Tax Rebates For Homeowners Web Breaker box 4 000 limit Electric wiring 2 500 limit Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you

Web Newly passed legislation will cover energy related tax credits and rebates starting in the 2023 tax year so we put together a list of some common home improvement and renewable energy tax credits that may help Web 9 sept 2022 nbsp 0183 32 Compared with electric resistance heating like baseboard heaters they can reduce electricity use by about 50 according to the Department of Energy Ranging

Tax Rebates For Homeowners

Tax Rebates For Homeowners

https://cdn.ihaveamortgageforthat.ca/images/20190224160245/iHaveAMortgageForThat_TAX_REBATES_FOR_HOMEOWNERS-768x414.jpg

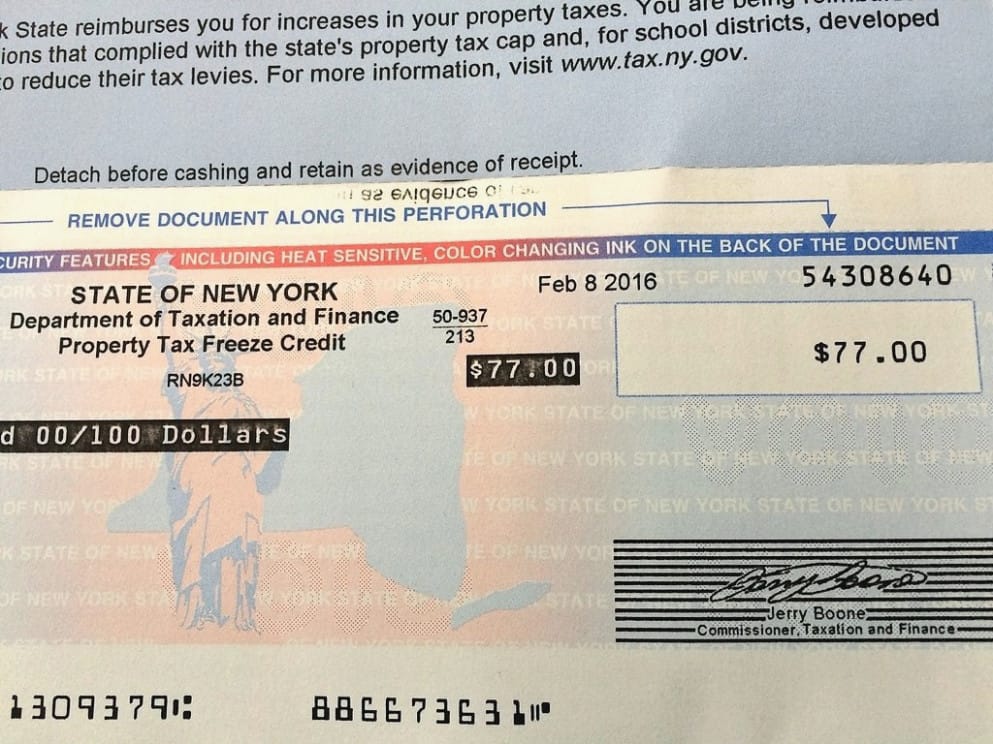

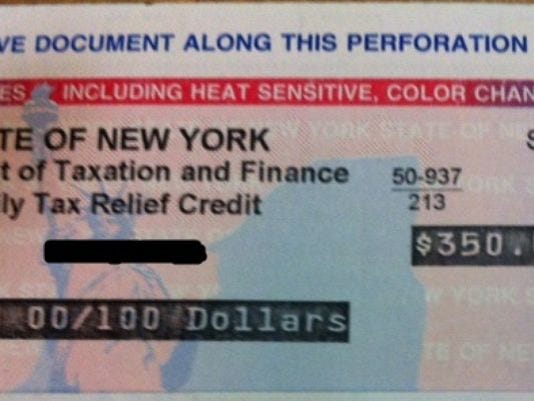

Tax Rebate Checks Come Early This Year Yonkers Times

https://yonkerstimes.com/wp-content/uploads/2018/09/check-2-2.jpg

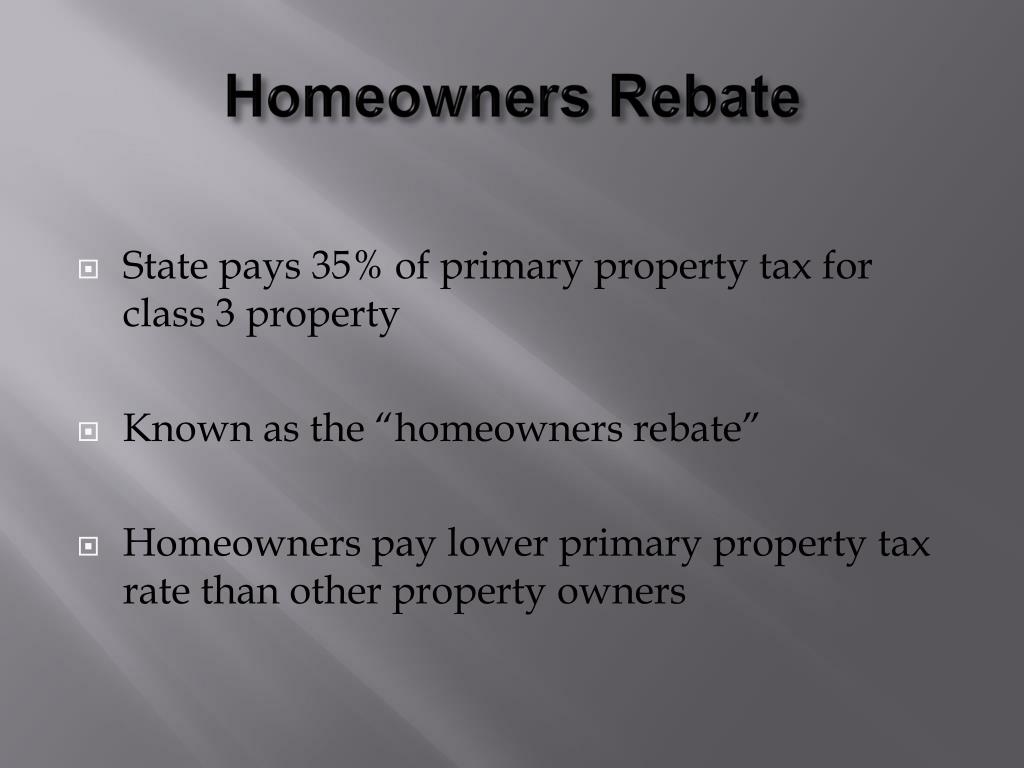

PPT Property Tax PowerPoint Presentation Free Download ID 1400751

https://image.slideserve.com/1400751/homeowners-rebate-l.jpg

Web 26 juil 2023 nbsp 0183 32 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 biomass stoves and boilers have a separate annual credit limit of Web 1 janv 2023 nbsp 0183 32 Clean Vehicle Credits If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can

Web 5 sept 2023 nbsp 0183 32 About the IRA Do I Qualify Homeowner Benefits Timeline Tips Highlights The Inflation Reduction Act of 2022 became law on August 16 2022 Homeowners can Web 30 d 233 c 2022 nbsp 0183 32 Savings for Homeowners New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements

Download Tax Rebates For Homeowners

More picture related to Tax Rebates For Homeowners

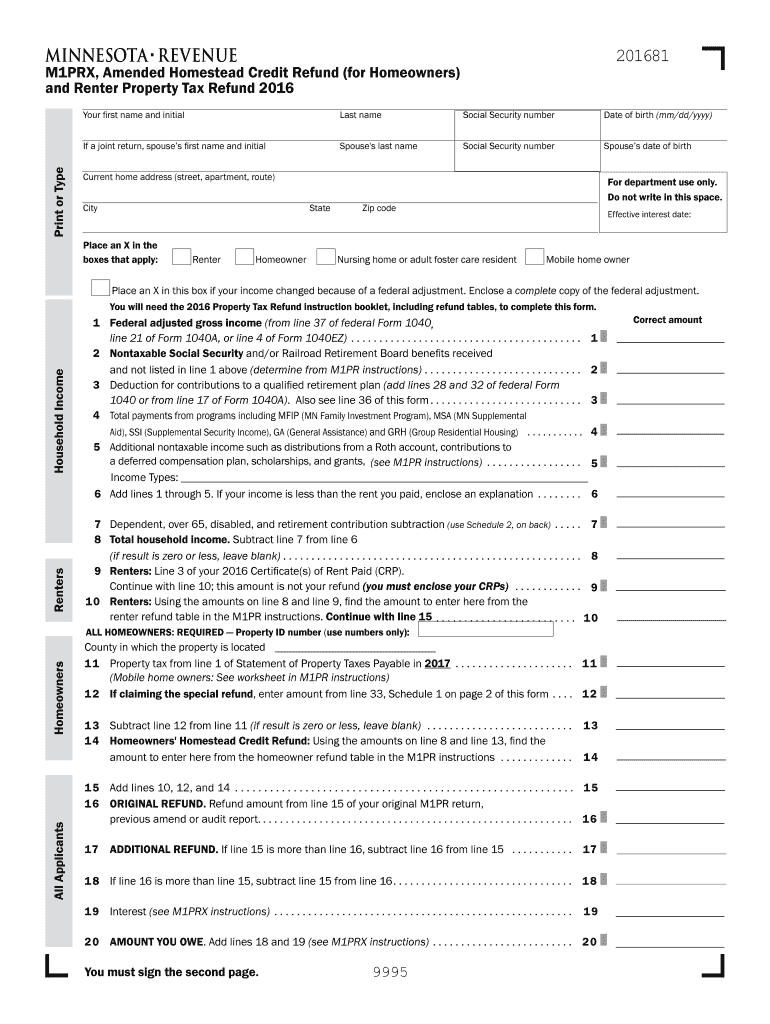

M1PRX Amended Homestead Credit Refund For Homeowners Fill Out And

https://www.signnow.com/preview/397/780/397780212/large.png

10 Rebates And Tax Credits More Homeowners Should Take Advantage Of

https://i.pinimg.com/originals/68/15/d6/6815d688370209e9c2c08f34ea1eb7cd.png

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

https://asapapartmentfinders.com/wp-content/uploads/2016/12/tax-rebate.jpg

Web 10 janv 2023 nbsp 0183 32 For tax year 2022 Homeowners can claim a federal tax credit for 10 of the cost of insulation materials and other energy efficient improvements such as energy Web 13 f 233 vr 2023 nbsp 0183 32 The IRA allows homeowners a 30 tax credit for some energy efficient updates capped at 1 200 per year There s also a 2 000 credit for heat pumps heat pump water heaters and biomass stoves

Web 8 sept 2023 nbsp 0183 32 Tax Credits for Homeowners What can you deduct as if you own a house Personal Finance Tax Credits Who is eligible for the 1 200 Tax Credit Montana Web 11 ao 251 t 2022 nbsp 0183 32 Homeowners interested in adding rooftop solar panels installing heat pumps and otherwise green ifying their houses have plenty to like in the big climate

Working From Home Tax Rebate Form 2022 Printable Rebate Form

https://www.printablerebateform.com/wp-content/uploads/2021/07/Work-from-Home-Tax-Rebate-Form-2021.jpg

Residents In These Md Counties Pay The Highest Property Taxes

https://washingtonreianetwork.com/wp-content/uploads/2017/07/countytax.jpg

https://www.cnet.com/home/energy-and-utilities/how-to-get-tax-credits...

Web Breaker box 4 000 limit Electric wiring 2 500 limit Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you

https://www.constellation.com/energy-101/ho…

Web Newly passed legislation will cover energy related tax credits and rebates starting in the 2023 tax year so we put together a list of some common home improvement and renewable energy tax credits that may help

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

Working From Home Tax Rebate Form 2022 Printable Rebate Form

Where It Takes The Least Time For Renters To Become Homeowners 2019

When Will The Hudson Valley Receive Their Homeowners Tax Rebate

Paulding County Homestead Exemption

Paulding County Homestead Exemption

Agawam Tax Rates Fall But Homeowners Will Pay More As Values Rise

Mass Tax Rebate Check

11 Tax Deductions For Homeowners 1040Return File 1040 1040ez And

Tax Rebates For Homeowners - Web 12 sept 2023 nbsp 0183 32 You re eligible for a rebate of 2 500 plus Austin Energy s Value of Solar Tariff which pays you 0 097 for every kilowatt hour kWh your solar panels can