Tax Rebates Energy Efficient Home Improvements Web 31 mars 2020 nbsp 0183 32 Les particuliers b 233 n 233 ficient d aides fiscales pour financer leurs travaux de r 233 novation 233 nerg 233 tique de leurs logements Comment ne pas se tromper dans la

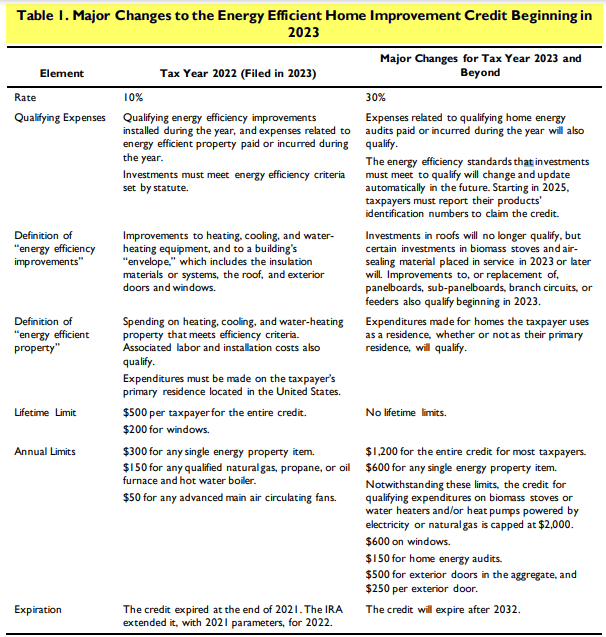

Web 1 janv 2023 nbsp 0183 32 Clean Vehicle Credits If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can Web 22 d 233 c 2022 nbsp 0183 32 Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act of 2022 IRA amended the credits for energy efficient

Tax Rebates Energy Efficient Home Improvements

Tax Rebates Energy Efficient Home Improvements

https://i0.wp.com/www.masssaverebate.net/wp-content/uploads/2022/10/energy-efficient-rebates-tax-incentives-for-ma-homeowners-4.png?fit=670%2C400&ssl=1

Home Energy Rebates NRGwise Home Energy Assessments Ontario

https://nrgwise.ca/wp-content/uploads/2021/07/NRGwise-Rebate-Flyer-July-2021-1.jpg

Home Improvement Tax Credit Energy Saving Tax Credit Utah

https://advancedwindowsusa.com/wp-content/uploads/tax-credit-for-energy-efficient-windows-2021.jpg

Web 22 d 233 c 2022 nbsp 0183 32 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide Web 9 sept 2022 nbsp 0183 32 A key element in that push is offering up to 14 000 in rebates and tax credits for people to make their homes more energy efficient Those benefits can be

Web the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200 Beginning January 1 2023 the amount Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30

Download Tax Rebates Energy Efficient Home Improvements

More picture related to Tax Rebates Energy Efficient Home Improvements

How To Save Money On Home Improvements With Energy Efficiency Tax

https://mlsjoxwh2dv5.i.optimole.com/cb:fJ2b~7176/w:auto/h:auto/q:90/f:avif/https://finmasters.com/wp-content/uploads/2022/12/How-to-Save-Money-on-Home-Improvements-with-Energy-Efficiency-Tax-Credits-Rebates.jpg

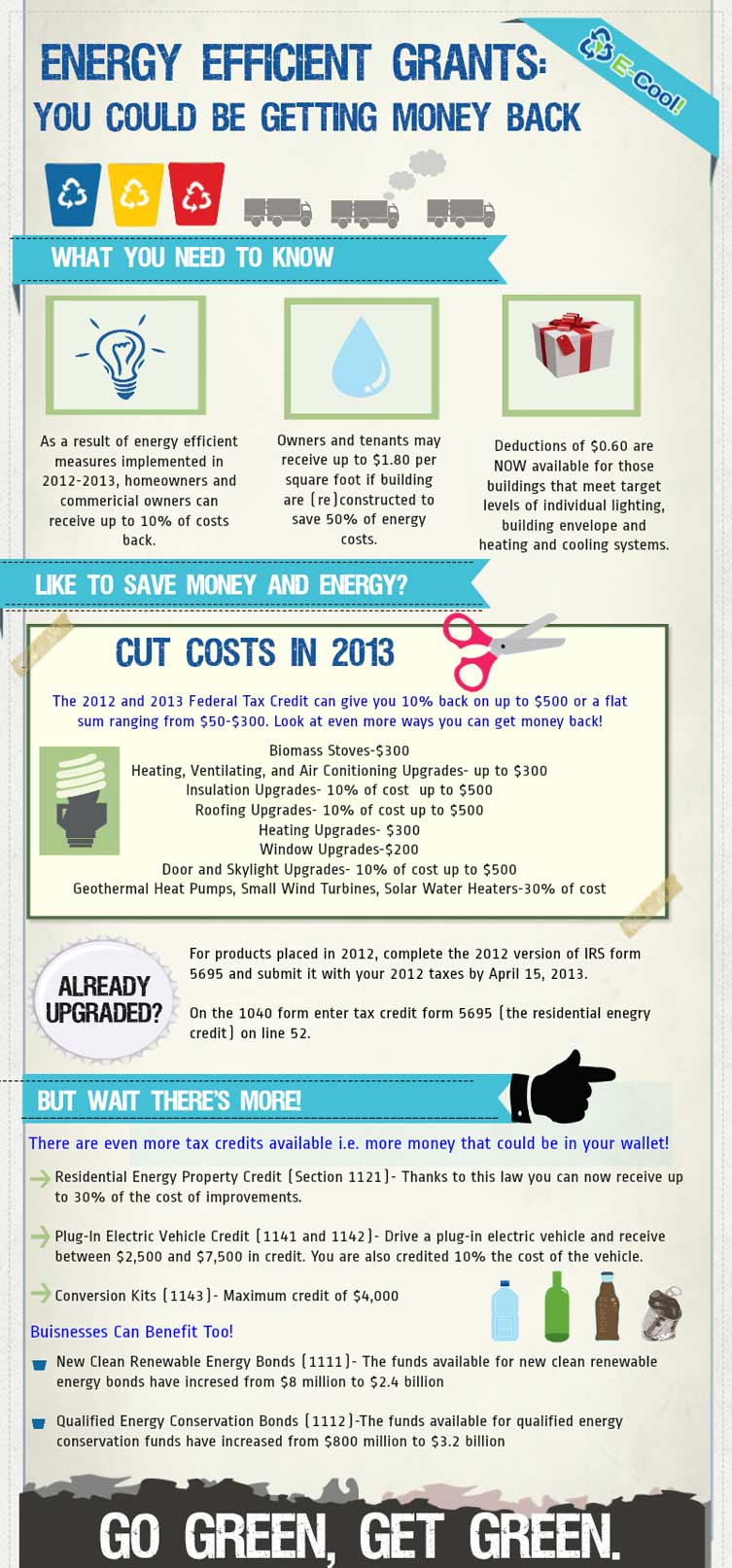

Energy Efficiency Tax Rebates Infographic

https://infographicjournal.com/wp-content/uploads/2013/02/My-Infographic1.jpg

Get Your Energy Efficiency Improvement Rebates Hansberger

https://blog.hansbergerrefrig.com/wp-content/uploads/2019/10/Tax-Rebates_iStock-1055975774-768x512.jpg

Web 16 mars 2023 nbsp 0183 32 The Energy Efficient Home Improvement Credit provides tax credits for the purchase of qualifying equipment home improvements and energy audits to Web 22 d 233 c 2022 nbsp 0183 32 While many states label their energy efficiency incentives as quot rebates quot these incentives may not qualify as rebates or purchase price adjustments under federal

Web 27 avr 2021 nbsp 0183 32 In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the Web 21 d 233 c 2022 nbsp 0183 32 December 21 2022 Office of Policy Making Our Homes More Efficient Clean Energy Tax Credits for Consumers Visit our Energy Savings Hub to learn more

The Homeowners Guide To Tax Credits And Rebates

https://blog.constellation.com/wp-content/uploads/2016/12/search-rebates-zipcode.gif

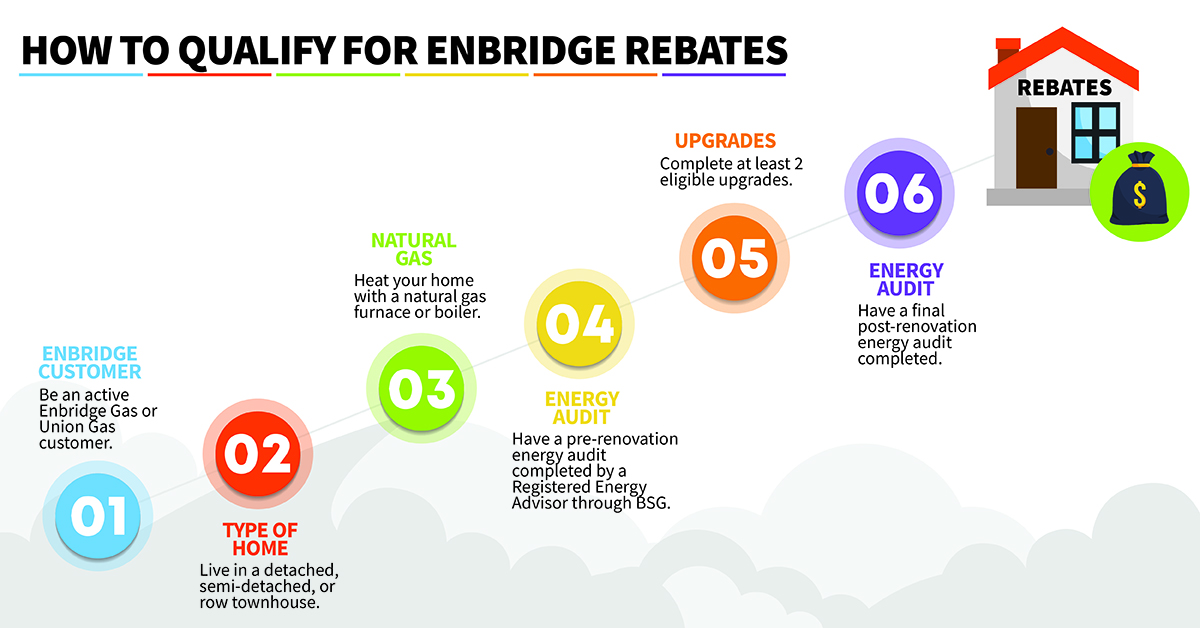

What Are The Enbridge Rebates Home Efficiency Rebates

https://www.barriersciences.com/user_files/upload/how-to-qualify-for-enbridge-rebates.jpg

https://www.lesechos.fr/patrimoine/impots/impot-2020-sur-le-revenu...

Web 31 mars 2020 nbsp 0183 32 Les particuliers b 233 n 233 ficient d aides fiscales pour financer leurs travaux de r 233 novation 233 nerg 233 tique de leurs logements Comment ne pas se tromper dans la

https://www.irs.gov/credits-deductions/energy-efficient-home...

Web 1 janv 2023 nbsp 0183 32 Clean Vehicle Credits If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can

Federal Tax Credit For Energy Saving Home Improvements Credit Walls

The Homeowners Guide To Tax Credits And Rebates

Florida Energy Rebates For Air Conditioners Fcs3266 Fy1032 Energy

Tax Credits For Energy Efficient Home Improvements

What Home Improvements Are Tax Deductible David Pope Insurance

Rebates For Energy Efficient Improvements SEC Inspection Services

Rebates For Energy Efficient Improvements SEC Inspection Services

The 2023 Energy Efficiency Rebates And Tax Credits BSH Accounting

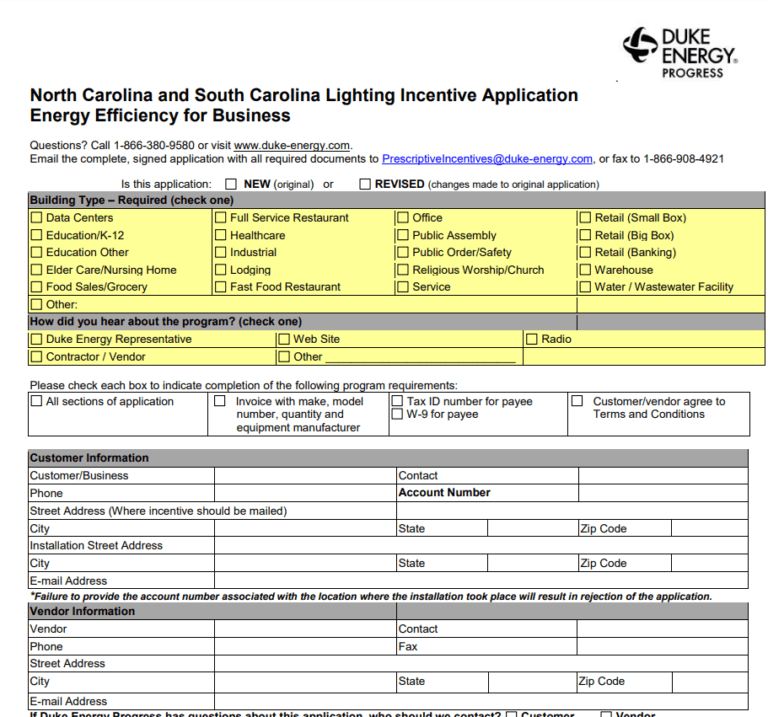

Duke Energy Rebate Form Florida Printable Rebate Form

How To Recoup Your Energy Efficiency Home Improvements At Tax Time

Tax Rebates Energy Efficient Home Improvements - Web The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary