Tax Relief Employment Expenses 84 rows Flat rate expenses sometimes known as a flat rate

If you have paid expenses related to your employment you may be able to claim tax relief We provide an example showing you how to complete form P87 which you can use to claim tax relief on Whether you are an employee or self employed use our calculator to find out how you can reduce your tax bill by getting tax relief using your work expenses

Tax Relief Employment Expenses

Tax Relief Employment Expenses

https://i0.wp.com/blog.ratemuse.com/wp-content/uploads/2019/10/tax_relief.png?fit=1200%2C978&ssl=1

Claiming Tax Relief On Expenses Moorgates

https://moorgates.co.uk/wp-content/uploads/2023/02/Tax-Relief-on-Expenses.png

Tax Relief Working From Home Get YourMoneyBack

https://yourmoneyback.ie/wp-content/uploads/2021/08/Taxd-Relief-Working-From-Home.jpg

In the UK tax relief on employment expenses is a valuable benefit that can significantly reduce your tax bill provided you know the ins and outs of the process This If your employer does not pay or reimburse your expenses you may be able to claim certain expenses as a deduction against your employment income and get tax

To obtain tax relief the expense must have been Incurred personally and not reimbursed by your employer Incurred wholly exclusively and necessarily in the Use a Self Assessment tax return if you are already registered and fill one in on a regular basis Make a claim online using your Government Gateway account Print and post

Download Tax Relief Employment Expenses

More picture related to Tax Relief Employment Expenses

Tax Relief Special Installment Plans And Deadline Extensions Crowe

https://www.crowe.com/mv/-/media/crowe/firms/asia-pacific/mv/crowehorwathmv/covid-19-tax-relief---02-01.jpg?rev=16c3c54fa0f047eb884e55dec9cad9d9

Claiming Tax Relief On Employment Expenses Edge Chartered Certified

https://www.edgeaccountants.co.uk/wp-content/uploads/2023/08/0e5bc131-a578-409c-9411-a8cca29ceca9.jpg

Tax Relief Overview Cumberland Law Group

https://cumberlandlawatlanta.com/wp-content/uploads/2023/06/Tax-Relief-Overview-min.jpeg

Employees may only claim tax relief for an expense if 1 They pay for a business expense personally and 2 It is not reimbursed by their employer Check that employees are aware of when they can claim tax relief for expenses that they have incurred in relation to their job and how to make the claim Sarah Bradford outlines

Tax Reliefs For Employees Read our overview of the types of expenses an employee can use to reduce their tax bill Tax relief for job expenses Working from home tax relief You may be eligible for tax relief if you work from home for all or part of the week During the coronavirus pandemic most

Cashtrak What Tax Relief Can Employees Claim For Employment Expenses

https://uk.rs-cdn.com/images/uwsul-hl6ix/blog/dcb5d18fbf23fc90d53d8253862bcc8c__b62f/zoom668x668z100000cw668.png?etag=2e743211466450bb7817692f23ae492e

The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax

https://i.pinimg.com/originals/58/2b/65/582b65591e10206b7e1a696e33dce68c.png

https://www.gov.uk/guidance/job-expenses-for...

84 rows Flat rate expenses sometimes known as a flat rate

https://www.litrg.org.uk/tax-nic/how-tax-…

If you have paid expenses related to your employment you may be able to claim tax relief We provide an example showing you how to complete form P87 which you can use to claim tax relief on

Tax Tip How To Know If You Qualify For A Tax Relief Program Tax Help

Cashtrak What Tax Relief Can Employees Claim For Employment Expenses

Business Expenses 101 Everything You Need To Know

How To Claim Tax Relief For Expenses

Tax Relief 101 Exploring Different Forms Of Tax Relief

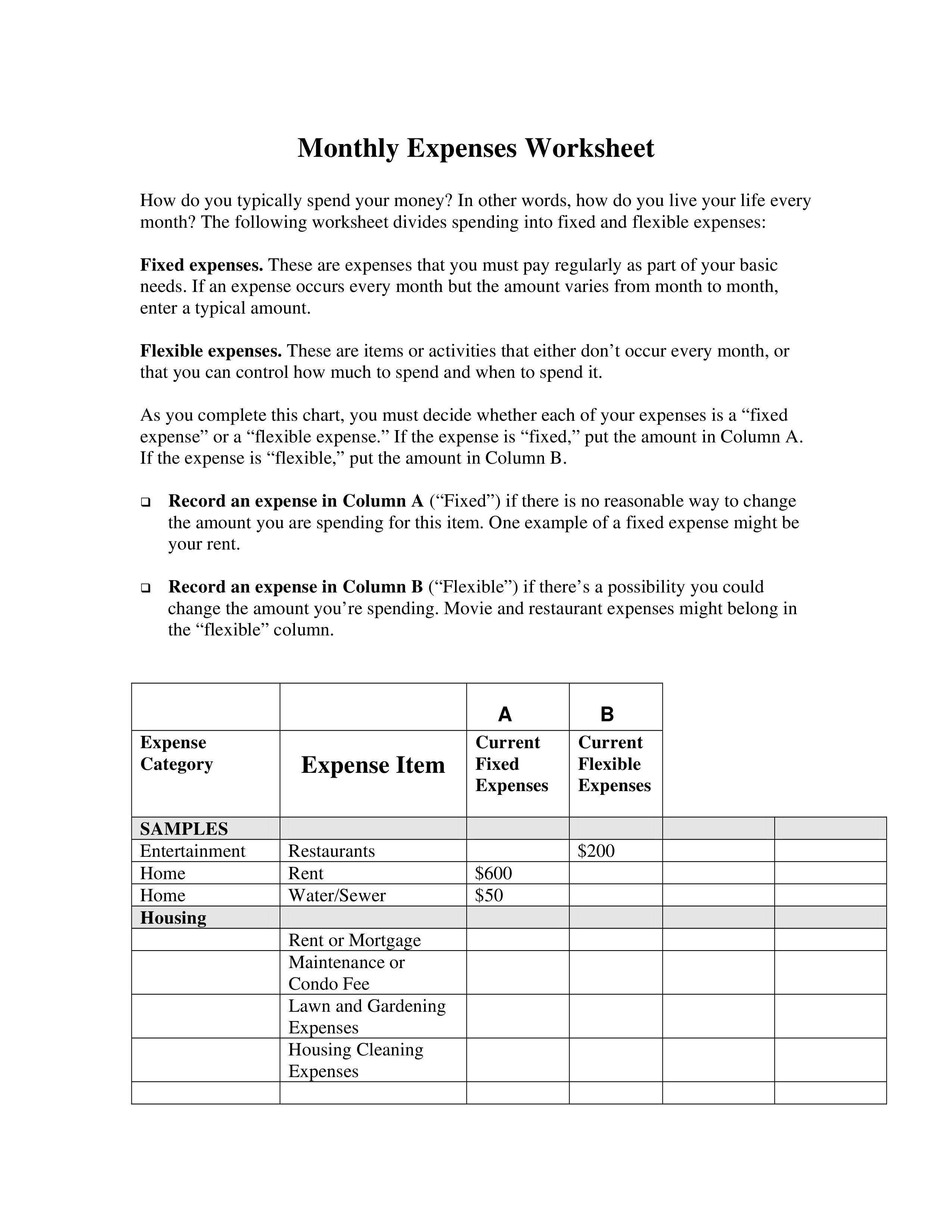

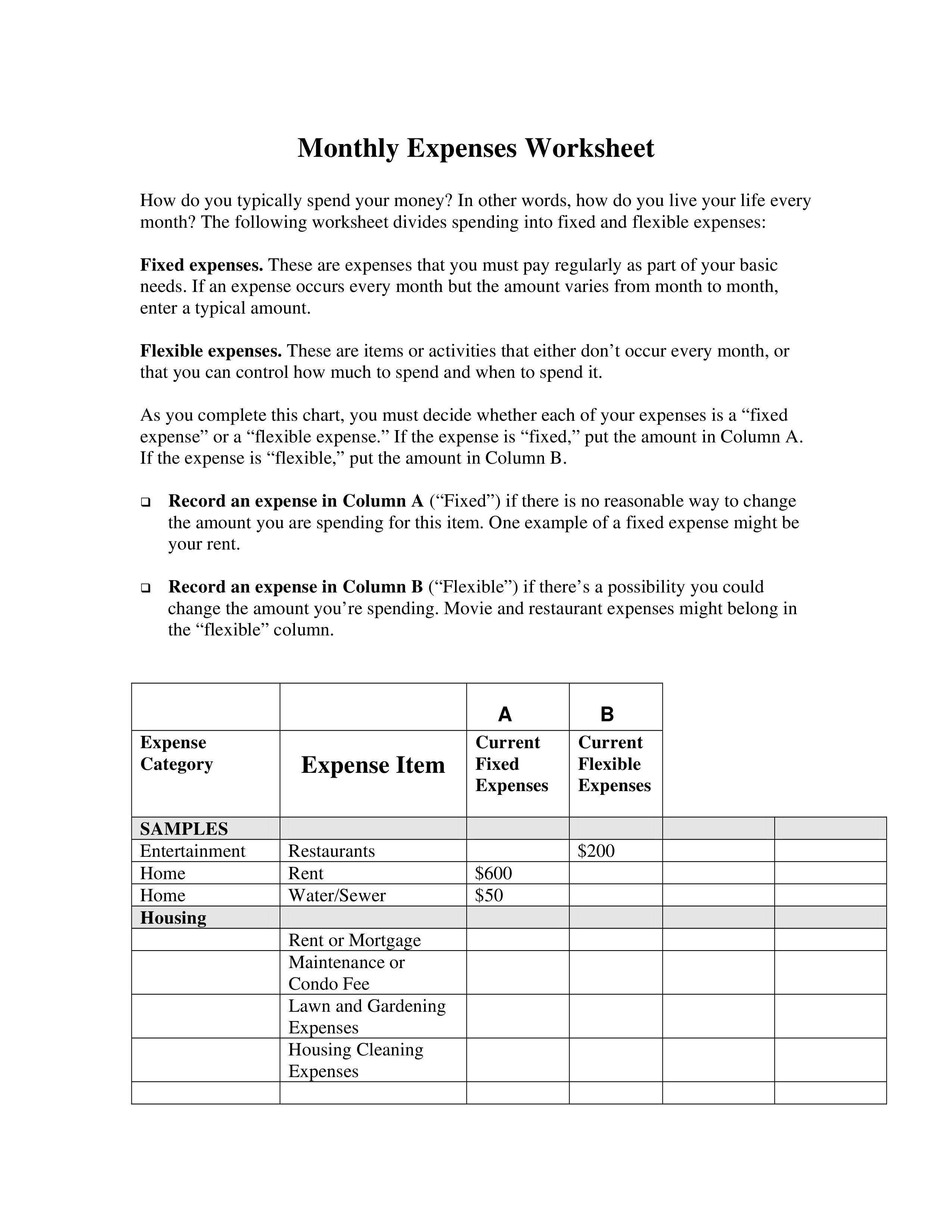

Monthly Expenses Worksheet Templates At Allbusinesstemplates

Monthly Expenses Worksheet Templates At Allbusinesstemplates

Claim Tax Relief As An Employee For Your Expenses Prestige Business

Tax Relief Prompts Easier Bank Rates Namibian Sun

Tax Relief Flat Rate employment Expenses Accountant s Notes

Tax Relief Employment Expenses - If you are an employee and you spend your own money on things you need for your job you might be able to get tax relief We know the rules can be confusing