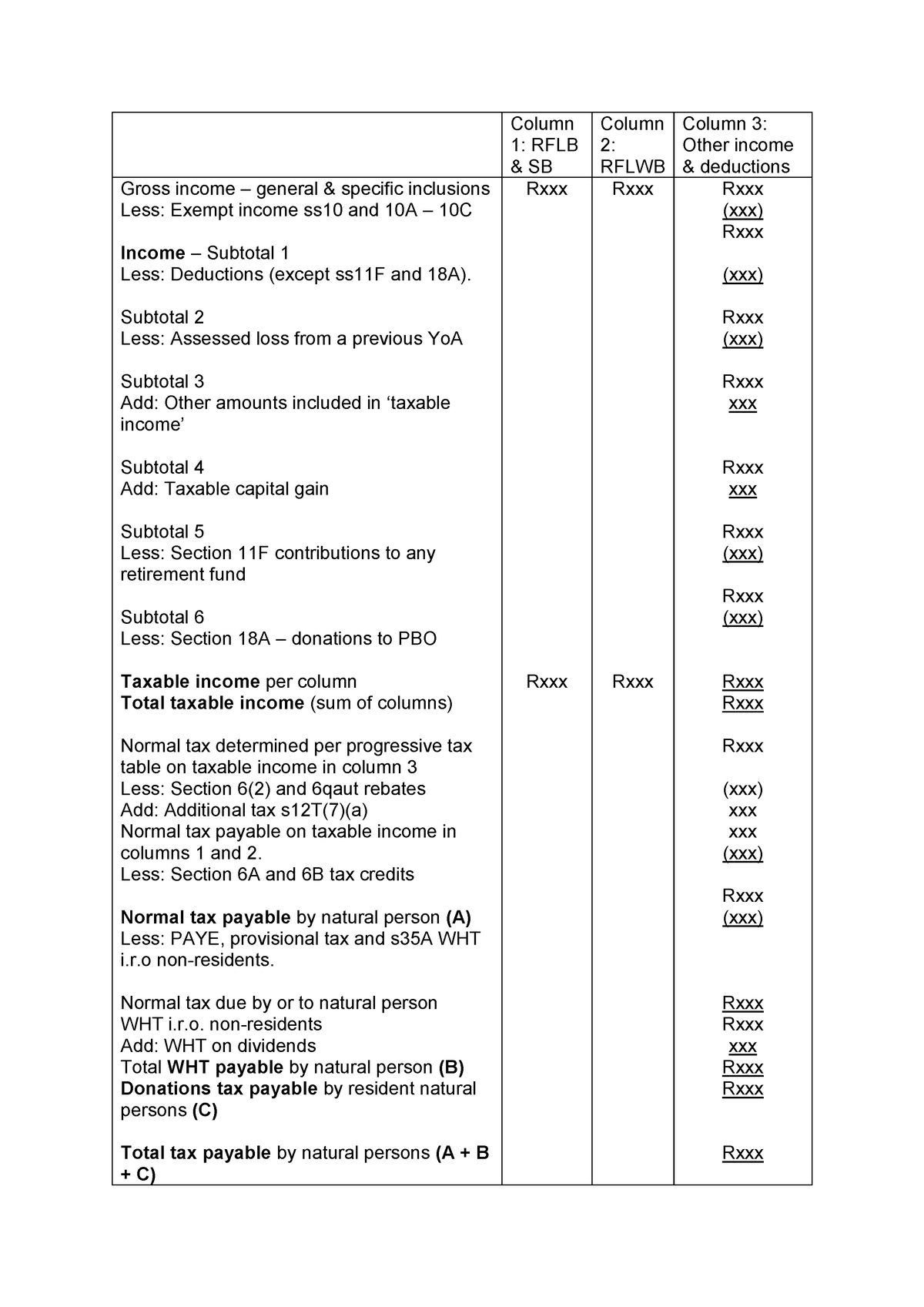

Natural Persons Column 1 RFLB SB Column 2 RFLWB Column 3 Other Income Deductions Studocu

Tax Rebates Worth At Least 75 To Start Going Out To 25 000 People This Week All You Need To

1 000 Tax Rebate Residents In This State May Receive Extra Money This Summer Here s How To Be

1 000 Tax Rebate Residents In This State May Receive Extra Money This Summer Here s How To Be

Tax Rebates Review Of Tax Credits On The Agenda For Senate GOP

Tax Rebates Are On The Way

SOUTH CAROLINA TAX REBATES ARE COMING TO ELIGIBLE TAXPAYERS WHO FILE RETURNS BY OCTOBER 17

Tax Rebates 2024 South Africa - VAT Donations Tax Estate Duty Foreign Entertainers and Sportspersons Royalties Securities Transfer Tax STT Skills Development Levy Unemployment Insurance Contributions Tax on International Air Travel The tax years are 2024 tax year is 1 March 2023 29 February 2024 2023 tax year is 1 March 2022 28 February 2023