Tax Refund Europe To Uk You can claim back tax and personal allowances as a UK non resident on any UK income you receive in the current tax year or in the last 4 tax years Before you start Check your residency

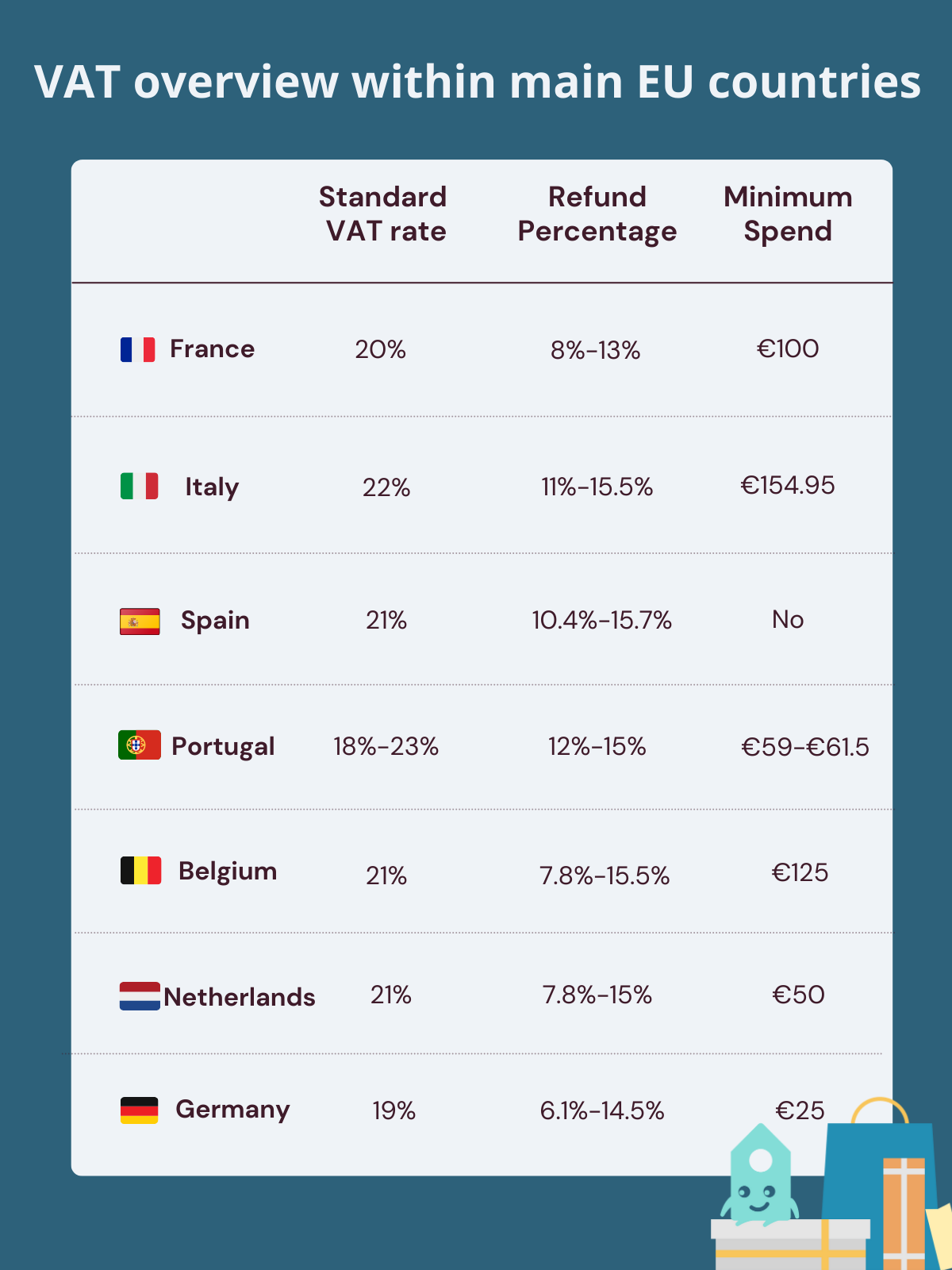

But since VAT refunds in Europe are typically a percentage of your total purchase price you can roughly guess the highest VAT refund in Europe by considering the VAT rates in each country For instance you can expect a higher VAT refund in Hungary because the country currently has the highest VAT rate in Europe with a standard rate of 27 4 It allowed them to get a refund on value added tax VAT on items bought in high street shops at airports or at other departure points from the UK and exported in their own personal luggage

Tax Refund Europe To Uk

Tax Refund Europe To Uk

https://www.gannett-cdn.com/-mm-/9e1f6e2ee20f44aa1f3be4f71e9f3e52b6ae2c7e/c=0-110-2121-1303/local/-/media/2019/02/12/USATODAY/usatsports/tax-refund_gettyimages-663281702.jpg?width=3200&height=1680&fit=crop

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

What Is VAT And How To Claim Your VAT Refund In Europe

https://images.travelandleisureasia.com/wp-content/uploads/sites/2/2023/05/24133817/VAT-refund-Europe_FI.jpg

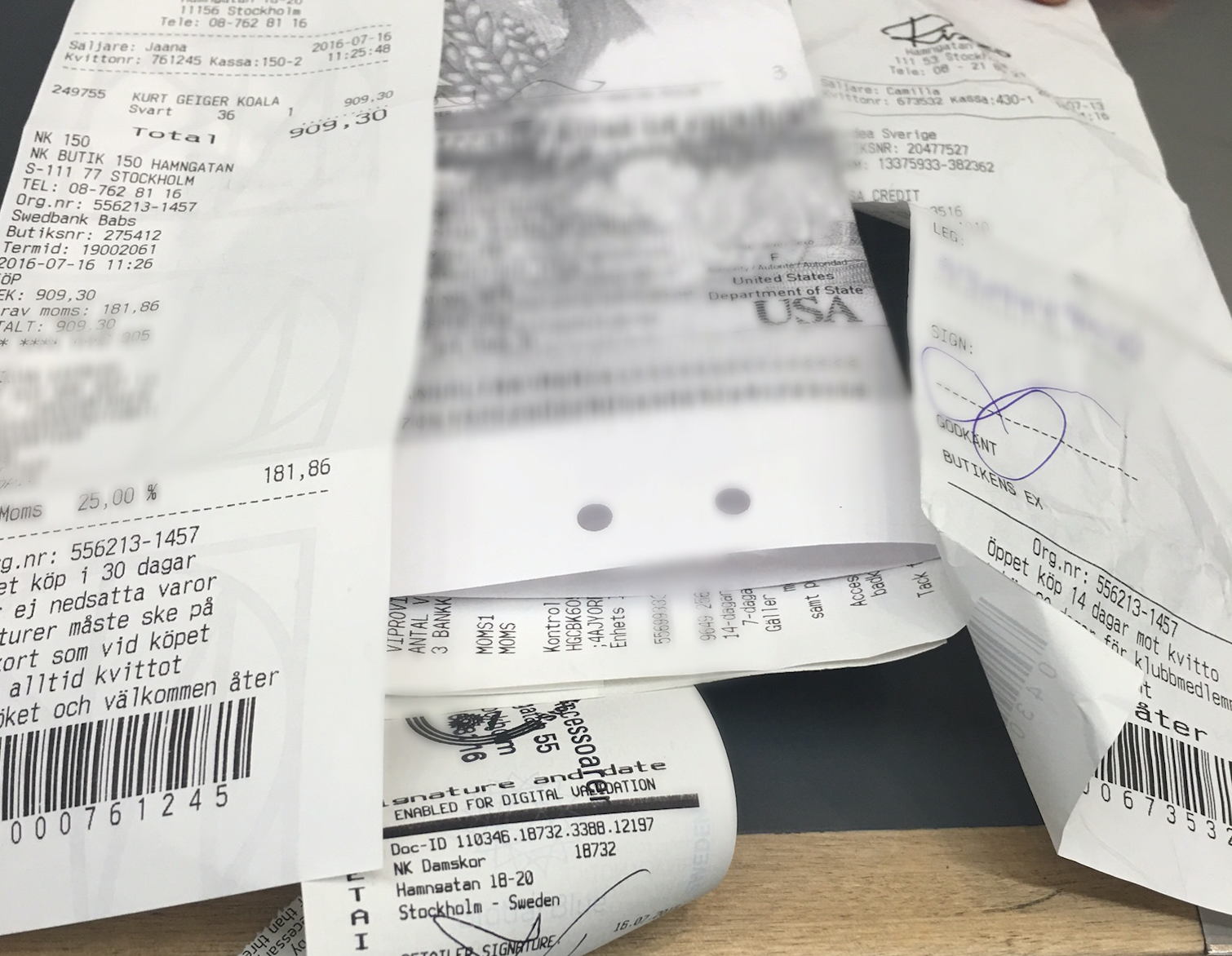

There are two main ways you can get a tax refund form using the traditional in store paper method or a digital app like Wevat Using the traditional method you ll need to show your passport to the sales assistant ask for a refund form and do some form filling every time you buy something VAT Refunds If you have paid VAT for a transaction in an EU Member State where you do not reside you may be eligible for a VAT refund in certain circumstances Note This page deals only with refunds for cross border transactions

As a result businesses must follow a different route to get VAT refund paid in EU countries From 1 April 2021 UK businesses no longer have access to the EU electronic portal The deadline for claiming VAT incurred on expenses in the EU on or before 31 Goods in the EU contain VAT value added tax automatically added to your shopping and can be as much as 20 25 of the net price If you re a non EU traveller shopping abroad and take your purchases home with you to enjoy

Download Tax Refund Europe To Uk

More picture related to Tax Refund Europe To Uk

VAT Refund Save Money In Europe Unseen Footprints

https://i0.wp.com/www.unseenfootprints.com/wp-content/uploads/2016/10/VAT-h-pin.jpg?resize=1024%2C683

Can I Receive The VAT Tax Refund In The UK With Brexit Petite In Paris

https://petiteinparis.com/wp-content/uploads/2020/10/7-949x1708.png

-d4c7.jpg)

This Map Shows The Average Tax Refund In Every State

https://cdn.howmuch.net/articles/tax-refund-by-state-(1)-d4c7.jpg

Check how to claim a tax refund You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay from Learn about eligibility minimum thresholds the refund process cash versus credit card refunds and essential tips for a successful VAT refund experience Save money on your European shopping spree with VAT refund opportunities

Yes if you are a visitor from outside the EU you can claim a VAT refund on goods purchased in the UK that you re exporting Before leaving the UK ensure that you have the necessary VAT refund form from the retailer and get it validated at the customs office at your point of departure Since the UK left the EU on the 1st January 2021 residents of England Scotland and Wales are eligible to shop Tax Free when shopping in the EU The money doesn t automatically come off though You have to fill out a form and claim the VAT back as a refund

ITR Refund Status How To Check Income Tax Refund Status The Economic

https://img.etimg.com/photo/msid-86750817/tax-refund-1.jpg

VAT Refund Save Money In Europe Unseen Footprints

https://i0.wp.com/www.unseenfootprints.com/wp-content/uploads/2016/10/VAT-refund-v-pin.jpg?resize=731%2C1024

https://www.gov.uk/guidance/claim-personal...

You can claim back tax and personal allowances as a UK non resident on any UK income you receive in the current tax year or in the last 4 tax years Before you start Check your residency

https://wise.com/gb/blog/vat-refund-europe

But since VAT refunds in Europe are typically a percentage of your total purchase price you can roughly guess the highest VAT refund in Europe by considering the VAT rates in each country For instance you can expect a higher VAT refund in Hungary because the country currently has the highest VAT rate in Europe with a standard rate of 27 4

What To Do With Your Tax Refund CBS News

ITR Refund Status How To Check Income Tax Refund Status The Economic

My Experience Getting A VAT Refund While Shopping In Europe How You

EU VAT Refund Procedure Of VAT Refund VAT Calculator European Union

Tax free Shopping In The EU Ultimate Guide To VAT Refund For Tourists

Guide To VAT Refund In Europe Tax Refund Bags Europe

Guide To VAT Refund In Europe Tax Refund Bags Europe

Check IRS Where s My Refund IRS Refund Status 2023

OS Payroll Your P60 Document Explained

My Experience Getting A VAT Refund While Shopping In Europe How You

Tax Refund Europe To Uk - There are two main ways you can get a tax refund form using the traditional in store paper method or a digital app like Wevat Using the traditional method you ll need to show your passport to the sales assistant ask for a refund form and do some form filling every time you buy something