Tax Refund Schedule 2023 Child Tax Credit You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a completed Schedule 8812

For 2024 the credit is up to 2 000 per qualifying child To qualify a child must A portion of the Child Tax Credit is refundable for 2024 This portion is called the Additional Child However families taking certain credits for the 2023 tax year will have to wait longer specifically those who claim the earned income tax credit or the additional child tax

Tax Refund Schedule 2023 Child Tax Credit

Tax Refund Schedule 2023 Child Tax Credit

https://i.pinimg.com/736x/5f/5e/0f/5f5e0f1c9fdd61fa87df5215e135f24d.jpg

The IRS Refund Schedule 2021 Tax Deadline Tax Return Deadline Tax

https://i.pinimg.com/originals/7d/b0/9e/7db09ee47275620c9c16a4628885c0c1.jpg

The IRS Tax Refund Calendar 2024 R Frugal

https://preview.redd.it/the-irs-tax-refund-calendar-2024-v0-sroiy1c7d8cc1.jpg?width=1600&format=pjpg&auto=webp&s=ab50d78c4de6ff0a8553e76d51a6aae4ddb611c3

However taxpayers with the Earned Income Tax Credit or Child Tax Credit generally have their refunds delayed by about one month while the IRS confirms eligibility for these credits See how much the 2023 child tax credit is worth how to claim it on your federal tax return and differences in the child tax credit 2023 vs 2022 s credit

The delay covers your entire refund not just the part that is related to the credit you claimed on your tax return the IRS said For 2023 taxes filed in 2024 the Child Tax Credit is 2 000 for children under age 17 Up to 1 600 of that amount is refundable Learn what it means for your taxes

Download Tax Refund Schedule 2023 Child Tax Credit

More picture related to Tax Refund Schedule 2023 Child Tax Credit

Giving Tax Credit Where Credit Is Due

https://www.chevyhardcore.com/image/2023/12/giving-tax-credit-where-credit-is-due-2023-12-29_09-27-16_080592.jpg

2023 Tax Refund Date Chart Printable Forms Free Online

https://www.wealthysinglemommy.com/wp-content/uploads/Edited-Chart-1-1200x1737.png

Child Tax Credit Expansion In New Bipartisan Deal Has Battle In House

https://s.hdnux.com/photos/01/35/74/61/24628288/5/rawImage.jpg

For example if you owe 5 500 of income tax to the government getting awarded 2 000 of the child tax credit will reduce your tax bill to 3 500 Moreover the child tax credit is The key dates for the 2023 tax season have been compiled here including the deadlines for federal and state taxes as well as the timing of refunds so you don t miss anything this year

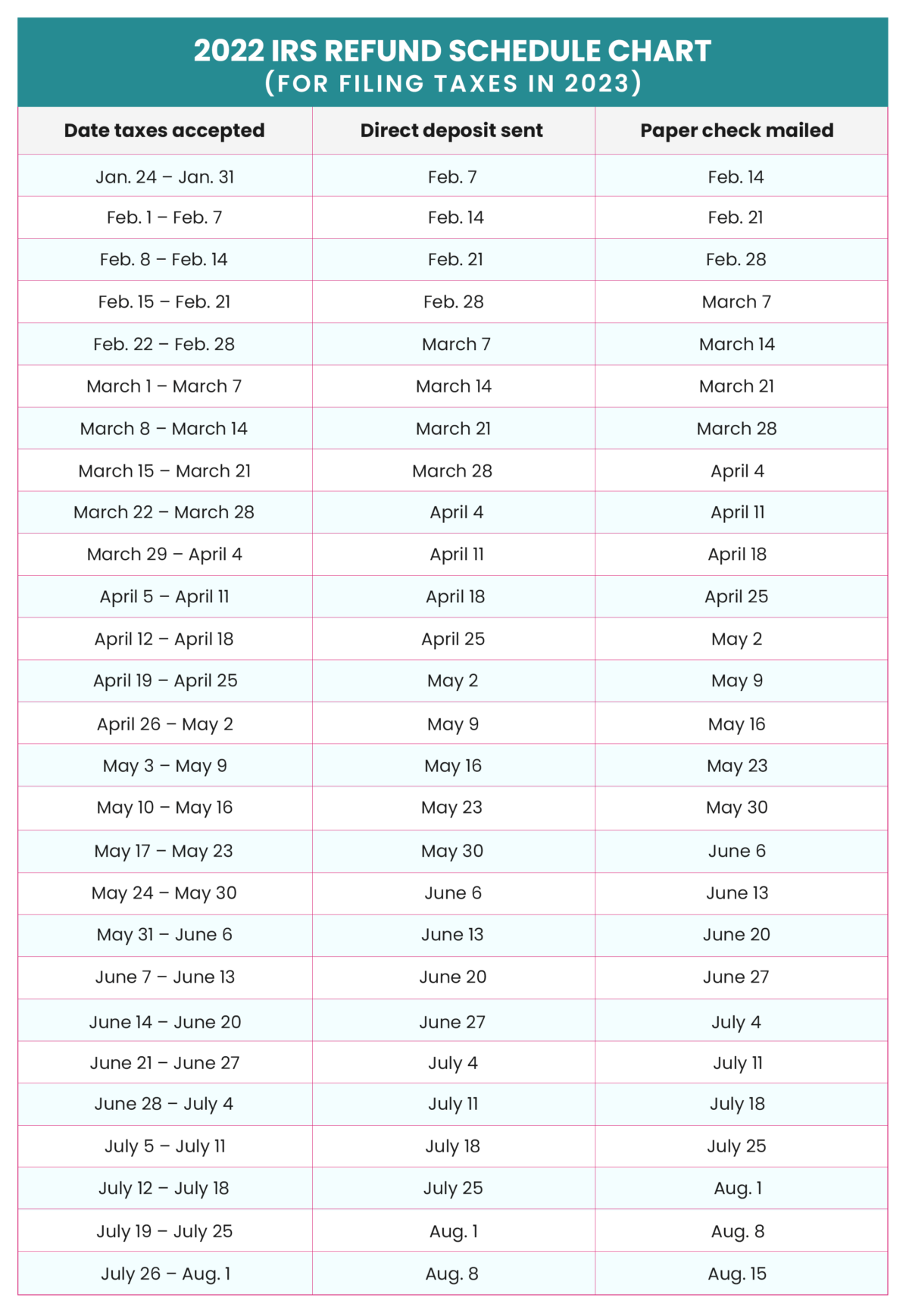

Was the Child Tax Credit Refundable in 2023 The Child Tax Credit or CTC is a partially refundable tax credit in 2021 only it was fully refundable Use the tool below to The 2023 IRS tax refund schedule is now available outlining the timeline for when refunds will be issued and when taxpayers can expect to receive their return The IRS will begin accepting

Taking A Stand For Children Through The Child Tax Credit Tax Credits

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

New Bill Could Expand The Child Tax Credit Here s What To Know For

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA14Uw4L.img?w=2385&h=1072&m=4&q=75

https://www.irs.gov › credits-deductions › individuals › child-tax-credit

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a completed Schedule 8812

https://www.irs.gov › ... › refundable-tax-credits

For 2024 the credit is up to 2 000 per qualifying child To qualify a child must A portion of the Child Tax Credit is refundable for 2024 This portion is called the Additional Child

Tax Refund Cycle Chart 2023 Printable Forms Free Online

Taking A Stand For Children Through The Child Tax Credit Tax Credits

Why Has Child Tax Credit Been Paid Early And What About The Next

3rd Round Of Child Tax Credit Payments Go Out This Week The Daily World

Earned Income Credit Calculator 2021 DannielleThalia

Earned Income Tax Credit For Households With One Child 2023 Center

Earned Income Tax Credit For Households With One Child 2023 Center

Watch CBS Mornings Child Tax Credit Set To Expire Full Show On

Monthly Child Tax Credit Payments Understand The Options Articles

November 15th Deadline Approaching For Missed Tax Credits Here s How

Tax Refund Schedule 2023 Child Tax Credit - Those claiming Earned Income Tax Credit EITC or Child Tax Credit CTC will face a two to three week delay as the IRS processes these refunds The department of