Tax Refund 2021 Child Tax Credit Verkko 31 tammik 2022 nbsp 0183 32 A1 The Child Tax Credit is a fully refundable tax credit for families with qualifying children The American Rescue Plan expanded the Child Tax Credit

Verkko 14 hein 228 k 2022 nbsp 0183 32 A1 For tax year 2021 the Child Tax Credit increased from 2 000 per qualifying child to 3 600 for children ages 5 and under at the end of 2021 Verkko 14 hein 228 k 2022 nbsp 0183 32 Advance Child Tax Credit payments are advance payments of your tax year 2021 Child Tax Credit However the total amount of advance Child Tax

Tax Refund 2021 Child Tax Credit

Tax Refund 2021 Child Tax Credit

https://static.twentyoverten.com/5d5413591d304774fba39eb3/6kFYVeqmtJC/Adjusted-Gross-Income.jpg

Earned Income Credit Calculator 2021 DannielleThalia

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T05-0195.gif

Child Tax Credit 2022 Age Limit Latest News Update

https://i2.wp.com/www.cpabr.com/assets/htmlimages/Articles/child tax credit payments chart.JPG

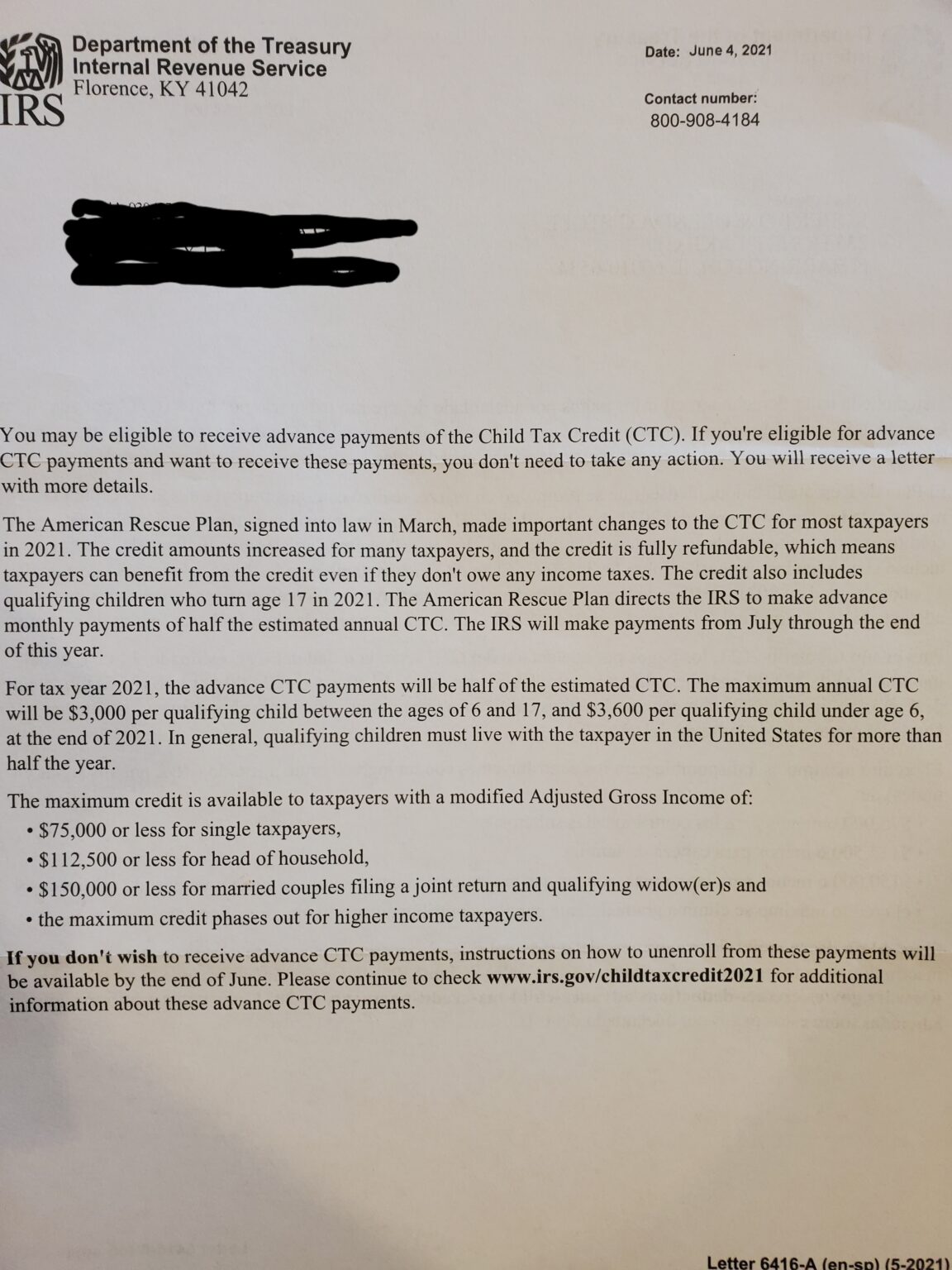

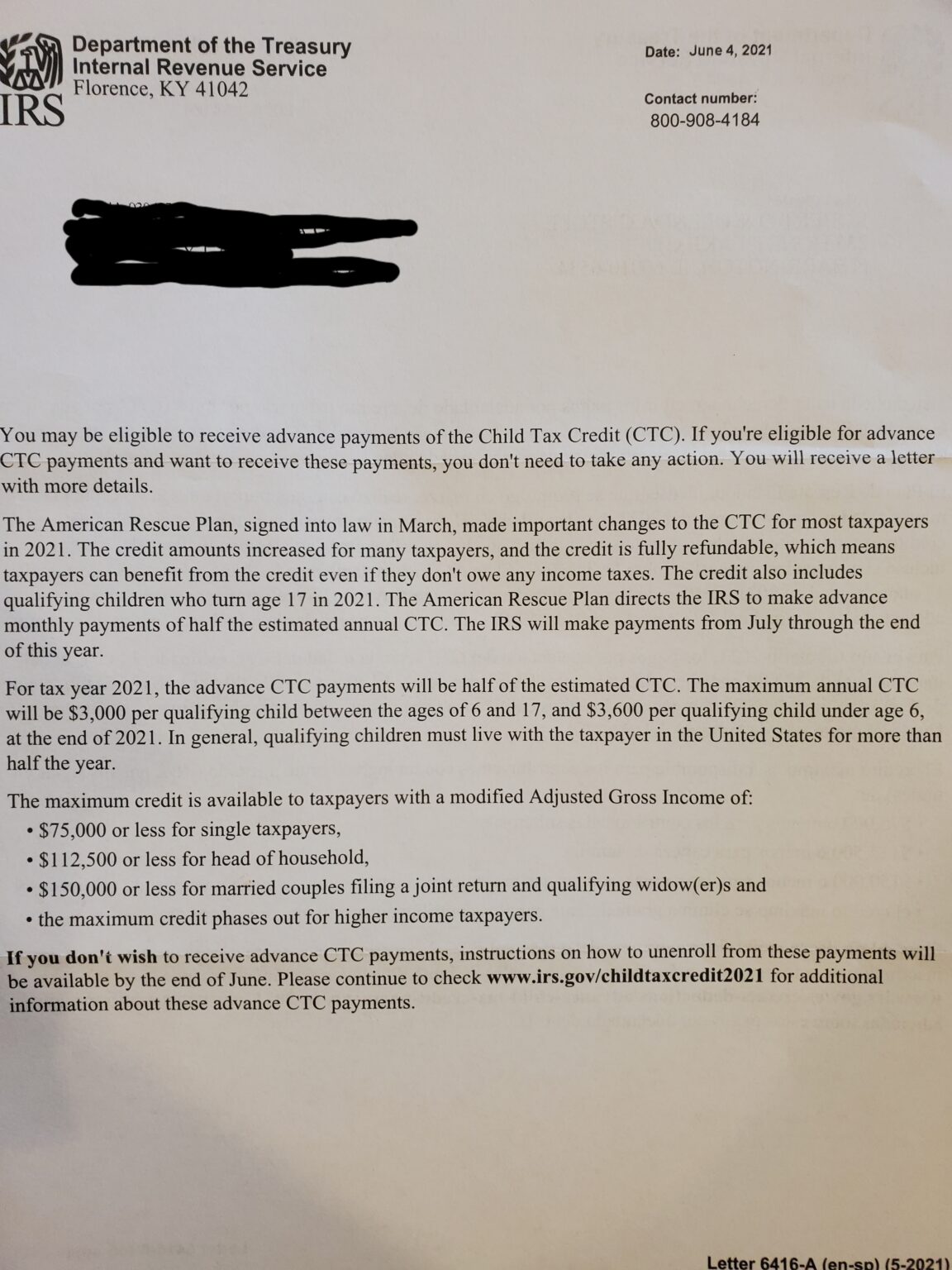

Verkko In July 2021 the Internal Revenue Service began making partial payments monthly up to 300 per month for each child under age 6 and up to 250 a month for each child between the ages of 6 Verkko 2021 Child Tax Credit information Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers The

Verkko The Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever and as of July 15 th most Verkko 26 tammik 2022 nbsp 0183 32 The American Rescue Plan only guarantees the increased amounts for the 2021 tax year so unless Congress makes them permanent they will revert in 2022 to the previous rules of

Download Tax Refund 2021 Child Tax Credit

More picture related to Tax Refund 2021 Child Tax Credit

See The EIC Earned Income Credit Table Income Tax Return Income

https://i.pinimg.com/originals/aa/af/be/aaafbed0a4b639f5c32ede742b5dd17b.png

Tax Filing 2022 Eitc Latest News Update

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T10-0248.GIF

Grandparents And Others With Eligible Dependents Shouldn t Miss Out On

https://markham-norton.com/wp-content/uploads/2022/10/MNMW_BlogGrandparentsTaxCredit_20221102_Final.jpg

Verkko 31 tammik 2022 nbsp 0183 32 No Excess Advance Child Tax Credit Payment Amount or Remaining Child Tax Credit Amount If the amount of Child Tax Credit that you can properly Verkko 31 tammik 2022 nbsp 0183 32 If you became eligible in 2021 for example because of the birth or adoption of a qualifying child but didn t receive advance Child Tax Credit payments

Verkko In some cases these monthly payments will be made beginning July 15 2021 and through December 2021 The Advanced Child Tax Credit payments authorized by Verkko 8 helmik 2022 nbsp 0183 32 Parents can claim the other half of the credit on their 2021 tax return Democrats also beefed up the total child tax credit to a maximum of 3 600 per year

The 2021 Child Tax Credit An Overview Letitia Berbaum

https://www.letitiaberbaum.com/wp-content/uploads/2022/11/07132022-scaled.jpg

American Rescue Plan 2021 Tax Credit Stimulus Check Rules

https://www.kitces.com/wp-content/uploads/2021/03/04CHAN1.png

https://www.irs.gov/credits-deductions/tax-year-2021-filing-season...

Verkko 31 tammik 2022 nbsp 0183 32 A1 The Child Tax Credit is a fully refundable tax credit for families with qualifying children The American Rescue Plan expanded the Child Tax Credit

https://www.irs.gov/credits-deductions/2021-child-tax-credit-and...

Verkko 14 hein 228 k 2022 nbsp 0183 32 A1 For tax year 2021 the Child Tax Credit increased from 2 000 per qualifying child to 3 600 for children ages 5 and under at the end of 2021

2021 Child Tax Credit And Payments What Your Family Needs To Know

The 2021 Child Tax Credit An Overview Letitia Berbaum

Advance Child Tax Credit How To Ensure You Receive Your Monthly 300

Estimate Tax Refund 2021 BiancaMalika

Care Credit Printable Application Printable Word Searches

2021 Advanced Child Tax Credit What It Means For Your Family

2021 Advanced Child Tax Credit What It Means For Your Family

Child Tax Credit 2020 Form 1040 8 Photos Earned Income Credit Table

2021 Advanced Child Tax Credit What It Means For Your Family

What Is The Child Tax Credit And How Much Of It Is Refundable Brookings

Tax Refund 2021 Child Tax Credit - Verkko 27 helmik 2021 nbsp 0183 32 Our calculator will give you the answer Big changes were made to the child tax credit for the 2021 tax year The two most significant changes impact the