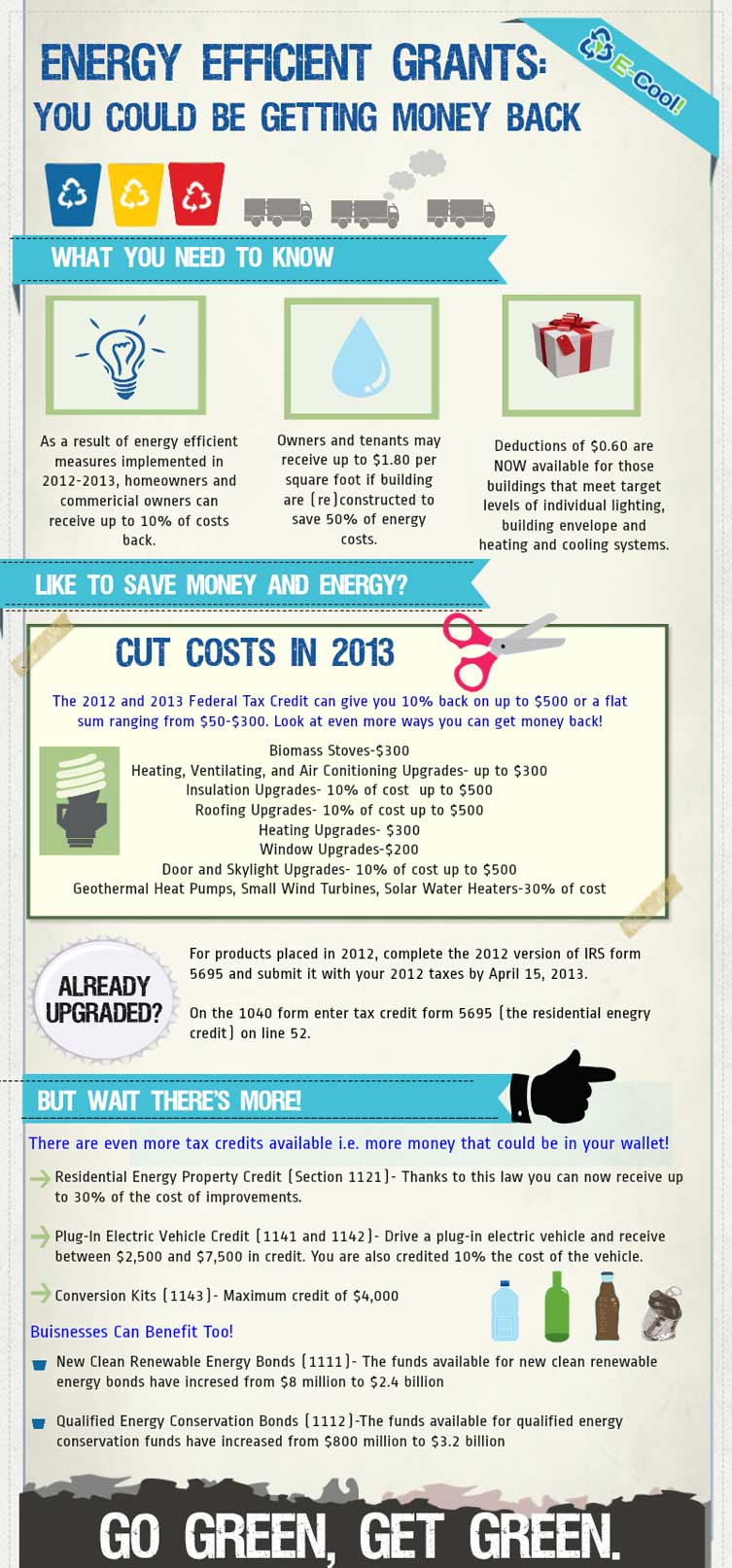

Tax Rebates For Energy Efficient Home Heating Systems Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use

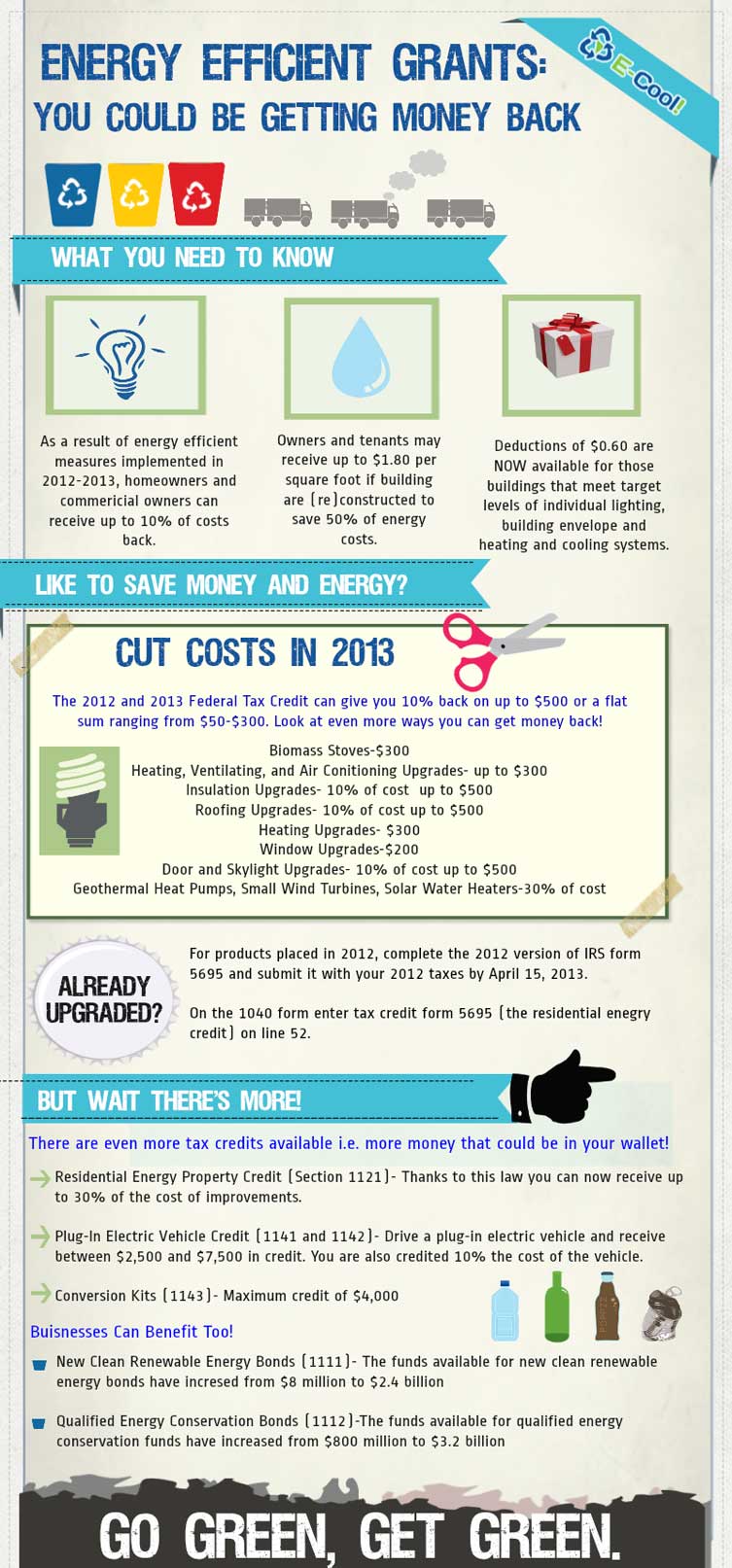

Web 9 sept 2022 nbsp 0183 32 High Efficiency Electric Home Rebate Act HEEHRA This provides rebates for low and middle income families to electrify their homes such as by installing heat pumps or electric clothes Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can receive a rebate for

Tax Rebates For Energy Efficient Home Heating Systems

Tax Rebates For Energy Efficient Home Heating Systems

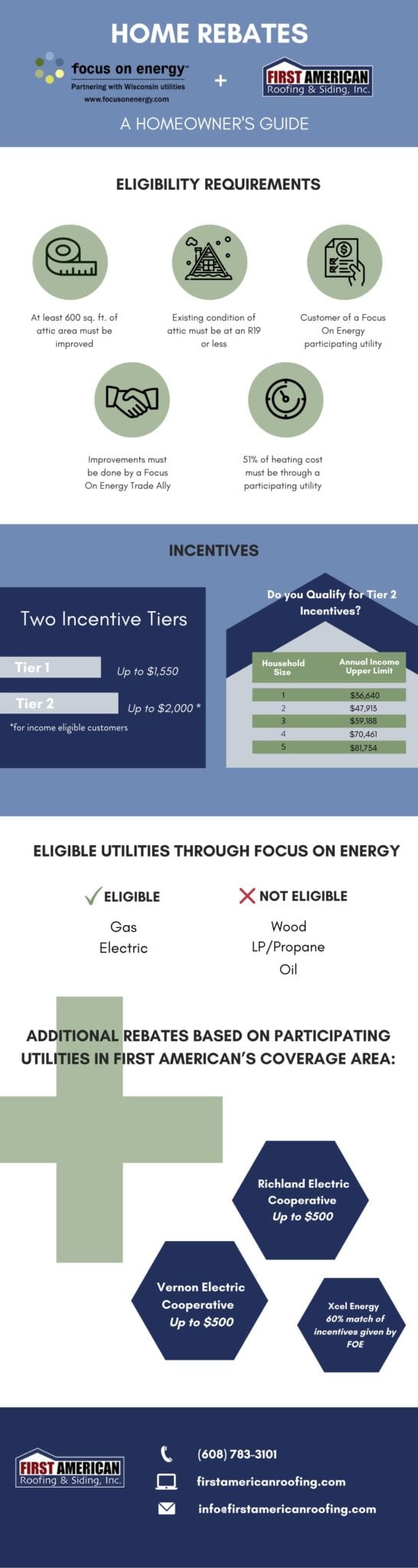

https://infographicjournal.com/wp-content/uploads/2013/02/My-Infographic1.jpg

The Homeowners Guide To Tax Credits And Rebates

https://blog.constellation.com/wp-content/uploads/2016/12/search-rebates-zipcode.gif

Taking Advantage Of HVAC Rebates Federal Tax Credits With An

https://149354076.v2.pressablecdn.com/wp-content/uploads/2020/10/Taking-Advantage-of-HVAC-Rebates-and-Federal-Tax-Credits-with-An-HVAC-System.png

Web 26 juil 2023 nbsp 0183 32 Energy Efficient Home Improvement Credit These expenses may qualify if they meet requirements detailed on energy gov Exterior doors windows skylights and insulation materials Central air conditioners water heaters furnaces boilers and heat Web 22 d 233 c 2022 nbsp 0183 32 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and

Web SCEP Announces 8 5 Billion Home Energy Rebate Programs The U S Department of Energy s Karen Zelmar explains the Inflation Reduction Act s Home Energy Rebate Programs and their top energy savings goals Video courtesy of the U S Department of Web Effective January 1 2023 the Energy Efficient Home Improvement Federal Tax Credit EEHI gives you a tax credit equal to 30 of equipment and installation costs for the highest efficiency tier products up to 600 for qualified air conditioners and 600 for

Download Tax Rebates For Energy Efficient Home Heating Systems

More picture related to Tax Rebates For Energy Efficient Home Heating Systems

Guide To Rebates Tax Credits And Manufacturer And Dealer Incentives

https://s3-us-east-2.amazonaws.com/comfortmon-01-prod-wp/content/uploads/2019/08/p_rebates.png

Utility Company Rebates And Government Tax Incentives AEE

http://www.aee-inc.com/images/2017-dte-rebates.png

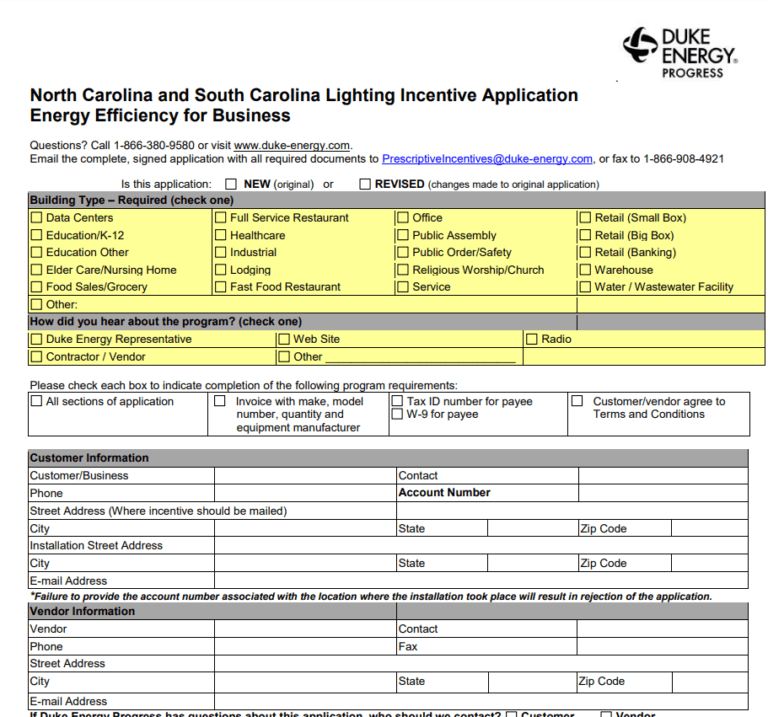

Duke Energy Rebate Form Air Conditioner Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/08/Duke-Energy-Rebate-Form-768x717.png

Web The following energy efficient home improvements are eligible for the Energy Efficient Home Improvement Credit o insulation materials or systems and air sealing materials or systems 30 of costs Home energy audits 30 of costs up to 150 see Q5 under Web 3 f 233 vr 2023 nbsp 0183 32 Under the Inflation Reduction Act you can get a tax credit for 30 percent of the cost of installing clean energy systems in your home including solar panels wind turbines battery storage and more 2 Get Pumped Heat pumps are rapidly gaining

Web 31 mars 2023 nbsp 0183 32 Taxes Personal Finance Money Home How to Get Valuable Home Energy Tax Credits You can still get tax breaks for energy efficient home improvements and the IRS has expanded them Web 28 ao 251 t 2023 nbsp 0183 32 Many states label energy efficiency incentives as rebates even though they don t qualify under that definition Those incentives could be included in your gross income for federal income tax purposes Find more about how subsidies affect home energy

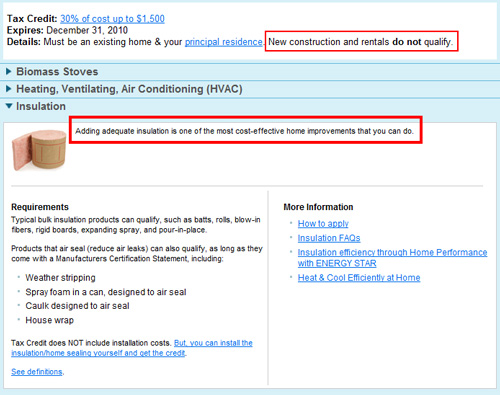

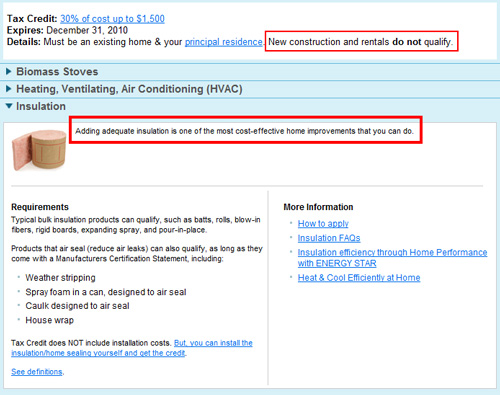

Rental Property Owners Need Not Apply Federal Energy Efficiency Tax

https://radioviceonline.com/wp-content/uploads/2010/10/energy-rebate-rentals-excluded.jpg

Focus On Energy A Wisconsin Homeowner s Guide To Rebates

https://firstamericanroofing.com/wp-content/uploads/2020/03/FOCUS-On-ENERGY-Rebates-for-your-home-scaled.jpg

https://www.irs.gov/credits-deductions/energy-efficient-home...

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use

https://www.cbsnews.com/news/inflation-reduction-act-joe-biden-climate...

Web 9 sept 2022 nbsp 0183 32 High Efficiency Electric Home Rebate Act HEEHRA This provides rebates for low and middle income families to electrify their homes such as by installing heat pumps or electric clothes

2023 Home Energy Rebates Grants And Incentives Top Rated Barrie

Rental Property Owners Need Not Apply Federal Energy Efficiency Tax

Tax Rebate On Energy Efficient Air Conditioners AirRebate

Piedmont Natural Gas Rebates Fill Online Printable Fillable Blank

Florida Energy Rebates For Air Conditioners Fcs3266 Fy1032 Energy

Alliant Energy Rebates 2022 Printable Rebate Form

Alliant Energy Rebates 2022 Printable Rebate Form

Energy Efficient Rebates Tax Incentives For MA Homeowners

Energy Efficiency Rebate Options JPUD

Rebates For Home Energy Efficiency Improvements Energy Efficiency

Tax Rebates For Energy Efficient Home Heating Systems - Web 13 avr 2023 nbsp 0183 32 Any combination of home energy efficient improvements windows doors skylights insulation electrical plus furnaces boilers and central air conditioners cannot add up to more than 1 200 in annual rebates