Tax Refund On Tuition Fees An education tax credit allows you to reduce your taxes owed and may in some cases generate a tax refund The IRS offers two types of education tax credits to offset tuition and fees you

You can claim tax relief on qualifying fees including the student contribution that you have paid for third level education courses The qualifying fees must be paid for an approved course at It is a tax credit of up to 2 500 of the cost of tuition certain required fees and course materials needed for attendance and paid during the tax year Also 40 percent of the credit for which

Tax Refund On Tuition Fees

Tax Refund On Tuition Fees

https://www.gannett-cdn.com/-mm-/9e1f6e2ee20f44aa1f3be4f71e9f3e52b6ae2c7e/c=0-110-2121-1303/local/-/media/2019/02/12/USATODAY/usatsports/tax-refund_gettyimages-663281702.jpg?width=3200&height=1680&fit=crop

Tax Benefits On Tuition Fees School Fees Education Allowances

https://www.alerttax.in/wp-content/uploads/2017/02/Tax-Benefits-on-Tuition-Fees-School-Fees-Education-Allowances.png

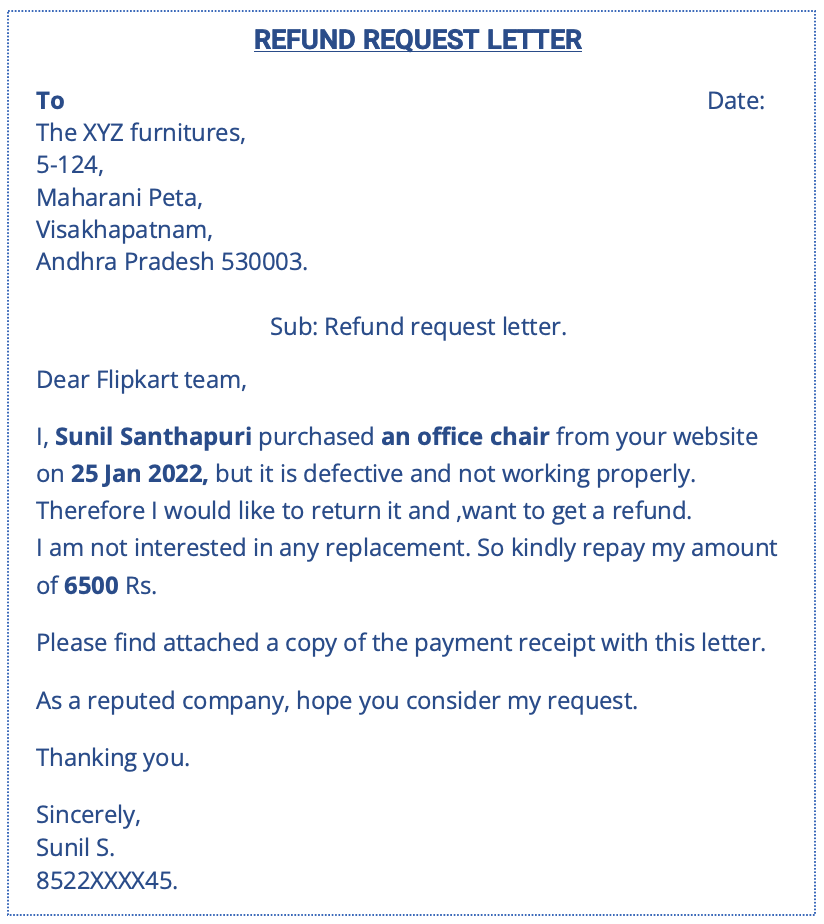

Letter For Refund Of Tuition Fees To School College Or University

https://semioffice.com/wp-content/uploads/2021/11/Letter-of-Refund-of-Request-in-Tuition-Fees.png

The relief is claimed by completing the tuition fees section on your Form 11 annual tax return at the end of the year If you receive any grant scholarship or payment Tuition and Fees Deduction for tax years before 2021 Another option is to claim a deduction of up to 2 000 or up to 4 000 of qualified tuition and mandatory enrollment fees depending on your income You do not have to itemize your

Chancellor Rachel Reeves confirmed at the Autumn Budget that she would remove the tax benefits of private schools with tuition and boarding tuition fees set to be taxed 20 The tuition tax credit is a non refundable tax credit available to post secondary students This means that if you pay for tuition and other educational costs under certain

Download Tax Refund On Tuition Fees

More picture related to Tax Refund On Tuition Fees

5 Ways To Make Your Tax Refund Bigger The Motley Fool

https://g.foolcdn.com/editorial/images/230742/getty-tax-refund.jpg

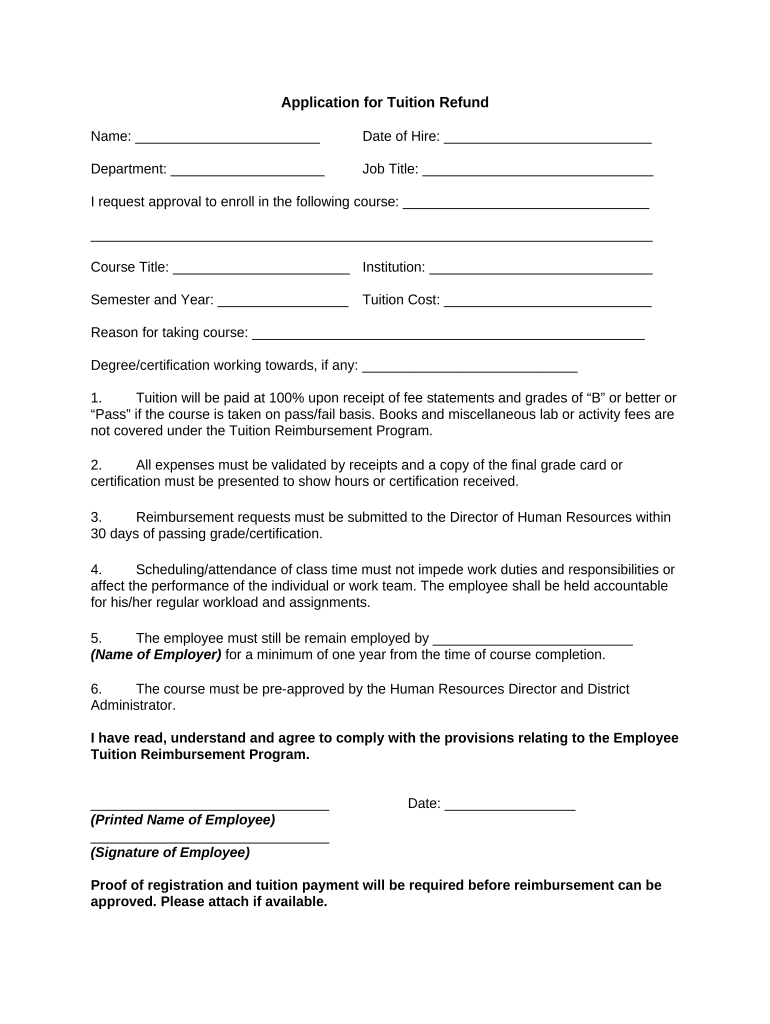

Application For Tuition Refund Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/332/497332180/large.png

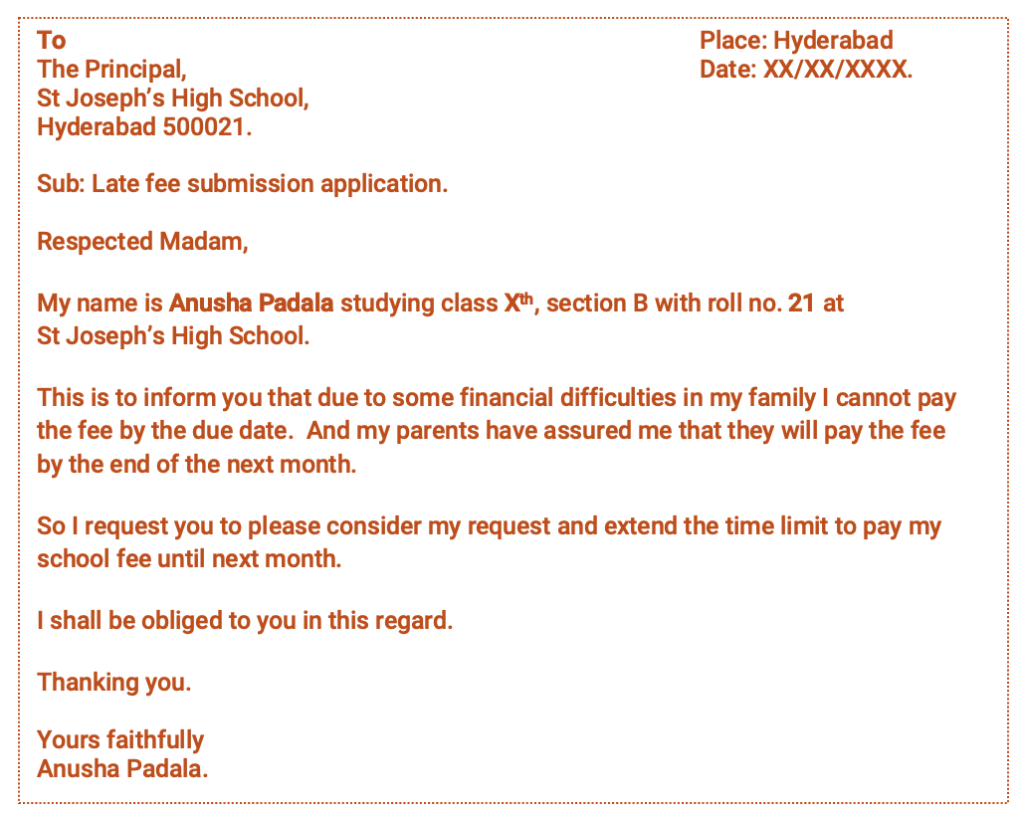

Application For Late Fee Submission Due To Financial Problems

https://www.samplefilled.com/wp-content/uploads/2022/04/Application-for-late-fee-submission--1024x818.png

If you have grants scholarships or federal student loans and spend them on non qualified education expenses you may need to report the aid as taxable income and that could lower your tax refund If you spend them on 2024 College Tuition Tax Deductions Depending on your financial situation you can claim up to 4 000 in tax deductions Here are tax credits and deductions to claim in 2024

For those parents who are fortunate enough to get a partial refund of tuition and fees there are some potential tax traps Let s start with the obvious tax deductions and credits An education credit helps with the cost of higher education by reducing the amount of tax you owe on your return The American Opportunity Tax Credit AOTC is a partially refundable tax credit for college education

SOLUTION Tuition Refund Appeal Letter Studypool

https://sp-uploads.s3.amazonaws.com/uploads/services/588841/20171025215232tuition_refund_appeal_letterpage0.png

-d4c7.jpg)

This Map Shows The Average Tax Refund In Every State

https://cdn.howmuch.net/articles/tax-refund-by-state-(1)-d4c7.jpg

https://www.forbes.com › advisor › taxe…

An education tax credit allows you to reduce your taxes owed and may in some cases generate a tax refund The IRS offers two types of education tax credits to offset tuition and fees you

https://www.revenue.ie › en › personal-tax-credits...

You can claim tax relief on qualifying fees including the student contribution that you have paid for third level education courses The qualifying fees must be paid for an approved course at

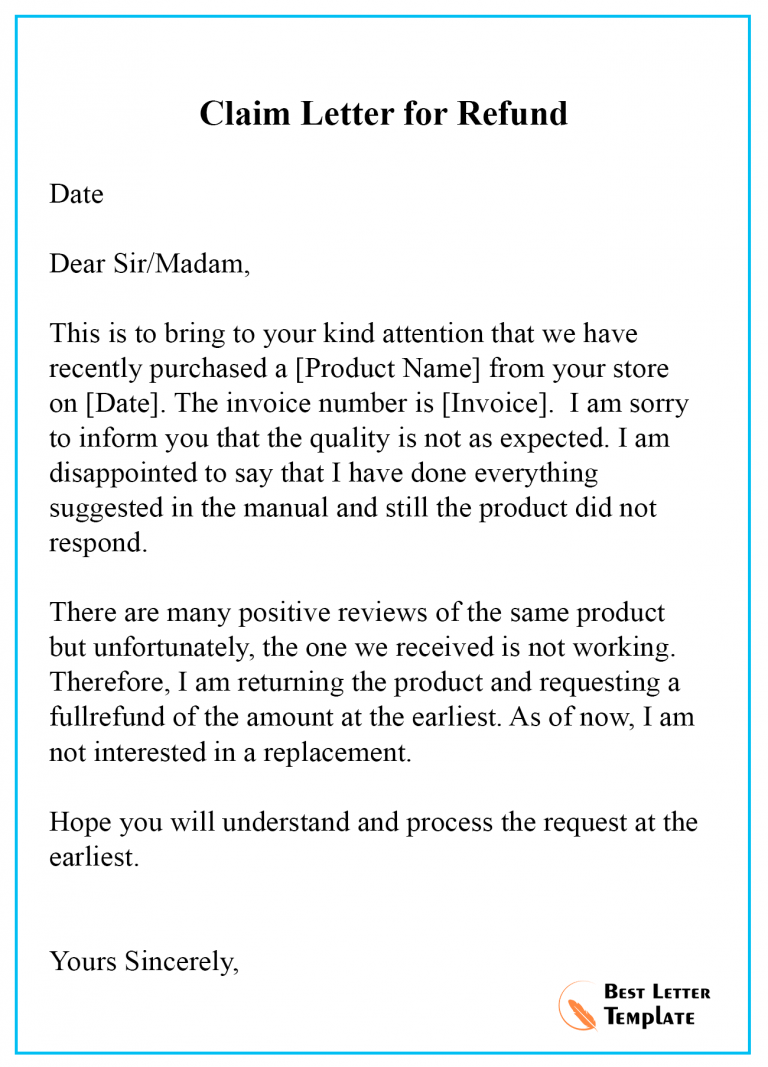

Letter Of Application Letter Of Request For Refund Template Images

SOLUTION Tuition Refund Appeal Letter Studypool

Insurance Overpayment Refund Letter Sample Financial Report

Request Letter For Refund Template Format Sample Exam Vrogue co

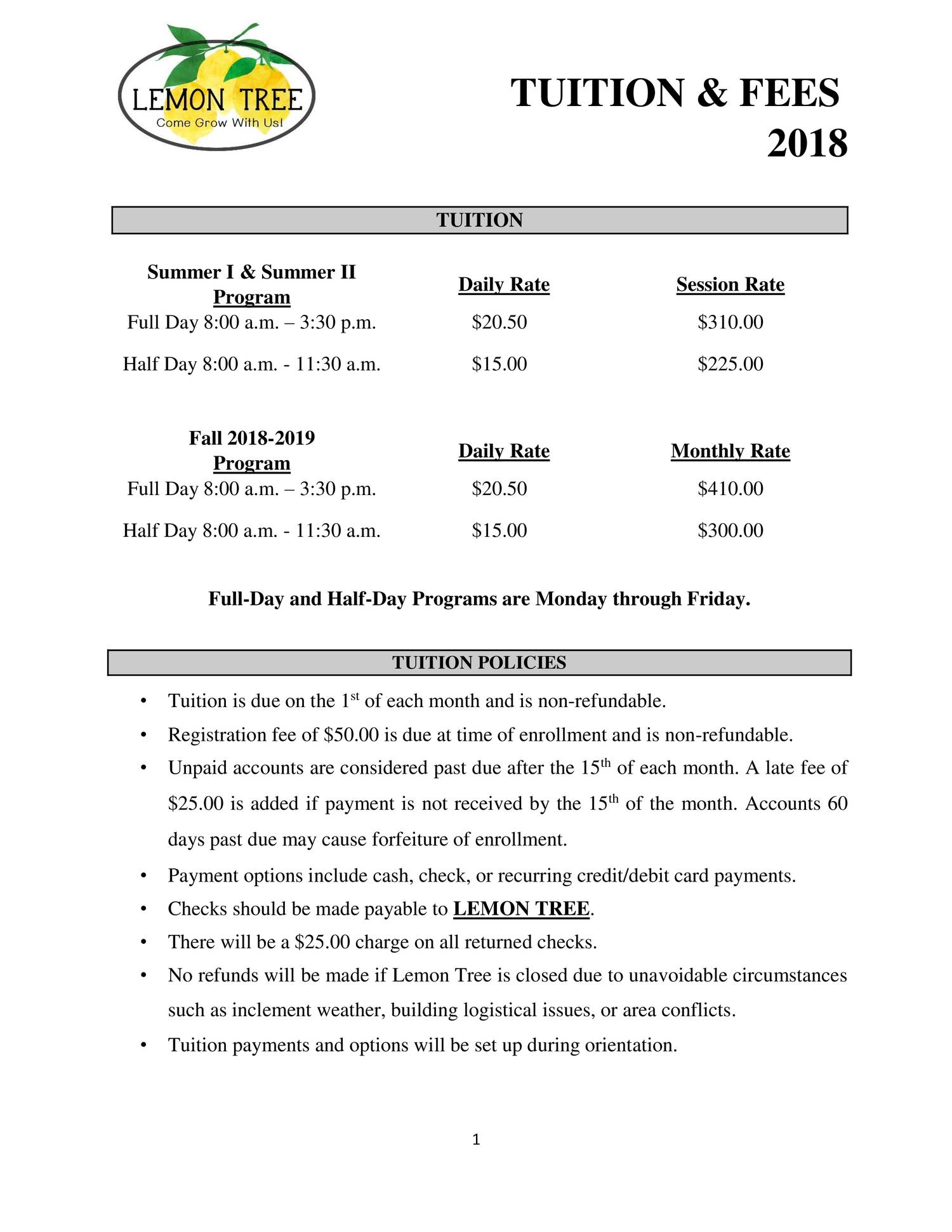

Tuition Fees

How To Write A Refund Letter For Overpayment Allardyce Pen

How To Write A Refund Letter For Overpayment Allardyce Pen

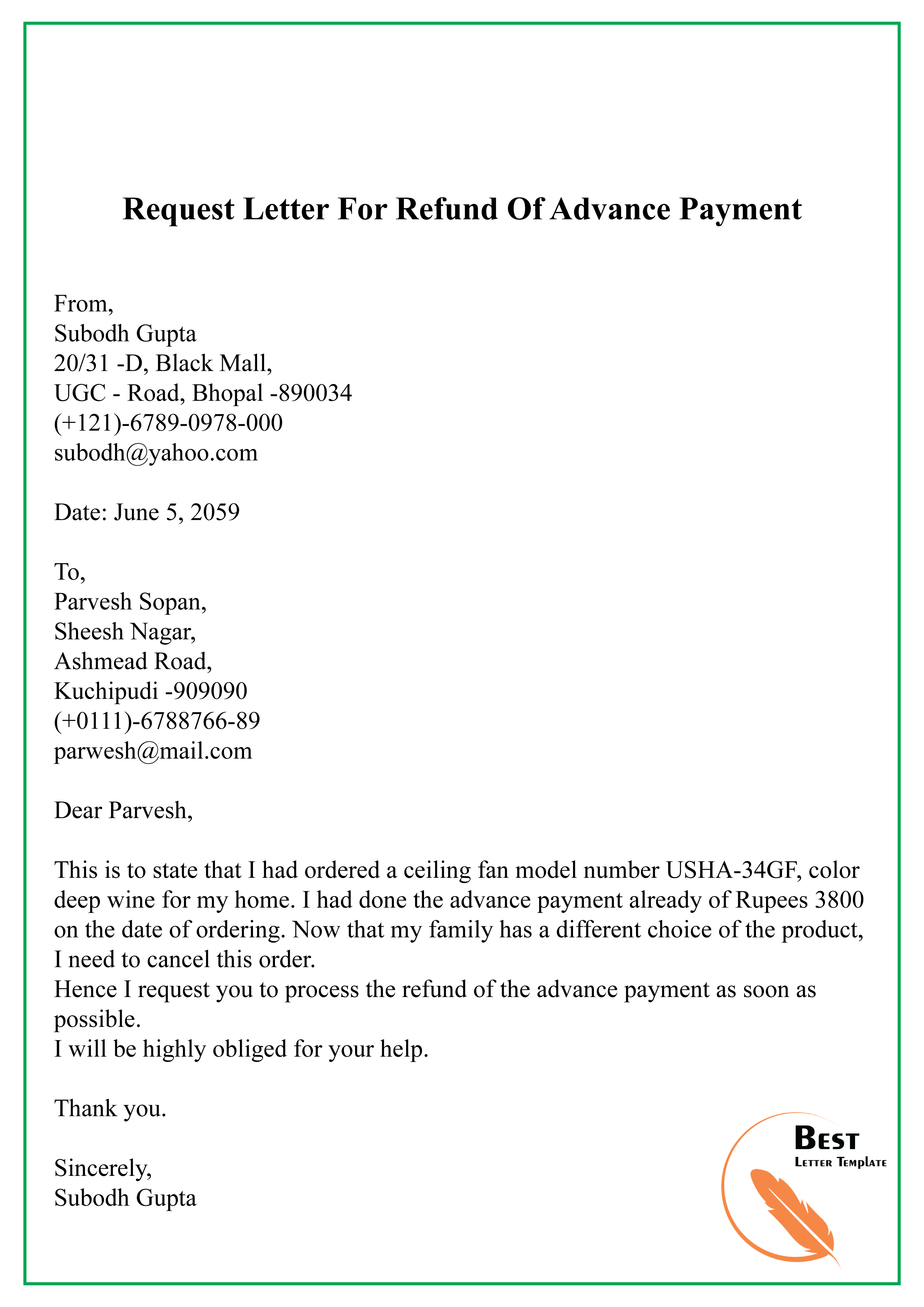

How To Write A Refund Request Letter 01 Best Letter Template Images

Authorization Letter Claim Tax Refund For Sample Printable Formats Vrogue

Tuition Fees Northern New Mexico College

Tax Refund On Tuition Fees - The tuition tax credit is a non refundable tax credit available to post secondary students This means that if you pay for tuition and other educational costs under certain