Tax Refund Rebate 2024 Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief

IR 2024 04 Jan 8 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline The law requires the IRS to hold the entire refund not just the portion associated with the EITC or ACTC The IRS expects most EITC and ACTC related refunds to be available in taxpayer bank accounts or on debit cards by Feb 27 2024 if the taxpayer chose direct deposit and there are no other issues with the tax return

Tax Refund Rebate 2024

Tax Refund Rebate 2024

https://www.swiftrefunds.co.uk/wp-content/uploads/2019/08/tax-refund-min-2-e1566379535551.jpg

When Can I Expect My Tax Refund Premium Services

https://specials-images.forbesimg.com/imageserve/5c4875ac4bbe6f7020fcb7f6/960x0.jpg?fit=scale

Missouri Gas Tax Refund Form Veche info 16

https://i2.wp.com/data.formsbank.com/pdf_docs_html/255/2552/255274/page_1_thumb_big.png

Nov 22 2023 December is here which means the 2024 tax filing season is coming soon The IRS usually starts accepting e filed income tax returns in the last week of January each year with Updated January 16 2024 at 2 41 p m EST Published January 15 2024 at 6 00 a m EST More families could be eligible for the child tax credit as soon as 2024 if new legislation passes Congress

The 2024 tax season officially opens Monday meaning the IRS will begin accepting and processing returns for the 2023 tax year The deadline to file is April 15 Ti ng Vi t IRS Tax Tip 2024 01 Jan 4 2024 Tax credits and deductions change the amount of a person s tax bill or refund People should understand which credits and deductions they can claim and the records they need to show their eligibility Tax credits

Download Tax Refund Rebate 2024

More picture related to Tax Refund Rebate 2024

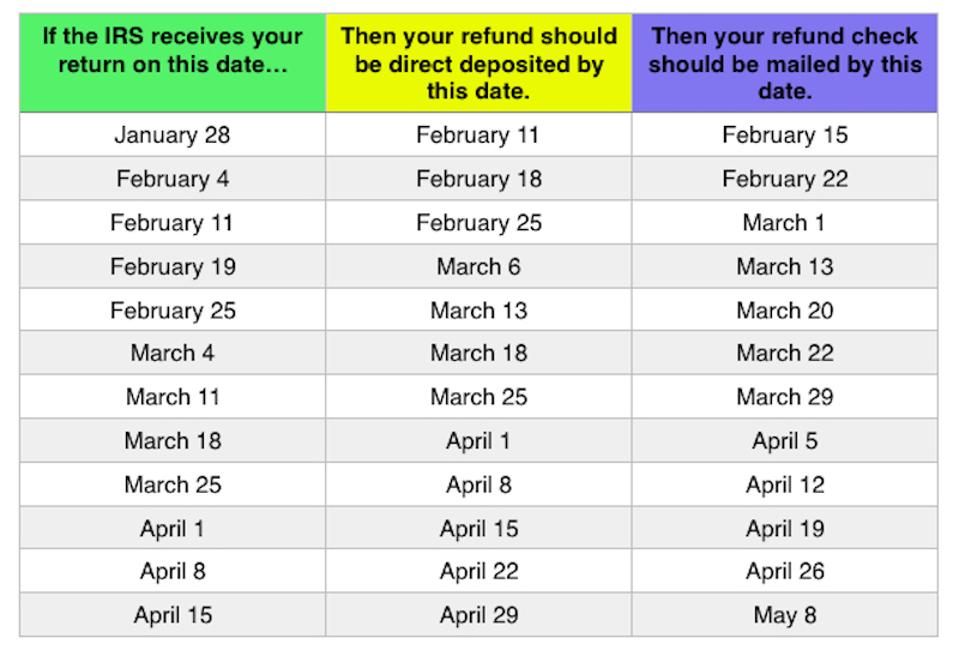

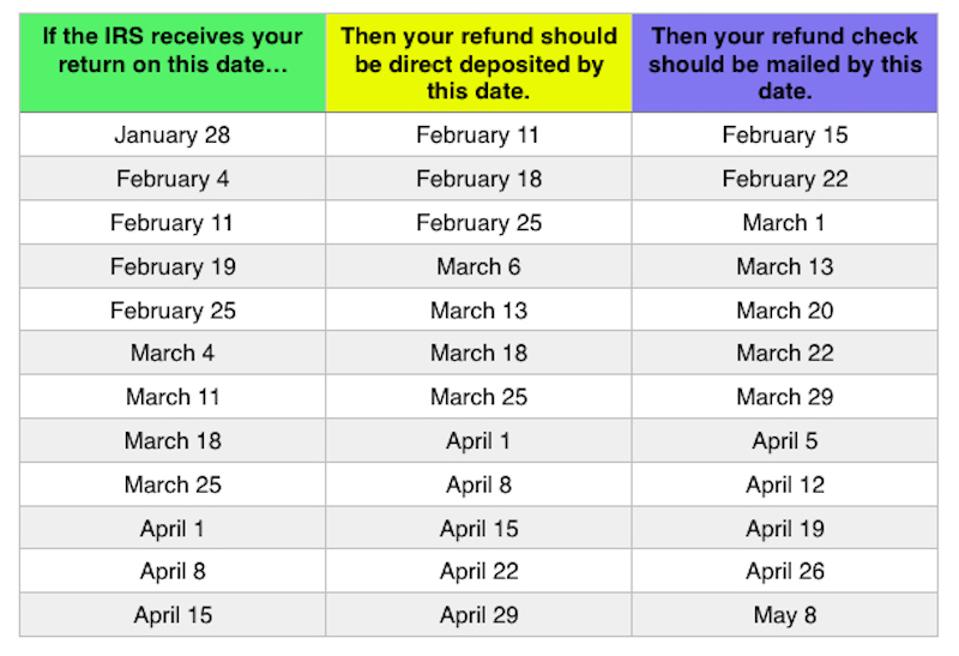

Ga State Refund Cycle Chart 2023 Printable Forms Free Online

https://assets-global.website-files.com/600089199ba28edd49ed9587/639cea54c198630aeee5555f_bNV6iWgT5vJ_yDpbDq6FOQd8uecl8AoDbc3OST7eDyES5Wo66fZYQHyAMSrt88WS4XPf5vMuqIBIuQ3f6RK_OgjKpkcA7hVoX5TMGxlmsaunWtl3XuOnSpuyVykgb5sZMz8qxrJHHDTqiNZYrXEHzBEj5VcLo8jVmQioEXzzgugLty9QrLWN__neHMME4ouh3QV6mkb43w.png

Here s How To Get A Refund For Missouri s Gas Tax Increase Howell County News

https://www.howellcountynews.com/sites/default/files/field/image/afront-gas rebate.jpg

Claim Your Tax Refund Rebate Now

https://superiorshooterssupply.com/wp-content/uploads/2023/05/2-1.jpg

Taxes State tax Features States Sending Tax Rebate Stimulus Checks State stimulus checks tax rebates or other payments are on their way to eligible residents in some states Is The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 deadline Tax deductions Driving for work will pay more next year after IRS boosts 2024 mileage rate

If you are considering buying an electric car in 2024 there s good news and bad news A hefty federal tax credit for electric vehicles is going to get easier to access this year but fewer This earned income tax credit EITC is a refundable tax break for low income taxpayers with and without children For 2023 taxes filed in 2024 the credit ranges from 600 to 7 430 depending

Homeowner Renters District 16 Democrats

https://ld16nj.com/wp-content/uploads/2022/10/Homeowners-2.jpg

4923 H 2014 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/468/470/468470575/large.png

https://tax.thomsonreuters.com/blog/understanding-the-tax-relief-for-american-families-and-workers-act-of-2024/

Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief

https://www.irs.gov/newsroom/2024-tax-filing-season-set-for-january-29-irs-continues-to-make-improvements-to-help-taxpayers

IR 2024 04 Jan 8 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

Claim Your Tax Refund Rebate Now

Homeowner Renters District 16 Democrats

P55 Tax Rebate Form By State PrintableRebateForm

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

What Happens To Your Tax Refund In Bankruptcy IBankruptcy

Where s My Refund How To Track Your Tax Refund 2022 Money

Where s My Refund How To Track Your Tax Refund 2022 Money

Do You Know How To Track Your Tax Refund Here s How

From Refunds To Filing Here Are Tax Tips You Need To Know ABC Columbia

Minnesota Fillable Tax Forms Printable Forms Free Online

Tax Refund Rebate 2024 - Estimate your tax refund or how much you may owe the IRS with TaxCaster tax calculator Feel confident with our free tax calculator that s up to date on the latest tax laws For TurboTax Live Full Service your tax expert will amend your 2023 tax return for you through 11 15 2024 After 11 15 2024 TurboTax Live Full Service customers will