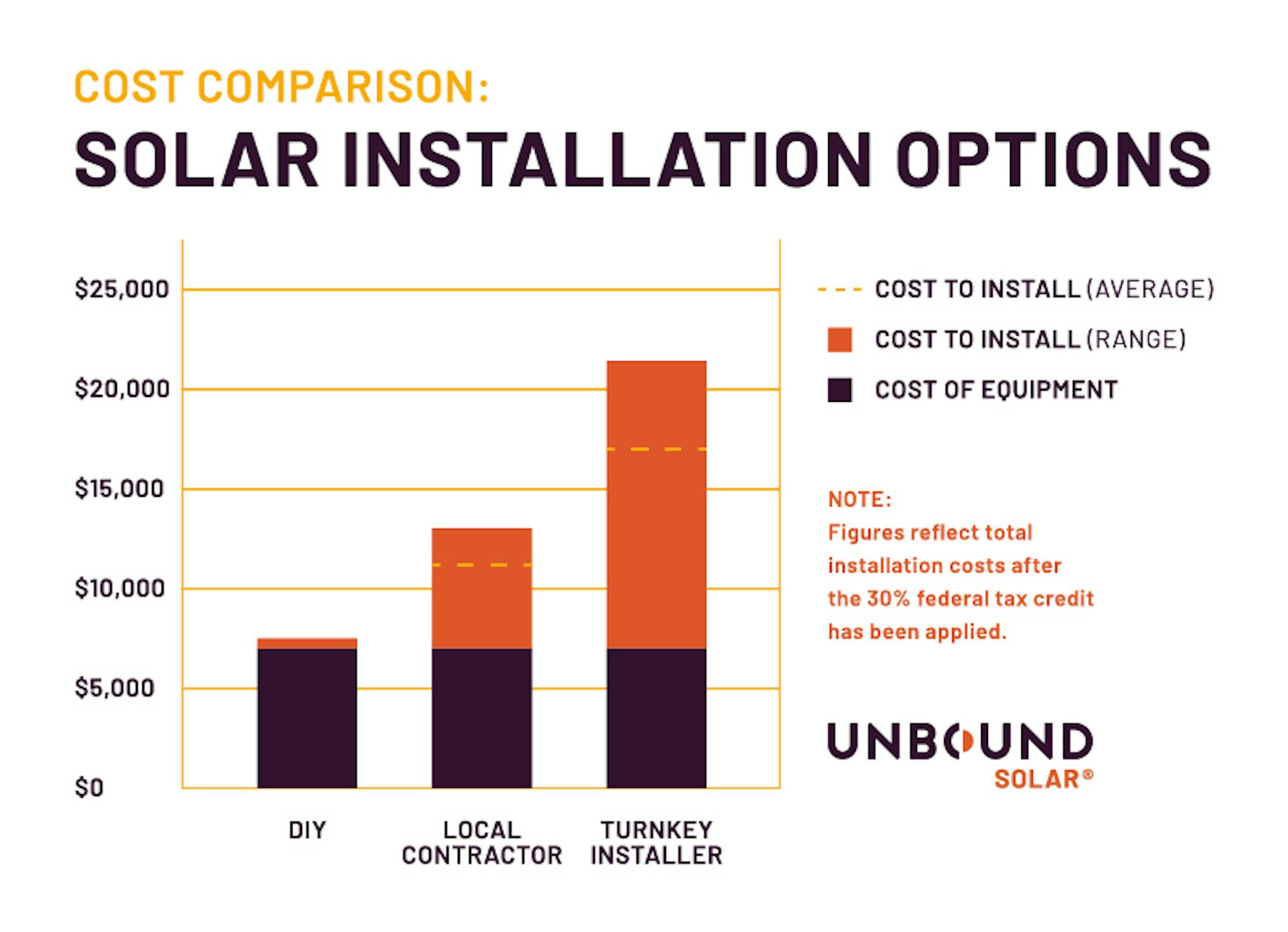

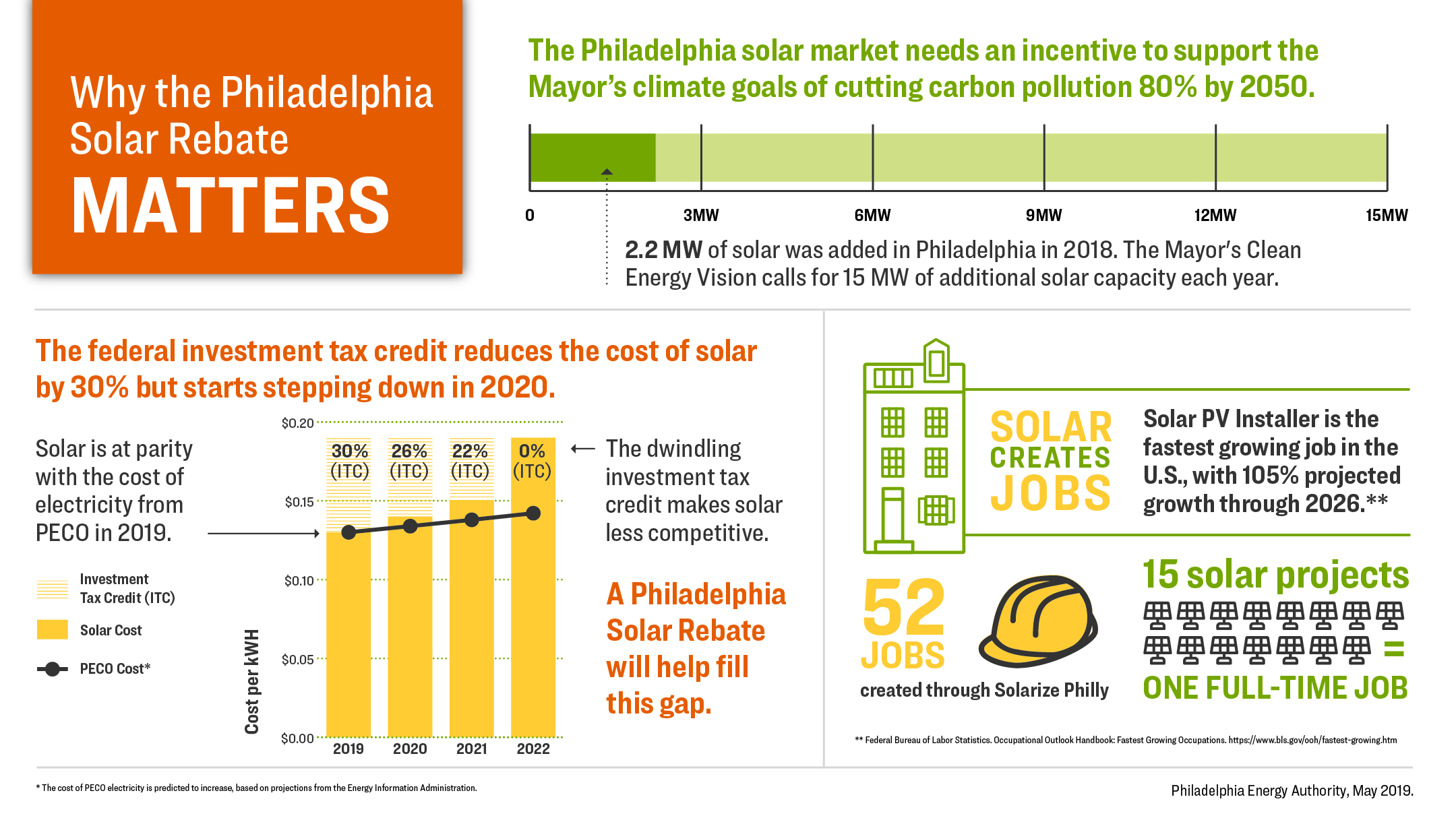

Tax Rebates For Solar Web 8 sept 2022 nbsp 0183 32 The ITC will cut the cost of installing rooftop solar for a home by 30 or more than 7 500 for an average system By helping Americans get solar on their roofs these tax credits will help millions more families

Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this Web 27 avr 2023 nbsp 0183 32 The tax credit is up to 25 of the cost of the solar PV panels but this is capped at R15 000 Paschini noted that the regulations ensure there is no duplication of tax incentives For example if you sell the solar panels for which you claimed the tax credit

Tax Rebates For Solar

Tax Rebates For Solar

https://i0.wp.com/www.powerrebate.net/wp-content/uploads/2023/05/tax-rebates-for-solar-power-ineffective-for-low-income-americans-but-1.jpg?w=1050&ssl=1

New York Solar Power For Your House Rebates Tax Credits Savings

http://www.solarpowerrocks.com/wp-content/uploads/2014/09/NewYorkPaybackYes-Lease.png

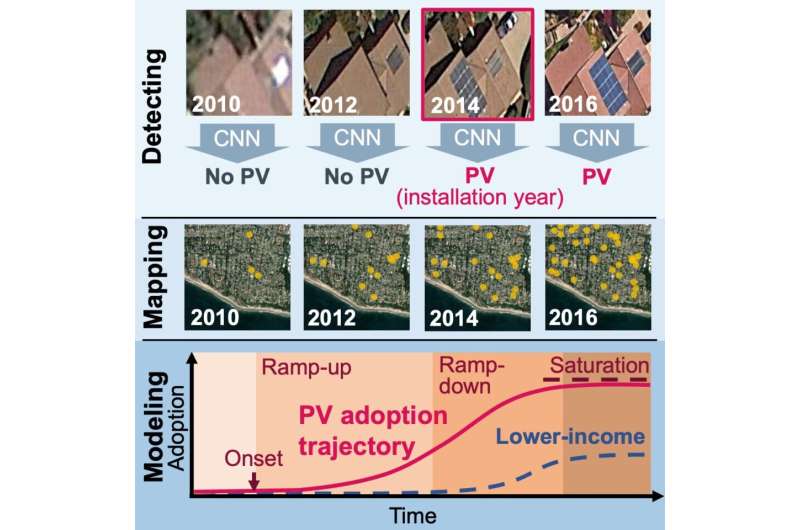

Tax Rebates For Solar Power Ineffective For Low income Americans But

https://scx1.b-cdn.net/csz/news/800a/2022/tax-rebates-for-solar.jpg

Web 1 ao 251 t 2023 nbsp 0183 32 The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home What is the federal solar tax credit The Web 26 juil 2023 nbsp 0183 32 Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 If you make energy improvements to your home tax credits are available for a portion of

Web 7 ao 251 t 2023 nbsp 0183 32 Therefore you should speak to your solar provider to supply the proper documentation and instructions which include the following File IRS Form 5695 as part of your tax return In Part I calculate the credit of the tax form File your solar system as Web 21 avr 2023 nbsp 0183 32 Starting in August 2022 the solar tax credit also called the Residential Clean Energy Credit homeowners can get a tax credit equal to 30 of the cost to install solar panels The solar tax credit can save

Download Tax Rebates For Solar

More picture related to Tax Rebates For Solar

2018 Guide To West Virginia Home Solar Incentives Rebates And Tax

https://i.pinimg.com/originals/2a/b8/14/2ab814871ec51f6c0c811affc8287602.png

2020 Guide To Oregon Solar Incentives Rebates Tax Credits More

https://www.solarpowerrocks.com/wp-content/uploads/2020/01/2020-OR-solar-rebates--ranked.png

Solar Rebate How It Works Ballarat Renewable Energy And Zero Emissions

https://breaze.org.au/images/19/Solar Rebate June 2019 Poster FB.png

Web 12 mai 2023 nbsp 0183 32 These rebates and incentives include a federal tax credit state rebates and state and local credits loans tax exemptions and grants that can help cut the cost of going solar by at least 30 Table of Web but it will not reduce the federal solar tax credit Rebate from My State Government Unlike utility rebates rebates from state governments generally do not reduce your federal tax credit For example if your solar PV system was installed in 2022 installation costs

Web 14 f 233 vr 2022 nbsp 0183 32 Solar Tax Credit is a term used to describe the Federal solar tax credit which is also known as Section 25D of the Internal Revenue Code This solar tax credit allows taxpayers who install solar energy systems in their homes and businesses to Web 8 sept 2022 nbsp 0183 32 The U S Department of Energy DOE Solar Energy Technologies Office SETO developed three resources to help Americans navigate changes to the federal solar Investment Tax Credit ITC which was expanded in 2022 through the passage of the

The Truth About The Solar Rebate SAE Group

https://web.archive.org/web/20190329204324/https://saegroup.com.au/wp-content/uploads/2015/07/Rebate-end1.jpg

Texas Solar Power For Your House Rebates Tax Credits Savings

https://solarpowerrocks.com/wp-content/uploads/2016/12/tx-header-image.png

https://www.energy.gov/eere/solar/articles/sol…

Web 8 sept 2022 nbsp 0183 32 The ITC will cut the cost of installing rooftop solar for a home by 30 or more than 7 500 for an average system By helping Americans get solar on their roofs these tax credits will help millions more families

https://www.energy.gov/sites/default/files/2021/02/f82/Guide …

Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this

Minnesota Solar Power For Your House Rebates Tax Credits Savings

The Truth About The Solar Rebate SAE Group

2018 Guide To Florida Home Solar Incentives Rebates And Tax Credits

Solar Tax Credits Rebates Missouri Arkansas

Federal Solar Tax Credit Save Money On Solar KC Green Energy

Solar Rebates Benefit SOLARInstallGURU Advantages Of Solar Energy Blog

Solar Rebates Benefit SOLARInstallGURU Advantages Of Solar Energy Blog

Solar Panel Tax Credit Unbound Solar

The Federal Solar Tax Credit Explained Sunshine Plus Solar

Councilwoman Reynolds Brown Introduces Legislation To Establish A Solar

Tax Rebates For Solar - Web 1 ao 251 t 2023 nbsp 0183 32 The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home What is the federal solar tax credit The