Tax Rebates In Pakistan Web 7 juil 2023 nbsp 0183 32 Individual Other tax credits and incentives Last reviewed 07 July 2023 There are no other significant tax credits or incentives for individuals in Pakistan

Web 27 juil 2021 nbsp 0183 32 Significant tax credits and tax exemptions for the financial year 2021 2022 are given below Profits from an electric power generation project Profits from a transmission line project setup Profits by refineries Web Foreign tax relief Any foreign source salary received by a resident individual is exempt from tax in Pakistan if the individual has paid foreign income tax in respect of that salary

Tax Rebates In Pakistan

Tax Rebates In Pakistan

https://www.zameen.com/blog/wp-content/uploads/2019/05/infographic-2-1024x640.jpg

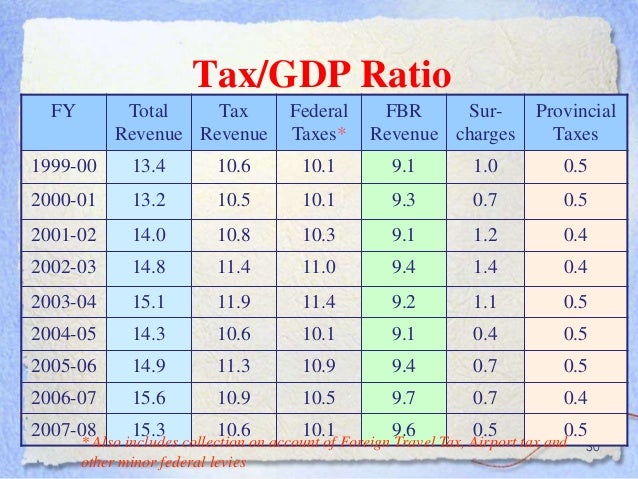

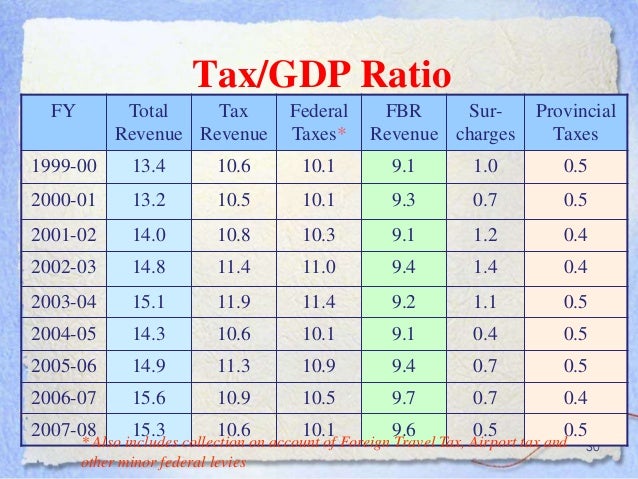

25 Years Of Taxes In Pakistan

https://image.slidesharecdn.com/25yearsoftaxesinpakistan-130817233012-phpapp01/95/25-years-of-taxes-in-pakistan-30-638.jpg?cb=1376782325

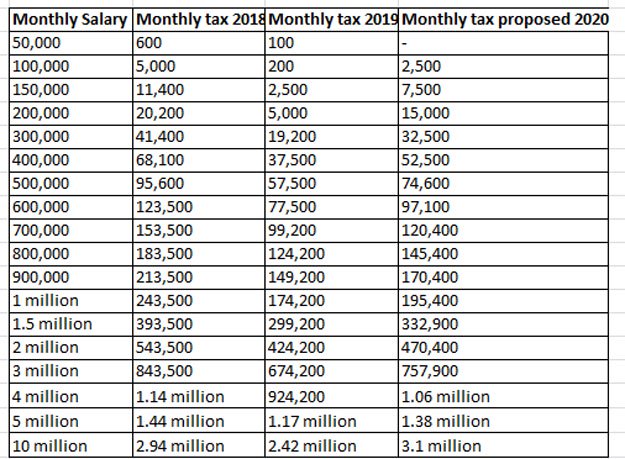

Employment Taxation KK Consultant Consultancy Firm Rawalpindi

https://kkconsultant.net/wp-content/uploads/2019/01/salary-tax-rate-2019-Pakistan.jpg

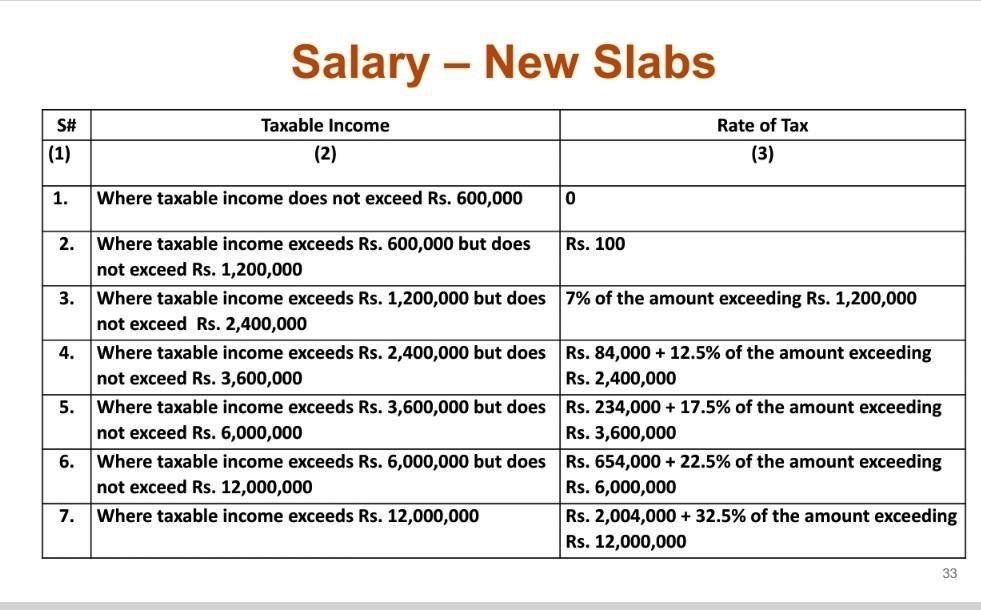

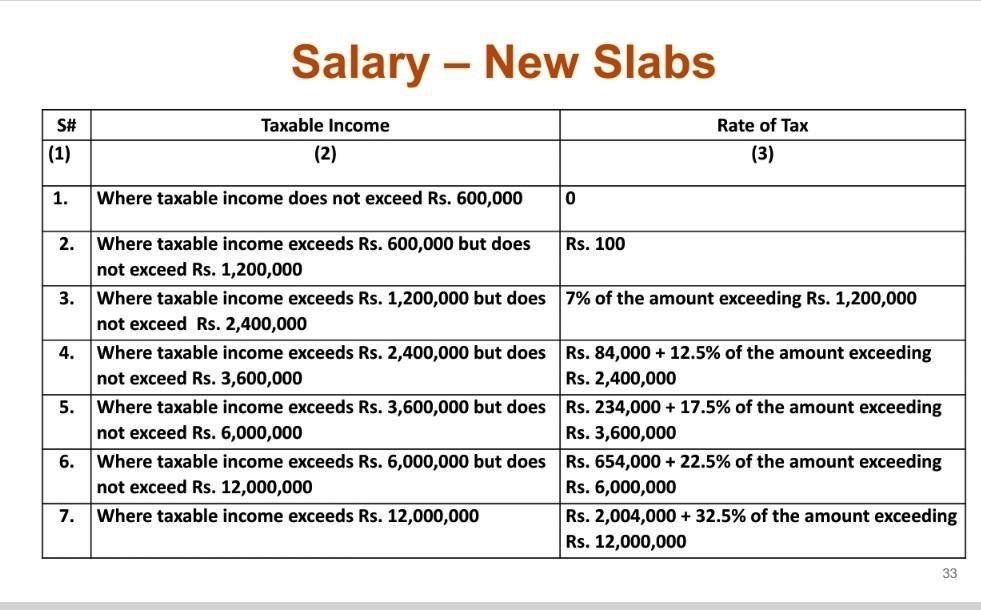

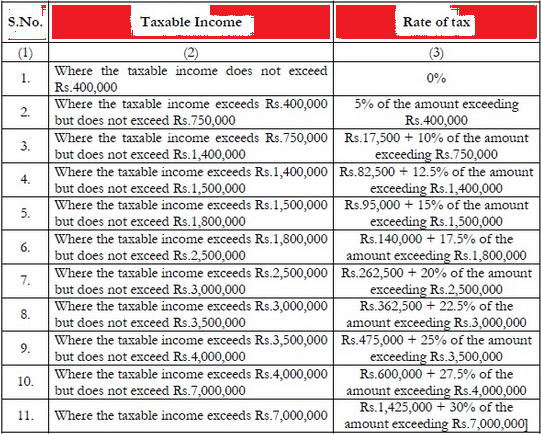

Web 15 f 233 vr 2023 nbsp 0183 32 Pakistan laid a supplementary finance bill before parliament on Wednesday proposing to raise the goods and services tax GST to 18 from 17 to help raise 170 Web 20 juin 2022 nbsp 0183 32 The existing income slabs and rate of tax for salaried persons READ MORE FBR assigned tax collection target of Rs7 trillion in 2022 2023 1 Where taxable income

Web Foreign tax relief A resident entity may claim a credit for income tax paid outside Pakistan on its foreign source income against its tax liability in Pakistan The amount of the credit Web There is an upper limit on the amount of donation eligible for tax benefit being 30 of taxable income where donor is an individual or AOP and 20 where donor is a

Download Tax Rebates In Pakistan

More picture related to Tax Rebates In Pakistan

11 Income Tax Rate 2018 19 Pakistan TheaIonatan

https://macropakistani.com/wp-content/uploads/2020/08/Taxes-are-a-problem.png

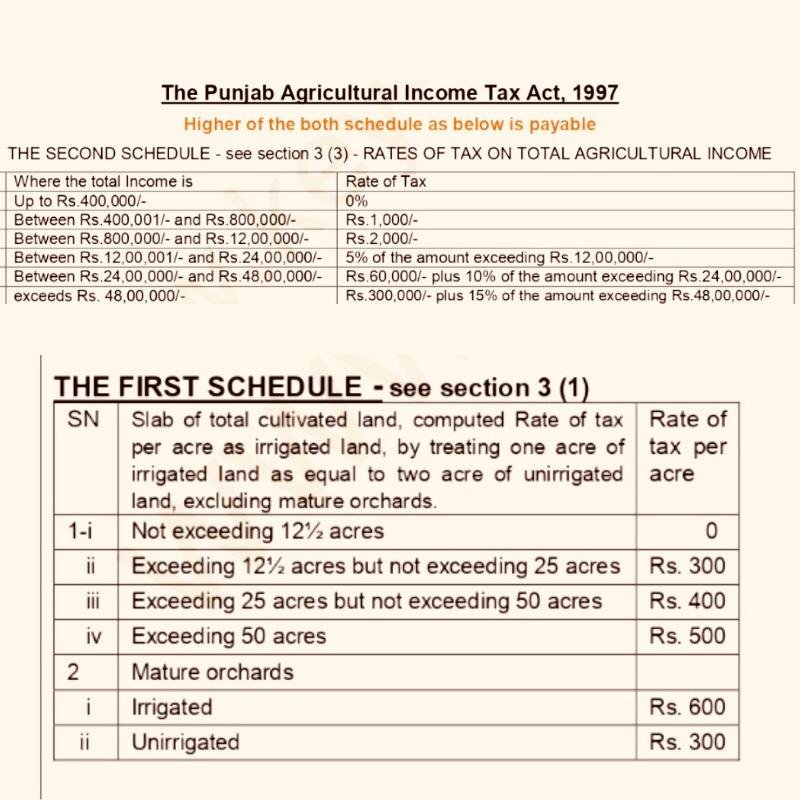

Tax On Agricultural Income In Pakistan 2022 Easy Latest Tax

https://tax.net.pk/wp-content/uploads/2021/01/Agriculture-Income-Tax-Rates-Provincial.jpeg

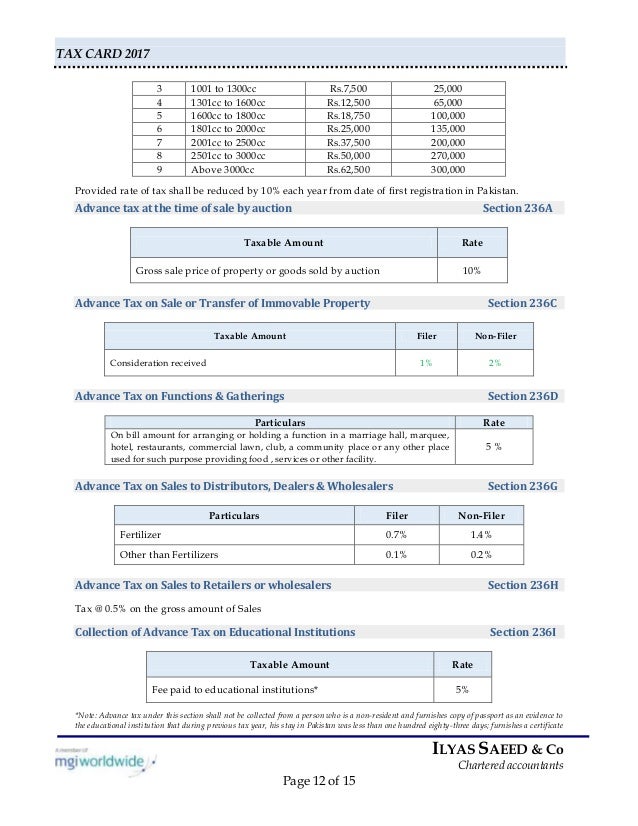

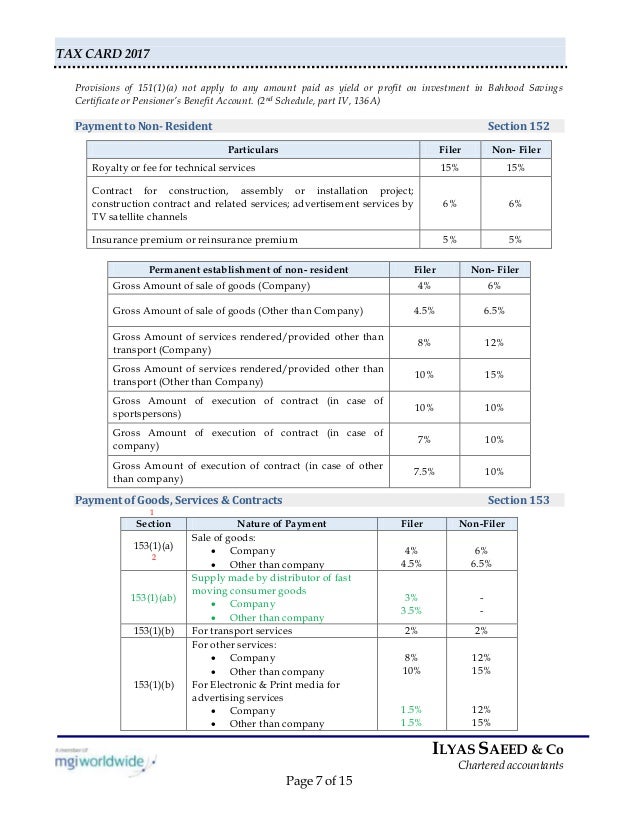

Tax Card In Pakistan Rate Of Taxes

https://image.slidesharecdn.com/iscotaxcardty2017-170924161051/95/tax-card-in-pakistan-rate-of-taxes-13-638.jpg?cb=1506269723

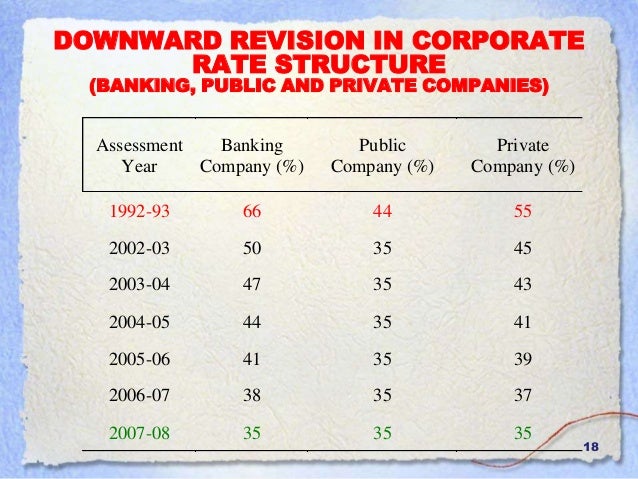

Web Corporate Income tax rates Currently the Corporate Income tax rate is 29 for tax year 2019 and onwards whereas the corporate tax rate is 35 for Banking Industry for TY Web There are the following tax credits rebates are allowable Full Time Teacher allowance under 2 schedule Part 3 Clause 2 Tax Credit on Pensioner s benefit account and

Web 4 d 233 c 2022 nbsp 0183 32 Tax Solutions Understanding Tax Adjustments and Rebates in Pakistan BySumera Shafqat December 4 2022 Write a Comment Filing taxes is an essential Web Income Tax Basics Register For Income Tax Change Your Personal Details File Income Tax Return Active Taxpayer List ATL Withholding Tax Rates Pay Income Tax

Income Tax Slabs Year 2022 23 Info Ghar Educational News

https://infoghar.com/wp-content/uploads/2022/06/Income-Tax-Slabs-for-year-2022-23.jpg

Govt Of Pakistan Has Reduced Taxes On Mobile Phones Coming Phones

https://3.bp.blogspot.com/-CkG88a6L3AE/XE3uerBDgDI/AAAAAAAADY0/dKrSr_1pyrUovZLN7C6HKua2RgOtn46rACLcBGAs/s1600/Capture.PNG

https://taxsummaries.pwc.com/pakistan/individual/other-tax-credits-and...

Web 7 juil 2023 nbsp 0183 32 Individual Other tax credits and incentives Last reviewed 07 July 2023 There are no other significant tax credits or incentives for individuals in Pakistan

https://tax.net.pk/2021/07/27/updated-tax-ex…

Web 27 juil 2021 nbsp 0183 32 Significant tax credits and tax exemptions for the financial year 2021 2022 are given below Profits from an electric power generation project Profits from a transmission line project setup Profits by refineries

Budget 2019 20 Salaried Class To Pay More Taxes Under PTI Govt

Income Tax Slabs Year 2022 23 Info Ghar Educational News

Income Tax Slab Rates For Salaried Class In Pakistan 2023 24

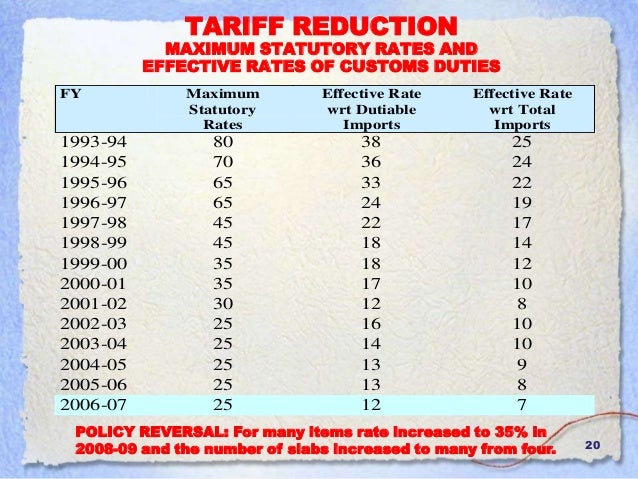

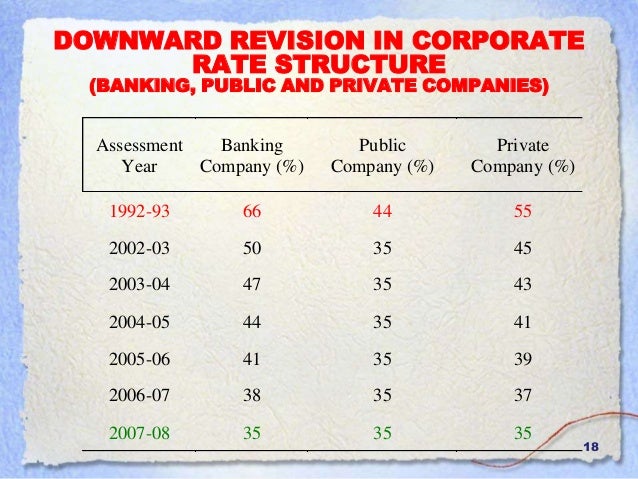

25 Years Of Taxes In Pakistan

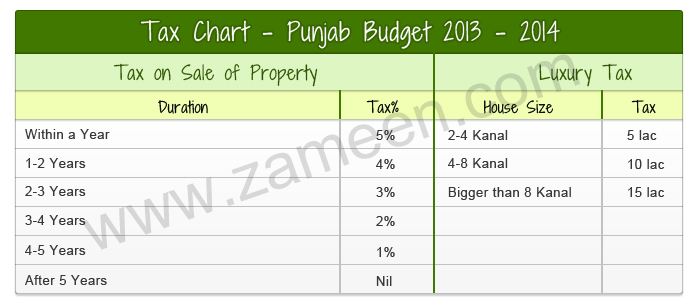

Punjab Tax

25 Years Of Taxes In Pakistan

25 Years Of Taxes In Pakistan

Tax Card In Pakistan Rate Of Taxes

11 Income Tax Rate 2018 19 Pakistan BroghanAdrijus

Income Tax Slab 2020 21 Pakistan Tax Rates For Salaried Non

Tax Rebates In Pakistan - Web 15 f 233 vr 2023 nbsp 0183 32 Pakistan laid a supplementary finance bill before parliament on Wednesday proposing to raise the goods and services tax GST to 18 from 17 to help raise 170