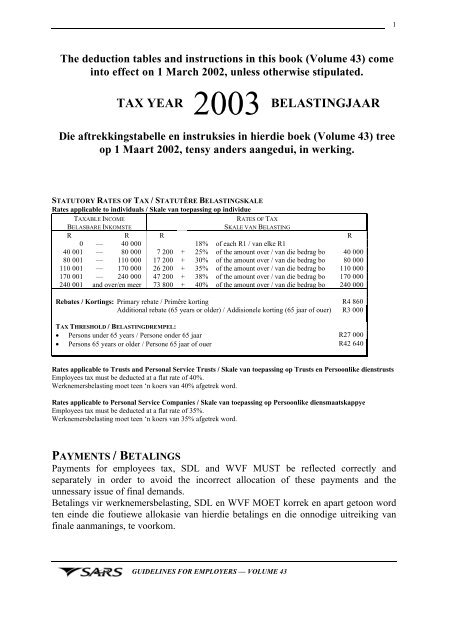

Tax Rebates Sars Web Tax Rates and Rebates Individuals Estates amp Special Trusts 1 Year ending 28 February 2023 Taxable income Rate of tax R0 R226 000 18 of taxable income R226 001

Web This SARS tax pocket guide provides a synopsis of the most important tax duty and levy related information for 2022 23 INCOME TAX INDIVIDUALS AND TRUSTS Tax rates Web Tax Rates and Rebates Individuals Estates amp Special Trusts 1 Year ending 28 February 2022 Taxable income Rate of tax R0 R216 200 18 of taxable income R216 201

Tax Rebates Sars

Tax Rebates Sars

https://i.ytimg.com/vi/ZZjVYJlYUSY/sddefault.jpg

Sars Personal Income Tax Tables 2022 Whichpermit

https://i2.wp.com/www.sanlam.com/productcatalog/PublishingImages/annexure1.PNG

SARS Tax Rates For Individuals South African Tax Consultants

https://www.tax-consultant.co.za/wp-content/uploads/2020/03/Tax-Rebates-and-Thresholds.png

Web 27 juin 2023 nbsp 0183 32 Tax rebates A taxpayer is entitled to so called tax rebates that are deducted from tax payable The rebates have the effect of establishing tax thresholds below Web 20 mars 2018 nbsp 0183 32 A rebate is an amount by which SARS reduces the actual taxes owing depending on certain circumstances SARS will calculate the amount of tax that you owe

Web 20 juil 2023 nbsp 0183 32 Who is it for You are liable to pay income tax if you earn more than For the 2023 year of assessment 1 March 2022 28 February 2023 R91 250 if you are Web Rebates In some instances where your taxable income is below a certain level according to your age group you will not pay any taxes These are the thresholds below Tax

Download Tax Rebates Sars

More picture related to Tax Rebates Sars

Tax Rebate For Individual China Individual Income Tax IIT Reform

https://cawinners.com/wp-content/uploads/2017/02/how-to-claim-rebate-us-87A-of-Income-tax-act-1961.jpg

Sars Tax Tables 2022 Pocket Guideline Brokeasshome

https://img.yumpu.com/42571125/1/500x640/sars-employee-tax-deductions-guidelines-workinfocom.jpg

SARS Tax Rates For Individuals South African Tax Consultants

https://www.tax-consultant.co.za/wp-content/uploads/2021/08/image-1.png

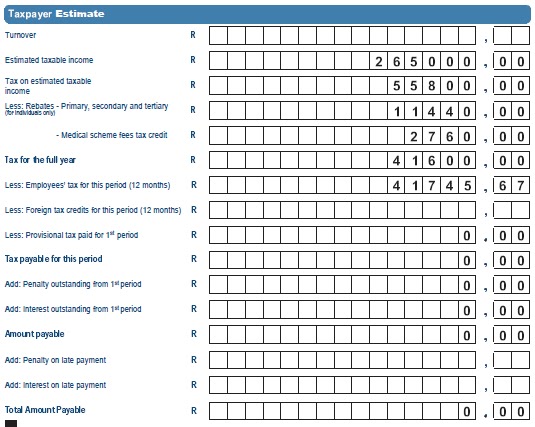

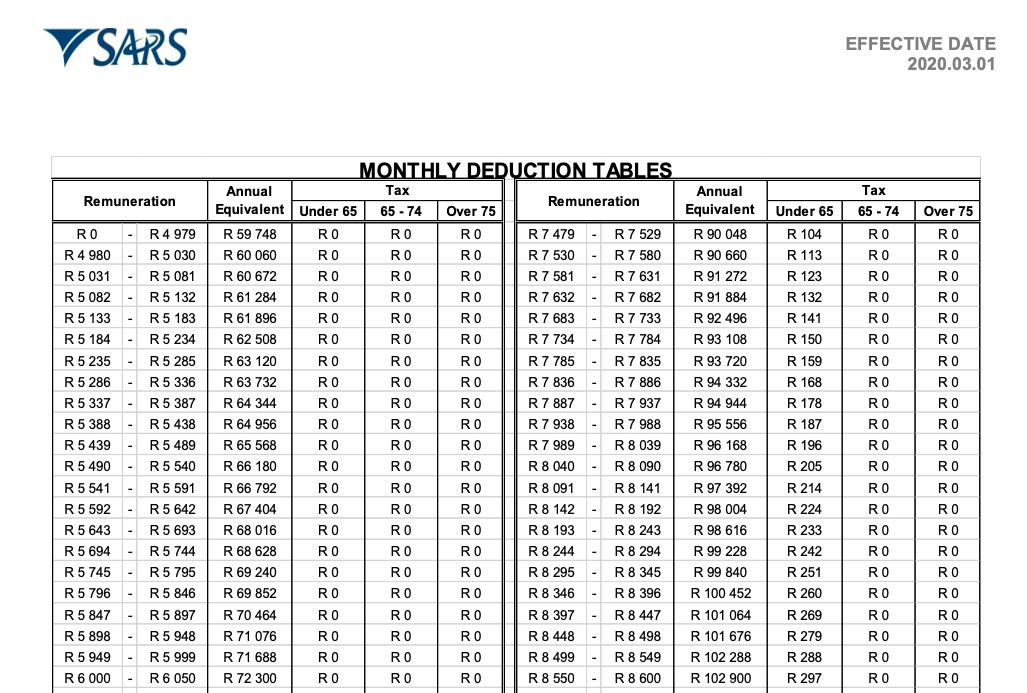

Web Tax compliant businesses in the alcohol sector can apply to the SARS for deferrals of up to three months for excise duty payments In order to qualify for the emergency tax Web What are tax tables SARS tax tables tax brackets for individuals SARS tax tables for businesses Tax rates for trusts Tables for transfer duty Taxes are the main component

Web 1 mars 2021 nbsp 0183 32 The primary and additional age rebate is available to all South African individual taxpayers The rebate is not reduced where a person has taxable income for Web Granting above inflation personal income tax relief of R5 2 billion by adjusting brackets and rebates PLASTIC BAG LEVY Increased by 3 cents to 28 cents per bag from 1 April

How The SARS Income Tax Brackets Work In 2022 Income Tax Brackets

https://i.pinimg.com/originals/28/df/2e/28df2e48fde63dc7e6d71c71080741ba.jpg

Sars 2022 Medical Tax Tables Brokeasshome

https://www.sars.gov.za/wp-content/uploads/images/Rev-2020-Table-2.jpg

https://www2.deloitte.com/content/dam/Deloitte/za/Documen…

Web Tax Rates and Rebates Individuals Estates amp Special Trusts 1 Year ending 28 February 2023 Taxable income Rate of tax R0 R226 000 18 of taxable income R226 001

https://www.sars.gov.za/wp-content/uploads/Docs/Budget/2…

Web This SARS tax pocket guide provides a synopsis of the most important tax duty and levy related information for 2022 23 INCOME TAX INDIVIDUALS AND TRUSTS Tax rates

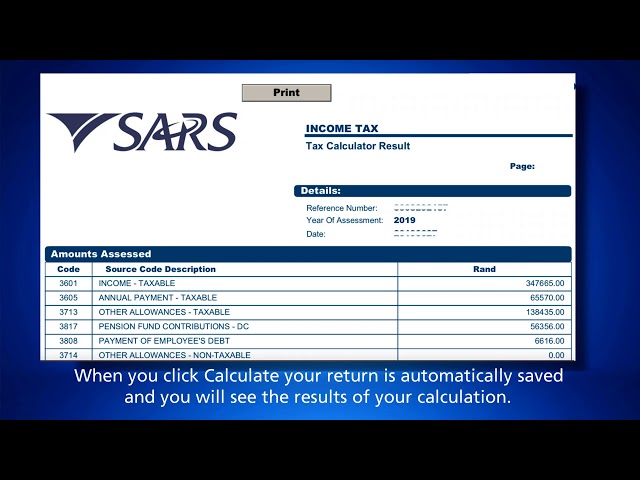

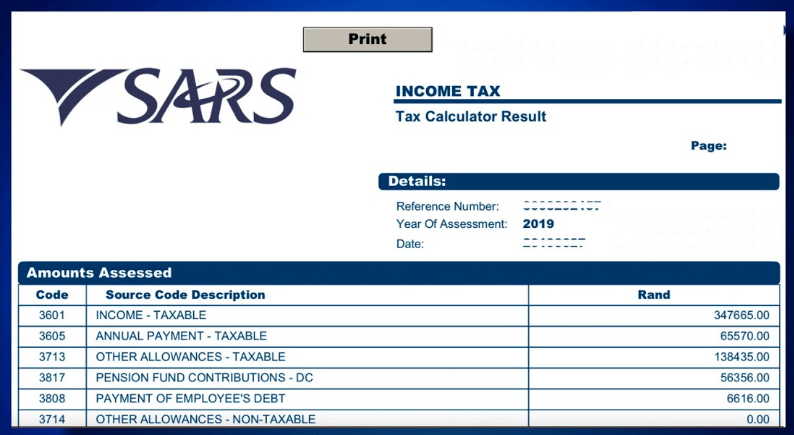

How To Submit An Income Tax Return SARS ITR12 Ujuzi Tz

How The SARS Income Tax Brackets Work In 2022 Income Tax Brackets

Accounting And Financial Updates SARS Provisional Tax Claim Your

SARS Budget 2020 Tax Guide SSK

How To Calculate Sars Penalties And Interest

Sars Tax Tables 2021 To 2022 Brokeasshome

Sars Tax Tables 2021 To 2022 Brokeasshome

National Budget Speech 2023 SimplePay Blog

Biweekly Payroll Tax Table 2021 Federal Withholding Tables 2021

SARS Budget Pocket Guide News

Tax Rebates Sars - Web 27 juin 2023 nbsp 0183 32 Tax rebates A taxpayer is entitled to so called tax rebates that are deducted from tax payable The rebates have the effect of establishing tax thresholds below