Tax Rebates On Geothermal Systems Web 28 ao 251 t 2023 nbsp 0183 32 Residential Clean Energy Credit If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may

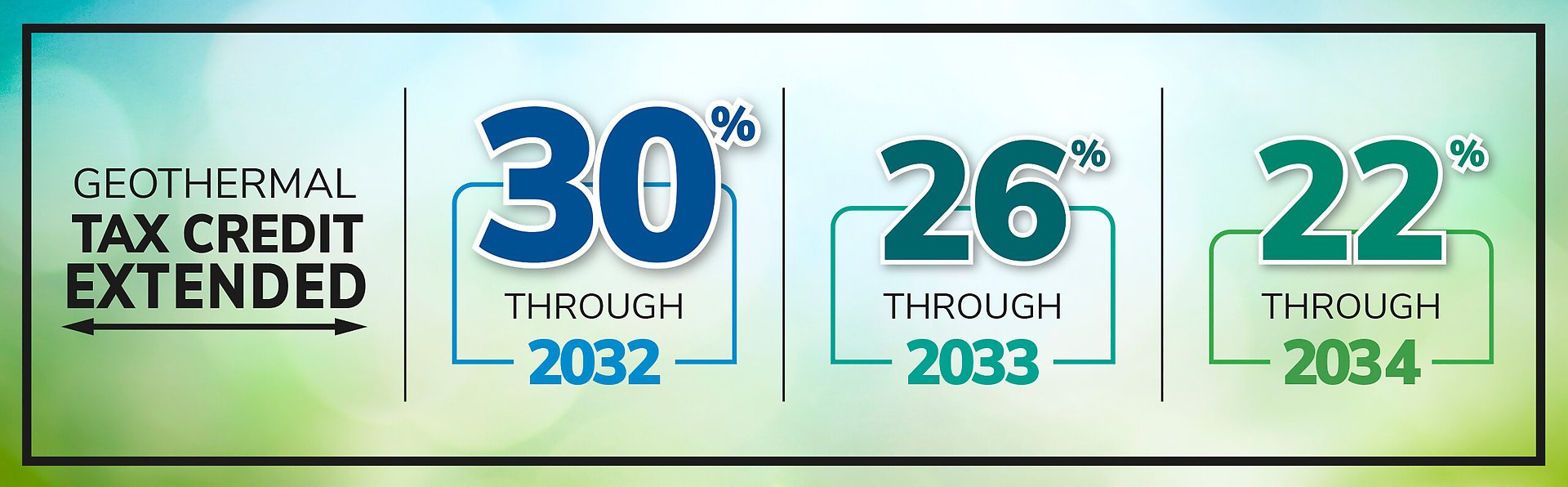

Web 3 d 233 c 2019 nbsp 0183 32 The federal tax credit initially allowed homeowners to claim 30 percent of the amount they spent on purchasing and installing a geothermal heat pump system from their federal income taxes The tax credit Web 23 mai 2023 nbsp 0183 32 Under the Inflation Reduction Act of 2022 IRA the federal tax credit for residential geothermal system installations was increased from 26 to 30 effective

Tax Rebates On Geothermal Systems

Tax Rebates On Geothermal Systems

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/what-incentives-rebates-are-available-for-geothermal-in-connecticut-2.png

Form Rpd 41346 New Mexico Geothermal Ground Coupled Heat Pump Tax

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/form-rpd-41346-new-mexico-geothermal-ground-coupled-heat-pump-tax.png?w=530&ssl=1

30 Tax Rebate HB McClure

http://hbmcclure.com/wp-content/uploads/30-Percent-tax-credit-geothermal-1.jpg

Web 4 janv 2021 nbsp 0183 32 Claiming a geothermal tax credit is as simple as filing your taxes next year The IRS issues federal tax credits themselves When submitting a tax return file Form 5695 under Residential Energy Credits Web US Tax Credits Through 2034 The energy tax credit can be combined with solar and wind credits as well as energy efficiency upgrade credits A 30 federal tax credit for residential ground source heat pump installations

Web The 30 federal tax credit for residential ground source heat pump installations has been extended through December 31 2032 The incentive will be lowered to 26 for systems Web 30 mars 2023 nbsp 0183 32 Budget 2023 proposes to expand eligibility of the Clean Tech Tax Credit to include geothermal energy systems that are eligible for Class 43 1 This includes

Download Tax Rebates On Geothermal Systems

More picture related to Tax Rebates On Geothermal Systems

Connecticut Light and Power Co Residential Geothermal Rebates

https://imgv2-2-f.scribdassets.com/img/document/125270046/original/c1c2a9d10f/1592909115?v=1

Rebate Expiring Slider Copy Lake Country Geothermal

https://i0.wp.com/lakecountrygeothermal.com/wp-content/uploads/2020/01/Rebate-Expiring-Slider-copy.png?ssl=1

ENERGY STAR Rebates For Home Appliances PSEG Long Island

https://www.psegliny.com/saveenergyandmoney/-/media/4DD7C03D215B4B8D92D8A70026290724.ashx

Web In August 2022 the 30 tax credit for geothermal heat pump installations was extended through 2032 and can be retroactively applied to installations placed in service on Web Will this tax credit always be available At this time no The tax credit will phaseout over the next few years 26 tax credit for systems placed in service from January 1 2021 until

Web Help Extend The Geothermal 30 Tax Credit Through 2024 In July a bill was introduced to the House and Senate to push for a five year extension of the 30 tax credit for Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

Heat Pump Geothermal Tax Credit PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/form-rpd-41346-geothermal-ground-coupled-heat-pump-tax-credit-claim.png?fit=530%2C749&ssl=1

Rebate Expiring Slider Copy Lake Country Geothermal

https://i0.wp.com/lakecountrygeothermal.com/wp-content/uploads/2019/11/Rebate-Expiring-Slider-copy.png?fit=2560%2C900&ssl=1

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Web 28 ao 251 t 2023 nbsp 0183 32 Residential Clean Energy Credit If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may

https://dandelionenergy.com/federal-geother…

Web 3 d 233 c 2019 nbsp 0183 32 The federal tax credit initially allowed homeowners to claim 30 percent of the amount they spent on purchasing and installing a geothermal heat pump system from their federal income taxes The tax credit

Energy Efficiency Tax Rebates Solar Energy Companies Energy

Heat Pump Geothermal Tax Credit PumpRebate

Geothermal Wins With New IRA Tax Credits HVAC Distributors

Geothermal Rebates Efficiency Maine Energy Saving Projects

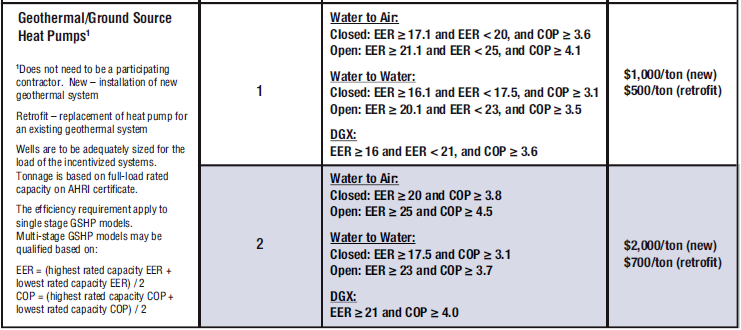

Rebates Incentives For Waterless DX Geothermal

Vermont Energy Tax Credit Rebates Grants For Solar Wind And

Vermont Energy Tax Credit Rebates Grants For Solar Wind And

Tax Rebates For Heat Pumps 2022 PumpRebate

IWAE Alerts Geothermal Heat Pump Owners Regarding New Federal Tax

Geothermal Heat Geothermal Heat Pump Tax Credit PumpRebate

Tax Rebates On Geothermal Systems - Web 15 ao 251 t 2022 nbsp 0183 32 So if you spend 10 000 on a heat pump and a heat pump water heater you could get 9 750 back depending on the specifics of your state s rebate program If your