Tax Relief Charitable Donations If you got tax relief on or before 14 March 2023 you will continue to get it until April 2024 This guide explains more about tax reliefs you can get if you donate to

You can claim extra tax relief If you live in England Wales or Northern Ireland and pay higher rate tax of 40 or additional rate tax of 45 then you can claim This helpsheet tells you about 4 of the tax reliefs for giving to charity Sometimes changes to these reliefs may be introduced that are not reflected in this helpsheet or in the

Tax Relief Charitable Donations

Tax Relief Charitable Donations

https://www.gannett-cdn.com/-mm-/3b8b0abcb585d9841e5193c3d072eed1e5ce62bc/c=0-30-580-356/local/-/media/2018/01/02/USATODAY/usatsports/donate-charity-coin-cash-tax-give-deduction-getty_large.jpg?width=3200&height=1680&fit=crop

How To Use Your Estate Plan To Make Charitable Donations Boyum Law

http://boyumlaw.com/wp-content/uploads/2017/12/qtq80-BnH2pa.jpeg

Reasons Why We Donate To Charity And Non profit Zonaltra

https://zonaltrabajoandahuaylas.com/wp-content/uploads/2020/02/Charity-donations-scaled.jpg

A charitable donation is a gift of money or goods to a tax exempt organization that can reduce your taxable income To claim a deduction for charitable Taxpayers who itemize can generally claim a deduction for charitable contributions to qualifying organizations The deduction is typically limited to 20 to

In the tax year April 2022 to April 2023 donations to charities using tax relief schemes were up eight percent year on year Understanding these tax efficient You can do this through a Self Assessment tax return or by asking HMRC to amend the tax code An Example Suppose you make a donation of 100 to your favourite charity

Download Tax Relief Charitable Donations

More picture related to Tax Relief Charitable Donations

Tax Relief Charitable Donations Ppt Powerpoint Presentation Slides

https://www.slideteam.net/media/catalog/product/cache/1280x720/t/a/tax_relief_charitable_donations_ppt_powerpoint_presentation_slides_slideshow_cpb_slide01.jpg

How To Ensure You Get Tax Relief On Charitable Donations

https://www.accountwise.co.uk/wp-content/uploads/2019/06/donations-1041971_1920-1080x675.jpg

How To Get Tax Relief For Charitable Donations

https://www.thetaxdefenders.com/wp-content/uploads/2020/10/495983408.jpg

Meaning that the tax relief is automatically and immediately applied at your highest tax rate So for example if you donate 20 per month to a charity the charity Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income A corporation may deduct qualified contributions of up to 25

The following donations to approved bodies qualify for tax relief a minimum donation of 250 a maximum donation of 1 000 000 in any one year Relief will be Joan donates 1 000 to an approved body in 2020 The approved body can claim a refund of the tax Joan has paid The tax rate is 31 so this means that the

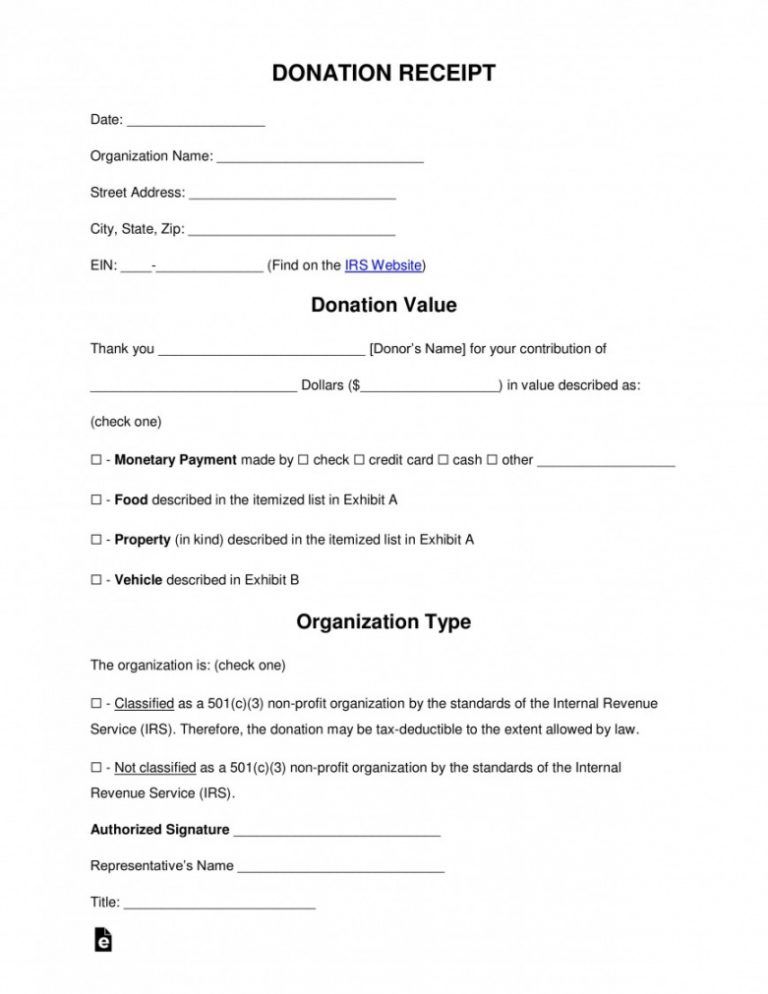

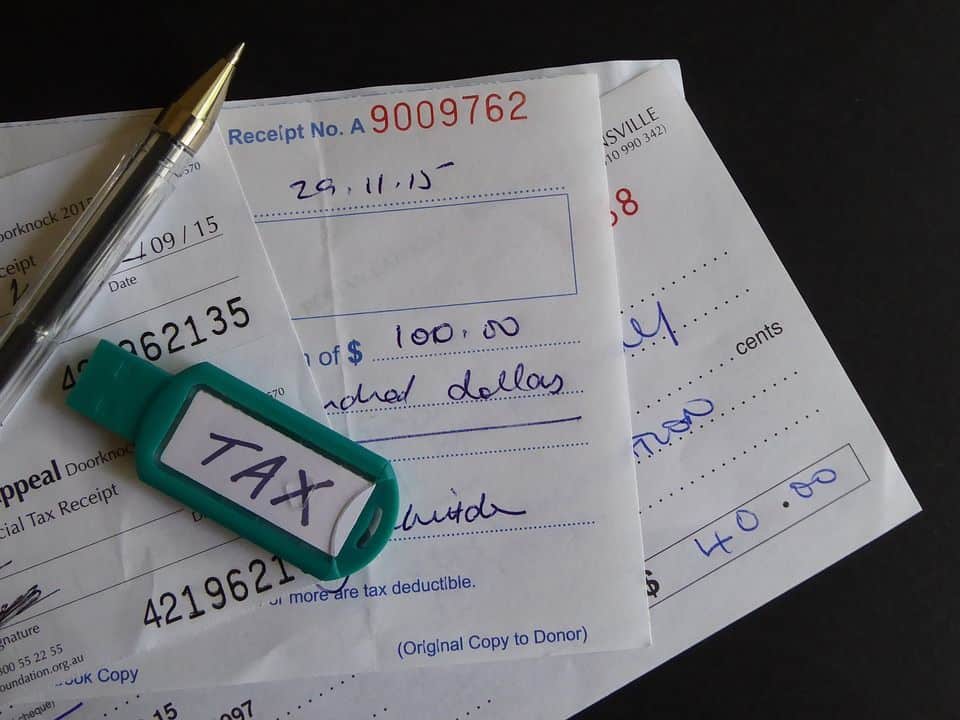

Free Tax Donation Form Template Addictionary Tax Deductible Donation

http://www.emetonlineblog.com/wp-content/uploads/2020/06/free-tax-donation-form-template-addictionary-tax-deductible-donation-receipt-template-sample-768x994.jpg

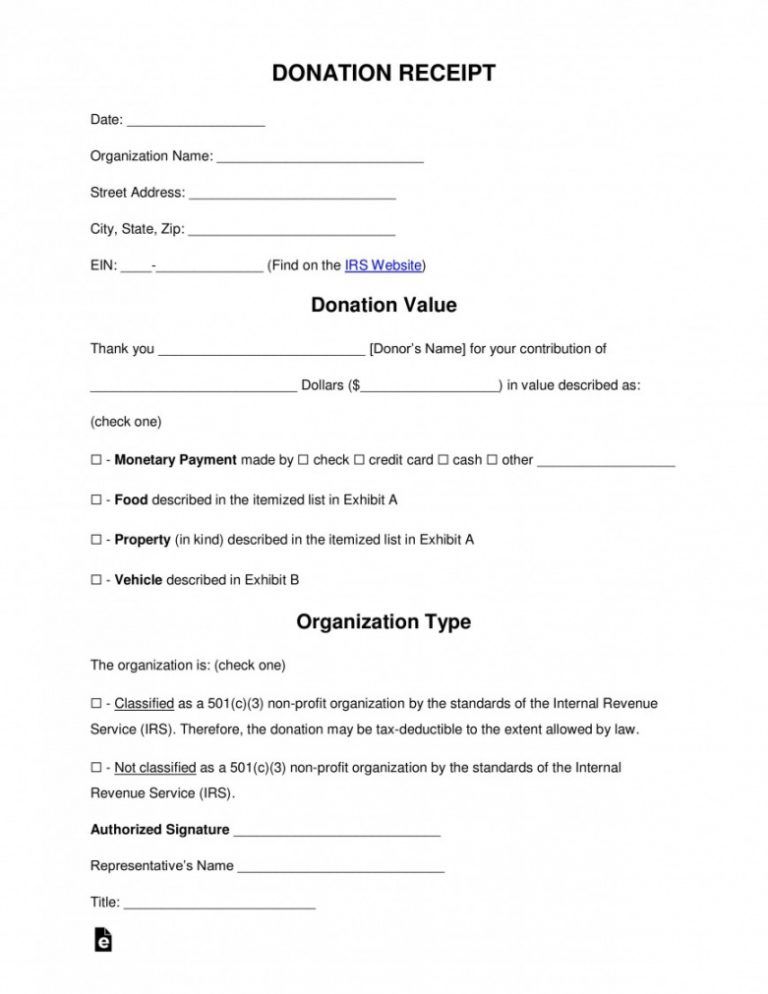

Tips On Tax Deductions For Donations

http://bargainbabe.com/wp-content/uploads/2014/02/taxable_donations.jpg

https://www.gov.uk/government/publications/...

If you got tax relief on or before 14 March 2023 you will continue to get it until April 2024 This guide explains more about tax reliefs you can get if you donate to

https://www.moneysavingexpert.com/family/gift-aid

You can claim extra tax relief If you live in England Wales or Northern Ireland and pay higher rate tax of 40 or additional rate tax of 45 then you can claim

/tax-deduction-for-charitable-donations-57a5e46a3df78cf459cd2099.jpg)

Charitable Giving Take Advantage Of The Tax Deduction

Free Tax Donation Form Template Addictionary Tax Deductible Donation

Tax Relief On Charitable Donations Johnston Smillie

Apply For Tax Relief Using Charitable Donations

DONATIONS

Business Charitable Contribution Rules Have Changed Under The CARES Act

Business Charitable Contribution Rules Have Changed Under The CARES Act

Printable Printable Church Donation Receipt Template For Religious

How To Keep Track Of Your Charitable Donations For Taxes Charitable

How Charitable Tax Deductions Work HowStuffWorks

Tax Relief Charitable Donations - You can do this through a Self Assessment tax return or by asking HMRC to amend the tax code An Example Suppose you make a donation of 100 to your favourite charity