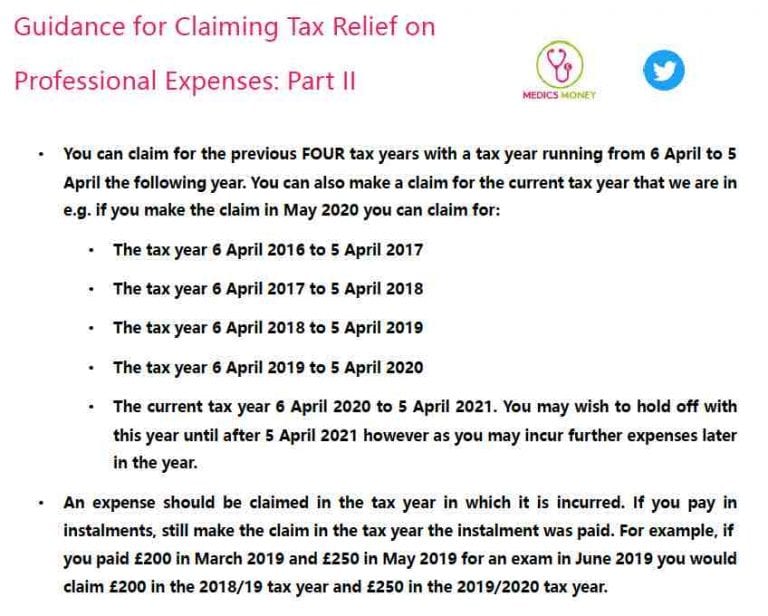

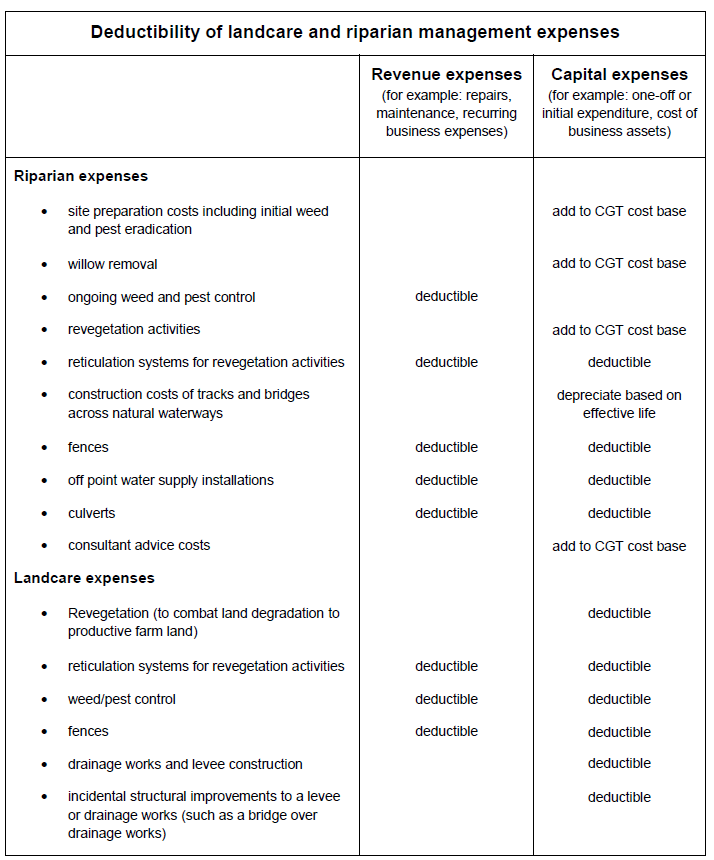

Tax Rebates For Doctors Web 12 avr 2019 nbsp 0183 32 How you make your claim will depend on the amount and your circumstances Tax Rebate Claims Up to 163 2 500 BY POST Complete a P87 form online then print and

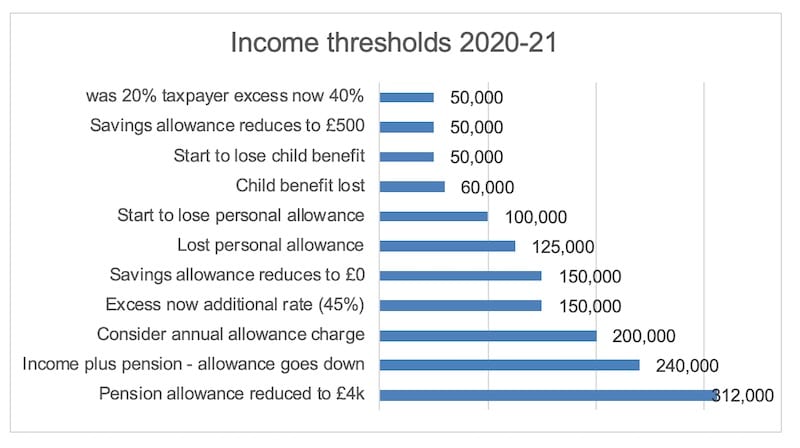

Web 8 mars 2022 nbsp 0183 32 This means that most doctors can save up to 40 or 41 for Scotland of any expense that they are allowed to claim income tax back on So a 163 100 expense Web Doctors claim an average tax rebate of 163 1245 using our free guides Speciality Get started Unique and free Our guides are unique and

Tax Rebates For Doctors

Tax Rebates For Doctors

https://www.medicsmoney.co.uk/wp-content/uploads/2019/04/tax-rebate-dates-768x616.jpg

Medical Billing Invoice Template Best Template Ideas

https://opendocs.com/wp-content/uploads/2019/10/Medical-Invoice-Sample.png

Doctors Tax Rebate Tax Rebate Online

https://tax-rebate.online/wp-content/uploads/2020/08/Doctors-1536x394.jpg

Web 11 f 233 vr 2019 nbsp 0183 32 A Personal Tax Account allows doctors to claim tax relief for expenses such as your GMC BMA MDU and MPS fees as well as any Web 11 juin 2013 nbsp 0183 32 Some of the most common reasons for a doctor to be entitled to tax relief are for 1 Membership into a professional fees like the GMC 2 The cost of professional

Web Our tax rebate guide for doctors will explore the various tax deductible expenses for NHS doctors and provide you with step by step instructions on how to claim your tax rebate Web We regularly identify rebates of over 163 1 000 for customers who were originally estimated a lower amount If you claim now you will receive tax relief for the current tax year and

Download Tax Rebates For Doctors

More picture related to Tax Rebates For Doctors

HMRC Personal Tax Account Step By Step Guide For Doctors Medics Money

https://www.medicsmoney.co.uk/wp-content/uploads/2018/12/IMG_2598-e1548519005106.jpg

How Much Tax Do Doctors Pay And Why Medics Money

https://www.medicsmoney.co.uk/wp-content/uploads/2020/06/income-tax-thresholds-doctors.jpg

Medical Doctors 2014 Tax Law Changes Impact And Financial Strategies

https://i1.wp.com/clubalthea.com/wp-content/uploads/2014/10/tax-brackets.jpg?ssl=1

Web Find out how to calculate your expenses to complete your Self Assessment tax return for doctors and medical practitioners involved in a partnership From HM Revenue amp Web 6 oct 2022 nbsp 0183 32 on October 6 2022 Tax Doctors can claim tax back on many work related expenses including GMC BMA and Royal college fees Some doctors may be able to claim tax back on exam costs and mileage costs

Web If you choose to start studying towards a new qualification then these costs are would not be tax deductible How to Claim Your NHS Doctors Tax Rebate You must make sure you keep all your receipts for any Web The criteria You meet the cost of the professional fee into an allowable professional body You are not reimbursed for the cost of the allowable professional fee by your employer

How Individual Tax Rates Work

https://irp.cdn-website.com/75ba66ee/dms3rep/multi/Rates+from+June+2021+-+June+2022.png

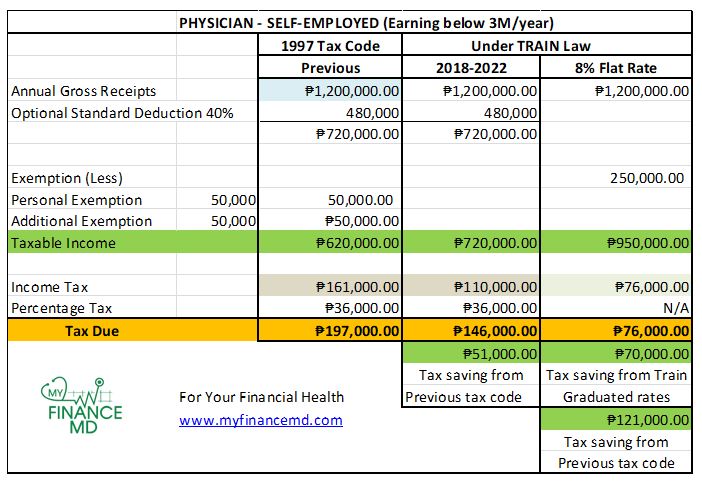

Australian Tax Deductions For Doctors

https://farmtable.com.au/wp-content/uploads/2018/10/Landcare-ATO.png

https://www.nealford.co.uk/nhs-doctors-expenses

Web 12 avr 2019 nbsp 0183 32 How you make your claim will depend on the amount and your circumstances Tax Rebate Claims Up to 163 2 500 BY POST Complete a P87 form online then print and

https://www.medicsmoney.co.uk/ep-85-pay-less-tax-by-claiming-a-doctor…

Web 8 mars 2022 nbsp 0183 32 This means that most doctors can save up to 40 or 41 for Scotland of any expense that they are allowed to claim income tax back on So a 163 100 expense

Free 15 Various Ways To Do Non Cash The Invoice And Form Template Non

How Individual Tax Rates Work

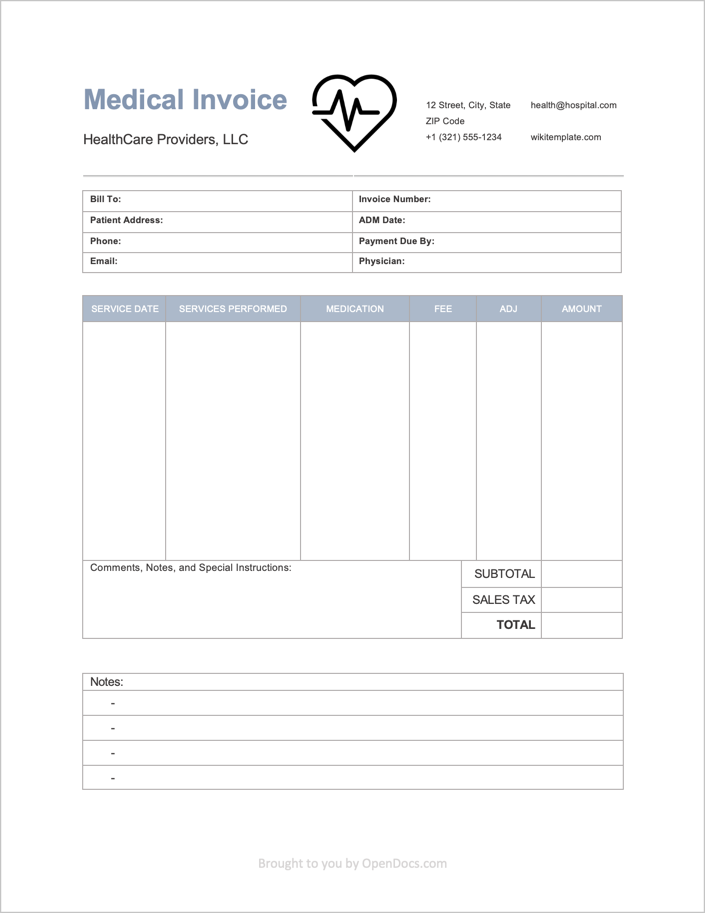

8 OPTIONAL FLAT RATE Vs GRADUATED TAX RATES Which Is Better For Self

Tax Deductions For Doctors 1099 Physicians

Tax Rebates For Doctors Doctors Tax

Personal Income Tax Brackets Ontario 2019 MD Tax Physician

Personal Income Tax Brackets Ontario 2019 MD Tax Physician

Tax Rebates Goselfemployed co

Rebate Form Download Printable PDF Templateroller

Ptr Tax Rebate Libracha

Tax Rebates For Doctors - Web Our tax rebate guide for doctors will explore the various tax deductible expenses for NHS doctors and provide you with step by step instructions on how to claim your tax rebate