Tax Rebates For Electric Cars Whole Process Explained Web 2 sept 2022 nbsp 0183 32 New battery electric cars that cost more than 55 000 do not qualify for the EV tax credit That price threshold rises to 80 000 for new battery electric SUVs vans

Web 22 ao 251 t 2022 nbsp 0183 32 The Biden administration s climate and health care bill revamps the available tax credits for buyers of electric cars Here s Web 17 ao 251 t 2022 nbsp 0183 32 The newly signed Inflation Reduction Act will have big implications for electric vehicle buyers Some popular electric vehicles may become eligible for a tax

Tax Rebates For Electric Cars Whole Process Explained

Tax Rebates For Electric Cars Whole Process Explained

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/2022-tax-brackets-jeanxyzander-5.jpg

Tax Rebates For Electric Cars Michigan 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/michigan-increases-taxes-to-fund-road-repairs-hybrids-and-electrics.jpg

Ev Car Tax Rebate Calculator 2022 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/california-s-ev-rebate-changes-a-good-model-for-the-federal-ev-tax-23.png?fit=570%2C278&ssl=1

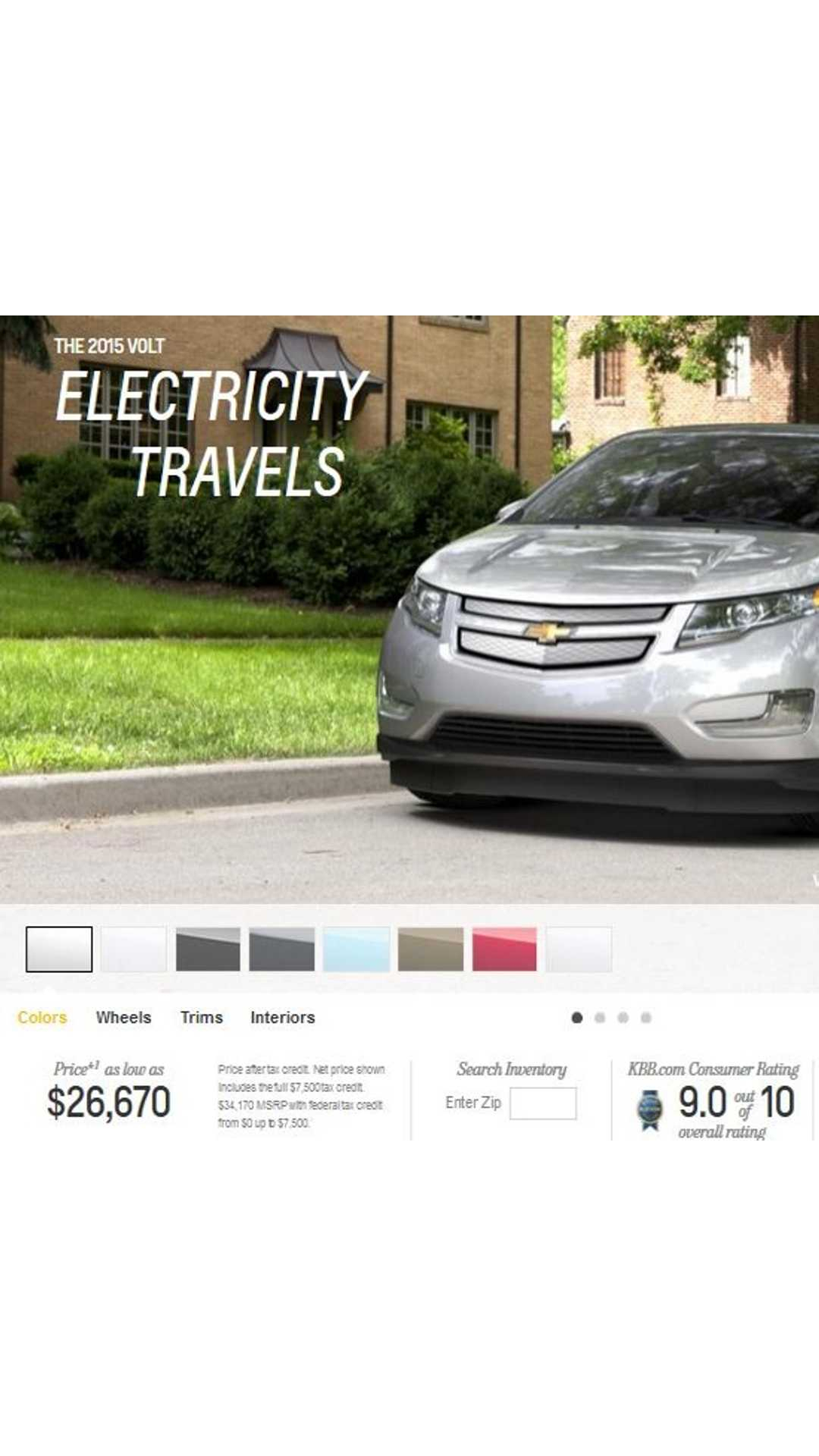

Web 7 mai 2022 nbsp 0183 32 1 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only Web 31 mars 2023 nbsp 0183 32 Under the new rule consumers can get up to 7 500 in tax credits on eligible cars There is no limit to the number of EVs automakers can sell with tax credits

Web 27 sept 2021 nbsp 0183 32 The maximum EV tax credit is 7 500 so if you buy a qualifying EV and owe 7 500 in federal taxes you likely wouldn t have to pay any federal taxes at all If you buy a qualifying vehicle and owe Web 7 janv 2023 nbsp 0183 32 If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit This tax credit has an income cap too 150 000 for a household 75 000 for a

Download Tax Rebates For Electric Cars Whole Process Explained

More picture related to Tax Rebates For Electric Cars Whole Process Explained

2022 Tax Rebate For Electric Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/federal-rebate-for-electric-cars-2022-carrebate-4.jpg

Tax Rebates For Electric Car 2023 Carrebate

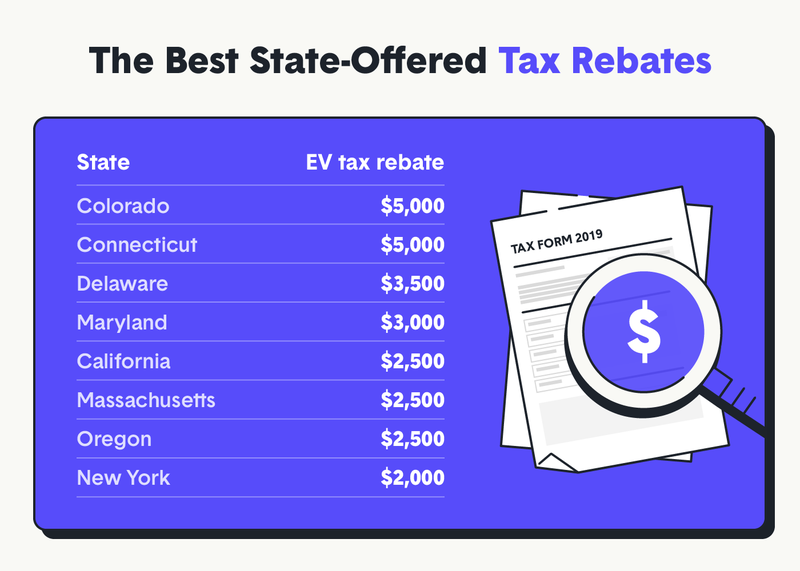

https://www.carrebate.net/wp-content/uploads/2022/06/going-green-states-with-the-best-electric-vehicle-tax-incentives-the-10.png

Texas Rebate For Electric Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/mitchell-schnurman-is-texas-going-green-with-rebates-for-electric-cars-1.png

Web 19 oct 2022 nbsp 0183 32 Federal electric vehicle tax credits are non refundable At most they will reduce your tax liability to zero If you don t owe taxes for the year in which the vehicle Web A federal EV tax credit can make buying or leasing an electric vehicle more affordable Unlike a manufacturer incentive though your ability to claim a clean vehicle tax credit

Web If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit Find information on credits for Web Before January 1 2026 a 2 000 tax credit for purchase and 1 500 for lease of a light duty EV or plug in hybrid electric vehicle per calendar year For a light duty electric

Electric Vehicles Canada Rebate

https://cms.creditcardgenius.ca/wp-content/uploads/2022/04/electric-car-rebate.jpg

Income Tax Rebate On Electric Car 2022 Carrebate

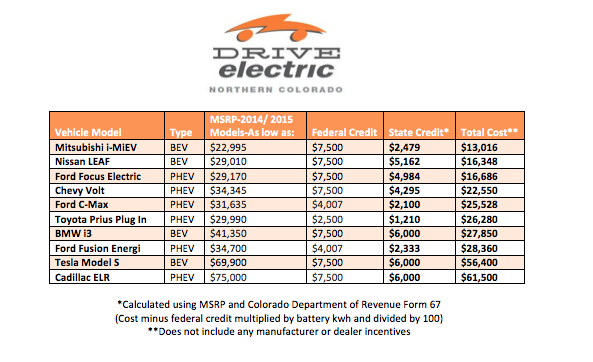

https://www.carrebate.net/wp-content/uploads/2022/06/eligible-vehicles-for-tax-credit-drive-electric-northern-colorado.png

https://techcrunch.com/2022/09/02/a-complete-guide-to-the-new-ev-tax...

Web 2 sept 2022 nbsp 0183 32 New battery electric cars that cost more than 55 000 do not qualify for the EV tax credit That price threshold rises to 80 000 for new battery electric SUVs vans

https://www.npr.org/2022/08/22/1118052620

Web 22 ao 251 t 2022 nbsp 0183 32 The Biden administration s climate and health care bill revamps the available tax credits for buyers of electric cars Here s

Irs Rebate For Electric Cars 2022 ElectricRebate

Electric Vehicles Canada Rebate

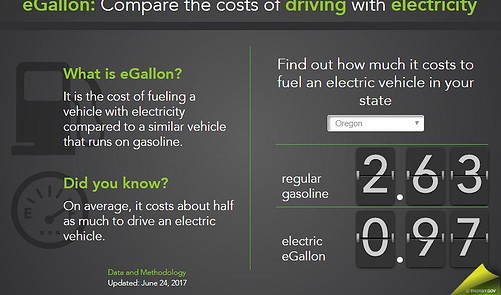

Read How The Oregon Rebate For Electric Cars Works Online

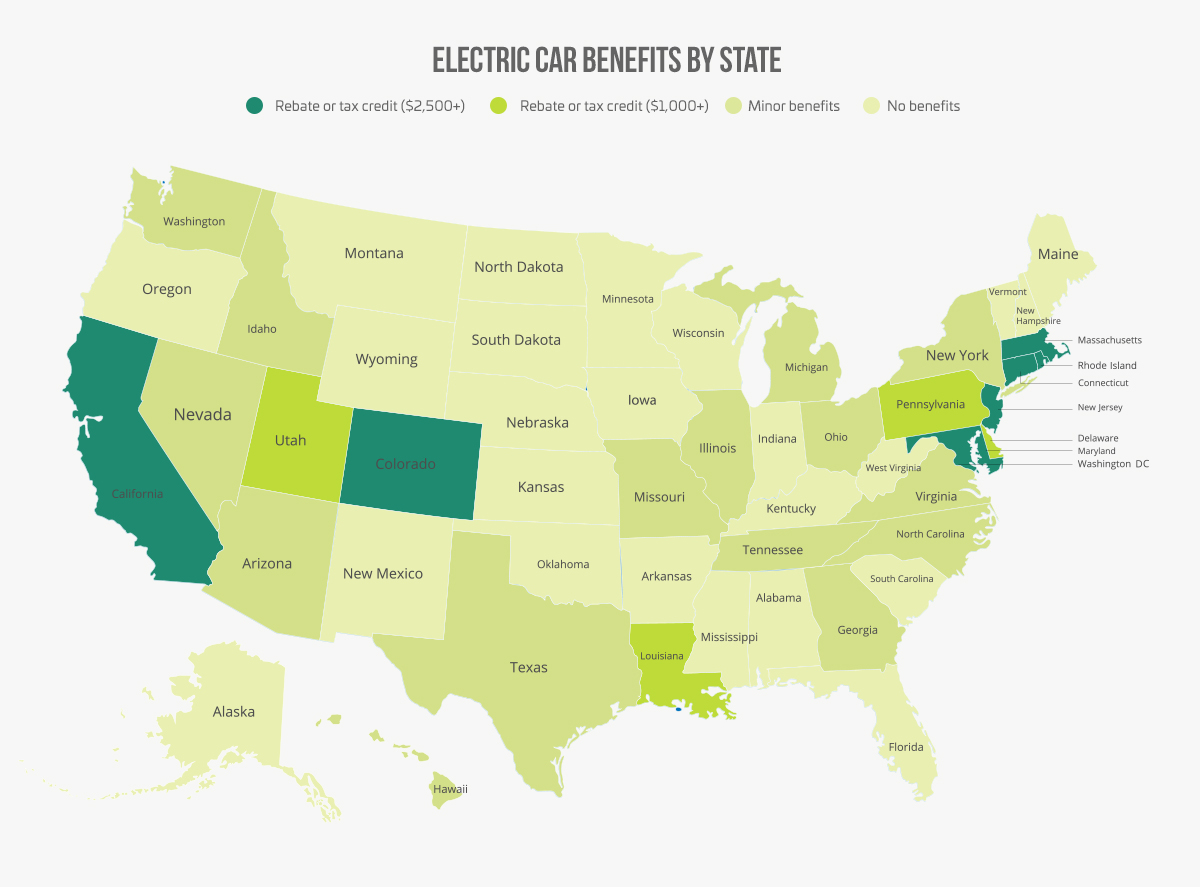

Electric Car Rebates By State ElectricRebate

Federal Tax Rebate For Electric Cars 2023 Carrebate

Tax Rebat Electric Cars Business 2022 Carrebate

Tax Rebat Electric Cars Business 2022 Carrebate

Canada Rebates For Electric Cars 2023 Carrebate

Delaware Electric Car Tax Rebate Printable Rebate Form

Georgia Rebate For Electric Car 2023 Carrebate

Tax Rebates For Electric Cars Whole Process Explained - Web 7 sept 2023 nbsp 0183 32 The Inflation Reduction Act extends the current incentives of up to 7 500 in tax credits for select electric cars plug in hybrids and hydrogen powered vehicles that