Tax Refund On Charitable Donations How to claim relief on a Self Assessment tax return if you donate to charity through Gift Aid Payroll Giving or gifts of shares securities land or buildings

A number of tax incentives for giving to charity are made available to incentivise taxpayers to donate Gift Aid being the most commonly used income tax relief This article considers the various options available and the The Charitable Donation Scheme allows tax relief on qualifying donations made to approved bodies If an individual donates 250 or more in a year the approved body can claim

Tax Refund On Charitable Donations

Tax Refund On Charitable Donations

https://www.craigieburntrails.org.nz/wp-content/uploads/2015/04/donations-giving-donate-charity-FinanceFox.jpg

Noncash Charitable Contributions Fair Market Value Guide 2019

https://www.accountingservicesofhhi.com/images/Streamlabs-charity-fundraising-donation.jpg

Tips On Tax Deductions For Donations

http://bargainbabe.com/wp-content/uploads/2014/02/taxable_donations.jpg

You can claim donation tax credits if all of the following situations apply to you You re claiming as an individual and not on behalf of a trust partnership or company You earned taxable In most cases the amount of charitable cash contributions taxpayers can deduct on Schedule A as an itemized deduction is limited to a percentage usually 60 percent

The approved body can claim a refund of 112 32 which is 362 32x31 The 112 32 is a Pay As You Earn PAYE tax refund now donated to the charity Any further PAYE tax refunds The easiest way to claim your donation tax credit is online in myIR and you ll receive your refund sooner Using myIR means we can work out your tax credit without you having to file a claim when the tax year ends on 31 March

Download Tax Refund On Charitable Donations

More picture related to Tax Refund On Charitable Donations

Bunching Up Charitable Donations Could Help Tax Savings

https://www.gannett-cdn.com/-mm-/3b8b0abcb585d9841e5193c3d072eed1e5ce62bc/c=0-30-580-356/local/-/media/2018/01/02/USATODAY/usatsports/donate-charity-coin-cash-tax-give-deduction-getty_large.jpg?width=3200&height=1680&fit=crop

The Surprising Relationship Between Taxes And Charitable Giving WSJ

https://i.pinimg.com/originals/81/ec/3c/81ec3c2dd750bee7291a34e6aff3f302.jpg

How To Get Tax Relief For Charitable Donations

https://www.thetaxdefenders.com/wp-content/uploads/2020/10/495983408.jpg

Charitable contributions to qualified organizations may be deductible if you itemize deductions on Schedule A Form 1040 Itemized Deductions PDF To see if the organization you have Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction To claim a tax deductible donation you must itemize on your taxes

You are responsible for all tax considerations that may arise if your donation is refunded Document large gifts using a standard agreement form that includes your return If you weren t aware you could claim additional tax relief on charity donations then you can make a claim for overpayment relief going back four tax years We re currently in the 2024 25 tax

How To Ensure You Get Tax Relief On Charitable Donations

https://www.accountwise.co.uk/wp-content/uploads/2019/06/donations-1041971_1920-1080x675.jpg

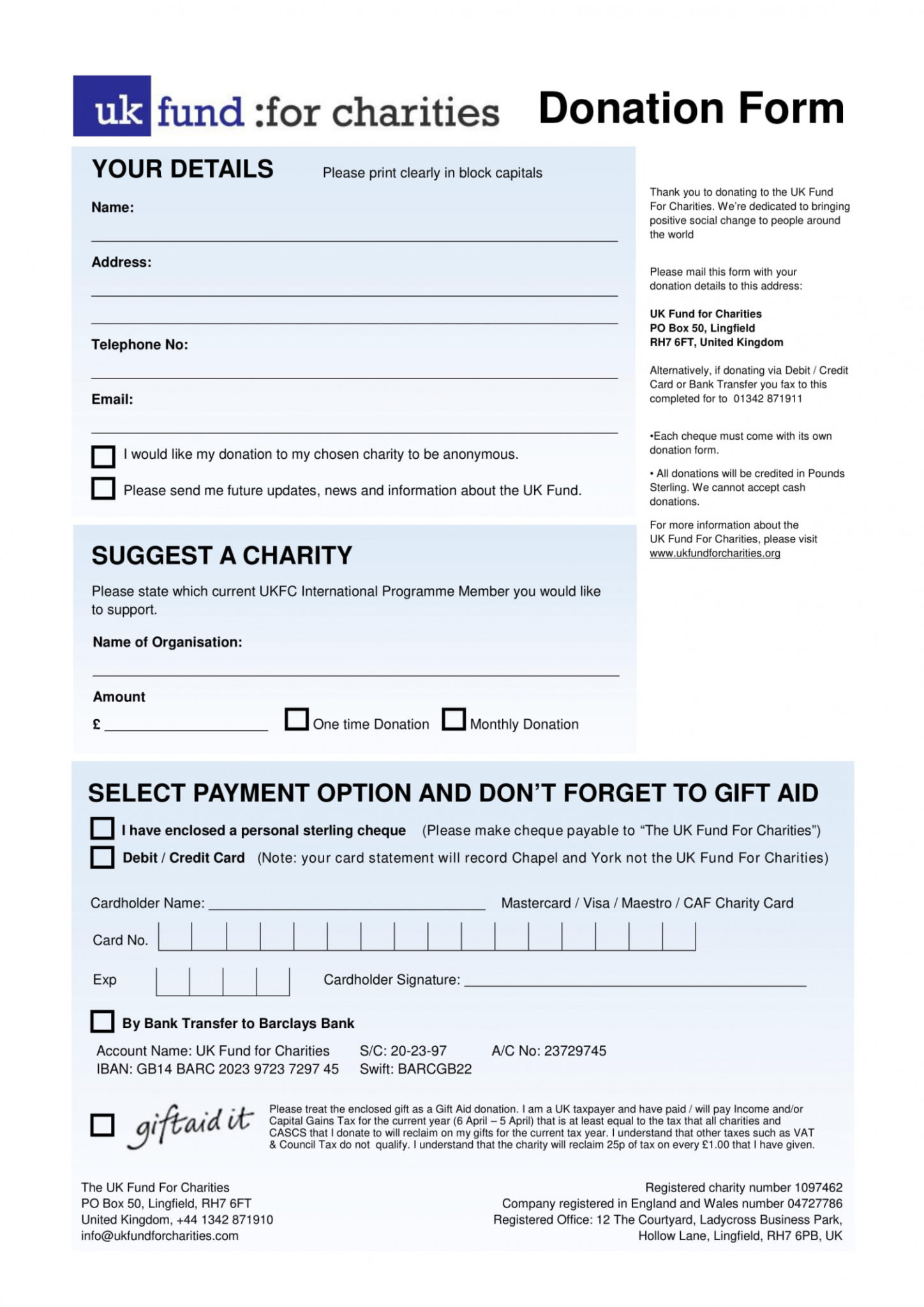

Printable Free 5 Charity Donation Forms In Pdf Ms Word Charitable

https://minasinternational.org/wp-content/uploads/2020/06/printable-free-5-charity-donation-forms-in-pdf-ms-word-charitable-donation-agreement-template-excel-1448x2048.jpg

https://www.gov.uk › government › publications

How to claim relief on a Self Assessment tax return if you donate to charity through Gift Aid Payroll Giving or gifts of shares securities land or buildings

https://www.saffery.com › insights › articl…

A number of tax incentives for giving to charity are made available to incentivise taxpayers to donate Gift Aid being the most commonly used income tax relief This article considers the various options available and the

Free Goodwill Donation Receipt Template PDF EForms

How To Ensure You Get Tax Relief On Charitable Donations

Non Profit Letter For Donations Database Letter Template Collection

Setting A Value To Your Donations CalhoonTax

Bundling Can Provide Tax Advantages Catholic United Financial

How The New Tax Laws Could Affect Episcopal Charitable Giving

How The New Tax Laws Could Affect Episcopal Charitable Giving

Sample Donation Receipt Letter DocTemplates

Image Result For Nonprofit Donation Letter For Tax Receipt

Free Donation Receipt Free To Print Save Download

Tax Refund On Charitable Donations - If the amount of Income Tax or Capital Gains Tax that you re due to pay for a tax year is less than the tax reclaimed for the year on your gifts by all the charities and CASCs to